Bitcoin Price Prediction Key Test At 100000 Resistance Near 50day EMA

Bitcoin Volatility Ahead of Fed Decision

Analysts caution that Bitcoin’s recent rally may face headwinds as the Federal Reserve prepares to announce its interest rate decision this Wednesday. Data from the CME Group futures market shows an 88.6% probability of a 0.25% rate cut.

Jeff Mei, Chief Operating Officer at BTSE Exchange, noted that Bitcoin’s rise is likely driven by expectations of a rate cut, but the market’s direction after the Fed’s announcement remains uncertain. He added that any hesitation on future rate cuts could create downward pressure on Bitcoin and the broader crypto market. CME futures indicate just a 21.6% chance of an additional rate cut in January.

Investor Perspectives

Long-term Bitcoin investor NoLimit argues that the recent surge to $94,000 exhibits clear signs of market manipulation. He points out that a thin order book allows large buy orders to push prices higher, and after a brief period of concentrated buying, the market quickly stalls with no sustained momentum. This is a typical tactic by major players to generate FOMO and offload positions at elevated prices.

Technical Resistance and Key Levels

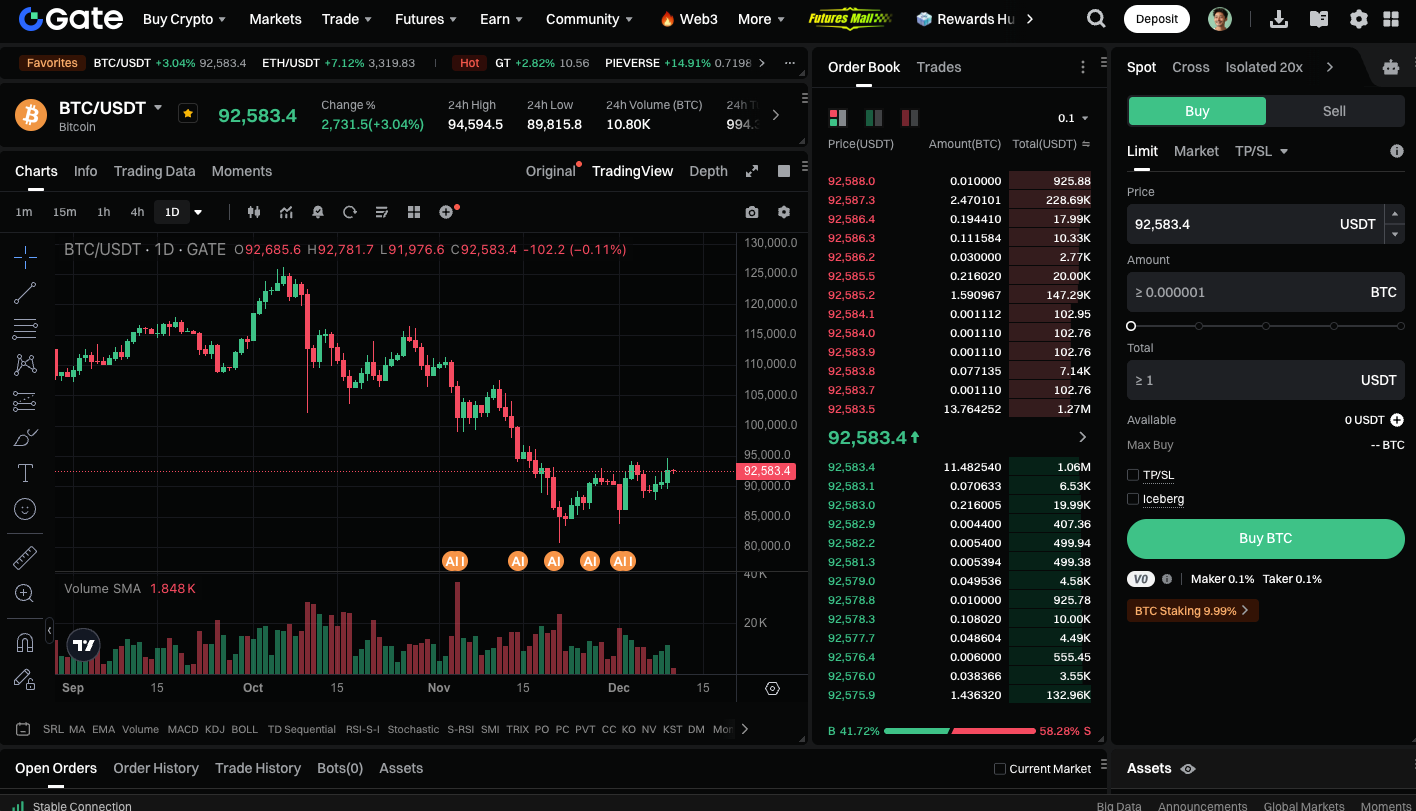

At present, Bitcoin faces resistance at the 50-day Exponential Moving Average (EMA) near $97,000—a critical entry point for bullish traders. A decisive breakout above this level, supported by strong trading volume, would signal a strengthening trend and could propel prices toward the $100,000 threshold.

Start BTC spot trading now: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin’s recent rally is shaped by the Fed’s rate decision, potential market manipulation, and technical resistance. Investors should watch if Bitcoin can break through the 50-day EMA resistance—this will be a key signal for whether it can successfully challenge the $100,000 mark.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution