Gate Simple Earn Launches 0G Boost Rewards on Earn, Offering Up to 213% Annualized Yield

Gate Simple Earn Unveils 0G Boost High-Yield Investment Plan

Image: https://www.gate.com/simple-earn

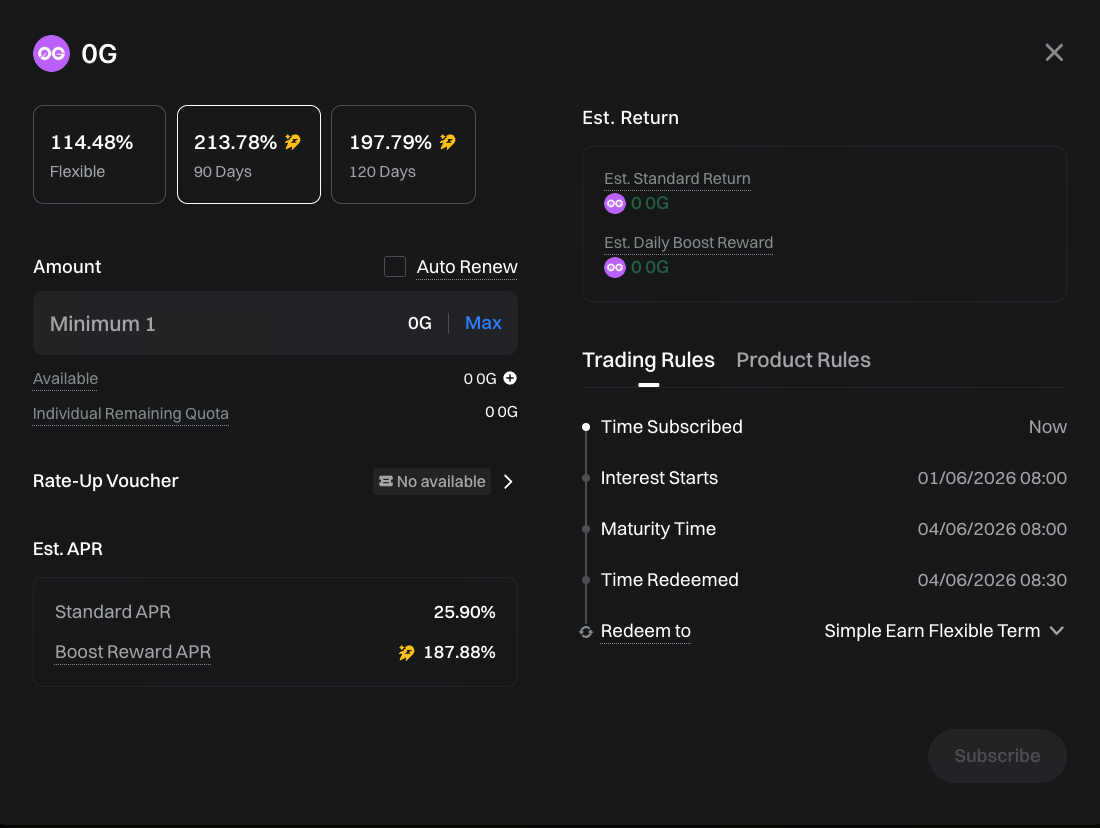

Gate Simple Earn has recently introduced the 0G Boost rewards program, providing participants in 0G fixed-term investments with an additional source of returns.

In addition to the standard base annualized yield, the platform is allocating an extra 850,000 0G as Boost rewards, enabling a maximum total annualized yield of up to 213%.

This mechanism is designed for users aiming to maximize short- and medium-term returns, while preserving the transparency of fixed-term investment rules.

What Is the 0G Boost Rewards Mechanism?

The 0G fixed-term investment yield structure consists of two components:

- Base annualized yield: generated from the fixed-term investment itself

- Boost annualized yield: additional 0G rewards distributed during the program period

The Boost reward is not a fixed rate; it is dynamically allocated based on the total user subscription volume.

This structure allows early participants, or those investing during periods of lower subscription volume, to potentially achieve higher actual annualized returns.

How Is the Boost Annualized Yield Calculated?

During the program period, all 0G fixed-term investment subscriptions—including holdings acquired before the program began—qualify for Boost reward allocation.

Please note the following:

- The total daily Boost reward is fixed

- The lower the daily total subscription volume, the higher the reward per subscription share

- As subscription volume increases, the actual annualized yield will gradually decrease

As a result, the annualized yield displayed on the subscription page is a real-time estimate that adjusts dynamically with subscription activity.

Distribution Rules for Interest and Boost Rewards

For Gate Simple Earn 0G fixed-term investments, base returns and Boost rewards are distributed differently:

- Base interest: interest accrues starting the day after subscription; principal and interest are redeemed together at maturity

- Boost rewards: distributed daily in 0G; automatically credited to your spot account or unified account

This separate distribution approach helps users more clearly track their different sources of returns.

Who Should Consider 0G Boost Investments?

From a product design perspective, 0G Boost is best suited for the following user profiles:

- Users already familiar with Gate Simple Earn fixed-term investment rules

- Participants seeking higher annualized returns within a defined time frame

- Users who understand variable annualized yields and are comfortable with fluctuating returns

Conservative users who prefer fixed rates should pay close attention to the dynamic nature of the annualized yield.

Risks to Consider When Participating in Gate Simple Earn 0G Investments

While Boost rewards can significantly enhance overall returns, users should remain aware of the following risks:

- Annualized yields are not fixed and may fluctuate based on subscription volume

- Fixed-term investments cannot be redeemed prior to maturity during the lock-up period

- Crypto asset prices are inherently subject to market volatility

Carefully planning your subscription allocation can help balance returns and liquidity needs.

Summary

Gate Simple Earn, through the 0G Boost rewards mechanism, introduces a more flexible yield model for fixed-term investments. During the program period, users can earn both base annualized yields and additional returns through Boost rewards, making 0G investments a more attractive yield option.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution