Solana investment commitment 2025

Key Points:* SOL Strategies’ $500M facility to enhance Solana staking infrastructure.

- First $20M tranche expected by May 1, 2025.

- Institutional investment bolsters Solana’s credibility and staking uptake. SolanaFloor reported on April 23 that SOL Strategies Inc, a Canadian-listed company, received a $500 million convertible note from ATW Partners. Funds will purchase and stake Solana.

The $500 million commitment from ATW Partners highlights significant institutional engagement, indicating growing confidence in Solana’s infrastructure and potential.

$500M Investment to Boost Solana’s Staking Infrastructure

SOL Strategies Inc, a Canadian stock exchange-listed company, announced securing up to $500 million through a convertible note from ATW Partners, dedicating funds solely for purchasing Solana (SOL) and staking on its validator nodes. The initial $20 million tranche is due on May 1, 2025, marking this as the largest of its kind in the Solana ecosystem.

The announcement marks a significant endorsement of Solana’s network, as the company aims to strengthen its staking position. The integration of such a substantial quantity of SOL via this facility could improve network security and yield rates, asserting SOL Strategies’ role as a Solana-native institutional entity.

Public reactions have been limited due to the lack of statements from major figures or companies. However, the unique structure linking convertible debt to proof-of-stake yields suggests a possible model for future institutional adoption, stirring interest in the sector.

Solana’s $500M Commitment Sets Institutional Investment Record

Did you know? The $500 million commitment is the largest direct institutional financial engagement for Solana, potentially setting a precedent for similar future investments in proof-of-stake blockchain networks.

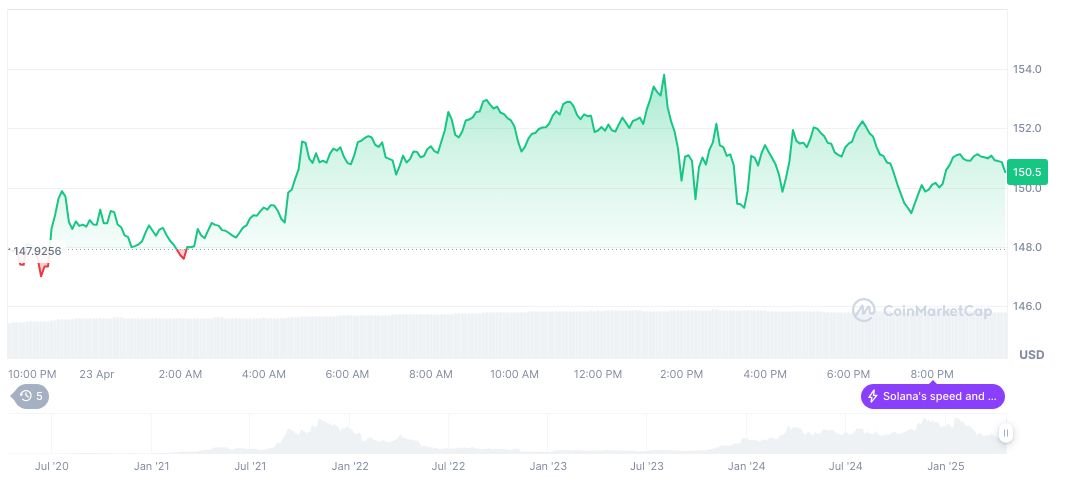

Solana (SOL) currently trades at $148.75, with a market cap of $76.95 billion, representing a dominance of 2.65%. The cryptocurrency saw a 1.53% decrease in the past 24 hours. Trading volume fell by 8.13%, indicative of market adjustments following the investment news, according to CoinMarketCap data.