2025 TOMI Price Prediction: Market Analysis and Future Outlook for the Emerging Digital Asset

Introduction: TOMI's Market Position and Investment Value

TOMI (TOMI), as a cryptocurrency aiming to increase digital freedom and build a more decentralized internet, has been making strides since its inception. As of 2025, TOMI's market capitalization has reached $14,737,804, with a circulating supply of approximately 47,668,936,138 tokens, and a price hovering around $0.00030917. This asset, dubbed as "the digital freedom enabler," is playing an increasingly crucial role in reshaping how people connect and transact in the digital age.

This article will provide a comprehensive analysis of TOMI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. TOMI Price History Review and Current Market Status

TOMI Historical Price Evolution

- 2023: TOMI reached its all-time high of $6.79266 on June 6, marking a significant milestone in its price history.

- 2025: The market experienced a sharp downturn, with TOMI's price plummeting to its all-time low of $0.00005653 on September 26.

TOMI Current Market Situation

As of October 7, 2025, TOMI is trading at $0.00030917, representing a significant decline of 99.36% from its price one year ago. The token's market capitalization currently stands at $14,737,804.99, ranking it 1242nd in the cryptocurrency market.

In the past 24 hours, TOMI has experienced a notable price decrease of 13.94%, with its trading volume reaching $358,109.49. Despite this short-term decline, TOMI has shown some positive momentum in the past hour, with a 17.36% increase.

The token's circulating supply is 47,668,936,138.48581 TOMI, with a total supply of 4,281,047,102.4379454 TOMI. The fully diluted market cap is $1,323,571.33, indicating that the current market cap represents 100% of the fully diluted valuation.

Click to view the current TOMI market price

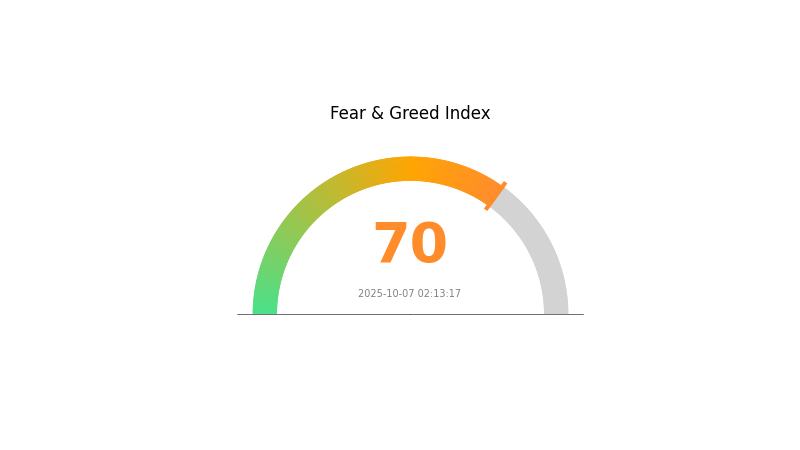

TOMI Market Sentiment Indicator

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 70. This suggests that investors are becoming overly optimistic, potentially leading to overvalued assets. While the bullish sentiment may continue in the short term, it's essential for traders to exercise caution. Remember, markets often correct when extreme greed prevails. Consider diversifying your portfolio and setting stop-loss orders to protect your gains. Stay informed and trade responsibly on Gate.com.

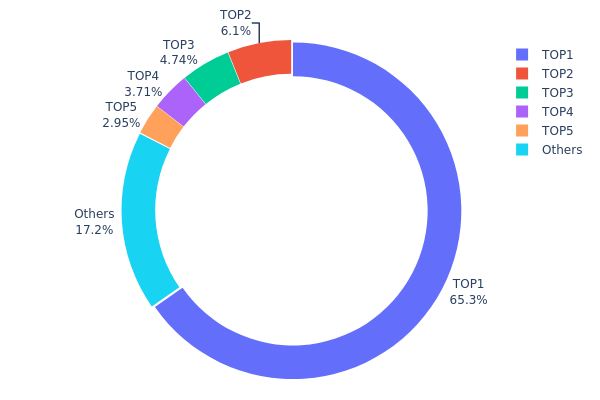

TOMI Holdings Distribution

The address holdings distribution data for TOMI reveals a highly concentrated ownership structure. The top address holds a staggering 65.30% of the total supply, equivalent to 31,137,994.19K TOMI tokens. This level of concentration raises significant concerns about centralization and potential market manipulation risks.

The subsequent four largest addresses collectively hold an additional 17.47% of the supply, bringing the total held by the top 5 addresses to 82.77%. This leaves only 17.23% distributed among all other holders. Such a skewed distribution suggests that TOMI's market is potentially vulnerable to large sell-offs or buy-ins initiated by these major holders, which could lead to increased price volatility and reduced liquidity for smaller participants.

This concentration of holdings may also impact TOMI's governance structure and decision-making processes, potentially compromising its decentralization ethos. Investors and traders should carefully consider these factors when assessing TOMI's market dynamics and long-term stability.

Click to view the current TOMI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf42a...36f173 | 31137994.19K | 65.30% |

| 2 | 0x75e8...1dcb88 | 2906564.89K | 6.09% |

| 3 | 0x6d0d...d9062d | 2261279.49K | 4.74% |

| 4 | 0xd4d2...9153b1 | 1767180.20K | 3.70% |

| 5 | 0x0000...e08a90 | 1405343.91K | 2.94% |

| - | Others | 8201297.13K | 17.23% |

Key Factors Affecting TOMI's Future Price

Supply Mechanism

- Market Conditions: The value of TOMI may fluctuate significantly due to various factors including market conditions, investor sentiment, regulatory developments, and technological advancements.

Institutional and Whale Dynamics

- Investor Sentiment: Investor sentiment plays a crucial role in influencing TOMI's price movements. Traders and investors closely monitor the token's value to make informed decisions when buying, selling, or holding.

Macroeconomic Environment

- Regulatory Developments: Changes in regulatory landscape can have a significant impact on TOMI's future price trajectory.

Technical Development and Ecosystem Building

- Technological Advancements: Ongoing technological progress in the TOMI project can affect its price performance.

- Ecosystem Applications: The development and adoption of key DApps and ecosystem projects may influence TOMI's value.

Investors should stay informed about the latest developments and plans for TOMI to make wise decisions in this highly volatile market.

III. TOMI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00022 - $0.00028

- Neutral prediction: $0.00028 - $0.00034

- Optimistic prediction: $0.00034 - $0.00039 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00029 - $0.00051

- 2028: $0.00030 - $0.00062

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00054 - $0.00062 (assuming steady market growth and project development)

- Optimistic scenario: $0.00062 - $0.00077 (assuming strong market performance and significant project milestones)

- Transformative scenario: $0.00077 - $0.00085 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: TOMI $0.00077 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00039 | 0.00028 | 0.00022 | -3 |

| 2026 | 0.00049 | 0.00034 | 0.00032 | 15 |

| 2027 | 0.00051 | 0.00041 | 0.00029 | 41 |

| 2028 | 0.00062 | 0.00046 | 0.0003 | 56 |

| 2029 | 0.00069 | 0.00054 | 0.0003 | 84 |

| 2030 | 0.00077 | 0.00062 | 0.00039 | 109 |

IV. TOMI Professional Investment Strategies and Risk Management

TOMI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in digital freedom

- Operational suggestions:

- Dollar-cost average into TOMI over time

- Hold through market volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

TOMI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Offline paper wallet

- Security precautions: Use two-factor authentication, avoid public Wi-Fi for transactions

V. Potential Risks and Challenges for TOMI

TOMI Market Risks

- High volatility: Extreme price fluctuations common in crypto markets

- Liquidity risk: Limited trading volume may impact ability to exit positions

- Competition: Other messaging/payment platforms may gain market share

TOMI Regulatory Risks

- Uncertain regulatory environment: Potential for unfavorable regulations

- Cross-border compliance: Challenges in adhering to multiple jurisdictions

- Privacy concerns: Increased scrutiny on data protection and user privacy

TOMI Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues with network congestion

- Cybersecurity threats: Risk of hacks or attacks on the network

VI. Conclusion and Action Recommendations

TOMI Investment Value Assessment

TOMI offers long-term potential in digital freedom and decentralized communications but faces short-term volatility and adoption challenges. The project's unique combination of messaging and crypto payments presents an innovative use case, yet investors should be aware of the high-risk nature of this investment.

TOMI Investment Recommendations

✅ Newcomers: Start with small, affordable investments to learn the market ✅ Experienced investors: Consider a balanced approach with strategic entry points ✅ Institutional investors: Conduct thorough due diligence and consider OTC options

TOMI Trading Participation Methods

- Spot trading: Buy and sell TOMI on Gate.com's spot market

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance options as they become available

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Toncoin reach $100?

While Toncoin has potential, reaching $100 is uncertain. Current price trends and market conditions suggest it's unlikely in the near future, but long-term growth remains possible.

What crypto will 1000x prediction?

While no crypto guarantees 1000x returns, emerging projects like Bullzilla (BZIL) show high potential for massive gains in the current market cycle.

What is about Tomi coin?

TOMI is a platform for a freer internet, offering a chat and wallet app for crypto transactions. It features private and public groups, simplified crypto sending, and focuses on creator-first monetization tools.

How much is Tomarket token worth in 2025?

Based on market analysis, Tomarket token is predicted to be worth between $0.065515 and $0.067891 in 2025, with an average price around $0.066703.

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

2025 HTPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Huobi Token

2025 MTLPrice Prediction: Analyzing Future Growth Trends and Market Potential for Metal Token

2025 CHEQ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Cheqd Network Token

2025 VICEPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Media Giant

2025 CRTSPrice Prediction: Analyzing Market Trends and Future Valuation for CRTS Tokens in the Evolving Cryptocurrency Landscape

What Are the Key Compliance and Regulatory Risks in Cryptocurrency Markets in 2025?

Understanding Crypto Payments: A Guide to Using Cryptocurrency for Purchases

What is the current crypto market overview by market cap, trading volume, and liquidity in 2025?

2025 Cryptocurrency Investment: Top Coins for Future Wealth

2025 BLD Price Prediction: Expert Analysis and Market Forecast for Buildel Token's Future Growth