2025 XCH Price Prediction: Expert Analysis and Market Forecasts for Chia Cryptocurrency

Introduction: XCH's Market Position and Investment Value

Chia (XCH) is a blockchain network founded by legendary programmer Bram Cohen that leverages underutilized hard disk storage space as a verification mechanism. Since its inception in 2021, Chia has established itself as an innovative approach to blockchain consensus through its unique Proof of Space and Proof of Time architecture. As of December 18, 2025, XCH has achieved a market capitalization of approximately $153.58 million with a circulating supply of approximately 14.62 million coins, trading at around $4.654 per token. This eco-conscious blockchain solution is increasingly playing a vital role in distributed storage and sustainable consensus verification.

This report will comprehensively analyze XCH's price trends and market dynamics through 2025 and beyond, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies.

I. XCH Price History Review and Current Market Status

XCH Historical Price Evolution

-

May 2021: Chia Network mainnet launch, XCH reached its all-time high of $1,645.12, marking the peak of initial market enthusiasm following the project's public debut.

-

2021-2024: Extended bear market period, price experienced significant depreciation as market sentiment shifted and the broader cryptocurrency market faced headwinds.

-

December 2025: XCH declined to $4.61, establishing a new all-time low as of December 18, 2025, reflecting prolonged downward pressure on the asset.

XCH Current Market Conditions

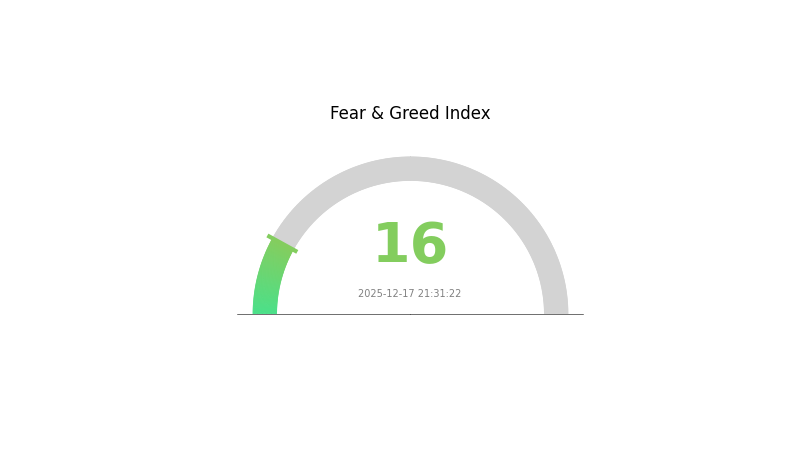

As of December 18, 2025, XCH is trading at $4.654, with a 24-hour trading volume of $246,677.46. The token has experienced a decline of 4.12% over the past 24 hours and 19.32% over the past 7 days. Over a 1-year period, XCH has fallen 82.50%, demonstrating sustained bearish momentum. The circulating supply stands at approximately 14.62 million XCH out of a total supply of 32.99 million XCH, with a market capitalization of $68.06 million and a fully diluted valuation of $153.58 million. XCH currently ranks 421st by market capitalization, representing 0.0049% of the total cryptocurrency market. Current market sentiment indicates extreme fear (VIX: 16), reflecting significant risk aversion across the broader market.

Click to view current XCH market price

XCH 市场情绪指标

2025-12-17 恐惧与贪婪指数:16(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the fear and greed index standing at 16. This reading indicates significant market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often presents contrarian trading opportunities, as excessive fear can signal potential market bottoms. However, traders should remain cautious and conduct thorough risk management. Historical data suggests that extreme fear periods can present buying opportunities for long-term investors, though short-term volatility may persist. Monitor market developments closely and consider your risk tolerance before making investment decisions on Gate.com.

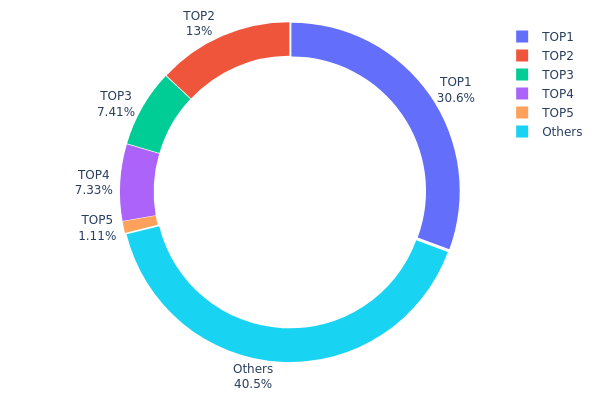

XCH Holdings Distribution

The address holdings distribution chart presents a snapshot of how XCH tokens are allocated across the blockchain's top holders, revealing critical insights into token concentration and market structure. By analyzing the proportion of total supply held by individual addresses, this metric serves as a fundamental indicator of decentralization and potential vulnerability to coordinated market movements.

The current XCH distribution exhibits pronounced concentration characteristics, with the top four addresses controlling approximately 58.38% of the measured holdings. The largest holder commands 30.62% of the supply, while the second and third largest holders respectively account for 13.02% and 7.41%. This hierarchical concentration pattern suggests a relatively centralized ownership structure, where a small number of entities wield substantial influence over the asset's market dynamics. Notably, the "Others" category represents 40.51% of holdings, indicating that while major holders dominate, a significant portion remains distributed among numerous smaller addresses, partially offsetting extreme centralization.

Such concentrated distribution patterns warrant careful consideration regarding market stability and price discovery mechanisms. The substantial holdings by top addresses create potential vectors for significant market impact, as coordinated or strategic moves by these entities could trigger substantial price volatility or liquidity disruptions. However, the meaningful proportion held by dispersed smaller addresses provides some counterbalance to top-holder dominance. The current distribution reflects a hybrid market structure—neither fully decentralized nor severely compromised—suggesting moderate concentration risk with gradual community participation in token ownership.

View current XCH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | xch1y6...nyzvgy | 10437.50K | 30.62% |

| 2 | xch1yx...lh08yl | 4437.60K | 13.02% |

| 3 | xch1au...srtdav | 2527.12K | 7.41% |

| 4 | xch197...c5nhnx | 2500.00K | 7.33% |

| 5 | xch13s...y09ndr | 377.62K | 1.11% |

| - | Others | 13807.05K | 40.51% |

II. Core Factors Affecting XCH's Future Price

Supply Mechanism

-

Block Reward Halving: XCH's price trajectory is significantly influenced by block reward reductions and hard forks. These protocol updates directly impact the rate of new token issuance, affecting supply dynamics in the market.

-

Strategic Reserve Management: According to Chia's latest business whitepaper, the company commits not to sell its strategic reserves through 2025. This reserve policy helps stabilize XCH's coin price by preventing large-scale market supply increases from company liquidation.

-

Historical Patterns: Supply changes have historically demonstrated direct correlation with price movements. The mining difficulty adjustments and changes in token emission rates have consistently impacted XCH's market valuation.

Institutional and Major Holder Dynamics

-

Regulatory Environment: Real-world regulatory events significantly influence XCH pricing. Government adoption, enterprise implementation decisions, and regulatory policy changes all serve as critical price drivers in the market.

-

Market Confidence Factors: XCH price volatility is substantially influenced by overall market confidence in cryptocurrency assets. Enterprise and government adoption levels directly correlate with investor sentiment and price performance.

Mining Network Dynamics

-

Mining Difficulty Changes: Fluctuations in mining difficulty represent a key price factor. As mining hardware efficiency improves with each new generation, older mining equipment becomes less competitive, causing some miners to exit while efficient new hardware attracts additional investment.

-

Mining Hardware Evolution: The introduction of next-generation, more efficient mining equipment impacts XCH's price through supply dynamics. When new mining hardware enters the market, it reshapes the profitability landscape and influences participation levels among miners.

-

Network Hashrate Growth: The overall network hashrate expansion curve directly affects XCH's future price trajectory and represents a critical variable for investment decision-making.

III. 2025-2030 XCH Price Forecast

2025 Outlook

- Conservative Forecast: $4.27-$4.65

- Neutral Forecast: $4.65-$5.06

- Optimistic Forecast: $5.06+ (requires sustained network adoption and positive regulatory sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, transitioning into accumulation period as network fundamentals strengthen

- Price Range Forecast:

- 2026: $2.86-$5.68

- 2027: $4.53-$7.79

- 2028: $5.62-$6.86

- Key Catalysts: Network protocol upgrades, expansion of decentralized storage use cases, institutional adoption of Chia farming infrastructure, and mainstream recognition of green blockchain solutions

2029-2030 Long-term Outlook

- Base Case Scenario: $6.43-$8.97 (assumes continued network growth with moderate mainstream adoption of decentralized storage technology)

- Optimistic Scenario: $8.97-$11.43 (assumes breakthrough in enterprise storage partnerships and increased integration with major platforms)

- Transformational Scenario: $11.43+ (extreme positive conditions including regulatory clarity favoring proof-of-space consensus, major institutional funding influx, and widespread commercial deployment of Chia infrastructure)

Market Context: XCH demonstrates a projected 68% cumulative gain through 2030, reflecting confidence in the long-term viability of proof-of-space technology and its environmental advantages. Monitor developments on Gate.com for real-time price movements and trading opportunities.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5.06305 | 4.645 | 4.2734 | 0 |

| 2026 | 5.67921 | 4.85403 | 2.86387 | 4 |

| 2027 | 7.79459 | 5.26662 | 4.52929 | 13 |

| 2028 | 6.85714 | 6.53061 | 5.61632 | 40 |

| 2029 | 8.96979 | 6.69387 | 6.42612 | 43 |

| 2030 | 11.43447 | 7.83183 | 5.16901 | 68 |

Chia (XCH) Professional Investment Strategy and Risk Management Report

IV. XCH Professional Investment Strategy and Risk Management

XCH Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Believers in proof-of-space consensus mechanisms and green blockchain technology; investors with long-term risk tolerance for emerging consensus algorithms

- Operational Recommendations:

- Accumulate XCH during price correction periods, focusing on support levels around $4.61 (all-time low)

- Hold positions through market volatility cycles, as the project's technology adoption may take extended periods to mature

- Reinvest any staking rewards or protocol incentives to compound holdings over time

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA50/MA200): Monitor trend direction and potential reversals at key resistance and support levels

- Relative Strength Index (RSI): Identify overbought (>70) and oversold (<30) conditions for entry and exit signals

- Wave Trading Key Points:

- Execute buy orders near historical support levels; current 24-hour low of $4.597 provides tactical entry opportunities

- Set take-profit targets at previous resistance levels; historical high of $1,645.12 represents long-term resistance

- Monitor 24-hour trading volume ($246,677) for liquidity confirmation before position entry

XCH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional/Speculative Investors: Up to 10-15% with strict stop-loss protocols

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Execute regular fixed-amount purchases over 6-12 month periods to reduce timing risk and average entry costs

- Portfolio Diversification: Maintain XCH as no more than 10% of total cryptocurrency holdings, balancing exposure with more established assets

- Stop-Loss Implementation: Set hard stops at -20% to -30% from entry price to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and smaller holdings; provides immediate liquidity and user-controlled private keys

- Cold Storage Solution: Transfer majority holdings to offline storage for long-term positions; use hardware wallets or paper wallet backups for enhanced security

- Security Best Practices: Enable two-factor authentication on all exchange accounts; regularly verify wallet addresses before transfers; maintain secure backup of seed phrases in geographically separate locations; never share private keys or recovery phrases

V. XCH Potential Risks and Challenges

XCH Market Risks

- Extreme Price Volatility: XCH has experienced -82.50% decline over the past year and a -4.12% drop in 24 hours; such significant fluctuations present substantial downside risk for unprepared investors

- Low Trading Liquidity: With 24-hour volume of only $246,677 and $68.06M market cap, XCH exhibits relatively thin order books, potentially resulting in significant slippage during large trades

- Market Capitalization Decline: Ranking at #421 with only 44.32% of fully diluted valuation represented in circulating supply indicates potential dilution risk as additional coins enter circulation

XCH Regulatory Risks

- Regulatory Classification Uncertainty: The status of XCH as a commodity, security, or other asset class remains ambiguous across different jurisdictions, creating potential compliance and trading restrictions

- International Compliance Challenges: Different countries implement varying frameworks for proof-of-space consensus mechanisms; regulatory changes could impact project operations or token utility

- Tax Treatment Ambiguity: Accounting standards for XCH holdings and transactions remain undefined in many jurisdictions, creating potential tax liability surprises

XCH Technical Risks

- Adoption and Scaling Challenges: Proof-of-space technology remains nascent compared to proof-of-work and proof-of-stake; limited real-world adoption demonstrates uncertain market demand

- Network Security Vulnerabilities: As a relatively new consensus mechanism, potential undiscovered technical vulnerabilities or 51% attack vectors remain possible

- Fork and Chain Splitting Risk: Disagreements within the Chia community regarding protocol upgrades could result in network forks, fragmenting liquidity and user base

VI. Conclusion and Action Recommendations

XCH Investment Value Assessment

Chia Network presents a technically innovative approach to blockchain consensus through proof-of-space mechanisms, utilizing underutilized hard disk storage instead of electricity-intensive mining. However, the project faces significant headwinds: an 82.5% year-over-year price decline, minimal market capitalization relative to peers, and limited mainstream adoption. The technology remains unproven at scale, and the gap between theoretical efficiency benefits and practical market acceptance remains substantial. Investors should evaluate XCH as a highly speculative, early-stage technology play rather than a stable investment vehicle.

XCH Investment Recommendations

✅ Beginners: Limit initial exposure to 1-2% of cryptocurrency portfolio through minimal positions on Gate.com; prioritize education on proof-of-space mechanisms before expanding exposure; use dollar-cost averaging to build positions gradually

✅ Experienced Investors: Consider 3-5% allocations with active monitoring of technical indicators and protocol developments; implement strict risk management with predetermined stop-losses; evaluate XCH as part of a diversified alternative consensus mechanism portfolio

✅ Institutional Investors: Conduct thorough due diligence on technical architecture, team capabilities, and regulatory landscape; structure positions with comprehensive risk frameworks; consider XCH as portfolio hedge against proof-of-work and proof-of-stake dominance rather than core holding

XCH Trading Participation Methods

- Spot Trading: Purchase XCH directly through Gate.com spot market; holds full token ownership with custodial responsibility; suitable for long-term position building

- Gate.com Trading Platform: Utilize advanced order types, technical analysis tools, and real-time market data available on Gate.com for active trading strategies

- Recurring Purchase Plans: Execute automated periodic purchases through Gate.com's investment features to implement dollar-cost averaging without active timing requirements

Cryptocurrency investment carries extreme risk of total capital loss. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Always consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

Is XCH crypto a good investment?

XCH shows promising recovery, up 34% from February 2025 lows. With technical breakouts and strong momentum signals, it presents growth potential. Current price around $11.52 suggests value opportunity for investors seeking mid-cap exposure.

Does chia coin have a future?

Yes, Chia coin shows promising potential with positive market forecasts indicating bullish trends ahead. Strong development fundamentals and growing adoption support its long-term viability and relevance in the crypto ecosystem.

How volatile is the XCH price?

XCH exhibits high volatility, ranging from $1,934.51 in 2021 to $8.61 in 2025. Currently at $11.52 in December 2025, the price is driven by market trends and technical factors. Analysts predict XCH will range between $7.76 and $15.49 in 2025.

Does chz have a future?

Yes, CHZ has strong future potential. With projected growth of 15.76% and forecasted price appreciation through 2028, the project maintains solid market fundamentals and long-term development prospects.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Exploring the Evolution and Advantages of DeFi 2.0

Understanding the Basics of Liquidity Mining

Understanding Segwit in Bitcoin: A Comprehensive Guide

Beginner's Guide to Purchasing Ethereum Classic (ETC) in India

Create Your Own Cryptocurrency Mining Network