NolanVincent

暗号市場アナリスト&リサーチャー

オンチェーンデータ、市場センチメント、暗号サイクルにおける投資家行動に焦点を当てています。

資本の流れ、流動性条件、リスクオン/リスクオフのレジームを分析して、市場構造と下方リスクを評価します。

データ主導で客観的なリサーチを行い、短期的な価格予測よりも文脈とリスク管理を優先します。

NolanVincent

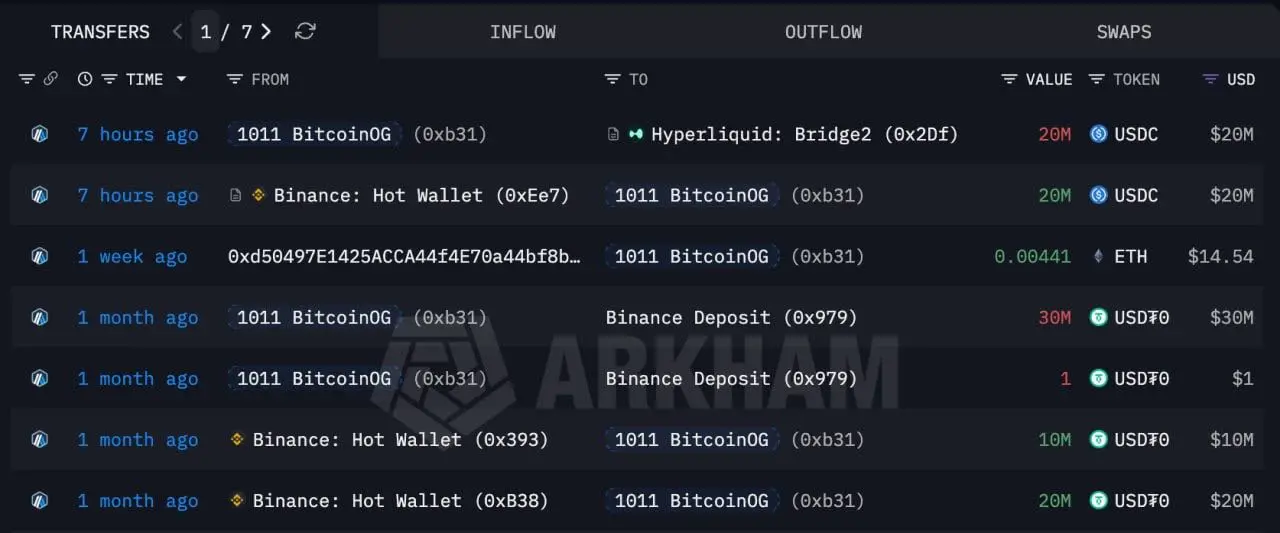

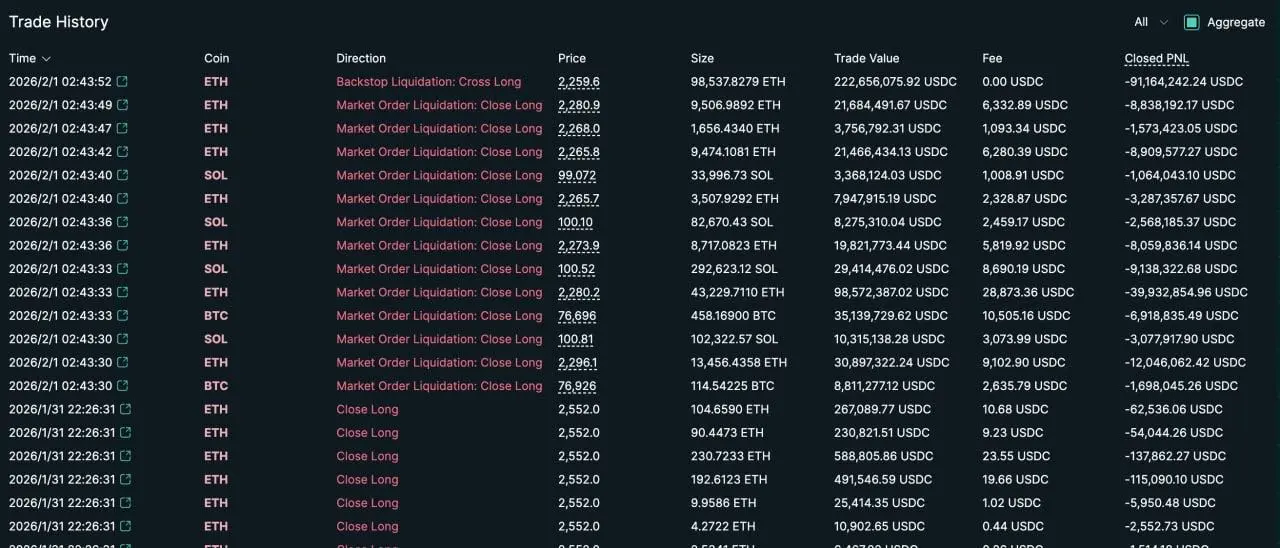

市場はついにこの#BitcoinOG(1011short)を清算し、総清算額は5億2200万ドルに達しました。

彼は利益の1億4200万ドル以上から1億2887万ドルの損失に転じました。

アカウントは完全に消去され、残高はゼロです。

原文表示彼は利益の1億4200万ドル以上から1億2887万ドルの損失に転じました。

アカウントは完全に消去され、残高はゼロです。

- 報酬

- いいね

- コメント

- リポスト

- 共有

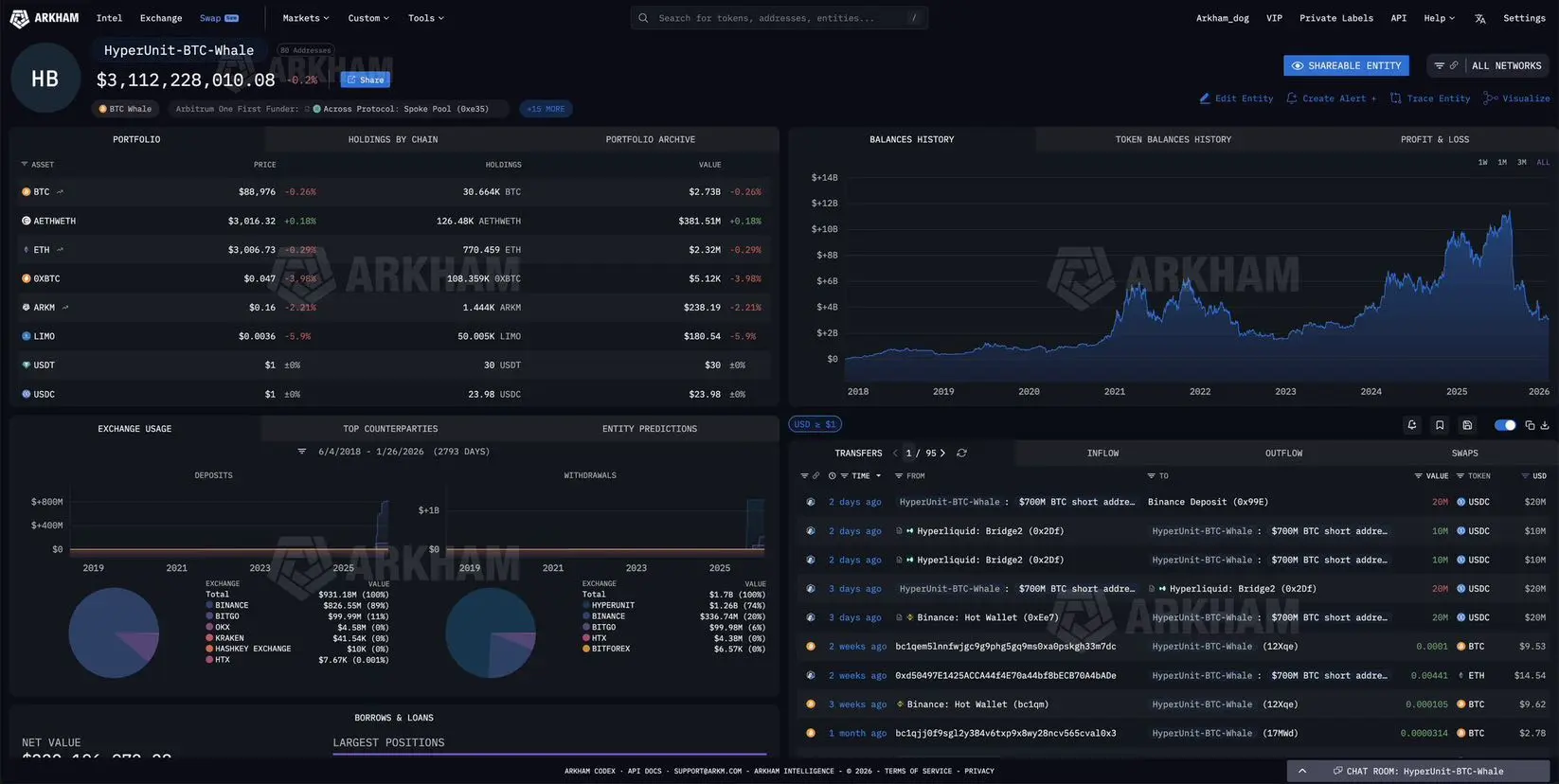

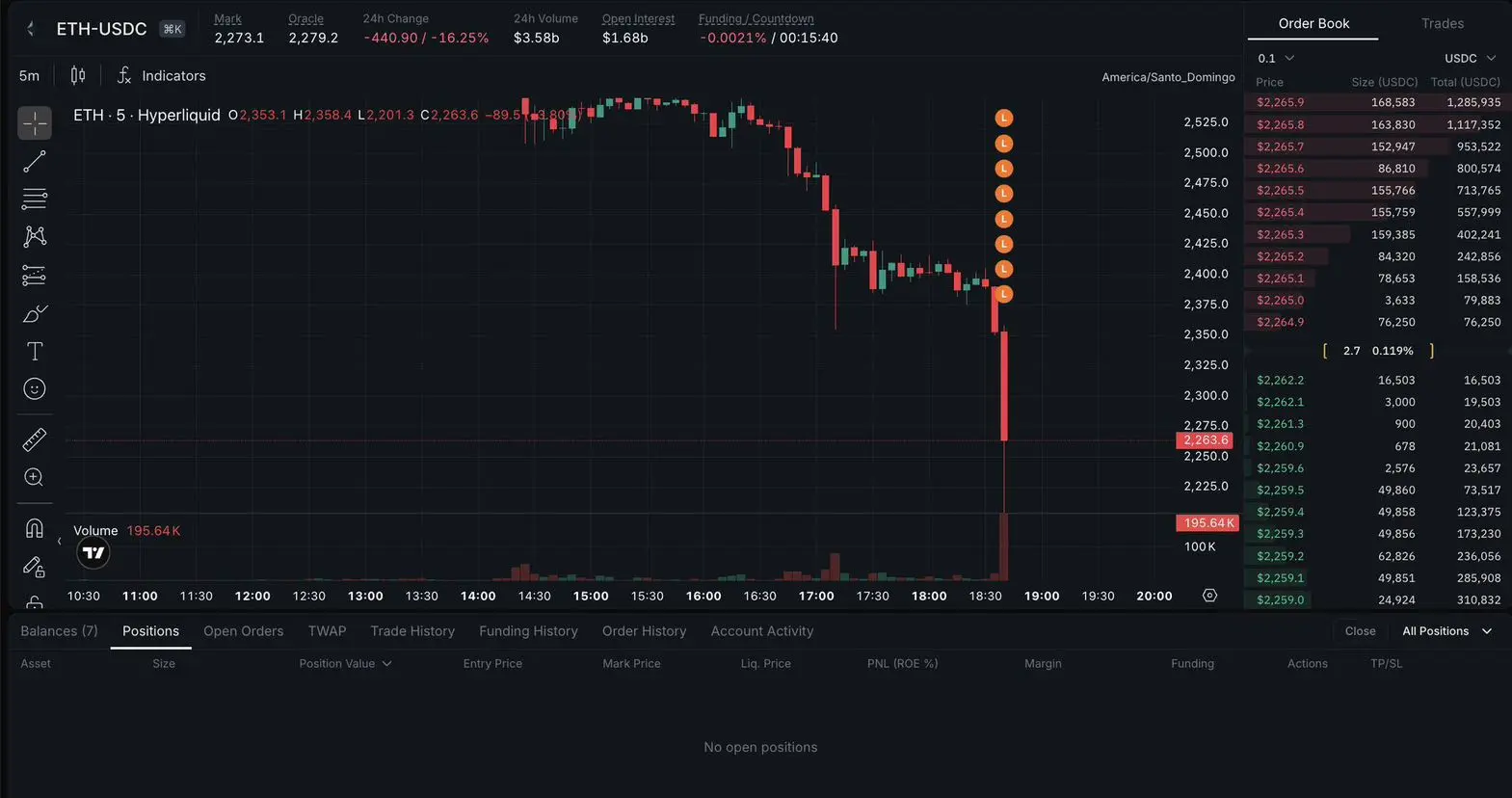

HYPERLIQUIDATED: HYPERUNIT WHALE [GARRETT JIN]

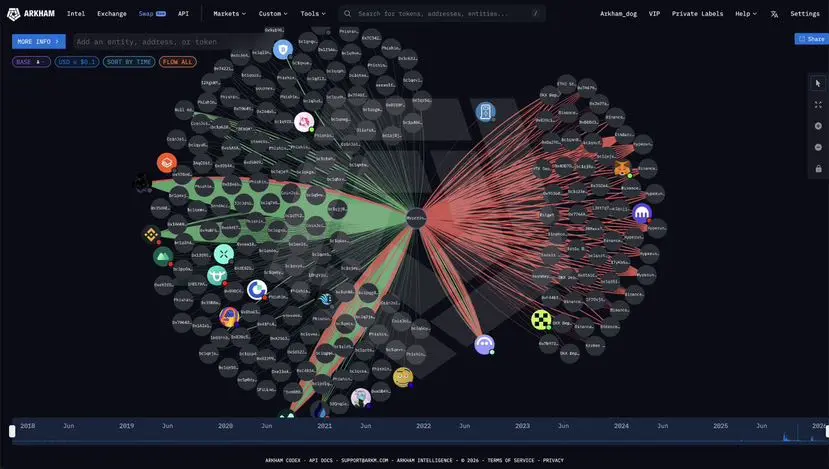

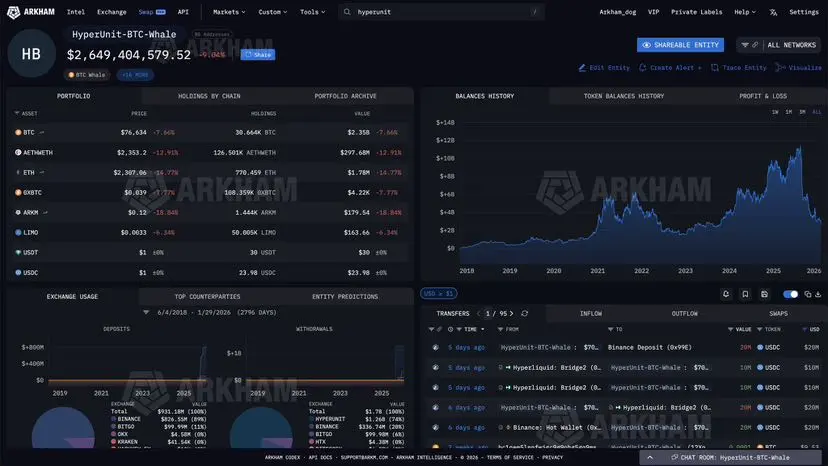

ハイパーユニットのホエール、ギャレット・ジンは、ついに彼の全ETHポジションを売却し、$250 百万の完全損失を確定しました。

彼はハイパーリクイッドアカウントに$53 を残しています。

ハイパーユニットのホエール、ギャレット・ジンは、ついに彼の全ETHポジションを売却し、$250 百万の完全損失を確定しました。

彼はハイパーリクイッドアカウントに$53 を残しています。

ETH3.29%

- 報酬

- いいね

- 1

- リポスト

- 共有

PhoenixPavilion :

:

そのデータはどこで監視していますか- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

フォロワーにとって大勝利、利益を取って、良いお年を

原文表示[ユーザーは自分の取引データを共有しました。アプリに移動して詳細を表示します]

- 報酬

- いいね

- コメント

- リポスト

- 共有

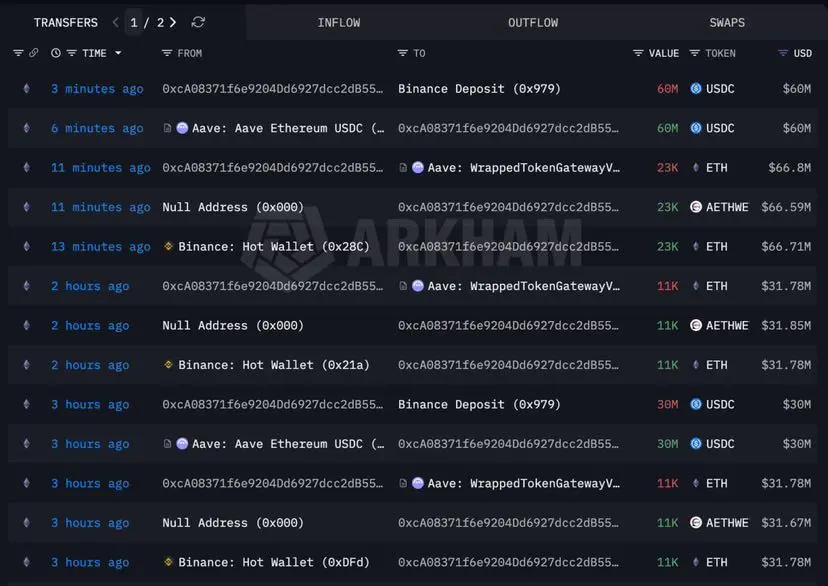

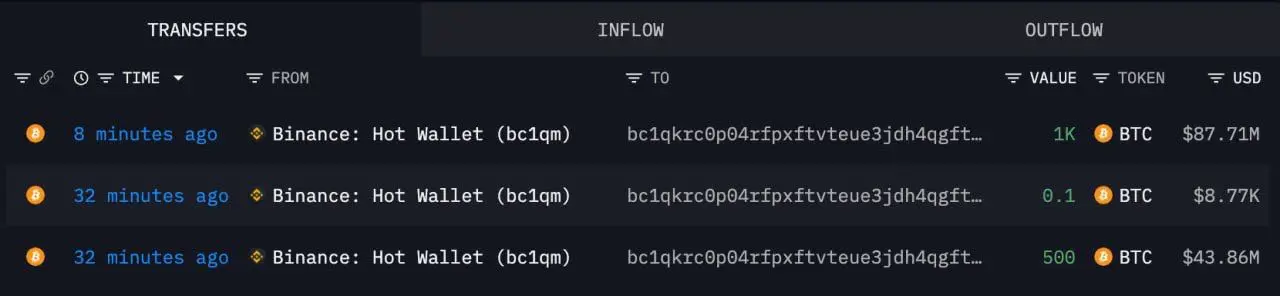

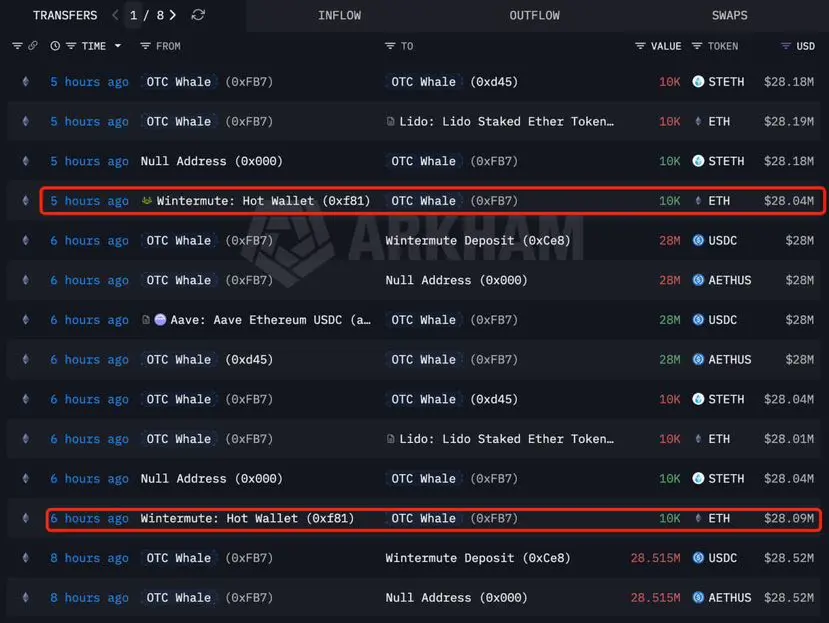

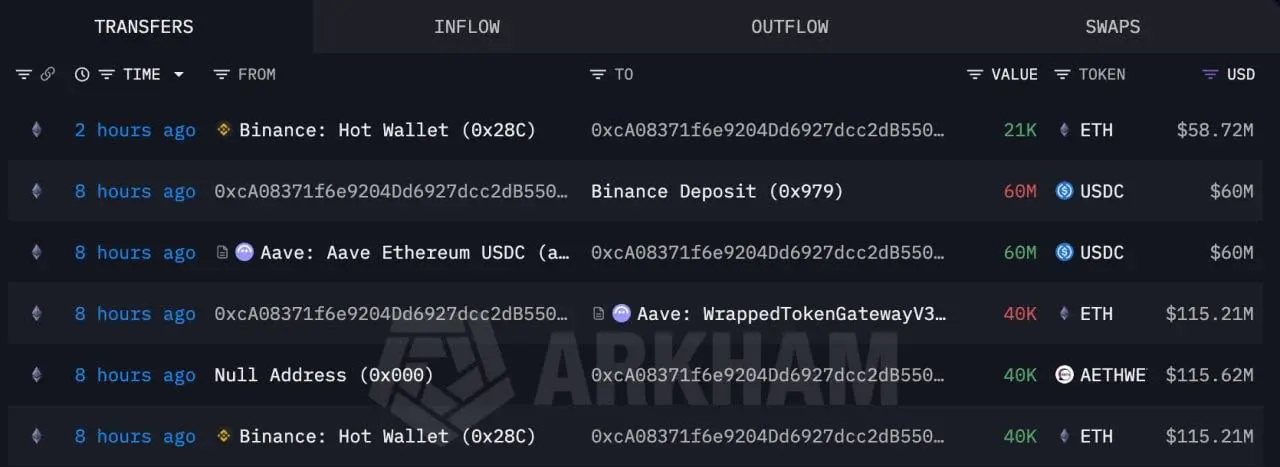

過去24時間で、大きなETHホエルが135K ETHをGeminiに預けました。

これらのウォレットは元々2017年にBitfinexから45万ETHを平均価格64ドルで引き出しました。

途中で一部を売却しましたが、ほとんどを保有し続けました

$29M コストベース、$431M 総収益、$402M 利益。過去24時間で、大きなETHホエルが135K ETHをGeminiに預けました。

これらのウォレットは元々2017年にBitfinexから45万ETHを平均価格64ドルで引き出しました。

途中で一部を売却しましたが、ほとんどを保有し続けました

原文表示これらのウォレットは元々2017年にBitfinexから45万ETHを平均価格64ドルで引き出しました。

途中で一部を売却しましたが、ほとんどを保有し続けました

$29M コストベース、$431M 総収益、$402M 利益。過去24時間で、大きなETHホエルが135K ETHをGeminiに預けました。

これらのウォレットは元々2017年にBitfinexから45万ETHを平均価格64ドルで引き出しました。

途中で一部を売却しましたが、ほとんどを保有し続けました

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- 1

- リポスト

- 共有

tantowi :

:

共有できます😀- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有

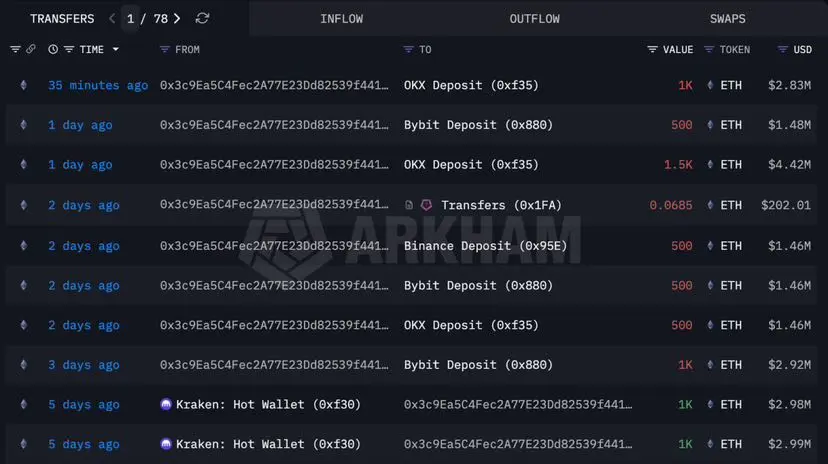

「買い高、売り安」のクジラ0x3c9Eは、過去3日間で$ETH(を5,500)、$16.02M(でパニック売りしました。価格は$2,912です。

わずか5日前に、彼は$ETH)を2,000、$5.97Mで$2,984で買いました。

もう一度言います:買い高、売り安。

わずか5日前に、彼は$ETH)を2,000、$5.97Mで$2,984で買いました。

もう一度言います:買い高、売り安。

ETH3.29%

- 報酬

- いいね

- コメント

- リポスト

- 共有

- 報酬

- いいね

- コメント

- リポスト

- 共有