Predicción del precio de XTZ en 2025: ¿Tezos alcanzará los 10 dólares en el próximo ciclo alcista?

Introducción: posición de mercado y valor de inversión de XTZ

Tezos (XTZ), como plataforma blockchain pionera que se autoevoluciona, ha avanzado notablemente desde su lanzamiento en 2017. A fecha de 2025, Tezos alcanza una capitalización de mercado de $835 861 360, con un suministro en circulación próximo a 1 058 588 348 tokens XTZ y un precio que ronda los $0,7896. Este activo, conocido como el “libro mayor criptográfico autoenmendable”, desempeña actualmente un papel clave en la gobernanza descentralizada y el desarrollo de contratos inteligentes.

En este artículo encontrarás un análisis detallado de las tendencias de precios de Tezos entre 2025 y 2030, con base en datos históricos, oferta y demanda, evolución de su ecosistema y factores macroeconómicos, para ofrecerte previsiones profesionales sobre su precio y estrategias de inversión prácticas.

I. Revisión histórica de precios de XTZ y situación actual del mercado

Evolución histórica del precio de XTZ

- 2018: Lanzamiento inicial; el precio alcanzó su mínimo histórico de $0,350476 el 7 de diciembre.

- 2021: Máximo durante el mercado alcista; el precio llegó a $9,12 el 4 de octubre.

- 2022-2023: Invierno cripto; pronunciado descenso desde el máximo histórico.

Situación actual del mercado de XTZ

El 16 de septiembre de 2025, XTZ cotiza en $0,7896. La criptomoneda muestra un impulso positivo a corto plazo, con subida de 1,73 % en la última hora y 2,18 % en las últimas 24 horas. El rendimiento semanal destaca con un crecimiento de 8,37 % en los últimos 7 días.

La evolución a 30 días revela un descenso de 8,03 %, lo que señala cierta volatilidad en el medio plazo. Sin embargo, XTZ ha experimentado un crecimiento notable en los últimos doce meses, con incremento de valor del 25,36 %.

Actualmente, XTZ ocupa la posición 121 en el ranking del mercado de criptomonedas, con una capitalización bursátil de $835 861 360. Su suministro en circulación es de 1 058 588 348,707176 XTZ, equivalente al 98,14 % del total.

El volumen negociado en 24 horas es de $672 423,0320021, reflejando una actividad de mercado moderada. El precio actual se mantiene muy por debajo de su máximo histórico de $9,12, lo que indica margen de crecimiento si el mercado mejora.

Haz clic aquí para ver el precio de mercado actual de XTZ

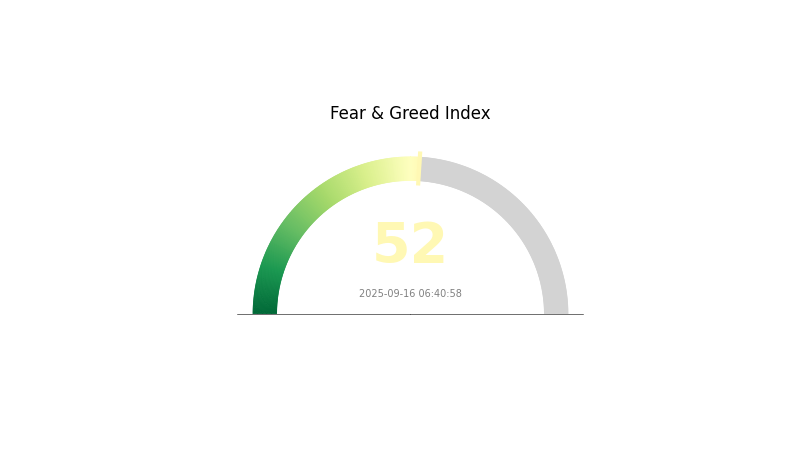

Indicador de sentimiento de mercado XTZ

16-09-2025 Índice Miedo y Codicia: 52 (Neutral)

Haz clic para consultar el Índice Miedo y Codicia

El sentimiento del mercado cripto sobre XTZ permanece equilibrado, con el Índice Miedo y Codicia en 52, señalando una posición neutral. Esto implica que los inversores ni son especialmente pesimistas ni excesivamente optimistas sobre las expectativas de XTZ. Si operas, conviene que actúes con cautela y analices a fondo las tendencias y los factores fundamentales antes de tomar decisiones. La diversificación y la gestión del riesgo siguen siendo esenciales ante la volatilidad del sector.

Distribución de tenencia de XTZ

No existen datos disponibles sobre la distribución de tenencia por dirección para XTZ. Esta carencia limita un análisis completo sobre la concentración y la estructura de mercado.

Sin información precisa acerca de las direcciones, resulta difícil valorar el grado de descentralización o concentración de tokens, además de dificultar el análisis de la dinámica de precios y la posible manipulación de mercado.

Ante la ausencia de datos concretos sobre la distribución, conviene recurrir a otras métricas y datos en la cadena para evaluar la salud y solidez de la red XTZ. Examinar la participación en la red, estadísticas de staking y volúmenes de transacción puede aportar información relevante sobre la estructura actual de mercado y los avances en descentralización.

Haz clic para ver la distribución de tenencia de XTZ

| Top | Dirección | Cantidad | Porcentaje de tenencia |

|---|

II. Factores clave que afectan al precio futuro de XTZ

Dinámica institucional y de grandes poseedores

- Adopción empresarial: Empresas relevantes que emplean tecnología Tezos

Entorno macroeconómico

- Propiedades de protección frente a la inflación: Comportamiento en entornos inflacionarios

Desarrollo tecnológico y del ecosistema

- Aplicaciones del ecosistema: Principales DApps y proyectos en el ecosistema Tezos

“Coordinar distintos factores para aumentar el precio de XTZ es fundamental para atraer público. Deberíamos centrarnos en la economía para explotar todo el potencial de Tezos.” - u/jakethebakedcake

III. Predicción de precio de XTZ para 2025-2030

Pronóstico para 2025

- Estimación conservadora: $0,54 - $0,65

- Estimación neutral: $0,65 - $0,78

- Estimación optimista: $0,78 - $0,90 (requiere recuperación significativa del mercado)

Pronóstico para 2027-2028

- Fase esperada de mercado: Consolidación seguida de crecimiento gradual

- Previsión de rango de precios:

- 2027: $0,83 - $1,18

- 2028: $0,92 - $1,50

- Factores clave: Avances tecnológicos y mayor adopción en DeFi y NFT dentro del ecosistema Tezos

Pronóstico a largo plazo para 2030

- Escenario base: $1,47 - $1,62 (suponiendo un crecimiento y adopción estables)

- Escenario optimista: $1,62 - $2,09 (si hay integración blockchain generalizada y un entorno regulatorio favorable)

- Escenario transformador: $2,09+ (en caso de avances excepcionales en el mercado cripto y en el ecosistema Tezos)

- 31 de diciembre de 2030: XTZ $2,08 (posible máximo, reflejando fuerte crecimiento de mercado)

| Año | Máximo previsto | Promedio previsto | Mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,90515 | 0,7803 | 0,54621 | -1 |

| 2026 | 1,17981 | 0,84272 | 0,65732 | 6 |

| 2027 | 1,18318 | 1,01127 | 0,83935 | 28 |

| 2028 | 1,5032 | 1,09723 | 0,92167 | 38 |

| 2029 | 1,93732 | 1,30021 | 0,97516 | 64 |

| 2030 | 2,08821 | 1,61877 | 1,47308 | 105 |

IV. Estrategias profesionales de inversión y gestión de riesgos en XTZ

Metodología de inversión en XTZ

(1) Estrategia de tenencia a largo plazo

- Para inversores tolerantes al riesgo y con perspectiva a largo plazo

- Recomendaciones operativas:

- Acumula XTZ durante caídas de mercado

- Haz staking de XTZ para generar ingresos pasivos

- Guarda tus activos en una wallet no custodiada y segura

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: Identifica tendencias y posibles puntos de reversión

- Índice de fuerza relativa (RSI): Determina situaciones de sobrecompra o sobreventa

- Aspectos clave para swing trading:

- Supervisa la correlación entre XTZ y Bitcoin, y el sentimiento de mercado

- Establece órdenes de stop-loss estrictas para gestionar el riesgo bajista

Marco de gestión de riesgos en XTZ

(1) Principios de asignación de activos

- Inversor conservador: 1–3 % de la cartera cripto

- Inversor agresivo: 5–10 % de la cartera cripto

- Profesional: Hasta el 15 % de la cartera cripto

(2) Soluciones de cobertura de riesgo

- Diversifica tu inversión en diferentes criptomonedas

- Utiliza opciones put como protección ante caídas

(3) Soluciones de almacenamiento seguro

- Hot wallet recomendada: Gate Web3 wallet

- Almacenamiento en frío: utiliza una hardware wallet para tus activos a largo plazo

- Medidas de seguridad: activa la autenticación en dos pasos y utiliza contraseñas robustas

V. Riesgos y desafíos potenciales para XTZ

Riesgos de mercado de XTZ

- Volatilidad: XTZ puede registrar movimientos bruscos en su precio

- Riesgo de liquidez: Menores volúmenes de negociación frente a criptomonedas líderes

- Competencia: Nuevas plataformas de contratos inteligentes pueden poner en riesgo la posición de Tezos

Riesgos regulatorios de XTZ

- Regulación incierta: El sector podría enfrentar restricciones más severas

- Clasificación como security token: XTZ podría ser considerado security y quedar sometido a mayor supervisión

- Restricciones internacionales: Regulaciones transfronterizas podrían limitar la adopción global de XTZ

Riesgos técnicos de XTZ

- Vulnerabilidades en contratos inteligentes: Riesgo de exploits en aplicaciones basadas en Tezos

- Congestión de red: Problemas de escalabilidad ante picos de demanda

- Desafíos de gobernanza: Conflictos comunitarios que puedan derivar en forks controvertidos

VI. Conclusión y recomendaciones de acción

Valoración del potencial de inversión de XTZ

Tezos (XTZ) ofrece una propuesta diferenciada por su blockchain autoenmendable y capacidades de verificación formal. Aunque presenta potencial de largo plazo como plataforma para contratos inteligentes, la volatilidad a corto plazo y la competencia suponen retos relevantes.

Recomendaciones de inversión en XTZ

✅ Principiantes: Empieza con una posición pequeña y céntrate en conocer la tecnología de Tezos.

✅ Inversores experimentados: Opta por una asignación moderada y participa activamente en staking.

✅ Institucionales: Considera XTZ dentro de una cartera diversificada, monitoreando los avances en gobernanza.

Formas de participar en XTZ

- Trading spot: Compra y mantén XTZ en Gate.com

- Staking: Participa en el sistema proof-of-stake de Tezos para obtener ingresos pasivos

- DeFi: Explora aplicaciones de finanzas descentralizadas desarrolladas en Tezos

Invertir en criptomonedas conlleva riesgos extremadamente elevados. Este artículo no constituye asesoramiento financiero. Decide siempre según tu tolerancia al riesgo y consulta con profesionales especializados. No inviertas jamás más de lo que puedas permitirte perder.

FAQ

¿XTZ tiene futuro?

XTZ cuenta con perspectivas prometedoras. Se espera estabilidad y potencial de desarrollo, respaldado por la evolución tecnológica y adopción de Tezos en el mercado cripto.

¿Cuánto podría valer XTZ en 2030?

De acuerdo con las tendencias actuales, se proyecta que XTZ cotice entre $1,20 y $1,32 en 2030, lo que apunta a un notable potencial de crecimiento para Tezos.

¿Tezos es una buena criptomoneda?

Tezos dispone de funciones diferenciales, como su blockchain autoenmendable y oportunidades de staking. Su calidad como criptomoneda depende de las tendencias del mercado y tus objetivos de inversión.

¿Por qué sube XTZ?

XTZ está subiendo por su mayor adopción, avances positivos en el ecosistema Tezos y un creciente interés del mercado. La especulación y la dinámica del sector cripto también favorecen el impulso de su precio.

Compartir

Contenido