Prévisions du prix YFI pour 2025 : facteurs de croissance possibles et analyse du marché du token Yearn Finance

Introduction : Positionnement de Yearn Finance (YFI) sur le marché et potentiel d’investissement

Yearn Finance (YFI), principale plateforme d’agrégation pour l’agriculture de rendement dans la finance décentralisée (DeFi), s’est imposée comme un acteur central depuis son lancement en 2020. En 2025, sa capitalisation boursière atteint 176 175 591 $, avec environ 33 905 jetons en circulation et un prix avoisinant 5 196 $. Surnommé « optimiseur de rendement DeFi », cet actif occupe une place croissante dans la maximisation des rendements des détenteurs de cryptomonnaies au sein de l’écosystème décentralisé.

Cette analyse détaillée examine l’évolution des prix de YFI de 2025 à 2030, en tenant compte des tendances historiques, de l’offre et de la demande, de l’évolution de l’écosystème et des facteurs macroéconomiques, afin de présenter des prévisions professionnelles et des stratégies d’investissement concrètes pour les investisseurs.

I. Historique des prix de YFI et situation de marché actuelle

Historique de l’évolution du prix YFI

- 2020 : Lancement de YFI en juillet ; le prix s’envole de 31,65 $ à plus de 43 000 $ en deux mois

- 2021 : Pic historique à 90 787 $ en mai, porté par l’essor de la DeFi

- 2022-2024 : Cycles de marché, fluctuations entre 4 000 $ et 10 000 $

Situation actuelle du marché YFI

Au 24 septembre 2025, YFI cote à 5 196,2 $, avec un volume d’échanges sur 24 heures de 135 163,75 $. Sur les 24 dernières heures, le jeton a progressé de 1,75 % et gagné 0,98 % la dernière heure. Sur la semaine écoulée, il accuse toutefois une baisse de 4,18 %, et de 8,61 % sur le mois. YFI affiche une capitalisation de 176 175 591 $, se classant 319ᵉ des cryptomonnaies. L’offre en circulation atteint 33 904,69 YFI, soit 92,47 % du total de 36 666 jetons. Le prix reste très en deçà du sommet historique de 90 787 $ du 12 mai 2021, mais très au-dessus du creux de 31,65 $ du 18 juillet 2020.

Voir le prix actuel du YFI sur le marché

Indicateur de sentiment du marché YFI

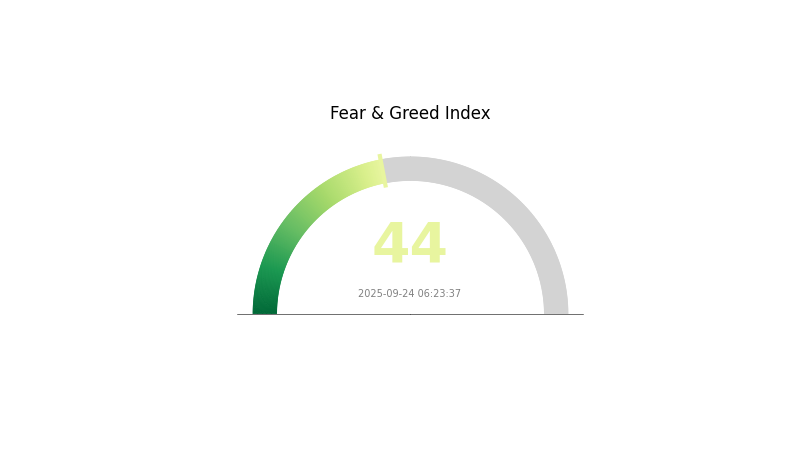

24 septembre 2025 : Indice de peur et de cupidité : 44 (Peur)

Consultez l’indice de peur et de cupidité actuel

Le marché crypto traverse une période d’incertitude, comme l’illustre un indice de peur et de cupidité à 44, signalant un sentiment de peur prévalent chez les investisseurs. Ce contexte offre généralement des opportunités à ceux qui misent sur le long terme. Les traders les plus avertis y voient souvent un signal d’achat potentiel, d’autres préférant rester prudents. Comme toujours, il est fondamental de mener une analyse sérieuse et d’évaluer son appétence au risque avant d’investir sur un marché crypto volatil.

Distribution des avoirs YFI

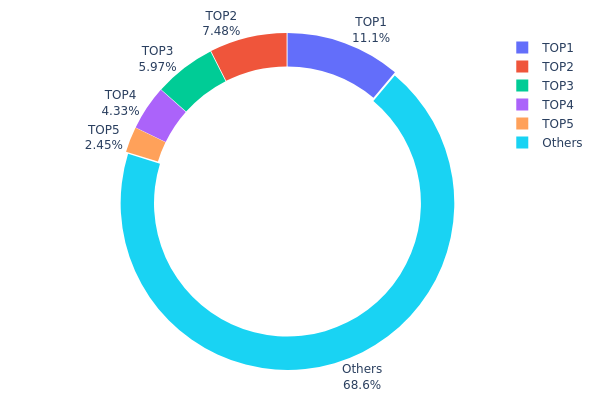

L’analyse de la répartition des adresses fournit une vision essentielle de la concentration des jetons YFI. On observe une concentration modérée des avoirs : la première adresse détient 11,12 % de l’offre, tandis que les cinq premières concentrent 31,33 %. Cette configuration traduit une structure d’actionnariat équilibrée, sans domination excessive d’une seule entité.

Cependant, la concentration d’environ un tiers de l’offre sur cinq adresses reste notable. Cette situation peut influencer la volatilité et la liquidité du marché, car les mouvements de ces grands détenteurs peuvent entraîner d’importantes variations de prix. Les 68,67 % restants, plus dispersés, renforcent la décentralisation, un facteur perçu comme favorable pour la stabilité de l’écosystème et du marché.

Globalement, la distribution actuelle des adresses YFI montre un équilibre modéré entre centralisation et diffusion. Cette répartition contribue à la stabilité on-chain, mais il convient de rester attentif à l’influence potentielle des grands détenteurs sur les cours à court terme.

Voir la distribution des avoirs YFI en temps réel

| Rang | Adresse | Quantité détenue | Part (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 4 080 | 11,12 % |

| 2 | 0xfeb4...faff52 | 2 740 | 7,47 % |

| 3 | 0x979d...293674 | 2 190 | 5,97 % |

| 4 | 0x90c1...588ad5 | 1 590 | 4,32 % |

| 5 | 0x47ac...a6d503 | 900 | 2,45 % |

| - | Autres | 25 170 | 68,67 % |

II. Facteurs majeurs influençant le prix futur de YFI

Mécanisme d’offre

- Distribution initiale : L’offre de 30 000 YFI a été répartie équitablement sur trois pools distincts, avec des mécanismes et objectifs propres à chacun.

- Impact actuel : La limitation de l’offre et le mode de distribution influencent directement la dynamique du prix de YFI.

Activité institutionnelle et grands détenteurs

- Adoption du protocole : Yearn Finance figure parmi les plus grands agrégateurs de rendement DeFi, avec près de 500 millions de dollars d’actifs sous gestion (ASG).

Environnement macroéconomique

- Couverture contre l’inflation : En tant que jeton DeFi, YFI est parfois considéré comme un instrument de couverture contre l’inflation selon les conditions économiques.

Évolution technique et développement de l’écosystème

- Améliorations de la gouvernance : Les détenteurs de YFI gèrent Yearn via des propositions hors chaîne (YIPs), soumises et votées sur la plateforme Snapshot.

- Vaults V3 : Yearn Finance a lancé Vaults V3, optimisant les frais de transaction et intégrant Keep3r pour la gestion de la liquidité.

- Intégration Iron Bank : Yearn exploite Iron Bank, plateforme interne de prêt co-développée avec CREAM Finance, pour dynamiser les rendements yVault et offrir des stratégies d’agriculture de rendement à effet de levier.

- Applications de l’écosystème : Les applications décentralisées clés de Yearn incluent yVaults, qui déploient des stratégies de rendement dynamiques et communautaires en DeFi.

III. Prévisions de prix YFI sur 2025-2030

Prévisions 2025

- Scénario conservateur : 4 555,94 $ à 5 177,20 $

- Scénario neutre : 5 177,20 $ à 6 342,07 $

- Scénario optimiste : 6 342,07 $ à 7 506,94 $ (sous condition de reprise durable et d’adoption DeFi croissante)

Prévisions 2027-2028

- Phase de marché attendue : Hausse potentielle accompagnée d’une forte volatilité

- Fourchette de prix anticipée :

- 2027 : 4 266,63 $ à 8 401,97 $

- 2028 : 4 639,47 $ à 9 727,91 $

- Moteurs principaux : Expansion du secteur DeFi, évolutions du protocole YFI, sentiment global du marché crypto

Prévisions long terme 2029-2030

- Scénario de base : 8 605,46 $ - 8 906,65 $ (sous hypothèse d’une croissance régulière de la DeFi et de l’écosystème YFI)

- Scénario optimiste : 9 207,84 $ - 12 202,11 $ (avec adoption accélérée et parts de marché renforcées)

- Scénario transformationnel : plus de 12 202,11 $ (en cas d’intégration massive de la DeFi)

- 31 décembre 2030 : YFI à 12 202,11 $ (pic potentiel selon les projections les plus favorables)

| Année | Prix maximum prévisionnel | Prix moyen prévisionnel | Prix minimum prévisionnel | Variation (%) |

|---|---|---|---|---|

| 2025 | 7 506,94 | 5 177,2 | 4 555,94 | 0 |

| 2026 | 6 786,01 | 6 342,07 | 4 819,97 | 22 |

| 2027 | 8 401,97 | 6 564,04 | 4 266,63 | 26 |

| 2028 | 9 727,91 | 7 483,01 | 4 639,47 | 44 |

| 2029 | 9 207,84 | 8 605,46 | 7 056,48 | 65 |

| 2030 | 12 202,11 | 8 906,65 | 8 461,32 | 71 |

IV. Stratégies professionnelles et gestion des risques sur YFI

Méthodologie d’investissement YFI

(1) Stratégie de conservation à long terme

- Profil : Investisseurs de valeur, forte tolérance au risque

- Conseils :

- Achat programmé (DCA) sur la durée

- Détenir YFI malgré la volatilité, en se focalisant sur les fondamentaux

- Stocker les jetons dans un portefeuille matériel sécurisé

(2) Stratégie de trading actif

- Outils d’analyse technique :

- Moyennes mobiles (MA) : identifier tendances et retournements

- RSI (indice de force relative) : repérer les zones de surachat/survente

- Pour la gestion active :

- Surveiller les tendances du marché DeFi et la performance relative de YFI

- Définir clairement les points d’entrée et de sortie selon les indicateurs techniques

Cadre de gestion des risques YFI

(1) Principes d’allocation d’actifs

- Investisseur prudent : 1 à 3 % du portefeuille crypto

- Investisseur dynamique : 5 à 10 %

- Investisseur professionnel : Jusqu’à 15 %

(2) Solutions de couverture du risque

- Diversification sur plusieurs projets DeFi

- Ordre de vente à seuil de déclenchement pour limiter les pertes

(3) Solutions de stockage sécurisé

- Portefeuille Web3 recommandé : portefeuille Web3 Gate

- Stockage hors ligne (portefeuille matériel) à privilégier pour la conservation long terme

- Bonnes pratiques : authentification à deux facteurs, mots de passe forts

V. Risques et défis majeurs de YFI

Risques de marché YFI

- Volatilité élevée : fluctuations marquées du prix de YFI

- Concurrence accrue dans le segment des agrégateurs DeFi

- Dépendance au sentiment général du marché crypto

Risques réglementaires

- Incertitude réglementaire : surveillance accrue possible sur les projets DeFi

- Défis de conformité avec l’évolution des exigences réglementaires

- Restrictions transfrontalières : statuts juridiques différents selon les juridictions

Risques techniques

- Failles potentielles dans les contrats intelligents

- Défis de passage à l’échelle lors de l’augmentation de l’adoption

- Dépendance à l’égard d’autres protocoles DeFi et de leur sécurité

VI. Conclusion et axes d’action

Évaluation du potentiel d’investissement YFI

YFI constitue une opportunité à fort rendement mais aussi à risque élevé dans l’univers DeFi. Le potentiel long terme s’appuie sur les stratégies d’optimisation du rendement de Yearn Finance, mais la volatilité conjoncturelle et l’incertitude réglementaire demeurent des risques majeurs.

Recommandations d’investissement YFI

✅ Débutants : Exposition limitée, développement des compétences et compréhension de la DeFi en priorité ✅ Investisseurs avertis : Pondérer modérément dans un portefeuille crypto diversifié ✅ Institutionnels : Procéder à une analyse préalable poussée, intégrer YFI dans une stratégie globale DeFi

Comment participer à YFI ?

- Achat au comptant : acquérir des jetons YFI sur Gate.com

- Agriculture de rendement : obtenir des rendements via les yVaults de Yearn Finance

- Participation à la gouvernance : voter sur les propositions au sein de l’écosystème

L’investissement en cryptomonnaies comporte des risques très élevés et cet article ne constitue pas un conseil financier. Les investisseurs doivent agir avec discernement selon leur propre profil de risque et demander conseil à un professionnel. N’investissez jamais plus que ce que vous pouvez vous permettre de perdre.

Foire aux questions

Quelle valeur pour Yearn Finance en 2030 ?

D’après l’analyse de marché, Yearn Finance pourrait se situer entre 12 184 $ et 18 277 $ en 2030, pour un prix moyen dans cette fourchette.

Yearn Finance peut-il atteindre 1 million de dollars ?

Bien que peu probable, atteindre 1 million de dollars reste envisageable. L’évolution du marché, l’adoption croissante et l’innovation pourraient permettre à YFI d’atteindre des sommets inédits.

Pourquoi le YFI est-il aussi onéreux ?

Le prix élevé de YFI provient de sa rareté, de son rôle central dans la gouvernance DeFi et de la forte demande au sein de son écosystème.

Quel avenir pour le YFI ?

Les perspectives de YFI sont favorables selon les projections, avec un potentiel de croissance marqué à long terme. En tant qu’élément clé de l’écosystème Yearn Finance, YFI devrait voir sa valeur progresser. Les scénarios les plus optimistes dessinent une trajectoire haussière durable pour le jeton.

Partager

Contenu