What is OKB?

What Is OKB?

OKB is a utility token designed for the OKX ecosystem, granting holders benefits such as trading fee discounts, participation in platform events, and voting rights. As a utility token, OKB is primarily used for accessing services and features, not for equity or ownership. Initially, OKB was issued as an ERC‑20 token on Ethereum (a widely adopted token standard ensuring wallet and application compatibility), but later integrated with the proprietary OKX public blockchain to unlock more use cases across the ecosystem.

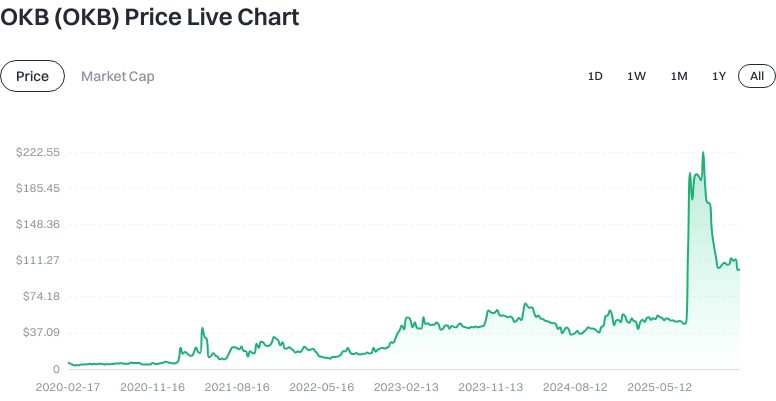

Current Price, Market Cap, and Circulating Supply of OKB

As of 2026-01-26, OKB is priced at approximately $102.49, with a circulating supply of 21,000,000 tokens. Both the total and maximum supply are capped at 21,000,000 tokens.

View OKB USDT Price

This translates to a circulating market capitalization of about $2.152 billion and a fully diluted valuation (FDV) of around $2.152 billion, representing approximately 0.069% of the total crypto market cap. Over the past hour, OKB has increased by +0.49%, while the 24-hour change is -0.63%. Over the last 7 days, it is down -6.68%, and over 30 days, -4.60%. The 24-hour trading volume is about $1.8843 million.

Circulating market cap refers to the current number of tradable tokens multiplied by the price. Fully diluted market cap assumes all tokens are released, providing a view of potential valuation. These figures are snapshots and will fluctuate with market dynamics.

Who Created OKB and When?

OKB was issued by the OK Blockchain Foundation and launched on February 28, 2018. The foundation formed a strategic partnership with OKX, making OKB a core component of the OKX ecosystem for enabling various platform privileges. In its early days, OKX introduced a platform-sharing plan that distributed some OKB tokens to users for free each year to incentivize ecosystem growth. OKB initially adopted the Ethereum ERC‑20 standard but later migrated to work with OKX’s proprietary public chain to support more on-chain applications and reduce transaction costs.

How Does OKB Work?

As a utility token, OKB’s main mechanisms include:

- Issuance & Standards: Originally an ERC‑20 token, making wallet and exchange integration straightforward. If migrating to a proprietary chain, cross-chain or “mapping” processes are used—users follow official instructions to complete token migration.

- Supply & Cap: Both total and max supply are fixed at 21,000,000 tokens, which helps control long-term inflation. Inflation here means the dilution effect caused by an increasing token supply over time.

- Privileges & Incentives: Holding OKB provides benefits like trading fee discounts, access to special events, and voting rights. Some use cases may require token lock-up—freezing tokens for a set period in exchange for extra rewards.

- Settlement & Transfers: On supported networks, users can deposit OKB into exchanges or self-custody wallets for transfers and payments. Each transaction requires a network gas fee, which varies by network in terms of cost and confirmation time.

What Can You Do With OKB?

- Trading Fee Discounts: Using or holding OKB on OKX grants tiered trading fee reductions or can be used for direct fee deductions.

- Event Participation: Enables access to ecosystem events, subscriptions, or governance votes, boosting user engagement and influence within the community.

- Payments & Settlement: On supported platforms or decentralized applications, OKB can serve as a payment medium or collateral—subject to each application’s terms.

- Cross-chain & Wallet Management: Transfer and store OKB across compatible networks and wallets for flexible asset management.

Key Risks and Regulatory Considerations for OKB

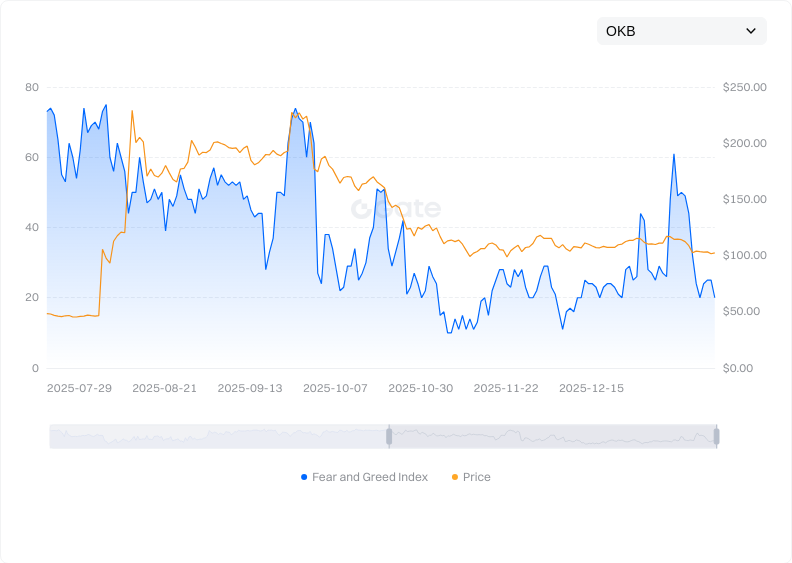

- Market Volatility: The price of OKB is influenced by market supply-demand dynamics and broader sentiment, leading to potentially significant short-term fluctuations.

- Platform Dependence: OKB is closely tied to the OKX ecosystem; changes in platform policy, business direction, or competitive landscape can affect demand and perceived value.

- Regulatory Uncertainty: Regulations regarding platform tokens differ widely by jurisdiction; policy changes may impact trading or use.

- Technical & Migration Risks: Cross-chain transfers and token migrations carry risks of operational errors or smart contract vulnerabilities. Always use official tools and guidance when migrating assets.

- Custody Security: Hot wallets (internet-connected wallets) are convenient but less secure; cold wallets (offline devices) offer better security. Always safeguard private keys/seed phrases, beware of phishing links, enable two-factor authentication (2FA), and set withdrawal whitelists.

What Drives the Long-term Value of OKB?

- Supply Structure: With a hard cap of 21,000,000 tokens, OKB has built-in scarcity if demand grows steadily.

- Ecosystem Demand: Key use cases like trading fee discounts, event participation, and voting create ongoing demand for holding and using OKB. The more diverse the ecosystem, the stronger the potential utility.

- Platform Integration: The value of OKB is linked to the growth of the OKX ecosystem—including product upgrades and user base expansion. More rights tied to OKB enhance its utility.

- External Factors: Market cycles, regulatory developments, and technical advancements all influence long-term performance. Investors should monitor ecosystem updates and policy trends closely.

How to Buy and Securely Store OKB on Gate

Step 1: Register and log in to your Gate account. Enable account security measures such as SMS/email verification and two-factor authentication (2FA).

Step 2: Complete identity verification (KYC) as prompted to increase deposit, trading, and withdrawal limits.

Step 3: Fund your account—either by purchasing crypto with fiat or depositing stablecoins like USDT—then exchange them for OKB in the spot market.

Step 4: On the trading page, search for “OKB,” select your preferred trading pair (e.g., OKB/USDT), review order book depth and price charts before placing an order.

Step 5: Place your buy order. Use limit orders for specific price targets (ideal for patient entry) or market orders for immediate execution at current prices—always confirm quantity and fees before submitting.

Step 6: For long-term storage, consider withdrawing your OKB to a self-custody wallet. Choose the correct withdrawal network (such as ERC‑20 or the official supported chain), test with a small amount first, then proceed with larger transfers after confirming receipt.

Step 7: Enhance security—enable withdrawal whitelist settings, anti-phishing codes, regularly review login devices/API permissions, and avoid large transactions over public networks.

Step 8: Track your cost basis and tax obligations. Save trade and withdrawal records for accurate asset tracking and regulatory reporting.

Risk Note: Trading and withdrawals incur fees and different confirmation times; asset prices fluctuate. Incorrect addresses may lead to irreversible loss—always test with small amounts first and verify all details.

How Does OKB Differ from GateToken?

- Issuance & Purpose: OKB is issued by the OK Blockchain Foundation for use within the OKX ecosystem; GateToken (GT) is issued for use within the Gate ecosystem. Both are platform ecosystem tokens but serve different communities.

- Utility Focus: OKB mainly offers fee discounts, event participation, and voting within OKX; GT provides similar benefits within the Gate ecosystem. Check each platform’s official announcements for details.

- Network & Technology: OKB started as an Ethereum ERC‑20 token before migrating to its native chain; GT is more closely integrated with the GateChain network. Differences in network structure affect gas fees and confirmation speeds.

- Supply & Mechanism: The maximum supply caps and potential burn/incentive mechanisms differ between the two tokens—impacting scarcity and inflation profiles; always refer to official disclosures.

- Risk Exposure: Both tokens are highly dependent on their respective ecosystems; platform policies, product development, and regulatory changes directly impact token demand and valuation expectations.

Impartial Conclusion: Both OKB and GT are platform ecosystem tokens; their core differences lie in their “target user base” and “specific benefit packages.” Choose based on your preferred platform, benefit needs, and risk tolerance.

Summary of OKB

OKB is a utility token serving the OKX ecosystem—originally launched as an ERC‑20 token with a fixed supply cap—enabling fee discounts, event participation, governance rights, and more. As of the snapshot on 2026-01-26, its price, market cap, and trading volume reflect periodic volatility; its value is primarily anchored by ecosystem expansion and incentive design while also subject to platform policy and regulatory factors. Beginners can acquire OKB on Gate by following step-by-step registration, KYC completion, funding, buying, and secure withdrawal processes—using small test transactions and robust security settings to minimize operational risk. Ongoing monitoring of official announcements and ecosystem developments is recommended; pay attention to supply mechanisms, benefit adjustments, regulatory changes, diversification strategies, and risk management when making decisions.

FAQ

What Are the Main Use Cases for OKB?

OKB is the native exchange token of OKX and is primarily used for trading fee discounts (up to 40%), participation in governance votes on new listings or proposals, and other incentive programs within the ecosystem. By holding OKB on OKX, users receive substantial fee reductions—the most direct use case—and gain access to exclusive events and voting rights.

What Factors Drive Price Fluctuations in OKB?

OKB’s price is mainly influenced by three factors: the growth of the OKX platform itself; broader cryptocurrency market trends; and macro-level policy changes. When OKX’s trading volume rises or user numbers increase, demand for OKB typically grows—lifting its price—and vice versa. As a platform token, its performance is also closely tied to major cryptocurrencies like Bitcoin or Ethereum; market downturns can introduce systemic risks for OKB holders.

How Can Beginners Safely Buy and Store OKB?

The simplest way to purchase OKB is via mainstream exchanges like Gate using fiat or other cryptocurrencies. After purchase, it’s recommended to transfer funds into a self-custody wallet (such as hardware wallets like Ledger) for maximum security rather than leaving them on exchanges long-term. For smaller amounts or frequent traders, keeping funds on Gate may be acceptable—just be sure to enable both two-factor authentication (2FA) and payment password protections.

What Advantages Does OKB Have Over Other Exchange Tokens?

OKB benefits from being backed by one of the world’s leading exchanges—OKX—with high liquidity and broad application scenarios. Compared to other platform tokens, OKB offers stronger fee discounts, numerous trading pairs, and is widely accessible via major exchanges like Gate. The technical capabilities of the OKX team and its large user base further underpin the value proposition of OKB.

What Risks Should Holders Pay Attention To?

As a platform token, OKB faces three main risks: regulatory risk (stricter crypto policies could negatively affect its value); platform risk (the health of the OKX business directly influences demand); and market risk (overall crypto market downturns will likely impact OKB). It’s advisable not to hold it as a primary asset—control your position size—and regularly monitor both platform updates and regulatory developments.

Key Terms Related to OKB

- Exchange Token: A token issued by a cryptocurrency exchange used for fee payments, governance participation, etc.

- Burn Mechanism: Periodic destruction of tokens to reduce circulating supply and increase scarcity.

- Ecosystem Governance: The right/mechanism for token holders to participate in voting on platform decisions.

- Trading Fee Discount: Reduced fees on trades or withdrawals when holding exchange tokens.

- Liquidity Mining: A rewards mechanism where users provide liquidity to trading pairs in exchange for additional tokens.

Further Reading & References

-

Official Website / Whitepaper:

-

Developer Resources / Documentation:

-

Authoritative Media / Research:

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?