Реальный сезон альткоинов начался на рынке криптовалютных акций

В последнее время возникает множество вопросов о перспективах альт-сезона на криптовалютном рынке в этом цикле. Многие считают, что пиковые значения пришлись на январь 2024 года или январь 2025 года, когда криптоактивы, кроме Bitcoin, существенно выросли и многие достигли новых исторических максимумов.

В предыдущих циклах значительный рост цены Bitcoin обычно опережал аналогичный рост (а иногда — и более высокую доходность) многих альткоинов. Но в последние годы эта закономерность не проявляется. Сейчас доля Bitcoin на рынке составляет 58 % и стабильно увеличивается с ноября 2022 г.

Значит ли это, что в этом цикле альт-сезон будет пропущен? Или он просто ещё не наступил? А возможно, альт-сезон уже идёт в другом сегменте, но остаётся незамеченным?

По моему мнению, верно последнее. Настоящий альт-сезон сейчас происходит в секторе криптовалютных акций.

Какие ключевые признаки формирования альт-сезона?

- Рост цен привлекает новый капитал — вопрос: откуда он поступает?

- Рост цен вызывает перераспределение прибыли — вопрос: кто фиксирует прибыль и куда направляет средства?

Новый капитал безусловно стремится к инвестициям в криптовалюты, но его большая часть — институциональная, а не розничная. Розничные инвесторы быстро реагируют, а институциональные действуют медленнее и предпочитают дождаться признания от регуляторов. Сейчас как раз это и происходит: в 2024 г. SEC одобрила спотовые ETF на Bitcoin и Ethereum, председатель Эткин анонсировал Project Crypto, генеральный директор Nasdaq Адена Фридман поддержала токенизацию акций — и подобных новостей становится всё больше.

Институциональные инвесторы заходят на рынок с новым капиталом. По моим оценкам, большая часть этих средств направляется именно в криптовалютные акции, а не в токены. Акции — привычный и удобный инструмент. Для них уже отработаны процессы хранения, соблюдения нормативных требований и взаимодействия с дилерами. Работа с криптоактивами требует новых инфраструктурных решений. Кроме того, покупка акций соответствует инвестиционному мандату институциональных инвесторов, тогда как прямое приобретение токенов (особенно менее известных альтов) часто выходит за рамки их политики.

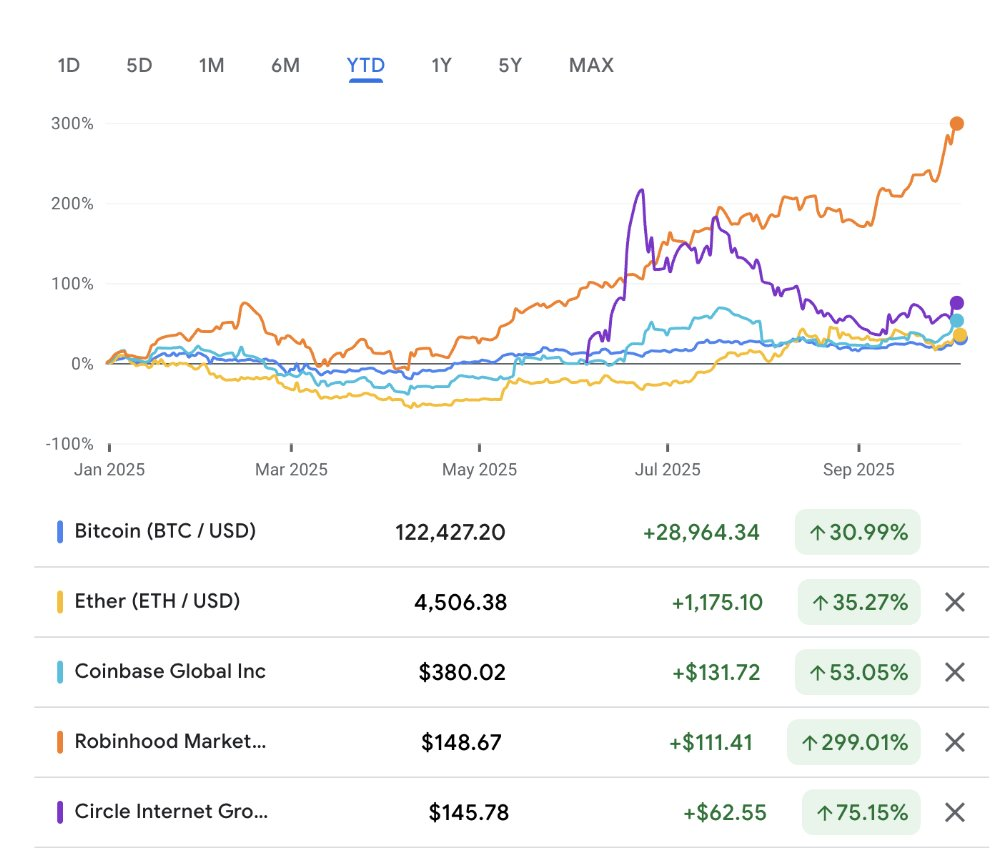

В итоге институционалы активно вкладываются в криптовалютные и смежные акции. Coinbase выросла на 53 % с начала года, Robinhood — на 299 %, Galaxy — на 100 %. Circle — на 368 % с момента IPO в июне. Если считать по цене закрытия первого дня торгов, рост составляет 75 %. Для сравнения: Bitcoin поднялся на 31 %, Ethereum — на 35 %, Solana — на 21 %. Преимущество криптовалютных акций очевидно.

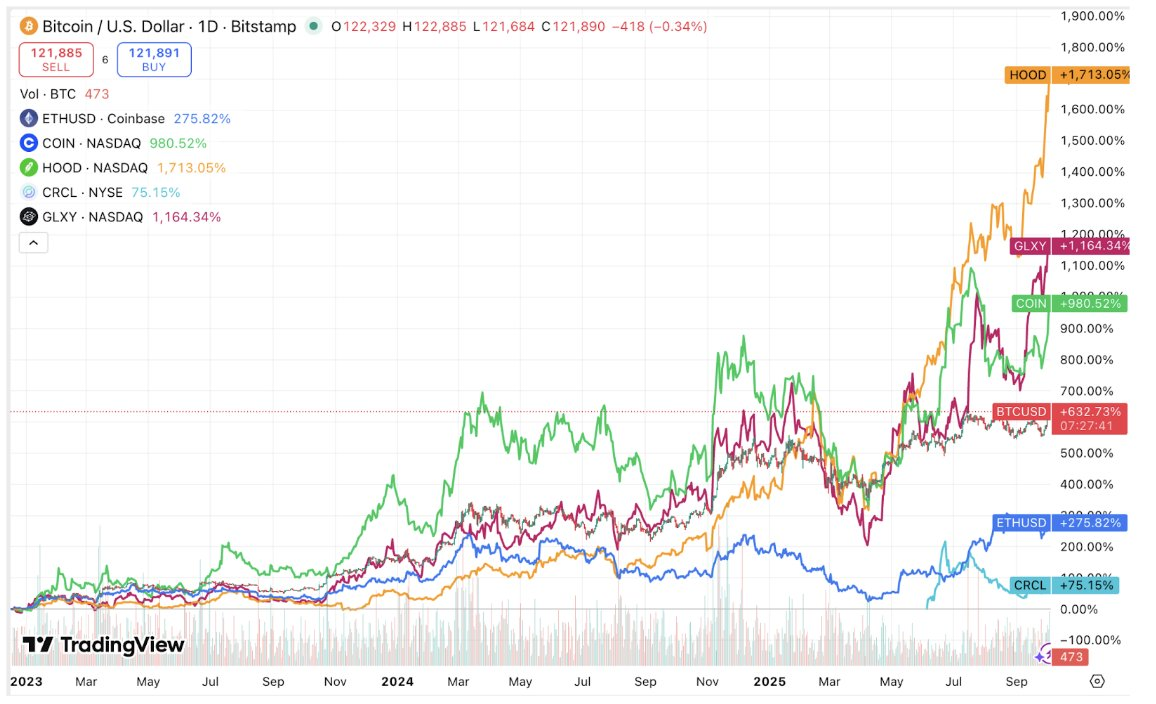

Аналогичная картина наблюдается, если отслеживать динамику с достижения дна Bitcoin 17 декабря 2022 г.:

Есть все основания ожидать, что данный тренд сохранится. На рынке намечается череда IPO криптовалютных компаний, а в ближайшие годы к публичному размещению готовы присоединиться более зрелые игроки.

Как и в классическом альт-сезоне, не все активы покажут высокую доходность. Ожидается ротация: трейдеры будут фиксировать прибыль на переоценённых активах (например, CRCL с коэффициентом P/S 26) и переводить капитал в другие инструменты.

В криптовалютном рынке часто сменяются «мета»-темы: рынок может переходить от DeFi к игровым токенам или AI-монетам. В секторе акций тенденции схожи: альт-сезон может сопровождаться переходом внимания от эмитентов стейблкоинов к биржевым компаниям или цифровым финансовым компаниям.

Есть и другие аргументы в пользу того, что альт-сезон в криптовалютных акциях может больше напоминать исторические периоды, чем будущие альт-сезоны на собственно криптовалютном рынке:

- Сосредоточение активов. Существует ограниченное число акций, обеспечивающих доступ к криптовалютам — как и в прошлых циклах, когда привлекательных токенов было меньше сотни. Это резко отличается от современной криптовалютной индустрии, где насчитываются миллионы токенов и происходит широкое распределение капитала.

- Возможность использовать кредитное плечо. В прошлом цикле ряд криптовалютных кредитных платформ прекратил существование, и новых игроков пока немного. Зато инвесторы в акции могут использовать кредитное плечо, что усиливает как рост, так и падения.

Вероятно, на криптовалютном рынке ещё будет новый альт-сезон, когда новые источники капитала постепенно наладят инфраструктуру для размещения средств в криптоактивах.

Таким образом, сейчас мы наблюдаем не тот альт-сезон, которого ждали многие, но альт-сезон всё же происходит.

Мы благодарим Hootie Rashifard и Mason Nystrom за ценные комментарии к статье.

Дисклеймер:

- Мы опубликовали статью в рамках репоста с ресурса [alanadlevin]. Все права принадлежат оригинальному автору [alanadlevin]. Если у вас есть претензии по перепечатке, обратитесь к команде Gate Learn, и мы оперативно рассмотрим ваш запрос.

- Отказ от ответственности: Мнения и выводы, изложенные в статье, отражают позицию автора и не являются инвестиционной рекомендацией.

- Переводы статьи на другие языки выполнены командой Gate Learn. Если не указано иное, перепечатка, распространение или копирование переведённых материалов запрещены.

Похожие статьи

Что такое Tronscan и как вы можете использовать его в 2025 году?

Что такое индикатор кумулятивного объема дельты (CVD)? (2025)

Что такое Нейро? Все, что вам нужно знать о NEIROETH в 2025 году

Что такое Solscan и как его использовать? (Обновление 2025 года)

15 криптовалютных проектов уровня 1 (L1), на которые стоит обратить внимание в 2024 году