Bitcoin at $90K as House Pressures SEC on 401(k) Crypto

Bitcoin at $90K followed congressional pressure urging the SEC to open retirement plans to digital assets.

The House Financial Services Committee sent a formal letter demanding regulatory amendments aligned with executive policy.

As a result, Bitcoin at $90K reflected modest market response tied to

CryptoBreaking·1m ago

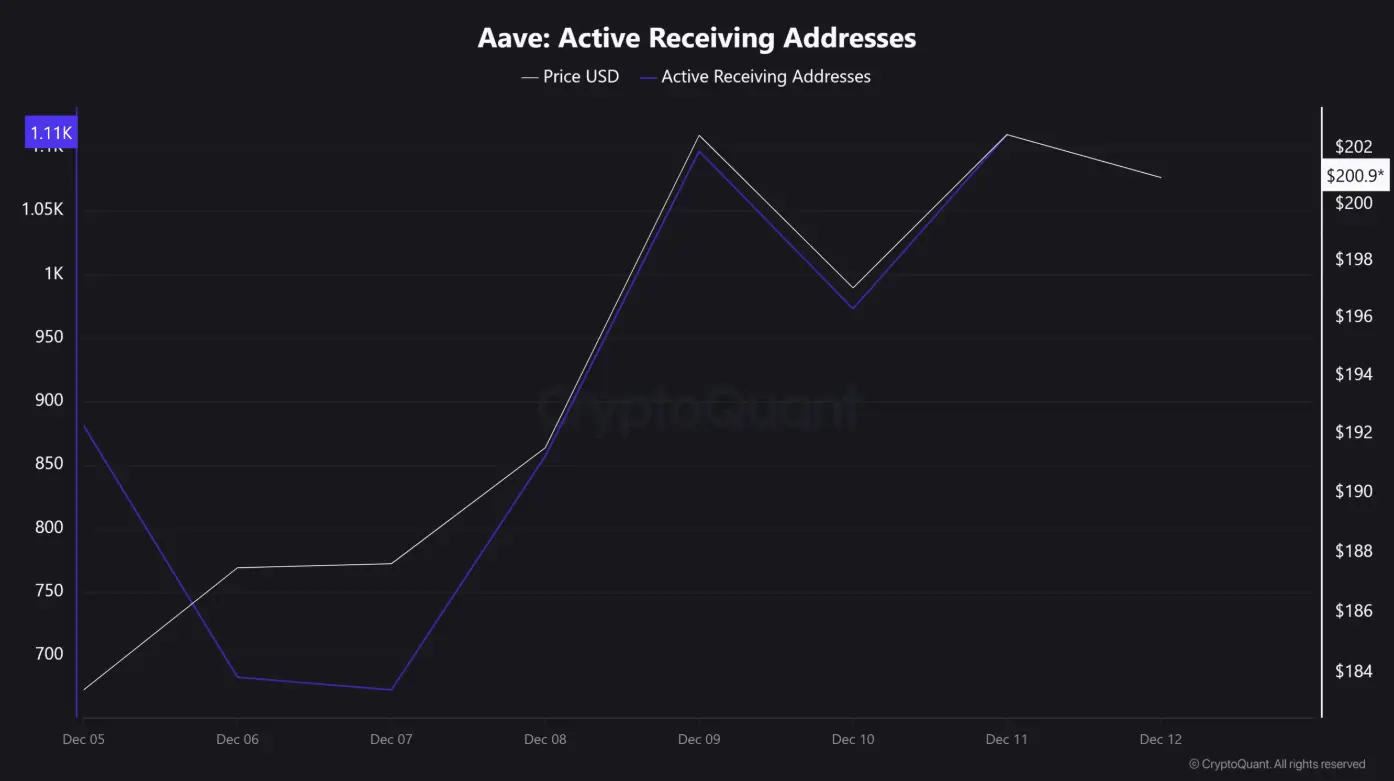

AAVE rises 9% after Fed cuts interest rates: Will the V4 upgrade give further growth momentum?

AAVE is emerging as one of the names most benefiting from the recent interest rate cuts by the US Federal Reserve (Fed).

In the latest trading session, this token saw a rise of about 9%, reaching around $205 at the time of writing. The upward momentum appeared when the focus

AAVE-2.98%

TapChiBitcoin·6m ago

ETF Bitcoin attracts $49.16 million, Ethereum experiences capital withdrawal, XRP records an inflow of $20.17 million

On December 12, Bitcoin spot ETFs saw a net inflow of $49.16 million, indicating strong institutional demand, mainly driven by BlackRock's IBIT. In contrast, Ethereum ETFs faced a net outflow of $19.41 million, while XRP ETFs noted a positive inflow of $20.17 million, reflecting selective investor preferences for liquidity and reputable brands.

TapChiBitcoin·6m ago

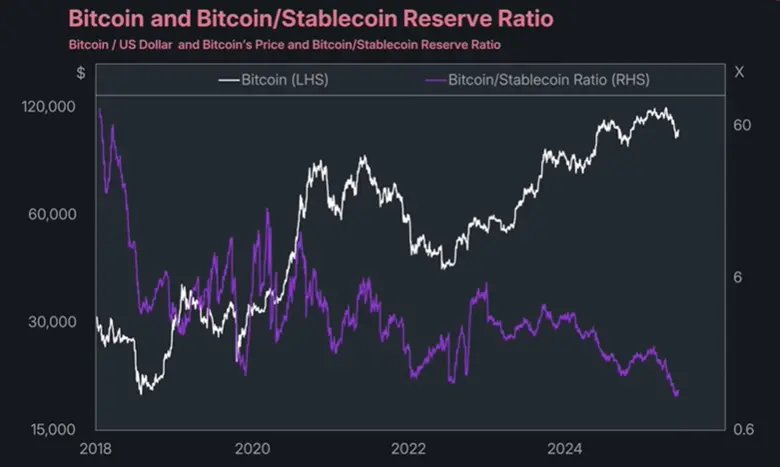

Bitcoin and Altcoins Moved in 2025, but New Data Suggests 2026 Could Be the Real Bull Cycle

Bitcoin started 2025 trading around $91,000 and later pushed to a new all-time high slightly above $126,000 before dipping back to $90,000 at the time of writing. For many market participants the move felt muted. Expectations were far higher because 2025 was widely believed to be the peak of the

CaptainAltcoin·8m ago

XRP Holds $2 as Market Pressure Builds Around a Critical Support Zone

XRP consolidates near $2 after months of weakening structure and repeated upper resistance failures

Selling pressure increased after rejected rallies above $3 earlier in 2025

Short-term stability masks elevated downside risk if $2 support breaks

XRP centers on a critical support test as the

XRP-0.68%

CryptoFrontNews·10m ago

Is a Year-End Rally Coming? Camel Finance Flags Fed-Fueled Dip & Rip

As the dust settles from the Federal Reserve’s latest 25 basis point rate cut, Bitcoin (BTC) clings to its breakout threshold amid choppy waters, while stocks flirt with Santa Claus rally dreams. Pro trader Camel Finance sees a classic “dip & rip” setup unfolding.

A YouTube live-trading veteran wit

DailyCoin·36m ago

XRP Bulls Maintain $2 Value While Ethereum Faces 35% Drop in 12 Weeks

XRP holds steady at $2 amid bullish sentiment, while Ethereum faces a 35% drop in 12 weeks, signaling shifting market dynamics.

XRP has held its ground at the $2 mark despite market fluctuations, while Ethereum has seen a 35% drop over the last 12 weeks.

Despite the strong performance of XRP,

LiveBTCNews·37m ago

South Korea, together with the US and allies, signs the Pax Silica cooperation declaration amid the AI race with China

The Pax Silica declaration, led by the U.S. with key partners like South Korea, aims to secure reliable supply chains for AI and strategic minerals. Signed by seven nations, it emphasizes stability, reduced dependency, and enhanced cooperation amid U.S.-China competition in AI.

TapChiBitcoin·38m ago

XRP Price Prediction Holds Above $2, Investors Push DeepSnitchAI to $1 Million With New Year Offe...

Ripple has launched the “XRP Ledger v3.0.0” upgrade, which promises to bring more stability to the blockchain. The XRP price prediction is promising, with charts showing a possible breakout of the resistance at $2.23. Ethereum is waiting for a massive falling wedge breakout to be confirmed, which

CaptainAltcoin·38m ago

Michael Saylor’s Strategy Keeps Nasdaq 100 Spot As MSCI Decision Nears

Strategy has retained its position in the Nasdaq 100 despite concerns over its Bitcoin-focused business model.

MSCI is reviewing whether digital asset treasury firms like Strategy should remain in its indexes, with a decision due in January.

A potential MSCI removal could trigger over $1.5

BTC-2.21%

CryptoNewsLand·48m ago

ETH Makes Bullish Higher Low After Volatile Moves and Fakeout Trap

Ethereum has experienced significant volatility over the past year, marked by several false breakouts and price fluctuations.

However, recent price action suggests Ethereum is stabilizing and showing signs of potential recovery. After battling through uncertainty, ETH has established a bullish

ETH-4.08%

LiveBTCNews·54m ago

TikTok accused of facilitating fake AI-generated advertisements

TikTok faces accusations of facilitating fake ads generated by AI, as misleading content easily bypasses filters. Despite claims of prohibiting misleading advertising, AI-generated scams proliferate, prompting EU officials to call for stricter regulations.

TapChiBitcoin·55m ago

Helius Labs Expands Solana Developer Power With New History API

Helius Labs rolled out a major upgrade for Solana developers. The company launched getTransactionsForAddress, a new history API. The tool allows developers to query every transaction linked to a wallet address. It supports sorting, filtering, and deep historical analysis. Solana shared the

Coinfomania·1h ago

What You Need to Know About Bitcoin Outlook in 2026

Recently, the US Fed confirmed the third consecutive interest rate cut in 2025. Before the announcement, most analysts believed that Bitcoin and other risk assets would benefit from this decision.

However, contrary to expectations, the price of Bitcoin dropped sharply from over $93,000 in a short period.

BTC-2.21%

TapChiBitcoin·1h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28