Kalshi: The U.S. Predictions Exchange Turning Real-World Events Into Tradable Markets

Kalshi’s Market Logic

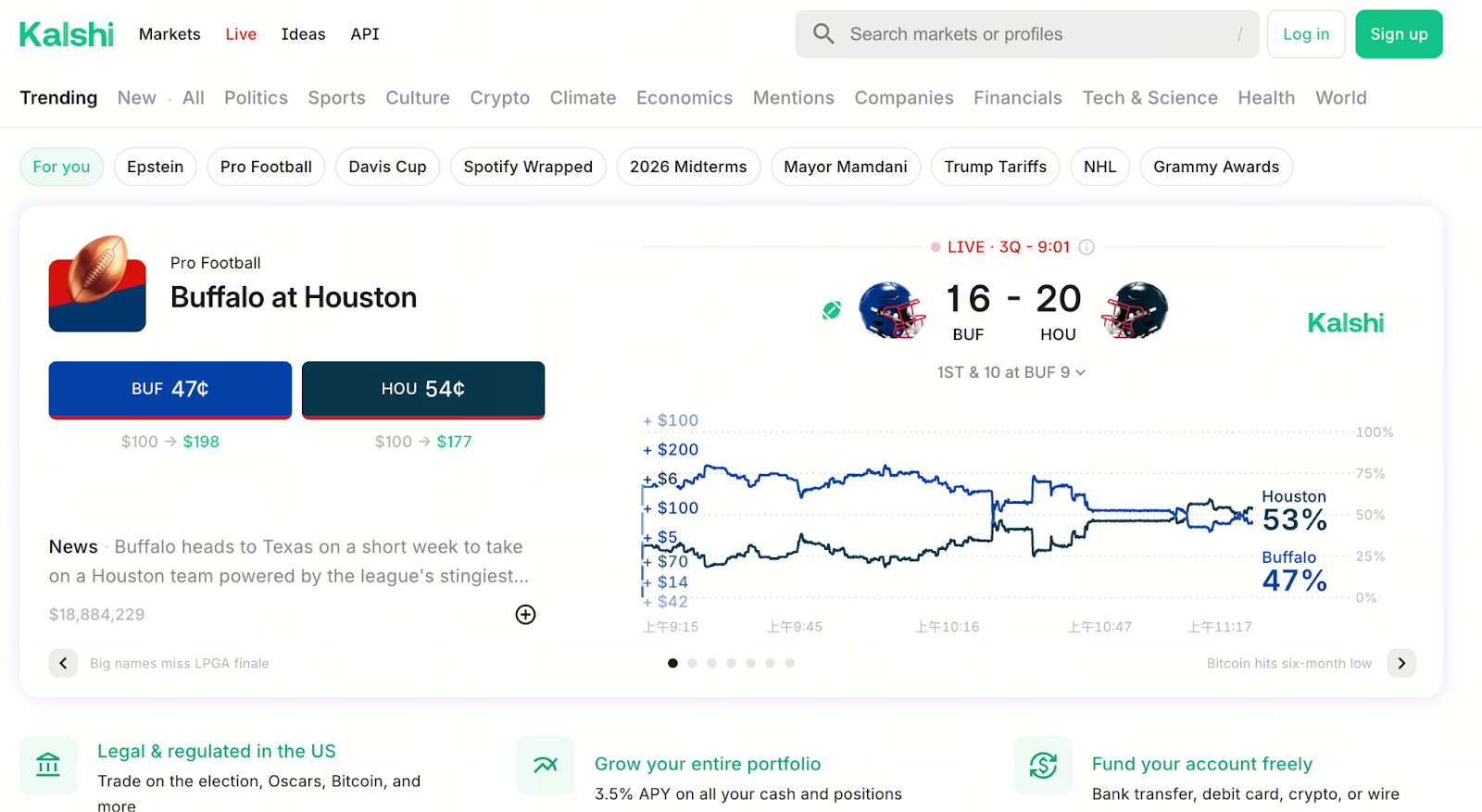

(Source: Kalshi)

In the United States, Kalshi is redefining how events are valued through an innovative approach. The company has established a centralized prediction market platform where anyone can take positions based on their analysis of real-world occurrences, turning the future into a tradable asset. The platform covers a diverse range of topics:

- Whether the temperature exceeds a specific threshold.

- Whether economic policies will be enacted.

- Whether corporations will undergo significant changes.

- And even trending events in the entertainment industry.

Kalshi may design any event with a clearly defined, objectively verifiable outcome as a tradable contract market.

Founding Team Background

Both of Kalshi’s founders, Tarek Mansour and Luana Lopes Lara, come from the hedge fund trading sector. They met at MIT, where they studied computer science and mathematics. This expertise enables them to apply data analysis, modeling, and risk management principles to market design. This establishes Kalshi’s professional foundation.

Core Principles of Event Contracts

Each Kalshi market operates on a straightforward, precise principle: event outcome → Yes or No → price reflects market expectations. The price of each contract captures participants’ real-time assessments, aggregating collective intelligence into a quantifiable result. This event prediction financial model transforms market prices into a valuable information resource.

For example:

If the “Yes” contract price for a policy passing is 0.67, the market consensus is a 67% probability that the event will happen.

Financial-Grade Architecture

Kalshi’s operations do not resemble gambling as it is commonly perceived; instead, the platform adopts mechanisms consistent with traditional financial markets:

- Order book system with bidding and matching functionality

- USD as the primary trading currency

- Comprehensive clearing procedures and adherence to a regulatory framework

These mechanisms ensure transparent pricing and clear fund flows. Every transaction is settled under established protocols, positioning Kalshi as one of the few fully compliant, institutional platforms in the U.S. for event-driven market trading.

Significant Capital Inflows

Kalshi’s recent fundraising has renewed interest in prediction markets. According to multiple reports:

- The latest round raised $1 billion, pushing its valuation past $11 billion

- Less than two months prior, Kalshi completed a $300 million round, with a valuation of $5 billion

This rapid growth is uncommon in the startup sector. It highlights strong investor confidence in prediction markets.

Lead investors include Sequoia Capital and CapitalG, while other notable investors include Andreessen Horowitz, Paradigm, Anthos Capital, and Neo. These firms have deep roots in technology and finance, and their participation signals a shift: event-based markets are evolving from niche concepts into mainstream financial instruments.

Legal and Regulatory Challenges

Prediction markets have always been subject to debate, sitting at the intersection of financial instruments and gaming. They routinely face regulatory and legal scrutiny. However, Kalshi’s model has received endorsements from major institutions. By using USD, implementing an order book system, and following regulatory compliance protocols, Kalshi positions itself as more closely aligned with financial markets than with gambling products.

If you want to explore more Web3 content, register here: https://www.gate.com/

Conclusion

By offering a structured, regulated platform, Kalshi empowers users to transform, quantify, and trade on their outlooks on future events. It is not simply about betting on outcomes; it is a new way to understand collective market expectations. With substantial capital, regulatory alignment, and a professional team, Kalshi is shaping a new mainstream market for event-based trading.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution