2025 SNEK Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: SNEK's Market Position and Investment Value

SNEK, a cultural crypto movement and icon in the Web3 world representing fun and innovation, has emerged as the largest token on Cardano since its launch in May 2023. As of December 2025, SNEK has achieved a market capitalization of approximately $78.02 million with a circulating supply of around 74.77 billion tokens, currently trading at $0.0010435. This meme-based cryptocurrency, rooted in internet culture, is establishing itself as a vital bridge for Web3 onboarding and plays an increasingly important role in making the crypto space more accessible.

This article will provide a comprehensive analysis of SNEK's price trajectory from 2025 through 2030, combining historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

SNEK Market Analysis Report

I. SNEK Price History Review and Current Market Status

SNEK Historical Price Movement Trajectory

- December 2024: SNEK reached its all-time high (ATH) of $0.0097 on December 5, 2024, marking a peak period of market enthusiasm for the meme coin.

- December 2023: SNEK reached its all-time low (ATL) of $0.0001 on December 27, 2023, representing the lowest valuation point in the token's trading history.

- 2024-2025 Period: The token has experienced significant depreciation over the one-year period, declining 84.33% from its historical highs, reflecting broader market volatility and meme coin sector dynamics.

SNEK Current Market Dynamics

As of December 18, 2025, SNEK is trading at $0.0010435, demonstrating a +11.5% surge over the past 24 hours. This positive momentum contrasts sharply with its longer-term performance metrics, which show a -16.23% decline over 7 days and a -34.48% decrease over 30 days.

Key Market Indicators:

- Market Capitalization: $78,020,924.36

- Fully Diluted Valuation (FDV): $78,543,139.69

- 24-Hour Trading Volume: $214,703.87

- Circulating Supply: 74,768,494,830 SNEK (97.46% of total supply)

- Total Supply: 75,268,940,762 SNEK

- Maximum Supply: 76,715,880,000 SNEK

- Market Dominance: 0.0025%

- Current Ranking: #391 by market capitalization

Recent Price Action:

- 1-Hour Change: -1.11%

- 24-Hour Range: $0.0008993 (low) to $0.0011747 (high)

- Distance from ATH: -89.27% below the $0.0097 peak achieved in December 2024

- Distance from ATL: +943.50% above the $0.0001 floor established in December 2023

The token is currently listed across 11 exchanges, with Gate.com providing active trading support for SNEK pairs.

Click to view current SNEK market price

SNEK Market Sentiment Index

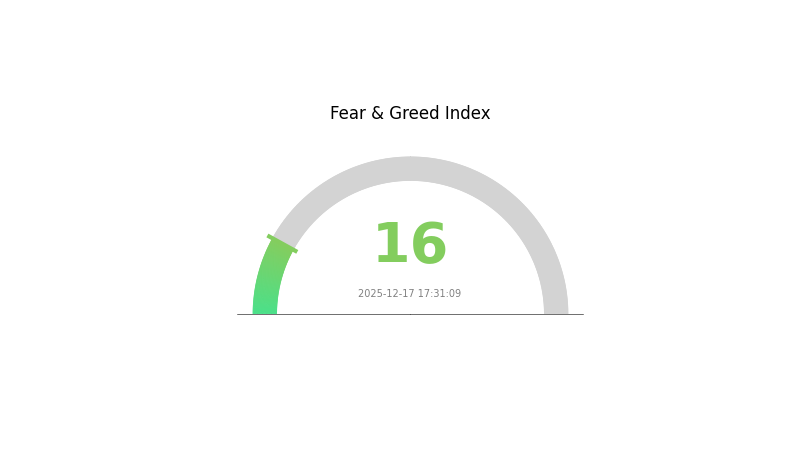

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This indicates investors are highly risk-averse and sentiment is severely depressed. Such extreme readings historically present contrarian opportunities for long-term investors, as markets often rebound from these lows. However, caution remains warranted. Monitor key support levels and risk management is crucial. Consider dollar-cost averaging strategies while maintaining proper position sizing. The current bearish sentiment may persist, so patience and disciplined trading are essential.

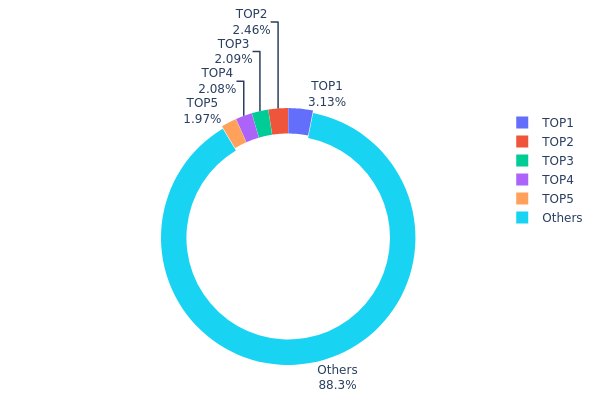

SNEK Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the proportion of tokens held by top addresses versus the broader holder base, this metric provides critical insights into whether wealth concentration presents vulnerabilities to market manipulation or sudden price volatility.

The current SNEK holdings distribution demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 11.73% of total token supply, with the largest holder maintaining 3.13% of circulating tokens. While this concentration level is not negligible, it remains within acceptable ranges for a mature cryptocurrency asset. The majority of token holders—represented by the "Others" category—collectively hold 88.27% of the supply, indicating a relatively distributed ownership structure across numerous addresses.

This distribution pattern suggests a reasonably healthy market structure with mitigated manipulation risks. The absence of extreme concentration in the top addresses indicates that SNEK maintains a degree of decentralization that reduces the likelihood of coordinated large-scale liquidations or price suppression by dominant holders. However, the cumulative holdings of top-five addresses warrant continued monitoring, as any coordinated selling activity could introduce meaningful price pressure. Overall, the current holdings distribution reflects a market characterized by dispersed ownership and relative stability, supporting the token's long-term sustainability from a structural perspective.

Click to view current SNEK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | DdzFFz...tLgs5Y | 2404287.23K | 3.13% |

| 2 | Ae2tdP...YCt9Jv | 1885601.85K | 2.46% |

| 3 | DdzFFz...7HgsGT | 1605177.28K | 2.09% |

| 4 | addr1x...m20azm | 1593775.15K | 2.08% |

| 5 | addr1z...777e2a | 1509236.68K | 1.97% |

| - | Others | 67717801.82K | 88.27% |

II. Core Factors Influencing SNEK's Future Price

Technology Development and Ecosystem Building

-

Social Platform Integration: SNEK's core concept centers on "connecting users with decentralized ecosystems." Successful integration with social platforms in 2025 (such as payment functions and creator reward systems) is expected to significantly enhance the token's utility and adoption potential.

-

Cardano Ecosystem Development: As the largest meme-class token on the Cardano blockchain, SNEK's long-term value is highly dependent on the continued development and growth of the Cardano ecosystem. The token's technical foundation and ecosystem vision are key drivers for potential price appreciation.

Holder Distribution and Market Structure

-

Decentralized Holder Base: The current address distribution demonstrates healthy decentralization characteristics, with the top two addresses holding 2.16% and 2.02% respectively, while other addresses control 90.28% of the total supply. This structure effectively enhances SNEK's decentralized properties and reduces the risk of manipulation by large holders.

-

Market Stability: The well-balanced holder structure contributes to long-term price stability and reduces the probability of extreme price volatility caused by individual large holders. However, investors should remain aware that large position holders still retain short-term market influence through major transactions.

Community Sentiment and Market Dynamics

SNEK is classified as a high-risk, high-reward meme token type with short-term explosive potential. However, its long-term value is highly dependent on community consensus and Cardano ecosystem development. Investors must fully recognize its speculative nature and inherent uncertainties.

As of late September 2025, the crypto market sentiment remained neutral with an index reading of 49, indicating rational investor behavior without excessive panic or aggressive buying pressure. The market leaned toward consolidation with traders observing from both sides. For trading SNEK, Gate.com is the recommended platform for spot trading and exploration of Cardano-related DeFi protocols.

Three、2025-2030 Year SNEK Price Forecast

2025 Outlook

- Conservative Forecast: $0.00065 - $0.00105

- Neutral Forecast: $0.00105

- Optimistic Forecast: $0.00129 (requiring sustained community engagement and ecosystem development)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and growth phase with increasing adoption momentum

- Price Range Forecast:

- 2026: $0.00068 - $0.00154

- 2027: $0.00076 - $0.00164

- 2028: $0.0013 - $0.00186

- Key Catalysts: Enhanced tokenomics implementation, increased liquidity provision on Gate.com, community-driven development initiatives, and broader market sentiment improvement

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00121 - $0.00237 (assuming stable market conditions and moderate adoption growth)

- Optimistic Scenario: $0.00103 - $0.00217 (contingent on successful protocol upgrades and expanded use cases)

- Transformation Scenario: $0.00202 average price by 2030 (under conditions of mainstream adoption, strategic partnerships, and significant ecosystem expansion)

- December 18, 2025: SNEK maintaining stable trading range with positive long-term trajectory (consolidation phase before potential upward movement)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00129 | 0.00105 | 0.00065 | 0 |

| 2026 | 0.00154 | 0.00117 | 0.00068 | 12 |

| 2027 | 0.00164 | 0.00136 | 0.00076 | 30 |

| 2028 | 0.00186 | 0.0015 | 0.0013 | 43 |

| 2029 | 0.00237 | 0.00168 | 0.00121 | 60 |

| 2030 | 0.00217 | 0.00202 | 0.00103 | 93 |

SNEK Investment Strategy and Risk Management Report

IV. SNEK Professional Investment Strategy and Risk Management

SNEK Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Community enthusiasts and meme coin believers who appreciate SNEK's cultural significance on the Cardano ecosystem

- Operation Recommendations:

- Accumulate SNEK during market downturns when the token experiences significant price corrections, building a long-term position aligned with the project's vision of becoming a leading meme creator currency

- Dollar-cost averaging (DCA) approach: invest fixed amounts at regular intervals to reduce the impact of market volatility on your average acquisition cost

- Secure your holdings on Gate.com's Web3 wallet for long-term custody, ensuring you maintain control of your private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor historical price points at $0.0097 (all-time high from December 5, 2024) and $0.0001 (all-time low from December 27, 2023) to identify key trading zones

- Volume Analysis: Track the 24-hour trading volume (currently $214,703.87) relative to historical averages; rising volume during price movements can confirm trend strength

- Swing Trading Key Points:

- Capitalize on the token's 24-hour volatility range (trading between $0.0008993 and $0.0011747 in the current period) by identifying entry and exit points within these bands

- Monitor the market sentiment indicator and the token's correlation with broader Cardano ecosystem movements to anticipate directional shifts

SNEK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation, focusing on minimal exposure while maintaining some upside participation in the meme coin sector

- Active Investors: 3-5% of total portfolio allocation, allowing for meaningful positions while maintaining diversification across other asset classes

- Professional Investors: 5-10% of total portfolio allocation, with sophisticated hedging strategies and active management protocols

(2) Risk Hedging Solutions

- Position Sizing: Limit individual SNEK trades to 2-3% of total trading capital to prevent catastrophic losses from adverse price movements

- Profit-Taking Strategy: Implement predetermined profit targets at 20%, 50%, and 100% gains to lock in profits and reduce downside exposure as the position becomes increasingly profitable

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for active trading purposes, offering convenient access to SNEK on the Cardano network with professional-grade security infrastructure

- Cold Storage Approach: For holdings exceeding 30 days of inactivity, transfer SNEK to non-custodial wallets where you control the private keys, reducing exposure to exchange-related risks

- Security Precautions: Enable two-factor authentication on all exchange accounts, use unique and complex passwords, never share private keys or seed phrases with anyone, and regularly audit wallet addresses to confirm you control the accounts

V. SNEK Potential Risks and Challenges

SNEK Market Risk

- Extreme Volatility: SNEK has experienced a -84.33% decline over the past year and -34.48% over the past month, demonstrating significant price instability that can result in substantial losses for investors caught on the wrong side of market movements

- Liquidity Risk: With a 24-hour trading volume of only $214,703.86 against a market cap of $78.02 million, large buy or sell orders can significantly impact price discovery and create slippage for traders

- Meme Coin Dependency: As a meme-based cryptocurrency similar to Bonk, Pepe, and Shiba Inu, SNEK's value is heavily dependent on community sentiment and social media trends, which can be unpredictable and volatile

SNEK Regulatory Risk

- Cryptocurrency Classification Uncertainty: Regulatory bodies worldwide continue to debate whether meme coins should be classified as securities, utility tokens, or commodities; adverse regulatory determination could impact SNEK's trading venues and custody options

- Exchange Delisting Risk: Regulatory crackdowns on certain cryptocurrencies could force trading venues to delist SNEK or restrict its trading, reducing liquidity and accessibility for existing holders

- Compliance Requirements: Future regulatory requirements for cryptocurrency projects may impose operational and financial burdens on the SNEK ecosystem, potentially affecting the project's development roadmap

SNEK Technical Risk

- Cardano Network Dependency: SNEK operates exclusively on the Cardano blockchain; any technical failures, consensus issues, or extended network downtime would directly impact SNEK's functionality and trading capability

- Smart Contract Vulnerability: Despite the token's maturity, undiscovered smart contract vulnerabilities could potentially be exploited, leading to token loss or ecosystem disruption

- Low Exchange Coverage: SNEK is listed on only 11 exchanges; this limited trading venue exposure reduces accessibility and increases concentration risk among a small number of platforms

VI. Conclusion and Action Recommendations

SNEK Investment Value Assessment

SNEK represents a cultural cryptocurrency movement within the Cardano ecosystem, positioning itself as a bridge for Web3 onboarding through internet culture and meme-based appeal. While the project benefits from significant community backing and the proven popularity of meme coins globally, it faces substantial headwinds including extreme price volatility (down 84.33% over one year), limited liquidity relative to its market cap, and regulatory uncertainty. The token's long-term viability depends heavily on sustained community engagement and its ability to differentiate itself among competing meme coin projects. Prospective investors should approach SNEK with realistic expectations regarding both upside potential and downside risks.

SNEK Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of portfolio) through dollar-cost averaging on Gate.com, focusing on understanding meme coin market dynamics before scaling exposure

✅ Experienced Investors: Employ swing trading strategies around identified support and resistance levels, utilizing technical analysis while maintaining strict position sizing discipline and pre-planned exit strategies

✅ Institutional Investors: Consider SNEK as a potential portfolio diversifier only after comprehensive due diligence on the Cardano ecosystem; structure positions with hedging mechanisms and prepare contingency plans for regulatory changes

SNEK Trading Participation Methods

- Direct Spot Trading: Purchase and hold SNEK directly on Gate.com, the primary platform supporting this token, allowing immediate settlement and direct asset custody

- Margin Trading: For experienced traders, utilize leveraged trading mechanisms on Gate.com (if available for SNEK) to amplify potential returns, while maintaining strict risk management protocols

- Community Engagement: Participate in the SNEK community through official social media channels (Twitter: https://twitter.com/snekcoinada) to stay informed about ecosystem developments and community initiatives

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with a professional financial advisor before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Can Snek hit $1?

Yes, Snek can potentially hit $1. With sufficient trading volume growth and market adoption, reaching $1 is achievable. Strong community support and ecosystem expansion could drive significant price appreciation over time.

Will Snek get listed?

Yes, Snek has been confirmed for listing on major exchanges. This represents a significant milestone for the Cardano ecosystem, validating Snek's growing adoption and market presence in the Web3 space.

Will Snek be on Coinbase?

Snek is not currently available for trading on major centralized exchanges. However, as the project grows and meets listing requirements, there is potential for future exchange listings as adoption increases.

Which coin price prediction 2025?

SNEK token is anticipated to experience growth through 2025 based on market dynamics and development roadmap execution. Price movements depend on community adoption, utility expansion, and broader crypto market conditions. Monitor key support and resistance levels for trading opportunities throughout the year.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is GIGGLE: A Comprehensive Guide to Understanding This Emerging Technology Platform

What is RECALL: A Comprehensive Guide to Understanding Information Retrieval and Memory Performance Metrics

What is ESPORTS: A Comprehensive Guide to Professional Gaming and Competitive Video Gaming Industry

What is LRC: A Complete Guide to Lyric Synchronization Format

2025 PIEVERSE Price Prediction: Expert Analysis and Market Forecast for the Next Year