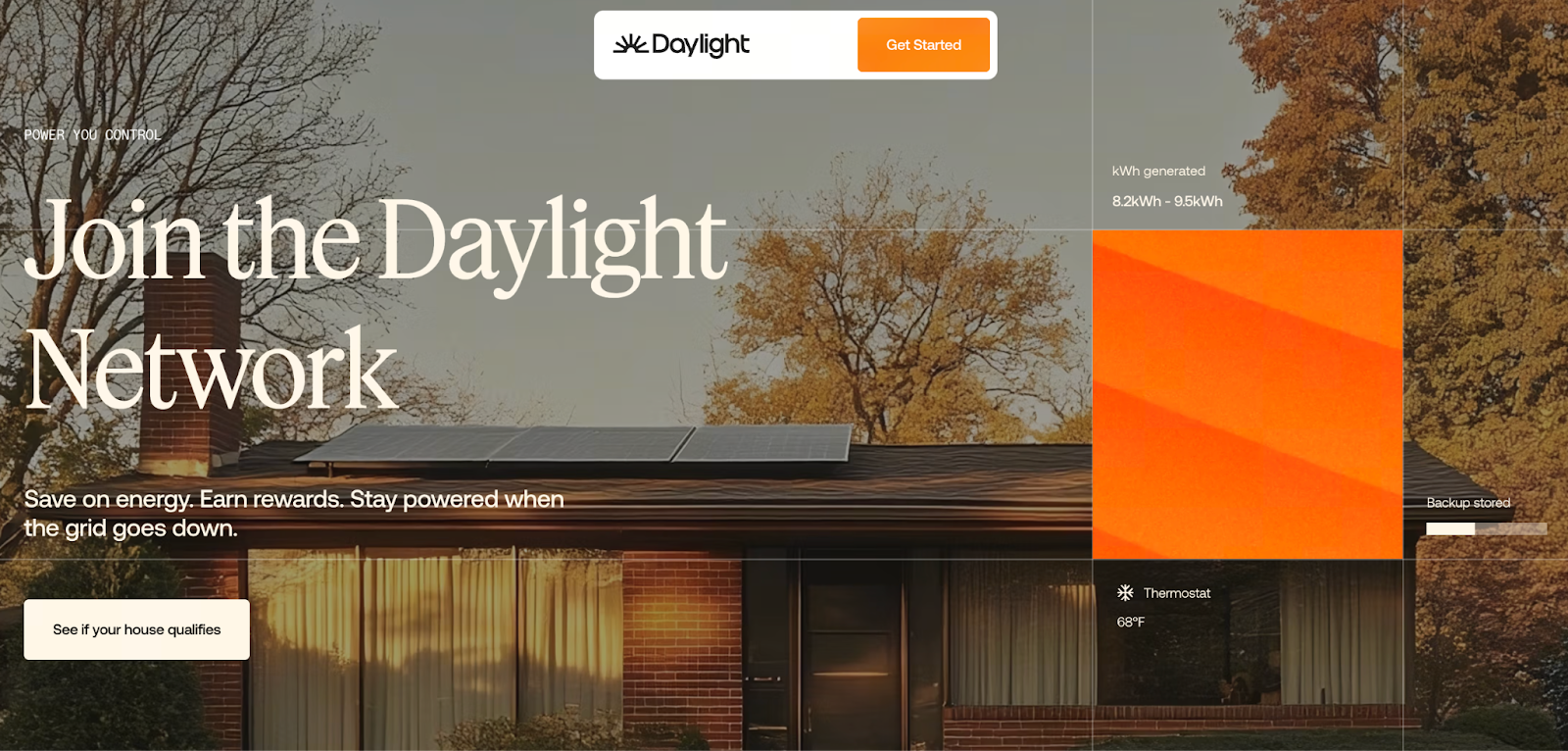

DePIN 賽道重大消息|去中心化能源網路 Daylight 成功籌得 7,500 萬美元資金,由 Framework Ventures 領投!

10-21-2025, 5:25:15 AM

新手

快讀什麼是 DePIN 賽道(Decentralized Physical Infrastructure Networks)?

「DePIN」即 Decentralized Physical Infrastructure Networks(去中心化物理基礎設施網路),是指利用區塊鏈與 DeFi(去中心化金融)機制,將現實世界的基礎設施(如能源、網路、運輸)以去中心化方式建構及營運。在傳統模式下,基礎設施多由大型企業或政府掌控,而 DePIN 賽道則強調個人參與、資產上鏈與收益共享。例如,將家用太陽能板、儲能設備連接成網路,配合代幣激勵機制,打造「小而分散」的物理設施網路化。

加密圈及基礎設施投資圈近年來高度關注此概念,因為它將 Web3 的思維延伸至實體世界。

在能源領域,一個典型場景是:家庭用戶安裝太陽能加儲能系統並接入網路,當電網負載高時,可將家用設備「調度」至電網,成為「虛擬電廠」之一。參與此網路的用戶不只降低電費,還有機會獲得網路代幣或其他獎勵。這種模式正是 DePIN 賽道在「去中心化+實體基礎設施」交匯點的代表。

Daylight 融資詳情及主要參與者

近期,專注於去中心化能源網路的美國公司 Daylight Energy 宣布完成 7,500 萬美元融資。本次融資分為兩部分:1,500 萬美元股權融資,由 Framework Ventures 領投;6,000 萬美元項目開發融資,由 Turtle Hill Capital 主導。

- 其他參與者包括:a16z crypto、Lerer Hippeau、M13、Room40 Ventures、EV3、Crucible Capital、Coinbase Ventures、Not Boring Capital。

- Daylight 的商業模式為:將家用太陽能板及儲能設備轉化為「去中心化發電站」,用戶透過訂閱方式享有較低電費,並在電網高峰期將儲能設備接入電網以獲取回報。Daylight 同時推出 DayFi 協議(DayFi Protocol),將電力基礎設施的回報引入 DeFi 市場。

這筆融資有何意義?

- DePIN 賽道於能源領域邁出重要一步:Daylight 的融資顯示,去中心化基礎設施網路不再只是概念,已獲得資本肯定。能源作為基礎設施核心,其「上鏈」與「分散化」發展受到投資人重視。

- 從硬體到金融化:傳統太陽能加儲能模式成本高、回收慢。Daylight 將家用設備整合為網路並導入 DeFi 收益機制,嘗試將電力轉化為「可投資資產」。換言之,硬體、服務與金融正逐步結合。

- 大型機構的指標作用:Framework Ventures、a16z crypto 等知名機構參與,代表「加密+實體基礎設施」已受主流資本關注,對後續相關項目具引領意義。

- 商業拓展潛力大:Daylight 目前在美國伊利諾州與麻州試點,憑藉本輪資金可迅速擴展至其他地區,並升級 DayFi 協議,打開 DeFi 與電力市場的結合面。

未來展望與風險提醒

看點:

- Daylight 如何推廣至全球?隨能源需求提升,更多家庭可能願意參與去中心化系統。

- DayFi 協議(DayFi Protocol)的演進:是否能讓一般投資人透過數位化方式參與家用發電與儲能網路回報?

- 政策與法規:全球多地補貼退場,傳統能源替代與去中心化能源政策變化快速。

風險提醒:

- 市場接受度未明:家庭是否願意把屋頂及電池作為「發電站」參與。

- 電網接入能力、設備維護成本及回收期等仍具挑戰。

- 加密金融機制與實體基礎設施結合複雜,面臨監管、技術、安全等多重風險。

- 地域擴展的在地化成本與營運難度可能超出預期。

作者: Max

* 投資有風險,入市須謹慎。本文不作為 Gate 提供的投資理財建議或其他任何類型的建議。

* 在未提及 Gate 的情況下,複製、傳播或抄襲本文將違反《版權法》,Gate 有權追究其法律責任。

相關文章

新手

黃金價格走勢:市場焦點轉向鮑威爾演說

投資人態度謹慎,受美元走強及加密貨幣現貨市場需求減弱影響。此外,市場也密切關注美國聯邦準備理事會主席鮑威爾在 Jackson Hole 會議上的最新談話。

8-21-2025, 8:20:53 AM

新手

新手必讀:2025 年最新美債 ETF 推薦及策略

美國國債ETF是新手投資人進行穩健配置的最佳選擇。本文結合最新殖利率變化及主流ETF之推薦,介紹多種不同期限的美國國債ETF,協助投資人快速入門並有效優化投資組合。

8-12-2025, 7:24:10 AM

新手

Nasdaq 100 指數最新動態與投資策略

本文深入分析 Nasdaq 100 指數近期的市場動態。探討科技股引領的成長趨勢,並說明投資人如何善用 ETF 或個股把握機會,以達成穩健的投資目標。

9-15-2025, 5:50:31 AM

新手

2025 年房屋稅新制全方位解析—政策修訂重點及納稅人因應對策

2025 年房屋稅新制將於 2025 年全面實施,涵蓋稅率調整、試點範圍擴大及納稅人應對策略,以利全方位掌握最新稅務動向,以便有效規劃房產資產。

8-12-2025, 6:31:26 AM

新手

如何以快速且安全的方式,將資金自 Binance 平台提領出去?

本文將詳細說明如何從 Binance 提款至外部錢包及銀行帳戶的流程,內容涵蓋選擇正確的資產類型、設定收款地址、選擇網路、評估手續費,以及進行安全驗證。

7-24-2025, 9:41:12 AM