El meteórico pasado y futuro de Bitcoin: aumentos de precio, predicciones para 2025 y perspectivas a largo plazo

Bitcoin, la primera criptomoneda del mundo, ha experimentado vertiginosos vaivenes de precios y hitos en la última década. De un experimento de nicho a un activo principal, su trayectoria ha estado marcada por boom y caídas dramáticas que cautivan tanto a inversores como a titulares. Hoy, en 2025, Bitcoin vuelve a estar en el centro de atención mientras ronda máximos históricos. Los entusiastas y escépticos están debatiendo con renovada intensidad una pregunta familiar: ¿Hasta dónde puede llegar el precio de Bitcoin en el futuro?

En este artículo, echaremos un vistazo rápido a las principales subidas de precios de Bitcoin y los máximos históricos pasados, luego examinaremos lo que los expertos predicen a corto plazo (2025) y a largo plazo (2030 y más allá). También analizaremos los factores clave — desde la escasez incorporada de Bitcoin hasta la adopción institucional y la regulación — que podrían influir en su precio futuro. El objetivo es ofrecer una visión equilibrada y periodística de las perspectivas de Bitcoin, basada en su historia y tendencias actuales, en un formato informativo y fácil de digerir.

Visión general histórica: Principales aumentos de precios de Bitcoin

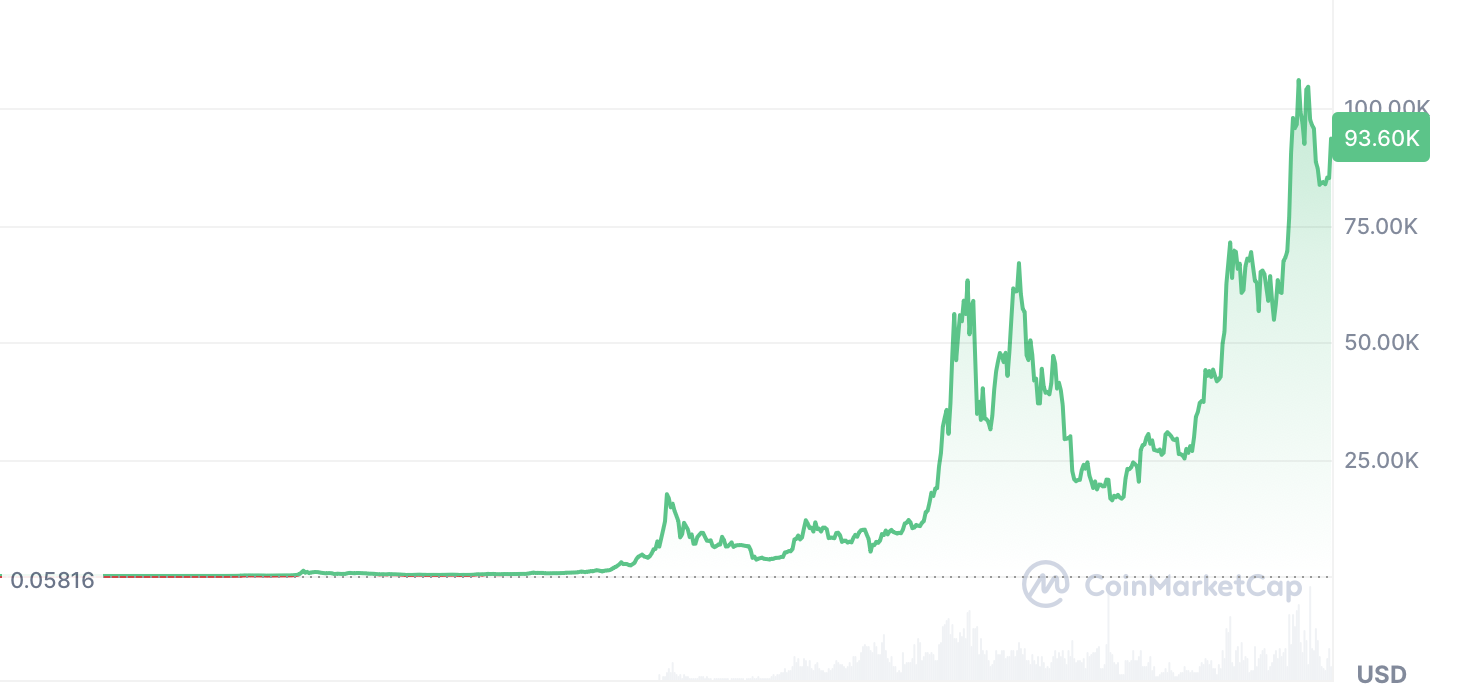

La historia de precios de Bitcoin es un relato de ascensos y caídas volátiles, pero con cada ciclo ha aterrizado generalmente más alto que donde comenzó. Aquí hay una visión general rápida de algunas de las subidas de precios más notables y máximos históricos en la línea de tiempo de Bitcoin:

2013: La primera gran subida de Bitcoin vio los precios subir de menos de $100 al comienzo del año a más de $1,000 en diciembre de 2013. Este temprano aumento, impulsado en gran medida por entusiastas de la tecnología y la primera ola de atención de los medios, puso a Bitcoin en el mapa mundial. Sin embargo, una caída posterior hizo que el precio volviera a estar en el rango de $200–$300 en 2014, mostrando lo rápido que el entusiasmo puede convertirse en pánico en mercados desconocidos.

2017Bitcoin entró en la conciencia general en 2017 con una impresionante subida desde aproximadamente $1,000 en enero hasta casi $20,000 en diciembre. Este auge de 2017 fue impulsado por el miedo de perderse (FOMO) de los inversores minoristas, las ofertas iniciales de monedas (ICOs) y la creciente conciencia de las criptomonedas. La locura culminó a finales de 2017 cuando Bitcoin alcanzó un máximo histórico justo por debajo de los $20,000 en algunos intercambios. Al igual que en 2013, siguió una corrección pronunciada: a lo largo de 2018, el precio de Bitcoin colapsó aproximadamente un 80%, tocando fondo en los $3,000; sin embargo, aún se mantuvo muy por encima de los niveles previos a 2017.

2021: La siguiente oleada histórica llegó en 2020-2021. Bitcoin empezó 2020 alrededor de $7,000, y para noviembre de 2021 alcanzó un nuevo pico de aproximadamente $69,000. Esta vez, el rally se caracterizó por la adopción institucional y el interés corporativo: grandes empresas como Tesla y Square (Block) compraron Bitcoin para sus tesorerías, empresas de Wall Street comenzaron a ofrecer servicios de criptomonedas, y un ETF vinculado a futuros de Bitcoin se lanzó en los EE. UU. Las políticas monetarias fáciles y los estímulos de la era de la pandemia de COVID-19 también jugaron un papel, con muchos inversores viendo a Bitcoin como “oro digital” en un entorno inflacionario. Después de alcanzar la marca de $69k, Bitcoin volvió a ver una desaceleración; a lo largo de 2022, los precios retrocedieron significativamente (en un momento por debajo de $20k en medio de una caída más amplia del mercado de criptomonedas) antes de estabilizarse.

2024–2025: En el último ciclo, Bitcoin ha vuelto a dispararse y superar su máximo anterior. A finales de 2024, impulsado por el revuelo en torno a un importante halving de recompensa por bloque y el optimismo sobre posibles aprobaciones de ETF de Bitcoin spot, el precio de Bitcoin se disparó por encima del récord de $69k de 2021. A principios de 2025, ha cotizado por encima de los $90,000 — incluso tocando brevemente el hito de seis cifras de $100,000 en algunos picos del mercado, según informes de la industria. Esta reciente subida consolidó el estatus de Bitcoin como uno de los activos con mejor rendimiento de la década y estableció un nuevo máximo histórico. Como siempre, la volatilidad intensificada acompaña a estos avances: las rápidas oscilaciones de precios son comunes, recordando a los inversores que el ascenso de Bitcoin nunca ha sido un camino fácil.

A largo plazo, cada pico ha superado con creces al anterior, como se ve en el gráfico de precios históricos de Bitcoin. A pesar de caídas periódicas del 50% o más después de estos máximos, la trayectoria general de Bitcoin sigue siendo alcista. Su valor de mercado hoy es órdenes de magnitud superior al de hace solo unos años, lo que ilustra una historia de crecimiento sin precedentes. Este patrón cíclico de auge y caída, pero con un suelo ascendente, enmarca el contexto de las predicciones de precios actuales y lo que podría deparar el futuro.

Predicciones de precios a corto plazo de Bitcoin (2025)

Con Bitcoin de vuelta en al alza entrando en 2025, los observadores del mercado especulan intensamente sobre cómo podría comportarse la criptomoneda a corto plazo. El sentimiento predominante entre muchos analistas e inversores es optimista. Después del halving de 2024 (la reducción programada de las recompensas de minería de Bitcoin que ocurre cada cuatro años), el impulso alcista ha ido creciendo. Históricamente, estos eventos de halving han actuado como un catalizador para el precio de Bitcoin, a menudo precediendo un fuerte rally en los siguientes 12-18 meses. Fiel a la forma, la renovada fortaleza de Bitcoin a finales de 2024 y principios de 2025 ha llevado a muchos a creer que el rally podría continuar hasta fin de año.

Rompiendo las seis cifras: Varios pronósticos de renombre sugieren que Bitcoin se consolidará por encima de su anterior máximo histórico y potencialmente alcanzará cifras de seis dígitos en 2025. Por ejemplo, los analistas de Standard Chartered predijeron que Bitcoin podría alcanzar alrededor de $100,000 para finales de 2024, citando un aumento en la demanda y una disminución en la oferta después del halving. Si ese escenario se cumple, significa que Bitcoin estaría operando alrededor de la marca de $100k al comenzar el 2025, un momento crucial para el mercado de criptomonedas. Muchos entusiastas de las criptomonedas ven los $100,000 como un hito psicológico, y superarlo podría atraer a una nueva ola de compradores, añadiendo más combustible al rally.

Objetivos de analista alcista: Más allá del nivel de $100k, algunos expertos de la industria vislumbran precios aún más altos a corto plazo. Anthony Scaramucci de SkyBridge Capital ha sugerido que Bitcoin podría potencialmente dispararse a alrededor de $150,000–$170,000 dentro del próximo año, asumiendo que el ciclo de mercado actual siga una trayectoria exponencial similar a la de los ciclos pasados. Del mismo modo, Tom Lee de Fundstrat Global Advisors, conocido por sus perspectivas optimistas sobre las criptomonedas, ha proyectado la posibilidad de que Bitcoin alcance las seis cifras en el corto plazo (ha mencionado objetivos en el rango de $100k+ para 2024/2025, impulsados por la disminución de la nueva oferta de Bitcoin y el creciente interés institucional). Incluso ciertos ejecutivos de intercambios de criptomonedas han hecho llamados audaces — por ejemplo, los directores de estrategia en algunos intercambios han especulado sobre $150k o más para finales de 2025 si persisten las condiciones alcistas. Estas predicciones subrayan una creciente confianza en que el ciclo de 2025 podría ver un pico sustancialmente por encima del máximo alcanzado en 2021.

Por supuesto, no todos los observadores son inequívocamente optimistas a corto plazo. Bitcoin sigue siendo un activo volátil, y los impulsores del precio a corto plazo pueden incluir factores impredecibles como cambios macroeconómicos o eventos geopolíticos. Algunos analistas cautelosos advierten que si la economía global enfrenta vientos en contra, digamos, una recesión o una política monetaria más estricta, los inversores podrían retirarse de activos especulativos como Bitcoin a corto plazo, lo que podría limitar su potencial al alza o introducir correcciones bruscas. Además, cualquier movimiento regulatorio adverso (por ejemplo, gobiernos que de repente restringen el comercio de criptomonedas o sorpresas fiscales) podría afectar temporalmente el sentimiento del mercado. Aun así, hasta ahora los alcistas tienen la voz más alta: un consenso general para 2025 es que Bitcoin probablemente establecerá nuevos máximos históricos, con muchos apuntando al hito de $100k y algunos apuntando mucho más allá. El pico exacto es una incógnita — las predicciones van desde moderadas (~$80k–$100k) hasta extremadamente optimistas (por encima de $150k) para finales de 2025 — pero se espera ampliamente que la tendencia sea al alza. En resumen, la perspectiva a corto plazo para Bitcoin en 2025 es de optimismo prudente, con la emoción de que el rally en curso aún tiene margen para continuar, aunque atemperado ligeramente por el conocimiento de que Bitcoin puede sorprender incluso a los traders más astutos en cualquier dirección.

Predicciones de precios a largo plazo de Bitcoin (2030 y más allá)

Mirando más allá en el futuro, las predicciones sobre el precio de Bitcoin se vuelven aún más ambiciosas —y, admitámoslo, más especulativas. Las proyecciones sobre lo que podría valer Bitcoin para 2030 (y en los años siguientes) varían ampliamente, reflejando diferentes creencias sobre qué tan ampliamente adoptado será Bitcoin y qué papel desempeñará en el sistema financiero global. A pesar de la incertidumbre, un tema común entre los creyentes a largo plazo de Bitcoin es: argumentan que los precios de hoy podrían parecer una ganga para finales de la década si el crecimiento de Bitcoin continúa.

Escenarios Mega-Alcistas (Cientos de Miles a $1 Millón+)

Algunas de las figuras más prominentes en el mundo de las criptomonedas y las inversiones han propuesto objetivos de precio asombrosos para el futuro a largo plazo de Bitcoin.Cathie WoodARK Invest ha modelado escenarios donde Bitcoin supera el $1 millón para el 2030. Su tesis se basa en la adopción institucional, el uso minorista y la oferta fija de Bitcoin creando una demanda explosiva.

Del mismo modo, Jack Dorsey, CEO de Block (anteriormente Square), ha hecho eco de estas opiniones, describiendo Bitcoin como la “moneda nativa de internet.” Dorsey cree que Bitcoin puede cruzar el umbral de $1 millón debido a su potencial como uninfraestructura financiera global.

Incluso las instituciones financieras tradicionales han considerado escenarios optimistas.JPMorgansugirió en un informe que Bitcoin podría alcanzar los $146,000 si capturara la cuota de mercado del oro como reserva de valor, una proyección al alza más conservadora, pero aún significativa.

Vistas a largo plazo moderadas a bajistas

Otros prevén un aumento más gradual. Las proyecciones en el rango de $150,000–$300,000 son comunes entre los analistas que esperan un crecimiento continuo, pero con más volatilidad, competencia o fricción regulatoria. Algunos piensan que Bitcoin puede estabilizarse como “oro digital” sin evolucionar más allá de ese papel.

Si bien las opiniones muy pesimistas (por ejemplo, Bitcoin cayendo a cero) se han calmado en los últimos años, algunos analistas aún advierten sobre posibles factores disruptivos: fallas tecnológicas, un activo competidor exitoso o importantes represalias regulatorias en mercados clave.

En resumen, las predicciones para 2030 van desde $150k hasta $1M +,dependiendo de las suposiciones sobre la adopción y las tendencias macro. El precio a largo plazo de Bitcoin probablemente dependerá de lo bien que naviGate.io regule, desarrolle infraestructura e integre en el mundo real en los próximos cinco años.

Factores Clave que Influyen en el Precio Futuro de Bitcoin

Varias fuerzas importantes darán forma al precio de Bitcoin en los próximos años:

Oferta y escasez:El límite máximo de 21 millones de monedas de Bitcoin y las reducciones periódicas a la mitad (se espera la próxima en 2028) crean escasez incorporada. Si la demanda crece o se mantiene estable, esta restricción de la oferta puede impulsar los precios.

Adopción Institucional:Más corporaciones, fondos de cobertura e incluso gobiernos que adoptan Bitcoin pueden impulsar la demanda a largo plazo. Si se aprueba un ETF al contado en EE. UU., podría abrir las puertas a billones de dólares en capital institucional.

Regulación:una regulación amigable puede legitimar y fomentar la adopción, mientras que las reglas hostiles podrían sofocar el crecimiento. Países como El Salvadoradoptar Bitcoin estableció importantes precedentes, pero los riesgos persisten si las principales economías imponen controles estrictos.

Tendencias macroeconómicas:La inflación, las tasas de interés y la incertidumbre geopolítica pueden afectar la apelación del Bitcoin. Algunos inversores lo consideran como un refugio contra la inestabilidad de la moneda fiduciaria.

Progreso tecnológico:Actualizaciones de Bitcoin como el Red Lightningmejorar la usabilidad y la velocidad de transacción. Un número creciente de usuarios y la integración con aplicaciones financieras podrían aumentar la utilidad y la adopción.

Efectos de red:La ventaja del pionero de Bitcoin y su enorme tasa de hash lo convierten en una de las blockchains más seguras. Su resistencia a lo largo de los años contribuye a la confianza de los inversores y a la viabilidad a largo plazo.

Conclusión

La historia de Bitcoin desde 2009 hasta 2025 ha sido nada menos que notable. Desde un experimento en dinero descentralizado hasta una clase de activo de varios billones de dólares, ha cambiado la forma en que pensamos sobre el dinero y la soberanía. Con el precio rondando cerca o por encima de máximos históricos nuevamente, la pregunta de hasta dónde puede llegar Bitcoin a continuación es más relevante que nunca.

Ya sea $100,000, $500,000 o $1 millón por BTC, el camino por delante dependerá de cuán bien Bitcoin siga atrayendo usuarios, obtenga claridad regulatoria e integre con el sistema financiero más amplio.Una cosa está clara: Bitcoin ya no es una idea marginal, es un tema central en el futuro de las finanzas globales.

Para aquellos que buscan comerciar o invertir en Bitcoin, plataformas como Gate.iocontinuar proporcionando acceso a los mercados de BTC en todo el mundo, apoyando entornos comerciales seguros y líquidos.

Como siempre, el consejo sigue siendo el mismo: nunca inviertas más de lo que puedes permitirte perder, y haz tu investigación. El viaje de Bitcoin todavía está en desarrollo, y la próxima década podría ser aún más transformadora que la última.

Enlaces relacionados:

Compartir

Contenido