- Reward

- 2

- 4

- Repost

- Share

GateUser-6e00fa59 :

:

Because it's not good, the dealer can't leave. They can only trigger a short squeeze to make some money.View More

- Reward

- 1

- 3

- Repost

- Share

BigBossScared :

:

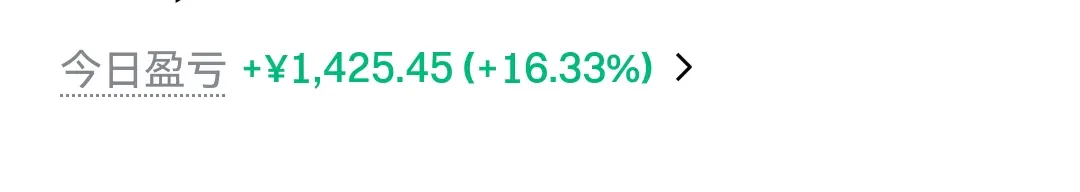

I make only 200 yuan an hourView More

- Reward

- 2

- 3

- Repost

- Share

WhatIsTheMudMeowing? :

:

This dog whale is crazy, they have over 23 million long positions but aren't selling, while the short positions are only 1.5 million.View More

$PIPPIN $PIPPIN Make a little money every day ✌, retail investors, does it hurt to get cut? You'll get used to it, cutting more is healthier, it grows back after being cut, don't worry.😅😅😅

$PIPPIN Make a little money every day ✌, retail investors, does it hurt to get cut? You'll get used to it, cutting more is healthier, it grows back after being cut, don't worry.😅😅😅

$PIPPIN Make a little money every day ✌, retail investors, does it hurt to get cut? You'll get used to it, cutting more is healthier, it grows back after being cut, don't worry.😅😅😅

$PIPPIN Make a little money every day ✌, retail investors, does it hurt to get cut? You'll get used to it, cutting more is healthier, it grows back after being cut, don't worry.😅😅😅

$PIPPIN Make a little money every day ✌, retail investors, does it hurt to get cut? You'll get used to it, cutting more is healthier, it grows back after being cut, don't worry.😅😅😅

PIPPIN10.27%

- Reward

- 2

- 3

- Repost

- Share

KhanhNguyen :

:

The night they gather again, crying once moreView More

- Reward

- 3

- 4

- Repost

- Share

OnceGambleOCNTurnsIntoA :

:

It broke five times before it was full.View More

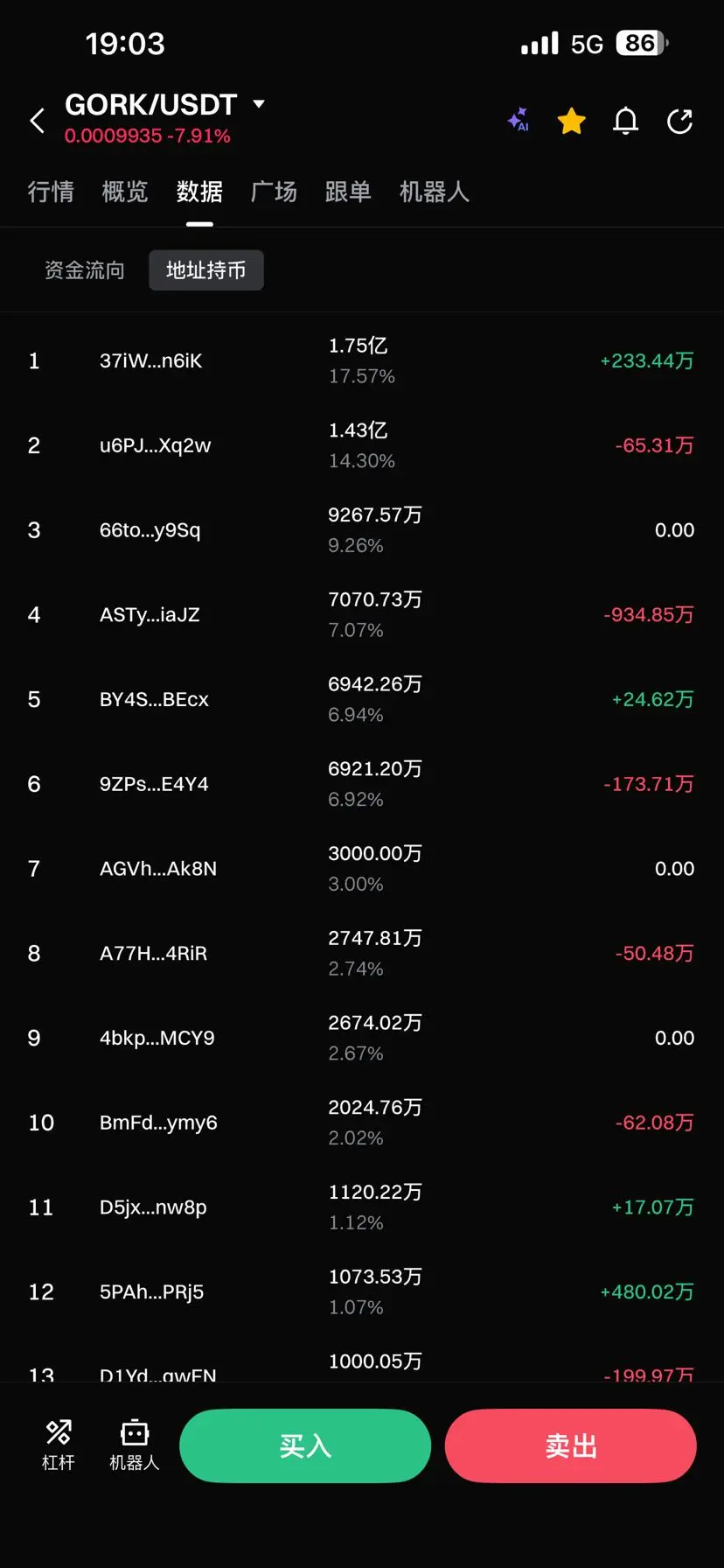

$GORK The change in holding addresses from January 7th to today clearly shows that the top addresses are selling off in large quantities. Especially the third-ranked address, which has remained unchanged for a long time, is no longer visible among the top 100, which is quite impressive!

GORK330.2%

- Reward

- 3

- 2

- Repost

- Share

GateUser-5dac3bfa :

:

I clearly sent two pictures, why does only one appear?View More

#加密市场反弹 Bearish divergence established, bulls are favored but pressure is clear

🟢 BTC Bitcoin weekly RSI drops to 25.7, hitting a low not seen since July 2022. A historically extreme oversold signal appears with 4-hour MACD bullish divergence + golden cross. Short-term bullish momentum is sufficient. Key zones:

Strong support: 66,500–67,500

Strong resistance: 69,500–70,000

Structural judgment: The rebound trend is clear, but the 70,000 level remains a watershed between bulls and bears.

🟢

Conclusion: Low-cost long positions are more favorable than high-leverage shorts

Technical

🟢 BTC Bitcoin weekly RSI drops to 25.7, hitting a low not seen since July 2022. A historically extreme oversold signal appears with 4-hour MACD bullish divergence + golden cross. Short-term bullish momentum is sufficient. Key zones:

Strong support: 66,500–67,500

Strong resistance: 69,500–70,000

Structural judgment: The rebound trend is clear, but the 70,000 level remains a watershed between bulls and bears.

🟢

Conclusion: Low-cost long positions are more favorable than high-leverage shorts

Technical

BTC2.98%

- Reward

- 6

- 10

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

1/26 Evening

Xiao Cang, the first half of this month was okay, but the second half was hit consecutively, and it hurts a lot.

Gou Ge, also reflect and update the gameplay to avoid significant losses.

View OriginalXiao Cang, the first half of this month was okay, but the second half was hit consecutively, and it hurts a lot.

Gou Ge, also reflect and update the gameplay to avoid significant losses.

Subscribers Only

Subscribe now to view exclusive content- Reward

- 1

- 5

- Repost

- Share

WantToEatSweetAndSourPorkRibs :

:

Can I still take the 2147 slot?View More

#GateSquare$50KRedPacketGiveaway

Kick Off the Lunar New Year with GateSquare’s $50,000 Red Packet Giveaway: A Personal Reflection on SocialFi, Community Engagement, and the Future of Web3 Rewards

As the Lunar New Year approaches, GateSquare’s New Year Carnival isn’t just about celebration—it’s a window into the evolving world of Web3, where participation, contribution, and engagement are rewarded in ways that go far beyond traditional platforms. The $50,000 Red Packet Giveaway is a perfect example of how SocialFi is transforming online interaction. Unlike conventional social media, where cont

Kick Off the Lunar New Year with GateSquare’s $50,000 Red Packet Giveaway: A Personal Reflection on SocialFi, Community Engagement, and the Future of Web3 Rewards

As the Lunar New Year approaches, GateSquare’s New Year Carnival isn’t just about celebration—it’s a window into the evolving world of Web3, where participation, contribution, and engagement are rewarded in ways that go far beyond traditional platforms. The $50,000 Red Packet Giveaway is a perfect example of how SocialFi is transforming online interaction. Unlike conventional social media, where cont

GT1.98%

- Reward

- 5

- 4

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

- Reward

- 2

- 4

- Repost

- Share

CryptoSelf :

:

LFG 🔥View More

- Reward

- like

- 2

- Repost

- Share

Tokyo119 :

:

I really don't dare to be empty anymore [尴尬]View More

#CLARITYActAdvances

📊 #CLARITYActAdvances – Crypto Regulation Inches Closer to Breakthrough

Latest CLARITY Act Updates

After years of debate and regulatory uncertainty, the Crypto CLARITY Act — a major U.S. legislative effort to define and structure digital asset markets — is advancing through key stages in Washington. This development has meaningful implications for the future of crypto regulation, institutional participation, and stablecoin frameworks.

📈 What’s Happening Now

Lawmakers and industry representatives are intensifying discussions ahead of a March 1 deadline to resolve key dif

📊 #CLARITYActAdvances – Crypto Regulation Inches Closer to Breakthrough

Latest CLARITY Act Updates

After years of debate and regulatory uncertainty, the Crypto CLARITY Act — a major U.S. legislative effort to define and structure digital asset markets — is advancing through key stages in Washington. This development has meaningful implications for the future of crypto regulation, institutional participation, and stablecoin frameworks.

📈 What’s Happening Now

Lawmakers and industry representatives are intensifying discussions ahead of a March 1 deadline to resolve key dif

BTC2.98%

- Reward

- 5

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

The market continues to fluctuate within the 2040-2080 range, with decreasing volume and limited liquidity. After the US stock market opens, it will clear out the liquidity within the range to form a new fluctuation zone. Subscription points will be updated pre-market at #加密市场反弹 .

View Original- Reward

- 2

- 2

- Repost

- Share

ChivesQiTongwei :

:

空空空,住皇宫View More

#BitdeerLiquidates943.1BTCReserves

Bitdeer Technologies (NASDAQ: BTDR), a leading Bitcoin mining company founded by Jihan Wu (former co-founder of Bitmain), has fully liquidated its entire corporate Bitcoin treasury, reducing its self-owned holdings to zero BTC (excluding customer deposits) as of February 20, 2026. This marked the culmination of an eight-week gradual drawdown that began with roughly 2,000 BTC at the end of 2025.

Timeline of the Liquidation

End of 2025: Approximately 2,000 BTC held on the balance sheet.

End of January 2026: Holdings reduced to about 1,530 BTC.

Mid-February 202

Bitdeer Technologies (NASDAQ: BTDR), a leading Bitcoin mining company founded by Jihan Wu (former co-founder of Bitmain), has fully liquidated its entire corporate Bitcoin treasury, reducing its self-owned holdings to zero BTC (excluding customer deposits) as of February 20, 2026. This marked the culmination of an eight-week gradual drawdown that began with roughly 2,000 BTC at the end of 2025.

Timeline of the Liquidation

End of 2025: Approximately 2,000 BTC held on the balance sheet.

End of January 2026: Holdings reduced to about 1,530 BTC.

Mid-February 202

BTC2.98%

- Reward

- 6

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

🔥 Gate ETH Trading Festival is now live

Limited-time prize pool of 30 ETH, 100% chance to win

👉 The event is in full swing, participate now: https://www.gate.com/zh/campaigns/4139

✅ Complete trading, deposit, and referral tasks to enter the draw and win 15 ETH

✅ Plus exclusive cashback + a special airdrop gift for newcomers, with a maximum of 6 ETH for a single person

Event details: https://www.gate.com/announcements/article/49960

Limited-time prize pool of 30 ETH, 100% chance to win

👉 The event is in full swing, participate now: https://www.gate.com/zh/campaigns/4139

✅ Complete trading, deposit, and referral tasks to enter the draw and win 15 ETH

✅ Plus exclusive cashback + a special airdrop gift for newcomers, with a maximum of 6 ETH for a single person

Event details: https://www.gate.com/announcements/article/49960

ETH5.6%

- Reward

- 4

- 2

- 1

- Share

İnsanElGaib :

:

2026 GOGOGO 👊View More

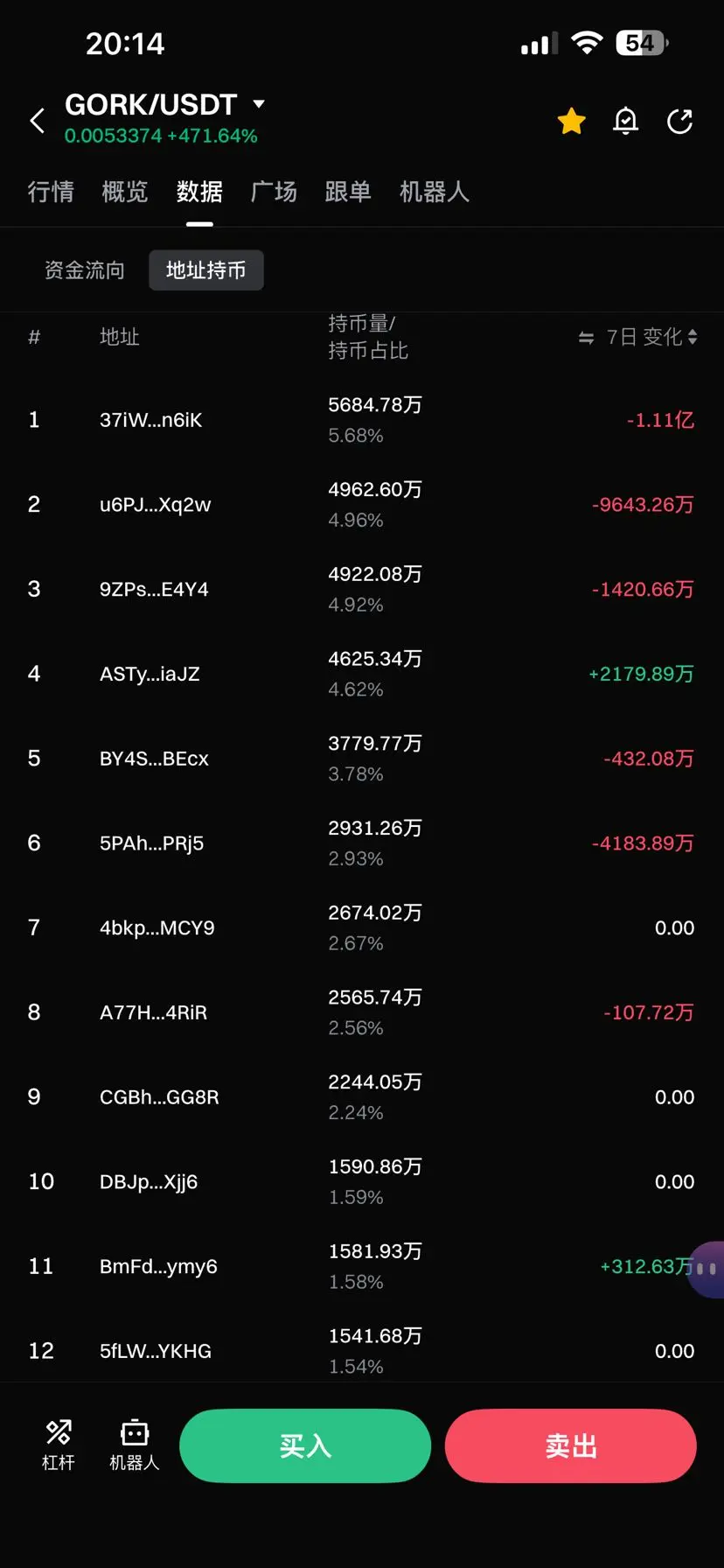

Following Musk's tweet "Grok returns today," the long-standing Meme coin gork surged over 520% in a single day 🚀

GORK330.2%

- Reward

- 3

- 1

- Repost

- Share

GateUser-4dc1e303 :

:

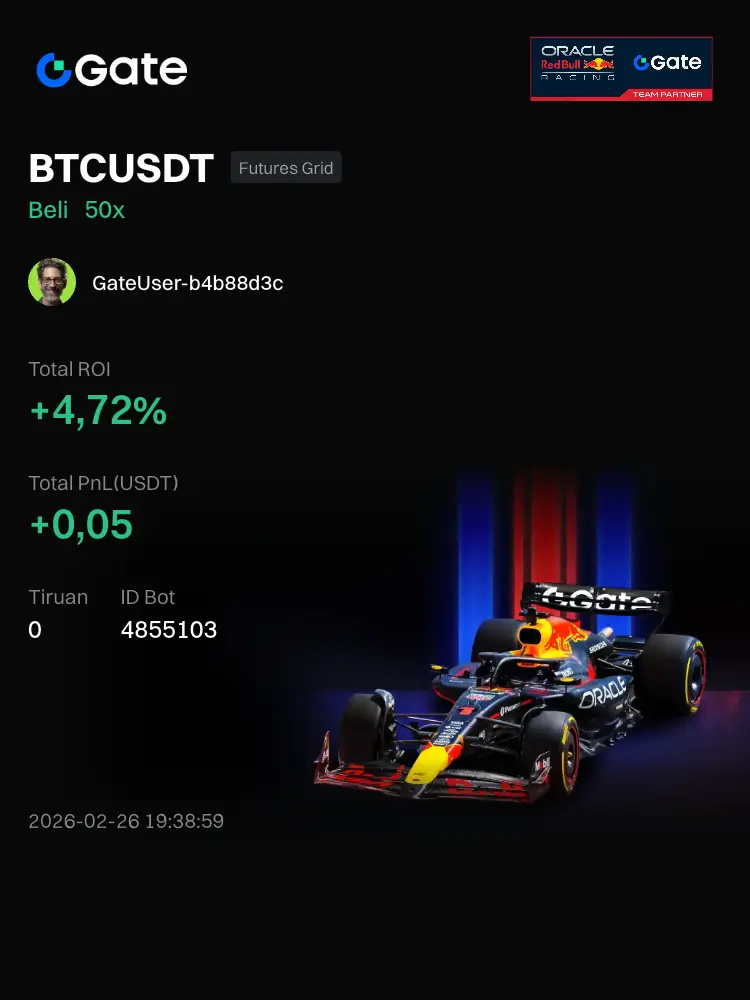

to the moon unexpectedly#Bot#Saat ini I am using the BTCUSDT Futures Grid bot on Gate. The ROI since the bot was created has reached +4.72%

View Original

- Reward

- 3

- 50

- Repost

- Share

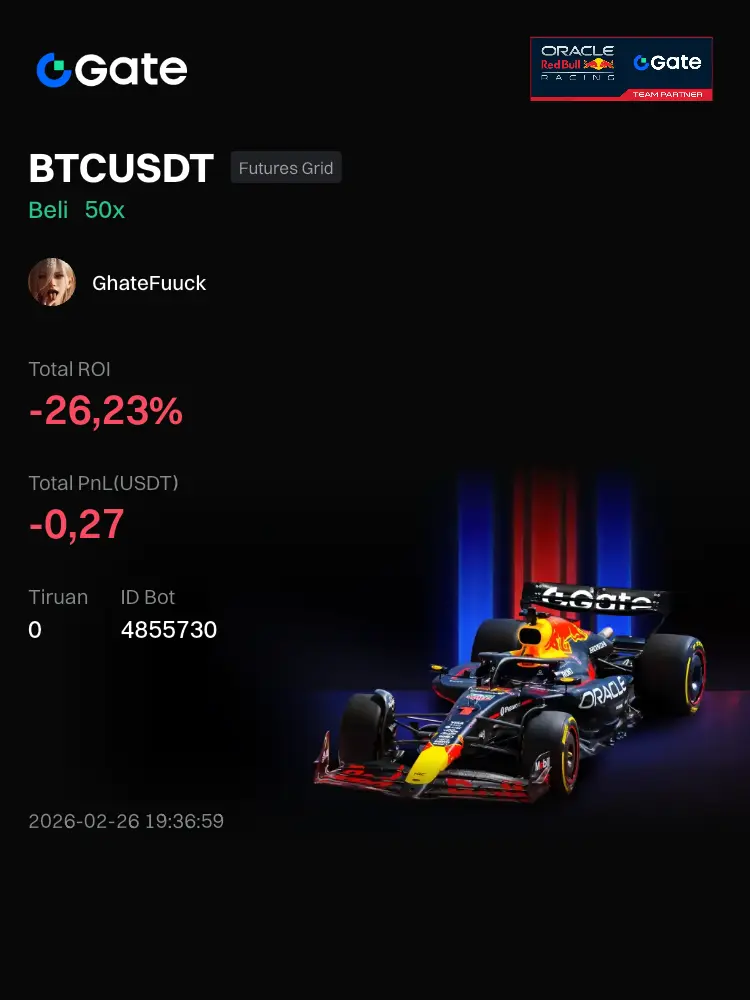

GhateFuuck :

:

HODL Tight 💪View More

#Bot#Saat ini I am using the BTCUSDT Futures Grid bot on Gate. The ROI since the bot was created has reached -26.23%

View Original

- Reward

- 4

- 30

- Repost

- Share

GateUser-b4b88d3c :

:

Ape In 🚀View More

I recently saw an event on Gate, the TradFi Gold Rush, and it seems pretty solid.

📅The event runs until March 12th at 16:00 (UTC+8).

It's accessible for beginners too—trade 100 USDT to receive a random red envelope of 5–20 USDT, no fuss, just follow the process.

For those who already trade regularly, it's even more suitable—accumulate 50,000 USDT to get on the leaderboard, and the 35,000 USDT prize pool is split among top traders. It’s all about easy participation.

There's also a small bonus:

Invite friends to trade together, and 10% of your friends' trading volume counts toward your total. M

📅The event runs until March 12th at 16:00 (UTC+8).

It's accessible for beginners too—trade 100 USDT to receive a random red envelope of 5–20 USDT, no fuss, just follow the process.

For those who already trade regularly, it's even more suitable—accumulate 50,000 USDT to get on the leaderboard, and the 35,000 USDT prize pool is split among top traders. It’s all about easy participation.

There's also a small bonus:

Invite friends to trade together, and 10% of your friends' trading volume counts toward your total. M

XAUT-0.35%

- Reward

- 5

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Happy New Year 🧨View More

Load More