Euler Finance (EUL): From Restructuring to Surge — Beginner’s Guide and Investment Highlights

Euler Overview

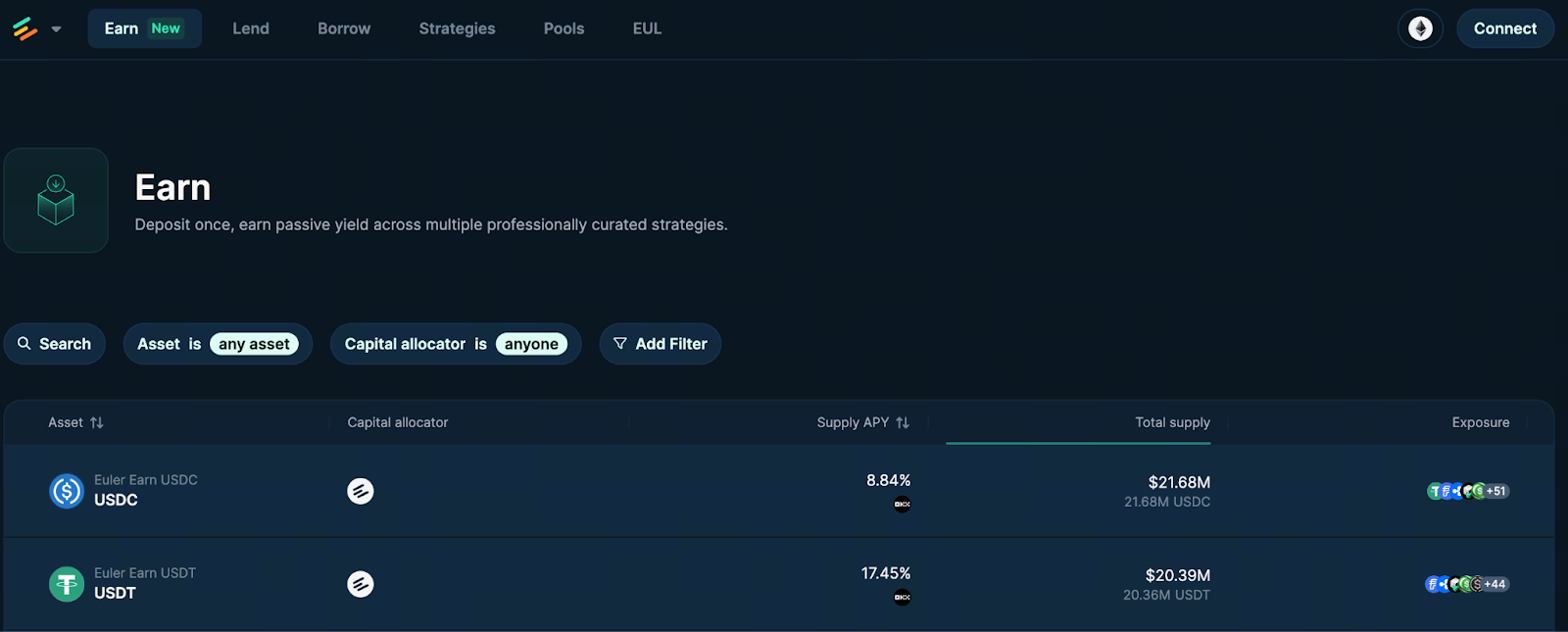

Image source: https://app.euler.finance/earn?network=ethereum

Euler Finance is a decentralized lending protocol built on Ethereum that focuses on providing a secure, flexible environment for long-tail asset lending. Unlike conventional DeFi lending platforms, Euler enables a broader range of tokens to participate in its lending markets and supports community self-governance through its EUL governance token. Euler stands out in the DeFi space because it introduces innovative risk isolation mechanisms and achieves efficient capital utilization.

Key Features: Modularity and Customization

The latest release, Euler V2, introduces a modular framework and the Euler Vault Kit (EVK) concept. This system allows anyone to create independent lending vaults and freely adjust parameters based on risk appetite, interest rate models, or asset types. This decentralized approach empowers developers and strategy traders to design custom lending markets, overcoming the limitations of single liquidity pools.

Recent Metrics and Price Performance

With the rollout of V2 and ecosystem expansion, Euler’s total value locked (TVL) and lending volumes have surged. Recent market data shows EUL trading in the $8–$10 range, with strong gains since the start of the year. As volumes on major exchanges grow, EUL’s market cap continues to rise, reflecting market confidence in its long-term prospects.

Trade EUL here: https://www.gate.com/trade/EUL_USDT

Token and Governance Model

EUL serves as Euler’s governance token, granting holders voting rights on protocol upgrades, parameter changes, and fund allocations. The governance system offers high transparency, and community participation is steadily increasing. For long-term holders, active governance not only deepens understanding of the project but may also provide future ecosystem incentives or fee-sharing opportunities.

Getting Started and Application Scenarios

Users can connect their wallets (such as MetaMask) to the official app to deposit or borrow; developers can leverage the Euler Vault Kit to deploy custom vaults and implement advanced lending strategies. For example, institutional investors can create dedicated stablecoin vaults, while quant teams can maximize capital efficiency through automated strategies.

Security and Risk Notice

Euler’s design incorporates robust risk controls. However, the protocol has experienced security incidents in the past. Stay vigilant about smart contract risks and any changes to liquidation mechanisms. Beginners should start with small trial amounts. Gradually scale up while keeping up with official security audits and announcements.

Investment Guidance and Outlook

Euler Finance (EUL) has captured market attention with its modular design, flexible architecture, and open ecosystem. As more projects build on Euler, the protocol’s use cases will continue to expand. New investors should take a phased approach, monitor governance updates and market trends, and carefully evaluate risk when exploring DeFi lending opportunities.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution