In The Battle For Liquidity, Are Memecoins The Salvation Or The Graveyard For CEXs?

This report, written by Tiger Research, analyzes how memecoins are reshaping cryptocurrency trading dynamics and challenging the dominance of CEXs.

Key takeaways

- Memecoins have evolved from purely speculative assets into a dominant trading force, attracting significant liquidity and reshaping capital flow patterns within the crypto market.

- Platforms like Pump.fun have driven the rise of decentralized exchanges (DEXs), pulling in liquidity and active traders, thereby weakening centralized exchanges’ (CEXs) early price discovery capabilities.

- Exchanges like MEXC that quickly adapted to memecoin trading have performed strongly, while platforms like Binance that reacted more slowly are facing dual challenges of liquidity loss and diminished market influence.

1. The New Battleground For Exchanges

Memecoins are redefining the cryptocurrency market. Starting as a speculative trend, they have now become major trading assets on leading exchanges, driving massive trading volumes.

To adapt to this trend, exchanges are adjusting their strategies. Gate.io and MEXC have captured market share by rapidly listing memecoins, while Binance launched “Binance Alpha,” focusing on the early listing of memecoins and providing a smoother transition. In the DEX market, Solana-based Raydium has successfully surpassed Ethereum-based Uniswap to become the market leader, demonstrating the strong momentum memecoins bring to the market.

As memecoins gain increasing importance on exchanges, their broader impact also deserves attention. Will memecoin trading lead to a lasting market transformation, or is it merely a short-lived cyclical phenomenon? Furthermore, how will regulatory changes affect the sustainability of memecoins as mainstream assets? These questions will shape the future of retail trading and exchange development.

2.DEX Breaks The Status Quo: Raydium Surpasses Uniswap

Source: The Block, DefiLlama

The memecoin boom has fueled Raydium’s rapid rise. As of January 2025, Raydium holds a 27% share of the DEX market, becoming the preferred platform for retail investors. Raydium’s success is closely tied to the technical advantages of the Solana network, offering lower fees and faster transactions compared to Ethereum-based exchanges. These features have made Raydium a core platform for memecoin trading.

Meanwhile, Uniswap’s market share dropped from 34.5% in December 2024 to 22% in January 2025, losing its dominance in the DEX space. High Ethereum gas fees have become a major barrier for memecoin traders, driving many cost-sensitive retail investors to alternative platforms. If Ethereum-based DEXs fail to innovate promptly, they will face greater liquidity migration pressure.

Although memecoin trading has clearly driven Raydium’s growth, the sustainability of this trend remains uncertain. Some analysts believe that as speculative demand decreases, the memecoin trading frenzy may gradually fade. However, Raydium has already become a familiar platform for users through this wave. If it can capitalize on this momentum by strengthening liquidity pools, optimizing user experience, and building a more efficient trading system, Raydium could further solidify its market position. These efforts will help Raydium maintain a long-term advantage in the competition between DEXs and CEXs.

3. CEX Response: Can They Keep Up With The Rise Of DEXs?

Gate.io and MEXC have successfully attracted a large number of retail investors interested in speculative assets by focusing on memecoin listing strategies. Among them, MEXC has emerged as a leader in this trend with its rapid memecoin listing policy. For example, they opened trading for Memecoins Official Trump ($TRUMP) on the day of its listing, which directly led to record-breaking trading volumes and a rapid increase in user numbers.

These strategies have had a significant impact. MEXC’s daily memecoin trading volume surged from 5.9% in Q1 2024 to 25.9% in January 2025. At the same time, the proportion of memecoin traders increased from 18.7% to 37.1%.

As the world’s largest cryptocurrency exchange, Binance is also actively expanding its memecoin listings to attract retail liquidity. Recently, Binance has focused more on speculative assets, aiming to capture opportunities in the “attention economy.” However, due to its nature as a centralized exchange (CEX), Binance is inevitably constrained by internal review processes. These processes often result in memecoins being listed only after market hype has faded or shifted to new trends.

While Binance provides ample liquidity to protect investors, this liquidity has also become an exit route for early holders to sell off memecoins. Because such sell-offs have a limited impact on market prices, many newly listed memecoins have seen their prices drop by over 75% in a short period, causing significant losses for investors. This situation has not only damaged Binance’s long-term reputation but also raised concerns about its listing review process.

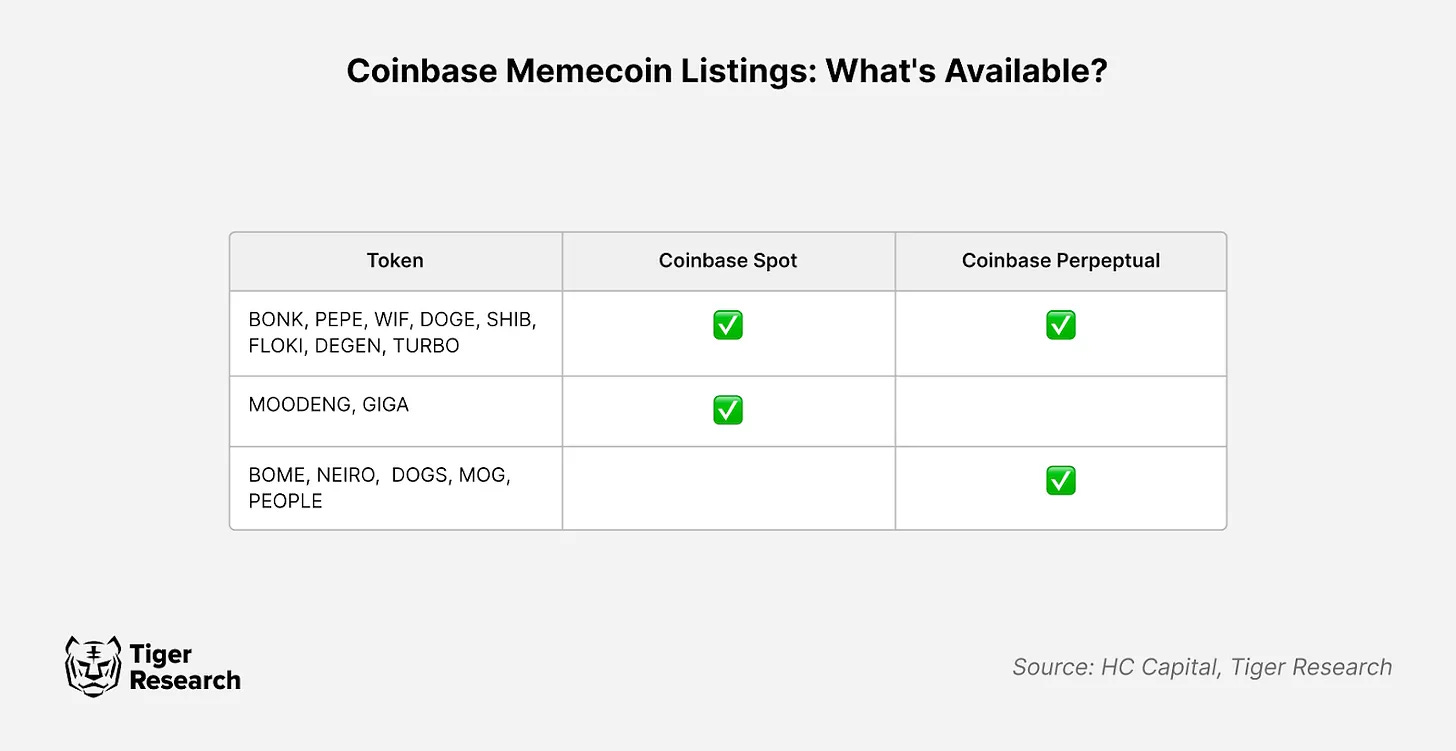

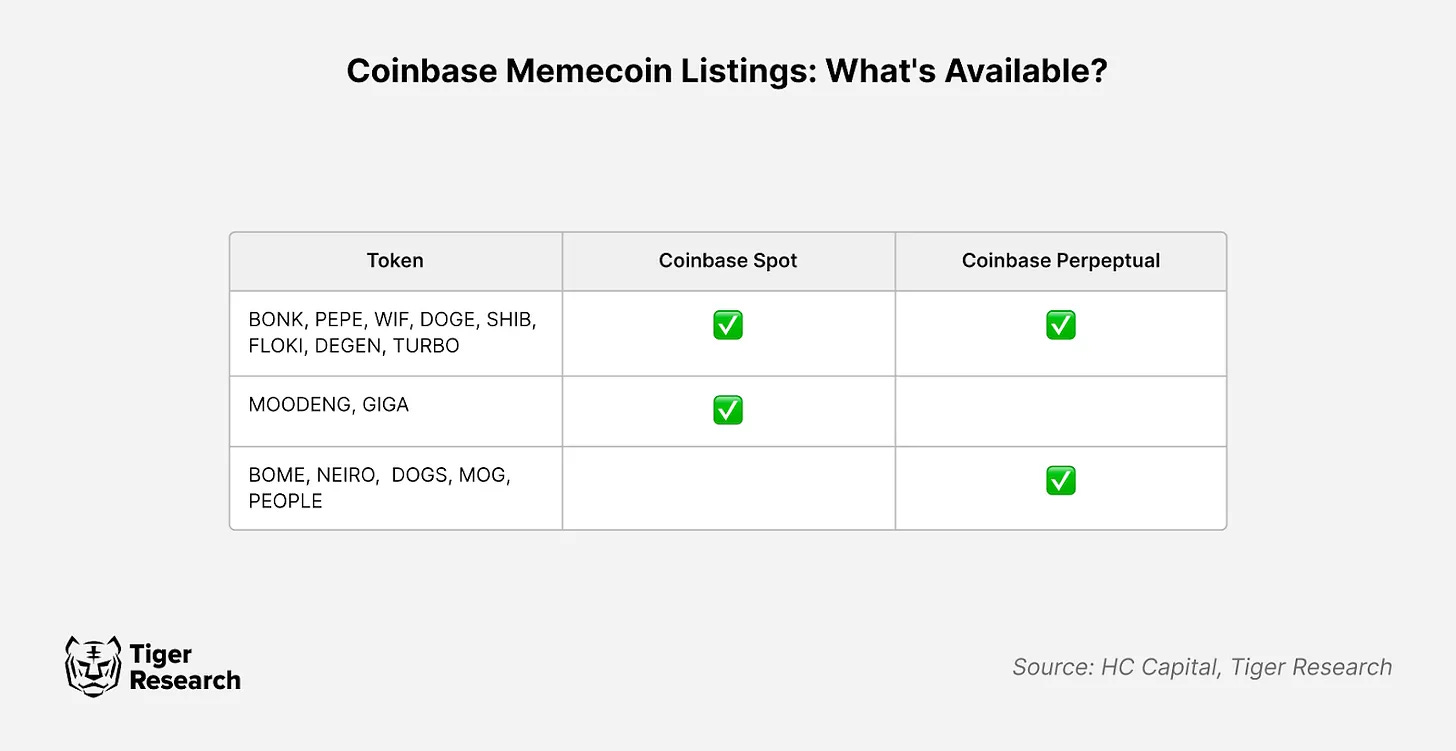

Compared to Binance, major centralized exchanges such as Coinbase, Kraken, and Upbit have adopted more conservative strategies, focusing on verified cryptocurrencies rather than memecoins. While this approach may miss out on short-term high-return market opportunities, it helps maintain platform stability and reduces regulatory risks.

In recent years, there has been an increasing trend of funds flowing from CEXs to DEXs, indicating that CEXs no longer hold absolute market dominance. In response to this shift, CEXs need to reassess their strategic positioning. They can choose from several approaches:

- SFiltering early assets and providing transparent information (e.g., Binance Alpha);

- Managing risk by selectively listing memecoins;

- Introducing hybrid trading models that combine on-chain order books with DeFi elements.

The core challenge for CEXs today is how to strike a balance between attracting short-term trading activity and maintaining long-term platform stability, while retaining institutional investors’ trust and effectively attracting more retail investors.

4. Strategic Summary and Future Outlook

Memecoins have evolved from mere speculative tools to significant trading assets in the cryptocurrency market. With a substantial increase in memecoin trading on decentralized exchanges (DEXs), this trend brings both new opportunities and challenges to the crypto industry.

During the recent bull market, memecoins on DEXs significantly outperformed assets listed on centralized exchanges (CEXs), prompting more and more investors to shift towards DEXs. Platforms like Pump.fun have optimized the issuance and trading process of memecoins, enabling new tokens to experience explosive growth even without being listed on CEXs.

To adapt to this shift, market makers, liquidity providers, and project teams have adjusted their strategies. They are no longer solely focused on CEX listings but are also prioritizing the DEX environment. By building liquidity pools across multiple platforms, they have enhanced the accessibility and flexibility of trading.

However, the memecoin market still faces numerous risks. Unethical behaviors such as rug pulls, small group manipulation, and malicious trading have severely harmed investors’ interests. The lack of effective regulation in the market has made these issues prevalent. For example, the Argentina Libra ($LIBRA) scandal exposed these potential risks, sparking widespread skepticism about memecoins and causing a significant drop in Solana DEX trading volume.

Nevertheless, memecoins continue to demonstrate their potential in the crypto space. They are increasingly becoming representative assets for certain entities and groups. For instance, the connection between Elon Musk and Dogecoin, Trump and Official Trump Token, as well as memecoins issued by some startups and countries, suggest that cryptocurrencies are capturing real economic and social value. This trend is similar to the securitization process in traditional financial markets and may gradually evolve into a new cultural phenomenon.

In response to this change, CEXs must rapidly adjust their strategies. Investors no longer wait for CEX listings to begin trading potential assets. To attract more users and remain competitive, exchanges need to integrate on-chain functions and DeFi elements while ensuring platform stability and compliance. This flexible and innovative strategy will be crucial in driving the crypto market into its next growth phase.

Disclaimer:

This article is reproduced from [Tiger Research], and the copyright belongs to the original author [CHI ANH, JAY JO, AND ELSA]. If you have any objections to the reprint, please contact the Gate Learn team, which will handle it as soon as possible according to relevant procedures.

Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

Other language versions of the article are translated by the Gate Learn team. The translated article may not be copied, distributed or plagiarized without mentioning Gate.io.

In The Battle For Liquidity, Are Memecoins The Salvation Or The Graveyard For CEXs?

Key takeaways

1. The New Battleground For Exchanges

2.DEX Breaks The Status Quo: Raydium Surpasses Uniswap

3. CEX Response: Can They Keep Up With The Rise Of DEXs?

4. Strategic Summary and Future Outlook

This report, written by Tiger Research, analyzes how memecoins are reshaping cryptocurrency trading dynamics and challenging the dominance of CEXs.

Key takeaways

- Memecoins have evolved from purely speculative assets into a dominant trading force, attracting significant liquidity and reshaping capital flow patterns within the crypto market.

- Platforms like Pump.fun have driven the rise of decentralized exchanges (DEXs), pulling in liquidity and active traders, thereby weakening centralized exchanges’ (CEXs) early price discovery capabilities.

- Exchanges like MEXC that quickly adapted to memecoin trading have performed strongly, while platforms like Binance that reacted more slowly are facing dual challenges of liquidity loss and diminished market influence.

1. The New Battleground For Exchanges

Memecoins are redefining the cryptocurrency market. Starting as a speculative trend, they have now become major trading assets on leading exchanges, driving massive trading volumes.

To adapt to this trend, exchanges are adjusting their strategies. Gate.io and MEXC have captured market share by rapidly listing memecoins, while Binance launched “Binance Alpha,” focusing on the early listing of memecoins and providing a smoother transition. In the DEX market, Solana-based Raydium has successfully surpassed Ethereum-based Uniswap to become the market leader, demonstrating the strong momentum memecoins bring to the market.

As memecoins gain increasing importance on exchanges, their broader impact also deserves attention. Will memecoin trading lead to a lasting market transformation, or is it merely a short-lived cyclical phenomenon? Furthermore, how will regulatory changes affect the sustainability of memecoins as mainstream assets? These questions will shape the future of retail trading and exchange development.

2.DEX Breaks The Status Quo: Raydium Surpasses Uniswap

Source: The Block, DefiLlama

The memecoin boom has fueled Raydium’s rapid rise. As of January 2025, Raydium holds a 27% share of the DEX market, becoming the preferred platform for retail investors. Raydium’s success is closely tied to the technical advantages of the Solana network, offering lower fees and faster transactions compared to Ethereum-based exchanges. These features have made Raydium a core platform for memecoin trading.

Meanwhile, Uniswap’s market share dropped from 34.5% in December 2024 to 22% in January 2025, losing its dominance in the DEX space. High Ethereum gas fees have become a major barrier for memecoin traders, driving many cost-sensitive retail investors to alternative platforms. If Ethereum-based DEXs fail to innovate promptly, they will face greater liquidity migration pressure.

Although memecoin trading has clearly driven Raydium’s growth, the sustainability of this trend remains uncertain. Some analysts believe that as speculative demand decreases, the memecoin trading frenzy may gradually fade. However, Raydium has already become a familiar platform for users through this wave. If it can capitalize on this momentum by strengthening liquidity pools, optimizing user experience, and building a more efficient trading system, Raydium could further solidify its market position. These efforts will help Raydium maintain a long-term advantage in the competition between DEXs and CEXs.

3. CEX Response: Can They Keep Up With The Rise Of DEXs?

Gate.io and MEXC have successfully attracted a large number of retail investors interested in speculative assets by focusing on memecoin listing strategies. Among them, MEXC has emerged as a leader in this trend with its rapid memecoin listing policy. For example, they opened trading for Memecoins Official Trump ($TRUMP) on the day of its listing, which directly led to record-breaking trading volumes and a rapid increase in user numbers.

These strategies have had a significant impact. MEXC’s daily memecoin trading volume surged from 5.9% in Q1 2024 to 25.9% in January 2025. At the same time, the proportion of memecoin traders increased from 18.7% to 37.1%.

As the world’s largest cryptocurrency exchange, Binance is also actively expanding its memecoin listings to attract retail liquidity. Recently, Binance has focused more on speculative assets, aiming to capture opportunities in the “attention economy.” However, due to its nature as a centralized exchange (CEX), Binance is inevitably constrained by internal review processes. These processes often result in memecoins being listed only after market hype has faded or shifted to new trends.

While Binance provides ample liquidity to protect investors, this liquidity has also become an exit route for early holders to sell off memecoins. Because such sell-offs have a limited impact on market prices, many newly listed memecoins have seen their prices drop by over 75% in a short period, causing significant losses for investors. This situation has not only damaged Binance’s long-term reputation but also raised concerns about its listing review process.

Compared to Binance, major centralized exchanges such as Coinbase, Kraken, and Upbit have adopted more conservative strategies, focusing on verified cryptocurrencies rather than memecoins. While this approach may miss out on short-term high-return market opportunities, it helps maintain platform stability and reduces regulatory risks.

In recent years, there has been an increasing trend of funds flowing from CEXs to DEXs, indicating that CEXs no longer hold absolute market dominance. In response to this shift, CEXs need to reassess their strategic positioning. They can choose from several approaches:

- SFiltering early assets and providing transparent information (e.g., Binance Alpha);

- Managing risk by selectively listing memecoins;

- Introducing hybrid trading models that combine on-chain order books with DeFi elements.

The core challenge for CEXs today is how to strike a balance between attracting short-term trading activity and maintaining long-term platform stability, while retaining institutional investors’ trust and effectively attracting more retail investors.

4. Strategic Summary and Future Outlook

Memecoins have evolved from mere speculative tools to significant trading assets in the cryptocurrency market. With a substantial increase in memecoin trading on decentralized exchanges (DEXs), this trend brings both new opportunities and challenges to the crypto industry.

During the recent bull market, memecoins on DEXs significantly outperformed assets listed on centralized exchanges (CEXs), prompting more and more investors to shift towards DEXs. Platforms like Pump.fun have optimized the issuance and trading process of memecoins, enabling new tokens to experience explosive growth even without being listed on CEXs.

To adapt to this shift, market makers, liquidity providers, and project teams have adjusted their strategies. They are no longer solely focused on CEX listings but are also prioritizing the DEX environment. By building liquidity pools across multiple platforms, they have enhanced the accessibility and flexibility of trading.

However, the memecoin market still faces numerous risks. Unethical behaviors such as rug pulls, small group manipulation, and malicious trading have severely harmed investors’ interests. The lack of effective regulation in the market has made these issues prevalent. For example, the Argentina Libra ($LIBRA) scandal exposed these potential risks, sparking widespread skepticism about memecoins and causing a significant drop in Solana DEX trading volume.

Nevertheless, memecoins continue to demonstrate their potential in the crypto space. They are increasingly becoming representative assets for certain entities and groups. For instance, the connection between Elon Musk and Dogecoin, Trump and Official Trump Token, as well as memecoins issued by some startups and countries, suggest that cryptocurrencies are capturing real economic and social value. This trend is similar to the securitization process in traditional financial markets and may gradually evolve into a new cultural phenomenon.

In response to this change, CEXs must rapidly adjust their strategies. Investors no longer wait for CEX listings to begin trading potential assets. To attract more users and remain competitive, exchanges need to integrate on-chain functions and DeFi elements while ensuring platform stability and compliance. This flexible and innovative strategy will be crucial in driving the crypto market into its next growth phase.

Disclaimer:

This article is reproduced from [Tiger Research], and the copyright belongs to the original author [CHI ANH, JAY JO, AND ELSA]. If you have any objections to the reprint, please contact the Gate Learn team, which will handle it as soon as possible according to relevant procedures.

Disclaimer: The views and opinions expressed in this article represent only the author’s personal views and do not constitute any investment advice.

Other language versions of the article are translated by the Gate Learn team. The translated article may not be copied, distributed or plagiarized without mentioning Gate.io.