2025 STORJ Price Prediction: Expert Analysis and Market Forecast for Decentralized Storage Token

Introduction: Storj's Market Position and Investment Value

Storj (STORJ) is a decentralized cloud storage platform dedicated to becoming censorship-resistant, surveillance-free, and non-downtime. Since its inception in 2017, Storj has established itself as a pioneering solution in the Web3 storage sector. As of December 2025, STORJ's market capitalization has reached approximately $50.19 million, with a circulating supply of around 143.79 million tokens, currently trading at $0.1181 per token. This innovative platform, recognized for its emphasis on security and decentralization, is playing an increasingly important role in providing secure and cost-effective data storage solutions.

This article will provide a comprehensive analysis of Storj's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to the decentralized storage sector.

I. STORJ Price History Review and Current Market Status

STORJ Historical Price Evolution Trajectory

- 2021-03-28: STORJ reached its all-time high (ATH) of $3.81, marking a significant peak in the asset's price history.

- 2020-03-13: STORJ touched its all-time low (ATL) of $0.05024, representing the lowest point in the project's trading history.

STORJ Current Market Situation

As of December 21, 2025, STORJ is trading at $0.1181, reflecting significant depreciation from its historical peak. The asset exhibits notable downward pressure across multiple timeframes:

Short-term Performance:

- 1-hour change: -0.51%

- 24-hour change: -0.08%

- 7-day change: -15.53%

Medium and Long-term Trends:

- 30-day change: -24.21%

- 1-year change: -73.8%

Market Capitalization Metrics:

- Circulating market cap: $16,981,296.51 USD

- Fully diluted valuation: $50,192,499.76 USD

- Circulating supply: 143,787,438.7 STORJ tokens

- Total supply: 424,999,998 tokens

- Market dominance: 0.0015%

Trading Activity:

- 24-hour trading volume: $15,724.01 USD

- Current price range (24H): $0.1167 - $0.1198

- Number of active holders: 104,663

- Listed on 35 exchanges

STORJ maintains a market ranking of 927 by capitalization. The asset's market capitalization represents 28.76% of its fully diluted valuation, indicating significant potential dilution upon full token circulation. The 24-hour price movement of -0.08% suggests relative stability in the immediate short term, though the substantial year-over-year decline reflects prolonged bearish pressure on the asset.

Click to view current STORJ market price

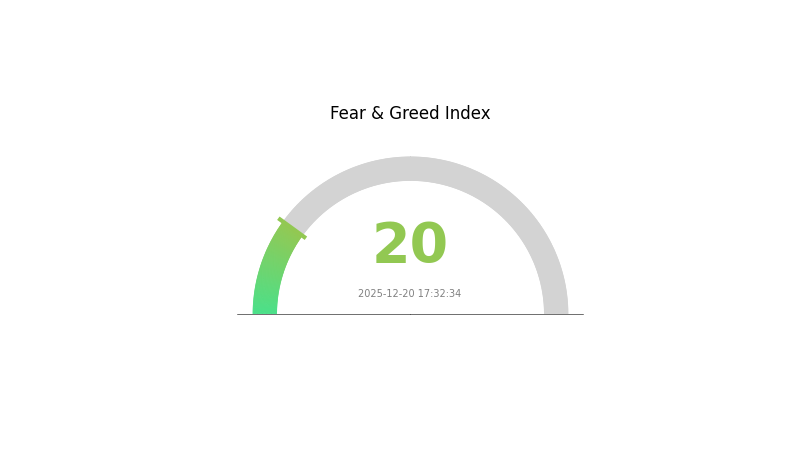

Crypto Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates heightened market anxiety and significant selling pressure across digital assets. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as panic-driven selloffs may create favorable entry points. However, cautious risk management remains essential during volatile periods. Monitor market developments closely and consider your investment strategy on Gate.com to navigate this uncertain environment effectively.

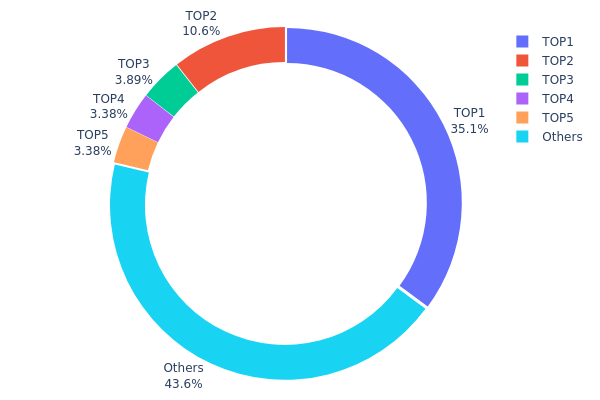

STORJ Holdings Distribution

The address holdings distribution map represents the concentration of STORJ tokens across blockchain addresses, serving as a critical metric for assessing decentralization levels and market structure. By tracking the top holders and their respective token quantities, this distribution pattern reveals potential risks related to token concentration, market manipulation susceptibility, and the overall health of the network's decentralized ecosystem.

STORJ currently exhibits notable concentration characteristics in its holder base. The top address commands 35.10% of the total token supply, representing a dominant position that significantly influences market dynamics. When combined with the second-largest holder at 10.60%, the top two addresses collectively control 45.70% of all STORJ tokens in circulation. This concentration level suggests a moderately centralized distribution structure. However, the remaining four addresses in the top five collectively account for only 10.64%, while the dispersed holder category ("Others") comprises 43.66% of the total supply. This bifurcated distribution indicates that while significant concentration exists at the apex, a substantial portion of tokens remains distributed across numerous smaller holders, providing some counterbalance to extreme centralization.

The current address distribution poses measurable implications for market microstructure and price stability. The substantial holdings by top addresses create potential liquidity imbalances and heightened volatility risk, particularly during periods of significant token movements or coordinated selling activity. The concentration level observed in STORJ suggests a market structure where whale actors retain considerable price discovery influence, though the significant "Others" category (43.66%) demonstrates that the token supply has not collapsed into severe oligopolistic control. This distribution pattern reflects a moderately decentralized network with identifiable concentration risks that warrant continued monitoring.

Click to view current STORJ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcb1c...b8d5b3 | 149209.24K | 35.10% |

| 2 | 0xf977...41acec | 45082.15K | 10.60% |

| 3 | 0xd2dd...e6869f | 16537.91K | 3.89% |

| 4 | 0x6ba6...39df31 | 14381.84K | 3.38% |

| 5 | 0xb8e3...7a92d3 | 14357.14K | 3.37% |

| - | Others | 185431.71K | 43.66% |

II. Core Factors Affecting STORJ's Future Price

Supply Mechanism

-

Token Inflation Rate: STORJ's price trajectory is influenced by token issuance inflation rates. When the inflation rate remains relatively low, token issuance tends to decrease over future periods, which typically creates upward price pressure as network participants are incentivized to accumulate tokens for asset appreciation.

-

Protocol Updates: Price movements are driven by supply-demand dynamics, with factors such as hard forks and protocol updates playing significant roles in influencing STORJ's price trajectory.

Macroeconomic Environment

-

Monetary Policy Impact: Global economic conditions, inflation rates, and monetary policy decisions affect investor behavior and indirectly influence STORJ's price movements.

-

Market Sentiment: Market sentiment plays a crucial role in STORJ price predictions. Optimistic sentiment and widespread "greed" can fuel bullish STORJ forecasts, while fear or negative news may lead to bearish outlooks.

Technology Development and Ecosystem

-

Enterprise Adoption: Real-world adoption events, including enterprise and government utilization of decentralized storage solutions, directly impact STORJ's price dynamics.

-

Regulatory Environment: Regulatory changes and compliance developments within the cryptocurrency sector influence STORJ's price movements and market acceptance.

III. STORJ Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.11328 - $0.14632

- Base Case Forecast: $0.118 (average price)

- Bullish Forecast: $0.14632 (market stabilization scenario)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Steady recovery phase with gradual adoption expansion and network utility improvement

- Price Range Predictions:

- 2026: $0.10969 - $0.17577 (11% potential upside)

- 2027: $0.13857 - $0.22017 (30% potential upside)

- 2028: $0.11785 - $0.22635 (58% potential upside)

- Key Catalysts: Enhanced decentralized storage adoption, increased enterprise integration, ecosystem expansion, and improved market sentiment toward distributed infrastructure assets

2029-2030 Long-term Outlook

- Base Case Scenario: $0.20185 - $0.2669 range (89% potential upside by 2030), assuming steady ecosystem development and mainstream adoption of decentralized storage solutions

- Bullish Case Scenario: $0.24185 - $0.26690 range (by 2030), contingent on accelerated enterprise partnerships and significant expansion of Web3 infrastructure demand

- Transformation Scenario: Potentially higher valuations if decentralized cloud storage achieves critical mass adoption and becomes industry standard for enterprise data management

Note: STORJ price predictions are based on historical data analysis and market trend projections. Investors are advised to conduct independent research and consider risk management strategies when trading on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14632 | 0.118 | 0.11328 | 0 |

| 2026 | 0.17577 | 0.13216 | 0.10969 | 11 |

| 2027 | 0.22017 | 0.15397 | 0.13857 | 30 |

| 2028 | 0.22635 | 0.18707 | 0.11785 | 58 |

| 2029 | 0.24185 | 0.20671 | 0.10749 | 75 |

| 2030 | 0.2669 | 0.22428 | 0.20185 | 89 |

STORJ Professional Investment Strategy and Risk Management Report

IV. STORJ Professional Investment Strategy and Risk Management

STORJ Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Investors with medium to long-term horizons seeking exposure to decentralized cloud storage infrastructure, with moderate risk tolerance.

-

Operational Recommendations:

- Establish a core position during market downturns, taking advantage of STORJ's current 73.8% year-over-year decline to accumulate at lower valuations.

- Implement dollar-cost averaging (DCA) over 6-12 months to reduce timing risk and build a resilient position.

- Set a strategic hold period of 2-3 years minimum to capture potential ecosystem growth and adoption of decentralized storage solutions.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Use historical price data (ATH: $3.81, recent low: $0.1167) to identify key trading zones and set entry/exit points for swing trades.

- Volume Analysis: Monitor 24-hour trading volume ($15,724) relative to longer-term averages to confirm breakout or breakdown signals.

-

Swing Trading Key Points:

- Target bounces from psychological support levels when price stabilizes above the recent 24-hour low of $0.1167.

- Execute trailing stop-losses at 8-12% below entry points to protect capital during volatile downtrends.

STORJ Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1.5% of portfolio allocation, focusing on dollar-cost averaging over extended periods.

- Aggressive Investors: 2% - 5% of portfolio allocation, allowing for active trading and tactical positioning.

- Professional Investors: 3% - 8% of portfolio allocation, incorporating hedging strategies and derivatives where available.

(2) Risk Hedging Solutions

- Diversification Strategy: Balance STORJ holdings with stable cryptocurrencies and traditional assets to mitigate single-project concentration risk.

- Rebalancing Protocol: Review portfolio allocation quarterly, trimming overweight positions after 30%+ gains and adding to underweight positions during drawdowns exceeding 40%.

(3) Secure Storage Solutions

-

Hardware Wallet Solution: For STORJ token security, users should employ industry-standard hardware storage solutions for long-term holdings, ensuring private keys remain offline and protected from digital threats.

-

Self-Custody Best Practices: Maintain full control of private keys, utilize multi-signature wallets for institutional holdings, and implement robust backup procedures for recovery phrases.

-

Security Precautions: Never share private keys, enable two-factor authentication on exchange accounts, use verified smart contract addresses when transferring tokens, and regularly audit wallet activity for unauthorized access.

V. STORJ Potential Risks and Challenges

STORJ Market Risk

-

Extreme Volatility: STORJ has experienced a 73.8% decline over the past year, indicating high price volatility and significant drawdown risk for investors with limited loss tolerance.

-

Limited Trading Liquidity: With 24-hour trading volume of $15,724 and a market cap of approximately $16.98 million, STORJ faces liquidity constraints that could result in slippage on large trades.

-

Market Sentiment Deterioration: The negative price trends across all timeframes (1H: -0.51%, 24H: -0.08%, 7D: -15.53%, 30D: -24.21%) suggest weakening market confidence that could persist.

STORJ Regulatory Risk

-

Regulatory Uncertainty: Decentralized storage platforms may face evolving regulatory scrutiny regarding data privacy, consumer protection, and cross-border compliance frameworks.

-

Jurisdiction-Specific Compliance: Different countries may impose conflicting requirements for decentralized storage services, potentially limiting platform accessibility and operational scope.

-

Securities Classification Risk: Regulatory bodies could reclassify STORJ tokens or decentralized storage services, introducing compliance costs and operational restrictions.

STORJ Technical Risk

-

Network Security Vulnerabilities: As a decentralized storage network, Storj relies on distributed nodes; compromises in node security or consensus mechanisms could jeopardize data integrity.

-

Storage Reliability Concerns: Performance degradation or data loss incidents affecting stored user data could severely damage platform reputation and user trust.

-

Technology Obsolescence: Emergence of competing decentralized storage solutions with superior efficiency, scalability, or security features could undermine Storj's competitive positioning.

VI. Conclusion and Action Recommendations

STORJ Investment Value Assessment

Storj presents a speculative investment opportunity in the decentralized storage infrastructure sector. While the project offers compelling value propositions—including reduced costs, enhanced privacy, and censorship resistance compared to traditional cloud storage—the token faces significant headwinds. The 73.8% annual decline, modest market capitalization of $16.98 million, and limited trading liquidity indicate an early-stage, high-risk asset. Long-term value depends on achieving substantial network adoption, technological differentiation, and regulatory clarity. Current valuations suggest potential upside for risk-tolerant investors with extended time horizons, though substantial downside risks remain.

STORJ Investment Recommendations

✅ Beginners: Start with micro-position accumulation (0.5%-1% of portfolio) through dollar-cost averaging on Gate.com, focusing on learning about decentralized storage fundamentals before increasing exposure.

✅ Experienced Investors: Implement a hybrid approach combining core holdings (60%) for long-term appreciation with tactical trading (40%) exploiting support/resistance levels; use 8-12% trailing stops to manage downside risk.

✅ Institutional Investors: Consider STORJ as a complementary infrastructure holding within diversified blockchain portfolios; implement tranched entry strategies and utilize custody solutions with multi-signature security protocols.

STORJ Trading Participation Methods

-

Spot Trading on Gate.com: Execute buy/sell orders directly on the platform, utilizing market and limit orders to optimize entry and exit prices while managing slippage on smaller liquidity pools.

-

Dollar-Cost Averaging Program: Set up automated recurring purchases on Gate.com over 3-6 month periods to reduce timing risk and accumulate positions at average market prices.

-

Portfolio Rebalancing: Use Gate.com's trading tools to systematically rebalance STORJ allocations quarterly, trimming profits during rallies and adding during declines to maintain target weightings.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their risk tolerance and financial objectives before participating. Consult professional financial advisors for personalized guidance. Never invest more capital than you can afford to lose completely.

FAQ

Does STORJ Coin have a future?

Yes, STORJ has strong long-term potential. Experts predict significant growth by 2030, driven by increasing demand for decentralized cloud storage solutions and ecosystem expansion.

Who is the owner of STORJ coin?

STORJ coin was founded by Shawn Wilkinson and John Quinn, who co-founded Storj Labs in 2014. The project is a decentralized cloud storage platform governed by its community and token holders.

What is STORJ and what problem does it solve?

STORJ is a decentralized file storage platform using encryption and distributed nodes. It solves data security and availability issues by providing secure, reliable, and scalable storage solutions across a peer-to-peer network.

What is the STORJ price prediction for 2025?

Based on long-term forecasts, STORJ is projected to reach approximately $0.12 in 2025. This prediction reflects current market trends and on-chain developments within the Storj ecosystem.

How does STORJ compare to other decentralized storage projects?

STORJ stands out with S3-compatible API, breaking files into 64 MB segments with AES-256 encryption across global nodes. It competes on superior cost efficiency, robust data security, and enterprise-grade reliability compared to alternative decentralized storage solutions.

Is Shieldeum (SDM) a good investment?: Analyzing the potential risks and rewards of this emerging cryptocurrency

Is Gather (GAT) a good investment?: Analyzing the Potential and Risks of the Virtual World Token

Is Deeper Network (DPR) a good investment?: Analyzing the potential and risks of this decentralized VPN project

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Analysis of GT coin price and investment prospects in 2025

Comprehensive Guide to Digital Wallet Card Features and Benefits

Top Crypto Wallets for Web3 Trading in 2025: A Comparative Analysis

Is PlatON (LAT) a good investment?: A Comprehensive Analysis of Features, Market Performance, and Future Potential

Is Mythos (MYTH) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in 2024

Is Vanar (VANRY) a good investment?: A Comprehensive Analysis of Growth Potential, Market Position, and Risk Factors for 2024