Un guide de l'arbitrage des prix sur le marché des cryptomonnaies

Qu'est-ce que l'arbitrage Crypto

Dans l'écosystème complexe du marché des cryptomonnaies, l'arbitrage crypto devient une stratégie de trading de plus en plus attrayante pour de nombreux investisseurs. Il exploite de petites différences de prix de la même cryptomonnaie sur différents marchés pour réaliser un profit grâce à des achats et des ventes stratégiques. Comparé aux marchés financiers traditionnels, le trading ininterrompu 24h/24, la forte décentralisation et la plus grande volatilité des prix sur le marché des cryptomonnaies offrent de nombreuses opportunités pour le trading d'arbitrage. Comprendre et maîtriser l'arbitrage crypto ouvre non seulement de nouvelles avenues de profit pour les investisseurs, mais aide également à acquérir une compréhension plus approfondie du fonctionnement du marché des cryptomonnaies.

L'arbitrage Crypto est une stratégie de trading qui tire profit des différences de prix de la même cryptomonnaie sur différents marchés en achetant bas et en vendant haut. Un comportement d'arbitrage similaire existe également dans les marchés financiers traditionnels, comme dans les marchés boursiers où l'action de la même entreprise pourrait avoir des prix différents en raison de facteurs tels que l'offre et la demande sur différents marchés. Sur le marché des cryptomonnaies, ces différences de prix sont plus fréquentes et plus remarquables en raison de ses caractéristiques uniques.

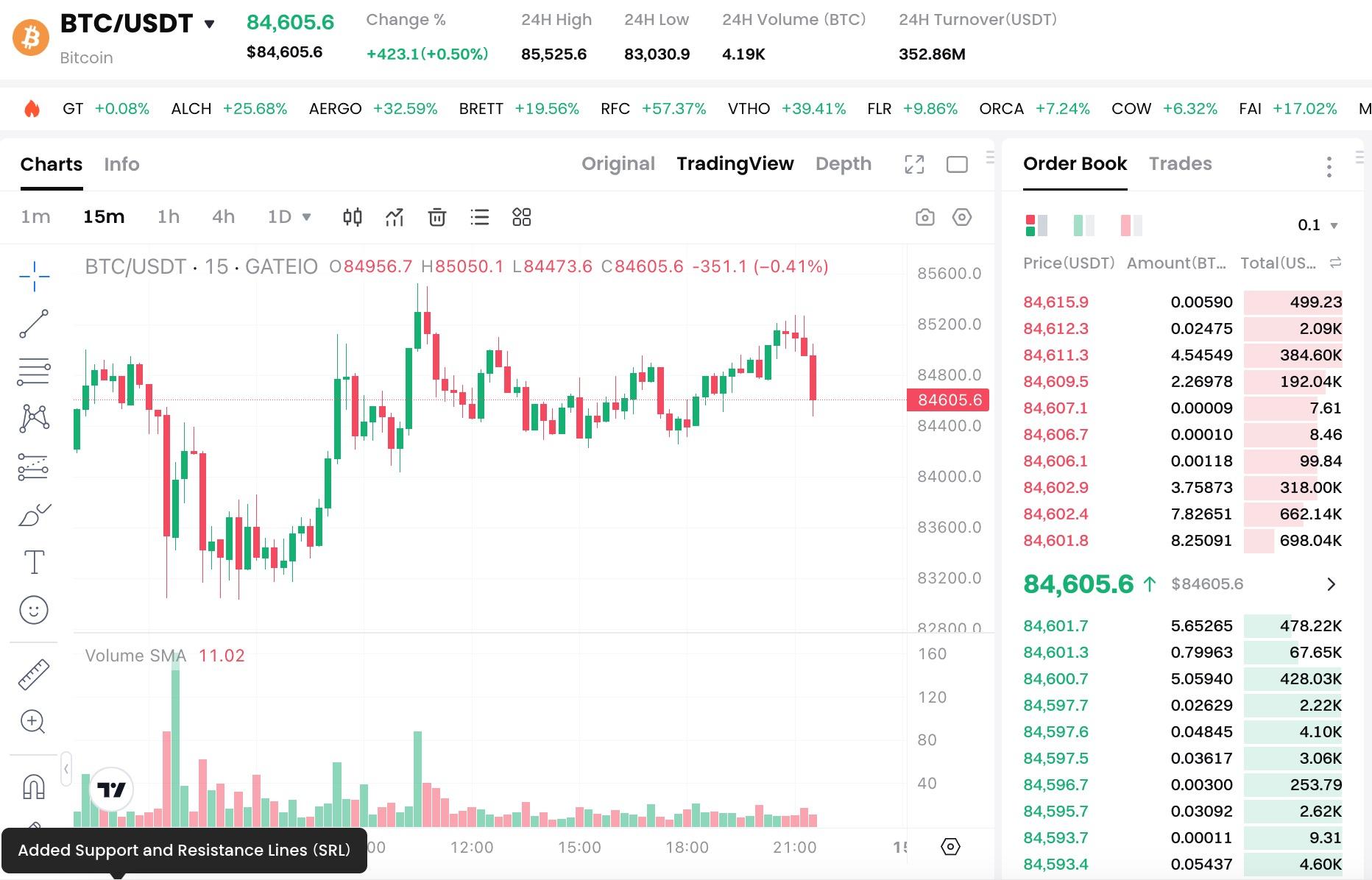

Source de l'image :https://www.gate.io/trade/BTC_USDT

Le marché des cryptomonnaies se compose de nombreuses plateformes de trading, chacune différant par ses règles de trading, sa démographie d'utilisateurs, sa liquidité, et plus encore. Ces différences entraînent des prix incohérents pour la même cryptomonnaie sur différentes plateformes. Par exemple, le prix du Bitcoin sur l'Échange A pourrait être de 50 000 $, tandis que sur l'Échange B, il pourrait être de 50 200 $. Dans ce cas, un arbitragiste peut acheter du Bitcoin sur l'Échange A et le revendre rapidement sur l'Échange B, réalisant un profit sur la différence de prix de 200 $ (hors frais de transaction et autres coûts). Les écarts de prix découlent principalement d'inefficacités du marché, notamment la diffusion d'informations retardée, des coûts de transaction variables, et des différences de demande régionale pour les cryptomonnaies, créant ainsi des opportunités d'arbitrage.

Raisons de l'arbitrage crypto

(1) Différences de liquidité : Les différentes bourses ont des bases d'utilisateurs et des activités de trading variables, ce qui entraîne des différences de liquidité. Les bourses avec une liquidité élevée sont moins susceptibles de subir de grands changements de prix suite à de gros échanges, et leurs prix se mettent à jour plus rapidement. En revanche, les bourses avec une liquidité plus faible pourraient observer des fluctuations de prix significatives suite à de plus petites commandes d'achat ou de vente, créant ainsi des écarts de prix par rapport aux bourses à haute liquidité. Par exemple, les plus petites bourses de cryptomonnaies avec moins d'utilisateurs pourraient voir des variations de prix importantes lorsque des ordres importants sont passés, créant un écart de prix entre elles et les principales bourses.

Source de l'image :https://www.gate.io/price

(2) Différences de demande régionale : les investisseurs de différentes régions ont des niveaux variables d'acceptation et de demande de cryptomonnaies. Dans certaines zones, des facteurs tels que l'environnement politique, les conditions économiques ou les préférences des investisseurs peuvent entraîner une demande plus forte pour des cryptomonnaies spécifiques, faisant ainsi monter leurs prix. En revanche, dans d'autres régions, le prix de la même cryptomonnaie pourrait être relativement plus bas. Par exemple, les régions présentant un intérêt plus actif pour la technologie de la blockchain pourraient voir une demande et des prix plus élevés pour des cryptomonnaies innovantes par rapport à des zones où la technologie est moins présente.

(3) Différences de coûts de transaction : les plateformes facturent des frais variables pour les transactions, les retraits et autres services. Ces coûts ont un impact direct sur le bénéfice net des investisseurs et influencent la tarification des cryptomonnaies. Sur les plateformes avec des frais de transaction plus bas, les investisseurs sont plus enclins à trader, ce qui pourrait pousser le prix des cryptomonnaies à la hausse (car des frais plus bas encouragent l'achat à des prix légèrement plus élevés). En revanche, les plateformes avec des frais plus élevés peuvent avoir des prix plus bas en raison des coûts accrus associés au trading.

Types de Crypto Arbitrage

1. Arbitrage inter-bourse

Il s'agit de la forme la plus courante d'arbitrage de cryptomonnaie, impliquant des échanges entre différentes bourses de cryptomonnaies pour profiter des différences de prix pour la même cryptomonnaie. Par exemple, si le prix de l'Ethereum sur l'échange A est de 1 800 $, tandis que sur l'échange B il est de 1 820 $, un arbitragiste peut acheter de l'Ethereum sur l'échange A et le vendre sur l'échange B, gagnant ainsi une différence de prix de 20 $ par Ethereum. La clé de cette stratégie d'arbitrage est d'identifier rapidement les divergences de prix et d'exécuter les transactions en temps opportun, car ces différences de prix diminuent souvent rapidement à mesure que les participants du marché réagissent aux changements.

En mai 2021, le prix du Bitcoin sur certaines bourses en Asie a brièvement dépassé les prix des bourses aux États-Unis et en Europe. Certains arbitragistes avisés ont profité de cela en achetant du Bitcoin sur des bourses européennes ou américaines à un prix inférieur et en le transférant rapidement vers des bourses asiatiques pour le vendre à un prix plus élevé, réalisant ainsi des profits substantiels en seulement quelques jours. Cependant, de telles opportunités sont souvent fugaces, nécessitant des arbitragistes d'avoir des systèmes de trading efficaces et des capacités de surveillance du marché en temps réel.

2. Arbitrage triangulaire

L'arbitrage triangulaire consiste à exploiter les relations de prix entre trois cryptomonnaies différentes au sein du même échange. Supposons qu'il y ait des incohérences de prix entre Bitcoin (BTC) et Ethereum (ETH), Ethereum et Litecoin (LTC), et Litecoin et Bitcoin sur un échange spécifique. L'arbitragiste peut effectuer une série de transactions, telles que l'achat d'Ethereum avec Bitcoin, puis l'achat de Litecoin avec Ethereum, et enfin la conversion de Litecoin en Bitcoin, en profitant des différences de prix. Ce type d'arbitrage nécessite une compréhension approfondie des relations de taux de change entre différentes cryptomonnaies sur le marché et des calculs précis, car même de petites fluctuations de prix ou des frais de transaction peuvent affecter le résultat.

À un moment donné, une bourse spécifique a montré un déséquilibre temporaire entre le taux Bitcoin/Ethereum, le taux Ethereum/Litecoin et le taux Litecoin/Bitcoin. Un arbitragiste expérimenté a repéré l'opportunité et, grâce à des calculs minutieux et une exécution rapide de l'arbitrage triangulaire, a réussi à finaliser plusieurs cycles de transactions en quelques heures, réalisant une augmentation de l'actif de 5%. Cependant, de telles opportunités sont rares sur le marché et nécessitent une exécution à haute vitesse et des calculs précis.

3. Arbitrage décentralisé

L'arbitrage décentralisé se produit principalement entre les échanges décentralisés (DEX) et les échanges centralisés (CEX). Les échanges décentralisés utilisent généralement des mécanismes de fournisseurs de liquidité automatisés (AMM) pour déterminer les prix des actifs, ce qui diffère du système de tarification basé sur le carnet d'ordres des échanges centralisés. En raison de ces différences dans les mécanismes de tarification, la même cryptomonnaie peut présenter une disparité de prix entre un échange décentralisé et un échange centralisé. Les arbitragistes peuvent acheter sur la plateforme au prix le plus bas, puis vendre sur la plateforme au prix le plus élevé. Par exemple, sur un échange décentralisé, un certain jeton ERC-20 peut avoir un prix relativement bas en raison des caractéristiques de son pool de liquidité, tandis que le même jeton est plus cher sur un échange centralisé. Les arbitragistes peuvent exploiter cette différence de prix pour réaliser un profit.

Pendant la croissance rapide du marché DeFi (Finance décentralisée), certains échanges décentralisés émergents ont proposé des frais de transaction réduits et des incitations à la liquidité uniques pour attirer les utilisateurs, entraînant des différences de prix pour certaines cryptomonnaies entre ces échanges décentralisés et les échanges centralisés traditionnels. Certains arbitragistes ont tiré parti de ces différences de prix en achetant des jetons DeFi populaires à un prix plus bas sur les échanges décentralisés, puis en les transférant vers des échanges centralisés pour une vente à un prix plus élevé, générant des rendements substantiels. Cependant, il est important de noter que le trading sur des échanges décentralisés comporte des risques tels que les vulnérabilités des contrats intelligents et les pertes impermanentes, donc les arbitragistes doivent évaluer soigneusement ces risques.

4. Arbitrage de prêt flash

L'arbitrage de prêt flash est une forme plus complexe et dépendante de DeFi de l'arbitrage. Les prêts flash permettent aux utilisateurs d'emprunter de grosses sommes sans garantie, à condition que le prêt soit remboursé dans le même bloc de transaction, sans frais d'intérêt (bien qu'une petite commission puisse être facturée). Les arbitragistes utilisent les prêts flash pour emprunter des fonds et rechercher des différences de prix entre différents protocoles DeFi ou pools de liquidité pour exécuter l'arbitrage. Après avoir effectué l'échange, ils remboursent immédiatement le prêt et empochent les bénéfices.

Par exemple, un arbitragiste pourrait utiliser un prêt éclair pour acheter une cryptomonnaie à un prix bas dans une pool de liquidité, puis la vendre à un prix plus élevé dans une autre pool de liquidité, la différence de prix étant utilisée pour rembourser le prêt et réaliser un profit.

Pendant la folie estivale DeFi de 2020, des divergences de prix importantes existaient entre certains protocoles DeFi sur la blockchain Ethereum. Des arbitragistes qualifiés ont utilisé des prêts flash pour emprunter de grosses sommes de capital du Protocole A, ont acheté une cryptomonnaie spécifique à bas prix dans le pool de liquidité du Protocole B, puis l'ont vendue à un prix plus élevé dans le pool de liquidité du Protocole C, complétant l'ensemble du processus d'arbitrage en une seule transaction. Ces opérations pouvaient générer des milliers de dollars de profits. Cependant, l'arbitrage avec prêt flash nécessite des compétences techniques très avancées et une vision du marché, car des erreurs ou des changements soudains sur le marché peuvent entraîner des pertes importantes.

Comment profiter de l'arbitrage crypto

(1) Saisir la vitesse et le timing

Le marché des cryptomonnaies fonctionne 24h/24 et est très volatil, donc les investisseurs doivent utiliser des outils comme CoinMarketCap, KairosPeak, et d'autres pour surveiller les prix sur plusieurs bourses en temps réel. Une fois qu'une opportunité d'arbitrage est identifiée, des robots de trading automatisés peuvent être utilisés pour exécuter des transactions en quelques millisecondes. Les robots avancés peuvent rapidement acheter sur des bourses avec des prix plus bas et vendre sur celles avec des prix plus élevés pour verrouiller les profits dès que des différences de prix apparaissent.

(2) Contrôler les coûts de transaction

Les frais de transaction peuvent entamer les profits d'arbitrage, et les différentes bourses ont des structures de frais différentes. Par exemple, Binance offre des réductions de frais aux détenteurs de BNB. Lors de l'arbitrage inter-bourses, le transfert de fonds peut entraîner des coûts supplémentaires. Les investisseurs peuvent minimiser ces coûts en préfinançant plusieurs bourses et en réduisant la fréquence des transferts de fonds. Il est également conseillé de déplacer des fonds pendant les périodes où les réseaux blockchain sont moins encombrés pour réduire les frais et les délais de transaction.

(3) Concentrez-vous sur la Liquidité

Les échanges avec une liquidité élevée garantissent que les transactions importantes peuvent être effectuées en toute fluidité. Les échanges populaires tels que Coinbase, OKX et d'autres ont de grandes bases d'utilisateurs et des volumes de trading élevés. Les investisseurs peuvent évaluer la liquidité d'un échange en vérifiant son volume de trading sur 24 heures et la profondeur du carnet d'ordres, évitant ainsi les grandes opérations d'arbitrage sur les échanges à faible liquidité pour éviter les échecs dans l'exécution des transactions au prix souhaité.

Risques de l'arbitrage crypto

(1) Risque de marché

Les prix des cryptomonnaies sont très volatils, et pendant l'arbitrage, la différence de prix peut se réduire ou disparaître complètement en raison des changements rapides du marché avant la finalisation de la transaction, ce qui peut entraîner des pertes potentielles. Les tendances du marché peuvent également avoir un impact sur les stratégies d'arbitrage, car les différences de prix peuvent changer si le marché passe d'une tendance à la hausse à une tendance à la baisse. Si les investisseurs n'ajustent pas leurs stratégies à temps, ils peuvent subir des pertes.

(2) Risque technique

Les retards ou les pannes du réseau peuvent empêcher l'émission et l'exécution des instructions de trading en temps voulu, entraînant des opportunités d'arbitrage manquées. Les plateformes de trading peuvent également subir des crashs de serveur, des bugs logiciels ou d'autres problèmes qui empêchent le traitement des transactions ou entraînent des erreurs de données, entraînant des pertes potentielles pour les investisseurs.

(3) Risque réglementaire

Les réglementations mondiales sur les cryptomonnaies varient et peuvent changer rapidement. De nouvelles politiques dans certains pays peuvent restreindre ou interdire les échanges, ce qui affecte les opérations sur le marché et modifie les écarts de prix. Il peut également y avoir des risques juridiques et de conformité. Les investisseurs qui ne sont pas au courant des réglementations locales et qui échangent de manière imprudente peuvent être confrontés à des poursuites ou à des pénalités.

(4) Risques de sécurité

Les échanges de cryptomonnaies sont sujets au piratage, comme le piratage de Coincheck en 2018 au Japon, où 530 millions de dollars de monnaie virtuelle ont été volés. La sécurité de la clé privée est également cruciale ; si une clé privée est divulguée, les pirates informatiques peuvent transférer les actifs du compte. Les investisseurs qui accèdent aux échanges via des réseaux ou des appareils non sécurisés ou qui stockent mal leurs clés privées peuvent risquer de se faire voler leurs actifs.

Articles Connexes

Pi Network (PI) au taux de change du franc CFA d'Afrique de l'Ouest (XOF) : Valeur actuelle et guide de conversion

Comment vendre la pièce PI : Guide du débutant

Valeur de Pi Crypto : Lancement sur Mainnet le 20 février 2025 & Prédictions de prix futures

Est-ce que XRP est un bon investissement? Un guide complet sur son potentiel

Qu'est-ce que FAFO : jeton MEME dérivé de la plateforme sociale de Trump