Gate BTC Staking зі ставкою 9,99% річних: Як отримати високий прибуток в умовах волатильного ринку

Поточна волатильність ринку BTC

Наразі Bitcoin (BTC) торгується біля своїх історичних максимумів. Попри те, що ціна перевищила позначку 65 000 USDT, тиск із боку продавців та фіксація прибутку спричинили коливання курсу в межах 50 000–60 000 USDT. Така постійна волатильність провокує невизначеність серед інвесторів, але відкриває можливості для тих, хто прагне стабільного доходу.

У цих умовах стейкінг-продукти BTC дозволяють інвесторам хеджувати ринкові ризики та отримувати стабільний прибуток. Стейкінг BTC допомагає зберігати активи та додатково заробляти завдяки вигідним пропозиціям платформ із високою дохідністю.

Основні переваги BTC-стейкінгу на Gate

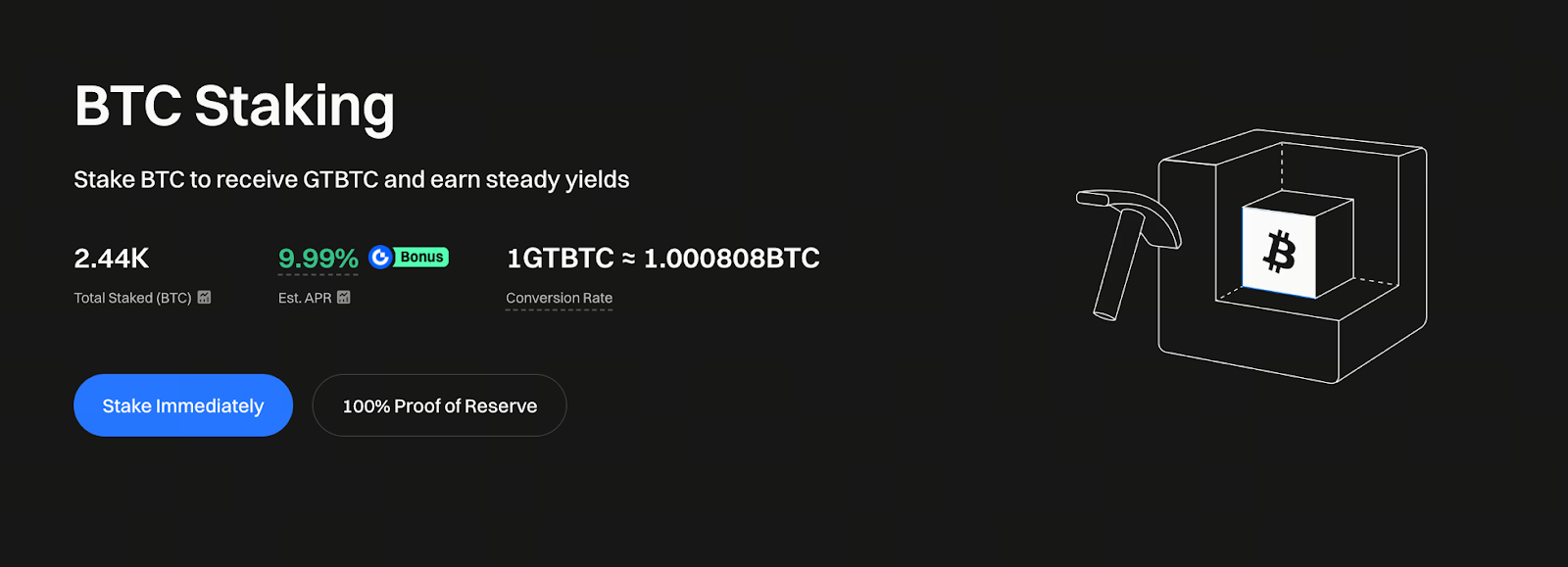

Джерело: https://www.gate.com/staking/BTC

На відміну від спекулятивної торгівлі, BTC-стейкінг передбачає блокування токенів на платформі для підтримки роботи мережі блокчейн та отримання фіксованої річної дохідності. Порівняно з частим трейдингом, стейкінг забезпечує інвесторам низку суттєвих переваг:

- Високий прибуток: Стейкінг дозволяє зберігати активи BTC, отримуючи стабільну річну дохідність у розмірі 9,99%.

- Низький поріг входу: Долучитися до BTC-стейкінгу та отримати конкурентні виплати можуть навіть інвестори з невеликим капіталом.

- Пасивний дохід: Платформа автоматично нараховує винагороди на рахунок користувача, жодних додаткових дій не потрібно — це оптимально для довгострокового зберігання.

- Диверсифікація ризиків: Стейкінг із фіксованою дохідністю допомагає зменшувати ризики, що виникають через значні цінові коливання Bitcoin.

Gate BTC Staking: Огляд продукту з річною дохідністю 9,99%

На Gate BTC-стейкінг пропонує конкурентну річну ставку до 9,99%. До ключових характеристик продукту належать:

- Висока дохідність: Ставка 9,99% значно перевищує традиційні фінансові інструменти, вигідна для інвесторів, які орієнтуються на максимізацію прибутку.

- Гнучкі умови виведення: Інвестори можуть забрати кошти у будь-який момент, а терміни стейкінгу залишаються гнучкими без тривалих блокувань.

- Автоматичне нарахування винагород: Щоденні премії зараховуються на рахунок автоматично — це забезпечує максимальну зручність.

- Відсутність обмежень за сумою: Можна стейкати будь-який обсяг BTC — ліміти на максимальну суму відсутні.

Максимізація прибутковості BTC-стейкінгу на волатильному ринку

Незважаючи на значні цінові коливання BTC, інвестори можуть отримати стабільний прибуток завдяки продукту Gate із річною дохідністю 9,99%. Рекомендовані підходи:

- Довгостроковий стейкінг: Ті, хто позитивно оцінює перспективу BTC, можуть стейкати частину портфеля для стабільних виплат навіть у періоди нестабільності.

- Порційний розподіл: Стейкінг частками дозволяє диверсифікувати ризики та мінімізувати можливі втрати в умовах волатильності.

- Регулярний аналіз ринку: Слід систематично переглядати ринкові тенденції та адаптувати обсяги стейкінгу для оперативного реагування.

Аналіз ризиків та рекомендації щодо інвестування

Незважаючи на відносно стабільну річну дохідність 9,99% у Gate BTC-стейкінгу, слід брати до уваги такі ризики:

- Волатильність ринку: Курс BTC сильно коливається, а фіксовані виплати не рятують від падіння вартості активу через загальні ринкові зміни.

- Ризики платформи: Продукти пропонують сторонні платформи, обирайте лише перевірених постачальників для захисту від операційних ризиків.

- Ризик ліквідності: Під час блокування стейкінг-активів кошти можуть бути тимчасово недоступні — оцінюйте обсяги інвестицій відповідно до ваших потреб у ліквідності.

Висновок

В умовах волатильного ринку BTC продукт Gate із річною дохідністю 9,99% відкриває інвесторам шлях до стабільного прибутку. Незалежно від змін ціни, стейкінговий дохід сприяє довгостроковому зростанню портфеля. Використання гнучких стратегій стейкінгу та високодохідних продуктів дозволяє отримувати вагомий пасивний прибуток без постійної участі у торгах. Ті, хто впевнений у довгостроковій перспективі Bitcoin, можуть вважати BTC-стейкінг оптимальним рішенням для накопичення капіталу.

Пов’язані статті

Як високо може піднятися XRP? Як політика криптовалют Трампа вплине на майбутній тренд XRP

Як продати монету Pi: Посібник для початківців

Прогноз ціни Bitcoin на 2025 рік

Аналізуючи взлом Bybit за допомогою нападу Radiant Multi-Signature на прикладі

Які наступні покоління криптовалюти варто купити? Посібник на 2025 рік