Эволюция методов привлечения средств в криптовалютной отрасли в условиях ажиотажа вокруг предпродаж в 2025 году

Введение: Возвращение эры пресейлов

В 2021–2022 годах рынок DeFi пережил всплеск эирдропов и первичных размещений (IDO). В сентябре 2020 года протокол децентрализованной биржи Uniswap провёл эирдроп токенов UNI на сумму около 6,43 миллиарда долларов; в марте 2022 года проект ApeCoin распределил токены примерно на 354 миллиона долларов. Эти масштабные эирдропы стали значимыми этапами для отрасли, заметно увеличив вовлечённость пользователей и активность сообществ. Параллельно появились IDO-платформы на базе бирж и комьюнити (BSCPad, DAO Maker и др.), открывшие инвесторам доступ к ранним возможностям. С наступлением медвежьего рынка в 2022 году активность временно угасла, однако к 2025 году «пресейл-модель» вновь оказалась в центре внимания. Аналитики отмечают, что инвесторы всё активнее ищут возможности раннего входа до листинга токенов, рассчитывая на высокий риск ради потенциально внушительной отдачи. На практике те, кто своевременно входил в бычий рынок через пресейлы, часто получали феноменальную прибыль: «В каждом крупном бычьем цикле немногие пресейл-инвесторы превращали небольшие суммы в существенное состояние». Очевидно, что эффект «раннего входа» в пресейл-проектах вновь сосредоточил интерес инвесторов. В связи с этим возникают ключевые вопросы: почему пресейлы снова в тренде и чем отличается текущая логика инвестирования от предыдущих циклов?

Эволюция пресейлов: от спекулятивного бума к структурированным инвестициям

Определение и основные форматы

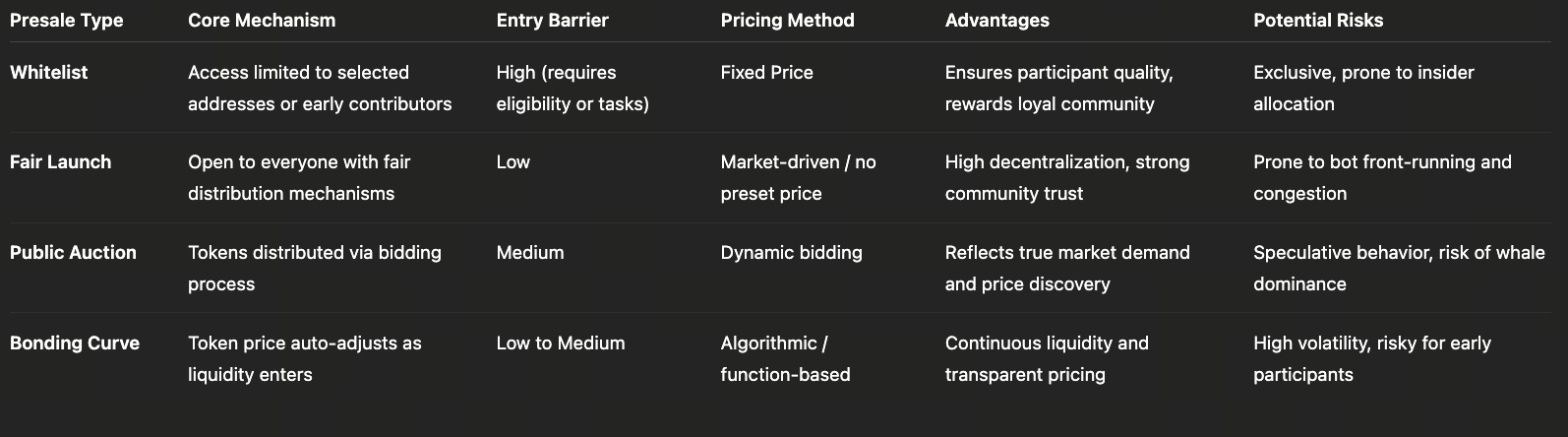

Под пресейлом понимается привлечение проектом инвестиций до выхода токена на биржу. Основные форматы: продажи по вайтлисту, fair launch, аукционы (открытые торги) и динамическое ценообразование (Bonding Curve).

- Пресейл по вайтлисту: Чтобы получить право на покупку токенов, необходимо попасть в список через выполнение заданий в комьюнити, верификацию или другие условия.

- Fair Launch: Все инвесторы покупают токены по одной цене. Модель подчёркивает открытость, прозрачность, управление сообществом. Благодаря равным условиям и отсутствию ранних скидок fair launch набирает популярность и становится более востребованным инструментом сбора средств, чем классические приватные раунды.

- Аукцион: Цена и аллокация определяются конкурирующими заявками; подход применяется в новых финансовых моделях.

- Динамическое ценообразование (Bonding Curve): Цена токена меняется автоматически в зависимости от объёма покупок, механизм реализуется смарт-контрактом и позволяет непрерывно выпускать токены с ценой, привязанной к спросу.

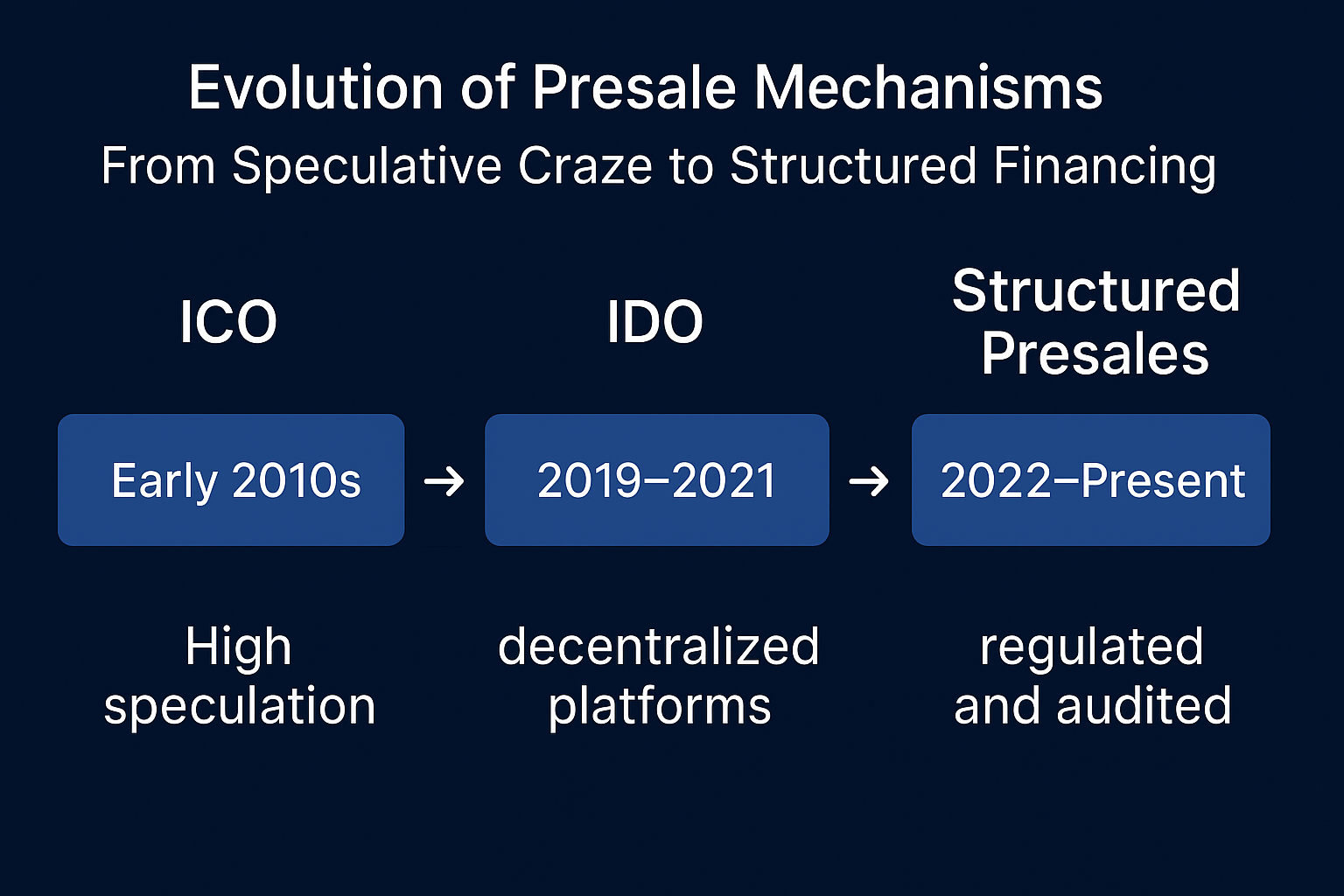

Этапы развития

Эволюция пресейлов проходит несколько фаз:

- Рост IDO (2021–2022): Преимущества ликвидности децентрализованных бирж сделали IDO трендом, а такие платформы, как BSCPad и DAO Maker, быстро аккумулировали стартовый капитал для множества проектов благодаря высокой эффективности и низким барьерам входа.

- Возвращение в 2025 году: По мере созревания рынка пресейлы становятся более структурированными и комплаентными. Современные проекты делают ставку на безопасность средств и консенсус комьюнити: фиксируют ликвидность, объявляют планы линейного разлока, проходят сторонний аудит, KYC-команды ещё на стадии пресейла. Инвесторы ждут подтверждения развития и зрелого управления, а лучшие проекты выделяются за счёт сильной технологии, прозрачности и реального вовлечения сообщества.

Черты пресейлов нового поколения

В 2025 году пресейлы нового поколения характеризуются:

- Блокировка токенов смарт-контрактом и поэтапный разлок: За счёт автоматической блокировки и постепенного выпуска предотвращается массовый сброс токенов командами или ранними инвесторами, что стабилизирует рынок.

- Прозрачность средств и аудит KYC: Перед пресейлом проекты проходят аудит безопасности, а команды проходят комплаенс-проверку (KYC), что укрепляет доверие. В лидирующих проектах аудит проводят Coinsult и CertiK, KYC — Solidproof, что значительно повышает уровень доверия инвесторов.

- Самоуправление и комплаенс: Активное участие комьюнити в управлении, повышенная осознанность регуляторных требований. В условиях ужесточения регулирования процедуры отчётности, AML-проверки становятся нормой и способствуют здоровому развитию рынка пресейлов.

Пресейлы и эирдропы: отличия

Хотя обе активности относятся к раннему этапу, их цели различны:

- Эирдроп: Увеличение узнаваемости и активности комьюнити без инвестиций со стороны пользователей, основной инструмент привлечения и маркетинга через бесплатную раздачу токенов.

- Пресейл: Инвестор вносит средства за право купить токены, то есть участвует в прямом финансировании. Это позволяет получить токены заранее по скидке, но сопряжено с рисками потерь. Пресейл как инвестиция заставляет инвесторов глубже анализировать сам проект, меняя классическую логику привлечения средств.

В итоге пресейлы эволюционировали из спекулятивного инструмента в зрелый формат финансирования, где на первый план выходят структурированное размещение средств и консенсус комьюнити. Успешные пресейлы — это не только стратегия или видение, но и подтверждённый прогресс разработки и устойчивая экосистема, что отвечает требованиям инвесторов к прозрачности и долгосрочной ценности.

Миграция ликвидности: почему средства возвращаются в ранние проекты

В первой половине 2025 года Bitcoin и Ethereum показали уверенный рост: Bitcoin пробил уровень 100 000 долларов, достиг исторического максимума и занял 62,1 % рынка; Ethereum вырос с 1 853 до 2 488 долларов, но остался ниже январской отметки в 3 337 долларов. На фоне сжатия прибыльности и расслоения рынка основные DeFi-возможности с высокой доходностью уходят, а ликвидность перетекает из крупных монет (BTC/ETH) и арбитражных стратегий в более динамичные новые проекты.

В инвестиционном поведении фондов выделяются две тенденции. С одной стороны, крупные средства перераспределяются в основные активы: к третьему кварталу 2025 года ETF на Bitcoin и Ethereum зафиксировали чистый приток более 28 миллиардов долларов, что может свидетельствовать о переходе от спекуляций к распределению активов. С другой стороны, риск-ориентированные фонды ищут краткосрочные возможности в пресейлах: новые проекты блокчейнов и приложений на пресейле привлекли десятки и сотни миллионов долларов, например, MegaETH собрал почти 87,7 миллиона долларов за один пресейл. Пресейл-токены привлекательны низкой ценой и высокой доходностью после листинга (арбитраж + ценовая волатильность). Дополнительно продвижение через KOL и соцсети, а также многочисленные эирдропы быстро привлекают внимание «ликвидного комьюнити» и конвертируют трафик в подписки.

Важное изменение происходит и в менталитете инвесторов: «спекулятивные комьюнити» сменяются «стратегическими группами», всё большее внимание уделяется дорожным картам и репутации команды, а не только настроению рынка. Это отражает тренд на зрелость и прозрачность рынка. В такой среде пресейлы ранних проектов становятся окном для капитала, ищущего новые точки роста: с одной стороны — новые возможности быстрого роста, с другой — акцент на поиске ценности и управлении рисками. По данным Launchpad-платформ, в первой половине 2025 года число пресейл-проектов и общий объём привлечённых средств заметно выросли, а средний ROI превышал доходность основных монет (по CryptoRank и CoinGecko ROI успешных пресейлов обычно в несколько-десятков раз выше). Несмотря на разброс доходности между платформами, лидирующие Launchpad (особенно premium-платформы с AI-отбором) сохраняют высокую активность и эффективность сбора средств.

Кейсы: от Plasma до MegaETH

Plasma: Layer 1 для стейблкоин-платежей

Источник: https://www.plasma.to/?r=0

Источник: https://www.plasma.to/?r=0

Plasma провела два ключевых события: пресейл и публичную продажу токенов. Первый этап — «депозитный раунд»: пользователи вносили USDT или USDC в Vault проекта для получения права на будущую покупку XPL. Лимит раунда сначала был 250 миллионов долларов, затем увеличен до 500 миллионов, но за 30 минут накопили более 1 миллиарда долларов — яркий пример рыночного ажиотажа. Депозиты не обменивались на XPL напрямую, а были основой для расчёта доступных к выводу активов после запуска основной сети (Beta). После этого состоялась публичная продажа: реализовано 10 % токенов примерно по 0,05 доллара за XPL при оценке проекта в 500 миллионов долларов. Планировалось привлечь 50 миллионов долларов, но подписки превысили 373 миллиона — значительное превышение цели. Часть средств пойдёт на стимулирование экосистемы и пополнение ликвидности, XPL для неамериканских инвесторов разблокируются при запуске сети, для инвесторов из США — локап 12 месяцев. Ажиотаж вокруг двух раундов обеспечил Plasma не только стартовое финансирование, но и давление на будущий оборот и управление проектом.

В публичной продаже XPL планировалось собрать 50 миллионов долларов (оценка 500 миллионов), но реально привлекли около 373 миллионов — более чем в 7 раз выше цели. XPL продавался по 0,05 доллара, на пике при листинге доходил до 1,7 доллара (к концу октября 2025 года — около 0,5 доллара), что обеспечило ранним инвесторам до 30-кратной доходности на бумаге. Кроме того, PLASMA выдала почти 10 000 XPL каждому успешному участнику, что значительно повысило интерес к пресейл-формату сбережений.

MegaETH: высокопроизводительный Layer-2 с низкой оценкой

Источник: https://www.megaeth.com/

MegaETH (MEGA) позиционируется как Layer-2 с высокой производительностью для масштабирования Ethereum. Проект заявляет о модульной архитектуре сети (выделенные sequencer и proof-узлы), что позволяет достичь сверхвысокой пропускной способности и минимальной задержки — цель сети — преодолеть барьер 100 000 TPS и обеспечить транзакции в реальном времени.

Результаты сбора средств и аллокации: По данным различных источников, публичная продажа MegaETH в октябре 2025 года прошла с выдающимися результатами. В публичном раунде было реализовано около 5 % эмиссии (примерно 500 миллионов MEGA); объём привлечённых средств оценивается от 50 до 450 миллионов долларов в зависимости от методики подсчёта.

Согласно The Block, итоговая сумма составила 49,95 миллиона долларов, CoinMarketCap и CoinDesk сообщают о 450 миллионах с многократной переподпиской. По некоторым данным, общий объём заявок превысил 1 миллиард долларов — редкий случай для рынка.

В публичном аукционе участвовали более 50 000 адресов, аллокацию получили около 5 000 — успех лишь у 10 % участников. По Bitget и ChainCatcher, в пул «Unlocked (non-locked)» подано 49 976 заявок, аллокацию получило 5 031 адрес. CoinDesk приводит цифру 14 491 участник, некоторые источники говорят о 53 000 заявок — уровень интереса был исключительным.

В целом пресейл MegaETH стал одним из самых обсуждаемых событий среди высокопроизводительных публичных чейнов 2025 года: многократная переподписка, низкая аллокация и амбициозные технологические цели привлекли внимание отрасли. Теперь рынок следит за графиком разлока, ликвидностью и запуском сети, чтобы оценить, удастся ли MegaETH выполнить обещания по 100 000 TPS и транзакциям в реальном времени.

Теневая сторона пресейлов: пузыри, мошенничество и кризис доверия

Несмотря на возвращение интереса к пресейлам в 2025 году, риски по-прежнему крайне актуальны. Главная проблема пресейлов — конфликт между соблазном быстрой прибыли и разрывом доверия из-за информационной асимметрии. За последние месяцы новые случаи rug pull вновь стали тревожным сигналом для рынка.

Последний пример — Aqua в экосистеме Solana. 9 сентября 2025 года аналитик ZachXBT сообщил, что Aqua подозревается в rug pull: команда вывела 21 770 SOL (около 4,65 миллиона долларов). Проект поддерживали известные участники экосистемы (Meteora, Quill Audits, Helius, SYMMIO, Dialect), его активно продвигали KOL, и он считался новым лидером Solana на этапе пресейла.

После инцидента команда разделила средства на четыре части и вывела их через промежуточные адреса на централизованные биржи. Официальный аккаунт Aqua отключил комментарии и не дал никаких разъяснений. Это не только привело к убыткам инвесторов, но и вызвало массовые вопросы к эффективности аудита пресейлов, ответственности KOL и due diligence Launchpad-платформ.

Суть инцидента Aqua — выявление самой опасной «серой зоны» пресейлов 2025 года: когда доверие подменяет трафик, а поддержка становится инструментом маркетинга, так называемые «ранние возможности» легко превращаются в системный риск.

Этот случай напомнил инвесторам: даже многократный аудит и внешняя поддержка не заменяют независимую проверку прозрачности потоков средств, открытости команды и обоснованности разлок-механизмов. От Aqua до ранних неудачных проектов — пузырь пресейлов демонстрирует хрупкость рынка в фазе быстрого восстановления: энтузиазм растёт, но доверие ещё не восстановлено.

Будущее: станут ли пресейлы главным трендом следующего цикла?

В перспективе пресейлы могут трансформироваться за счёт интеграции с другими механизмами. Один из трендов — совмещение Token Generation Event (TGE) и эирдропа, формируя гибридную модель пресейл+эирдроп. Например, Meteora на Solana провёл одновременный эирдроп и TGE, сразу выпустив 48 % токенов без блокировок, а классическую линейную разблокировку заменил стимулированием комьюнити. BlockDAG внедряет «коды пресейла» (TGE Code): ранние участники покупают по минимальной цене и получают право на эирдроп, что напрямую связывает ценовые и эирдроп-преференции для лояльных пользователей.

В комплаенсе Launchpad и команды ужесточают KYC и проверки хранения средств. Решения вроде Launchpad KYC от Blockpass дают платформам доступ к глобальной идентификации, соответствующей требованиям KYC/AML/CTF. Это особенно важно на рынках Европы, США и Азии, где идёт стандартизация криптовыпусков: команды обязаны раскрывать информацию, привлекать кастодианов и комплаенс-экспертов. В будущем появятся крипторазмещения с предварительным аудитом, хранением средств и раскрытием информации под контролем регуляторов — защита инвесторов встроится в институциональные рамки.

Технологически пресейлы ждут инновации: смарт-контракты динамического распределения будут выделять квоты по профилю пользователя, предотвращая переподписку с одного адреса; ончейн-рейтинги позволят ранжировать участников вайтлиста по риску; внедряются модели Proof of Contribution, где аллокация зависит от вклада в комьюнити. В целом, пресейлы сохранят роль канала формирования капитала Web3, но станут гибче и стандартизированнее: диверсификация методов размещения, автоматизация смарт-контрактов и комплаенс-аудит позволят рынку найти баланс между привлечением средств и доверием. В долгосрочной перспективе все — и проекты, и инвесторы — будут фокусироваться на устойчивом создании ценности, а зрелость и прозрачность пресейлов — определять вектор развития отрасли.

Заключение: возвращение к эпохе рациональных и основанных на доверии инвестиций

Текущий рынок демонстрирует: за новым всплеском пресейлов стоит глубокая логика. На фоне стагнации крупных активов капитал ищет новые возможности, а развитие блокчейна и регулирования открывает больше сценариев и легальных путей для ранних проектов. Эта волна пресейлов — и результат миграции ликвидности, и признак нового этапа развития отрасли. Несмотря на смену трендов, суть инвестиций — поиск ценности и управление рисками. Команды должны завоёвывать доверие через открытость и прозрачность, а инвесторы — избегать ошибок благодаря глубокому анализу и взвешенным решениям.

Похожие статьи

Альтсезон 2025: Поворот в рассказе и капитальная реструктуризация в атипичном бычьем рынке

Исследование Gate: Обзор рынка криптовалют на 2024 год и прогноз трендов на 2025 год

Влияние разблокировки токенов на цены

Руководство по Департаменту по повышению эффективности государственного управления (DOGE)

Что такое MAGA? Декодирование токена с тематикой Трампа