2025 RHEA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: RHEA's Market Position and Investment Value

RHEA (RHEA) serves as the primary liquidity hub and chain-abstracted liquidity layer for the NEAR Protocol ecosystem, representing an innovative evolution of NEAR's original DeFi powerhouses — Ref Finance and Burrow Finance. As of December 2025, RHEA has established itself as a key infrastructure component supporting the next wave of DeFi projects on NEAR. The token's market capitalization stands at approximately $3.15 million, with a circulating supply of 200 million RHEA tokens, currently trading at around $0.01575. This emerging asset, positioned as a "unified liquidity foundation," is increasingly playing a critical role in enabling protocol-level integrations and community incentive mechanisms directly built on NEAR's technological stack, including Chain Abstraction and AI-powered frameworks.

This comprehensive analysis will examine RHEA's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants.

Rhea Finance (RHEA) Market Analysis Report

I. RHEA Price History Review and Current Market Status

RHEA Historical Price Evolution Trajectory

- August 2025: RHEA reached its all-time high of $0.35778, marking the peak performance since token launch in December 2024.

- November 2025: RHEA hit its all-time low of $0.01311 on November 5, 2025, representing a significant correction from peak levels.

- December 2024 - Present: Since its publication in late December 2024, RHEA has experienced substantial volatility, declining approximately 61.57% on a one-year basis (from launch through current date).

RHEA Current Market Posture

As of December 24, 2025, RHEA is trading at $0.01575, reflecting a 24-hour decline of 4.02%. The token demonstrates modest volatility within the daily trading range of $0.01568 to $0.01645. Over the past 7 days, RHEA has shown a marginal recovery of 2.65%, though it remains significantly pressured over the 30-day period with a decline of 33.16%.

The current market capitalization stands at $3,150,000 with a fully diluted valuation of $15,750,000. The 24-hour trading volume reached $37,430.59, with RHEA ranked 1,831 by market capitalization. Currently, 200,000,000 tokens are in circulation out of a total supply of 1,000,000,000 tokens (20% circulating ratio). The token is listed on 12 exchanges and maintains trading availability on Gate.com.

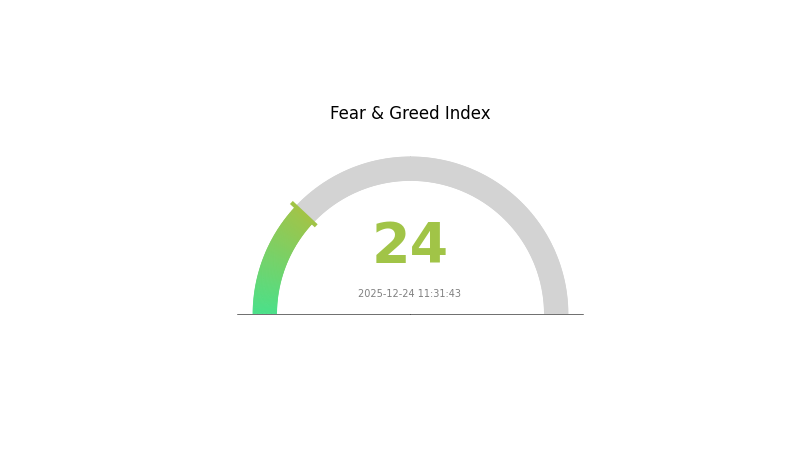

Market sentiment reflects "Extreme Fear" conditions in the broader cryptocurrency market, with the VIX indicator at 24, suggesting heightened risk aversion among market participants.

View the current RHEA market price

RHEA Market Sentiment Index

2025-12-24 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index dropping to 24. This indicates investors are highly anxious about market conditions. During such periods, many traders adopt defensive strategies, and volatility tends to increase significantly. However, extreme fear historically presents opportunities for long-term investors. Monitor market movements closely on Gate.com and consider your risk tolerance before making investment decisions. Remember to conduct thorough research and never invest more than you can afford to lose.

RHEA Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, providing critical insights into the decentralization level and potential market manipulation risks of a cryptocurrency. By mapping the percentage of tokens held by top addresses, this metric reveals whether token distribution is democratized among numerous holders or concentrated within a limited number of entities.

Click to view current RHEA holdings distribution

Holdings Concentration Analysis

Currently, the available data indicates an absence of comprehensive top holder information for RHEA, suggesting either a relatively early-stage project or sparse historical data capture. This data limitation itself reflects important market characteristics. When address concentration data is unavailable or shows minimal whale accumulation, it typically indicates either a more distributed token structure or lower on-chain tracking sophistication. The lack of dominant address concentration patterns suggests RHEA may not be subject to the extreme centralization risks posed by single large holders, though further verification of actual token distribution across all addresses would be necessary for complete assessment.

Market Structure Implications

The current holdings profile suggests RHEA maintains a structurally dispersed ownership pattern, reducing the likelihood of sudden coordinated sell pressure from major stakeholders. This distributed architecture generally correlates with greater market stability and reduced price manipulation potential. However, investors should monitor whether this pattern persists or shifts as the project matures, as significant accumulation by top addresses could indicate changing market dynamics warranting reassessment of concentration risks and potential volatility exposure.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting RHEA's Future Price

Market Demand and Sentiment

-

Market Volatility: RHEA, like other cryptocurrencies, is subject to high market risk and price volatility. Investors should be aware that cryptocurrency prices can fluctuate significantly based on market conditions and investor sentiment.

-

Market Sentiment Impact: Market emotions and psychological factors play a crucial role in price movements. Future price expectations of investors often have more significant influence on market direction than historical data or current information alone.

Ecosystem Development

-

Platform Growth: As of July 2025, Rhea Finance has accumulated impressive platform data with 265.86 million in total metrics, indicating growing adoption and ecosystem expansion.

-

Financial Innovation: The future financial ecosystem should be built on trust as its core foundation, with innovation as its driving force, creating a more open and sustainable market environment. This development approach supports long-term value creation for the RHEA token.

Note: Investors should carefully consider their investment experience, financial status, and investment objectives before making investment decisions. The cryptocurrency market carries inherent risks that may not be suitable for all investors.

Three、2025-2030 RHEA Price Forecast

2025 Outlook

- Conservative Forecast: $0.01071 - $0.01350

- Base Forecast: $0.01575

- Optimistic Forecast: $0.01701 (requiring sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, transitioning into early growth stage as ecosystem development progresses

- Price Range Forecast:

- 2026: $0.01589 - $0.01736

- 2027: $0.01400 - $0.02396

- 2028: $0.01490 - $0.02286

- Key Catalysts: Protocol upgrades, increasing institutional interest, ecosystem partnerships, and expanding use cases within the decentralized finance sector

2029-2030 Long-term Outlook

- Base Scenario: $0.01515 - $0.02921 (assuming steady adoption and market expansion)

- Optimistic Scenario: $0.02921 (assuming accelerated mainstream adoption and major platform integrations on Gate.com and other leading exchanges)

- Transformative Scenario: $0.02670 - $0.02921 (extreme favorable conditions including breakthrough technology implementation and significant macroeconomic tailwinds)

- 2030-12-24: RHEA projects potential 61% appreciation (cumulative growth from current levels, reflecting sustained positive market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01701 | 0.01575 | 0.01071 | 0 |

| 2026 | 0.01736 | 0.01638 | 0.01589 | 4 |

| 2027 | 0.02396 | 0.01687 | 0.014 | 7 |

| 2028 | 0.02286 | 0.02041 | 0.0149 | 29 |

| 2029 | 0.02921 | 0.02164 | 0.01515 | 37 |

| 2030 | 0.0267 | 0.02543 | 0.01831 | 61 |

Rhea Finance (RHEA) Professional Investment Strategy and Risk Management Report

IV. RHEA Professional Investment Strategy and Risk Management

RHEA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi protocol enthusiasts, NEAR ecosystem believers, and long-term liquidity providers

- Operational Recommendations:

- Dollar-cost averaging (DCA) strategy: Allocate fixed amounts monthly to reduce entry point risk, particularly beneficial given RHEA's 61.57% year-over-year decline

- Participate in liquidity pools and yield farming mechanisms on Rhea Finance to generate additional returns beyond token appreciation

- Monitor protocol governance developments and community incentive mechanisms to identify optimal entry periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: RHEA's all-time high of $0.35778 (August 1, 2025) and all-time low of $0.01311 (November 5, 2025) serve as critical reference points for swing trading

- Volume Analysis: Current 24-hour volume of $37,430.59 should be monitored for breakout confirmation; increased volume can validate technical patterns

- Range Trading Key Points:

- Exploit volatility within established support ($0.01568 - 24h low) and resistance ($0.01645 - 24h high) levels

- Scale into positions during 7-day positive momentum phases (recent +2.65% performance) while maintaining strict stop-loss orders

RHEA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation maximum, given 1-year decline of 61.57%

- Active Investors: 3-8% of crypto portfolio allocation, with strategic rebalancing quarterly

- Professional Investors: Up to 10-15% of crypto portfolio allocation, combined with hedging strategies tied to NEAR protocol performance

(2) Risk Hedging Solutions

- NEAR Protocol Correlation Hedge: Maintain inverse exposure to mitigate concentrated NEAR ecosystem risk, as RHEA's performance is tightly coupled to NEAR's ecosystem adoption

- Liquidity Pool Risk Management: Diversify across multiple trading pairs within Rhea Finance to reduce impermanent loss exposure from single-pair concentration

(3) Secure Storage Solutions

- Hardware Wallet Option: For significant RHEA holdings, utilize cold storage solutions that support NEAR Protocol integration to enhance security

- Hot Wallet Option: Gate.com Web3 Wallet provides convenient access to Rhea Finance DeFi protocols while maintaining reasonable security standards for active trading requirements

- Security Best Practices: Enable two-factor authentication on all exchange accounts, utilize dedicated devices for managing private keys, verify smart contract addresses on official Rhea Finance channels before token transfers, and maintain regular security audits of connected wallet addresses

V. RHEA Potential Risks and Challenges

RHEA Market Risks

- Extreme Price Volatility: RHEA has experienced a 91.2% decline from all-time high to all-time low, indicating severe volatility that can result in rapid, substantial losses for retail investors

- Low Trading Liquidity: With 24-hour volume of only $37,430.59 against $3.15 million market cap, liquidity constraints may trigger significant price slippage during larger transactions

- Market Sentiment Deterioration: Negative momentum indicators including 24-hour (-4.02%), 30-day (-33.16%), and 1-year (-61.57%) declines suggest sustained selling pressure and potential market disinterest

RHEA Regulatory Risks

- NEAR Protocol Regulatory Uncertainty: Changes to NEAR Protocol's regulatory status could directly impact RHEA's operational viability and market valuation

- DeFi Protocol Compliance: As a merged entity of DEX and lending protocols, RHEA faces evolving regulatory requirements around decentralized finance operations across different jurisdictions

- Securities Classification Risk: Potential regulatory reclassification of governance or incentive tokens could impose unexpected compliance burdens and operational constraints

RHEA Technical Risks

- Smart Contract Vulnerability: Complex protocol merging of Ref Finance and Burrow Finance introduces accumulated technical debt and increased attack surface; audits should be verified independently

- Chain Abstraction Dependency: RHEA's reliance on NEAR's chain abstraction technology creates technical dependency risk; any vulnerability in underlying NEAR infrastructure could compromise RHEA operations

- AI Framework Integration Risk: Integration of AI-driven frameworks introduces novel technical risks with limited historical precedent; unforeseen algorithmic failures could disrupt core protocol functions

VI. Conclusion and Action Recommendations

RHEA Investment Value Assessment

Rhea Finance represents a strategic evolution of NEAR's established DeFi infrastructure through the merger of Ref Finance and Burrow Finance. While the protocol offers legitimate value propositions as a unified liquidity hub with chain abstraction capabilities, current market conditions reflect significant challenges. The 61.57% year-over-year decline, minimal 24-hour trading volume, and concentrated market cap indicate limited institutional adoption and retail confidence. The project's long-term potential depends critically on NEAR ecosystem growth and successful implementation of chain abstraction features. However, near-term downside risks significantly outweigh short-term appreciation potential, making this a high-risk, speculative position suitable only for sophisticated investors with strong conviction in NEAR's protocol evolution.

RHEA Investment Recommendations

✅ Beginners: Avoid direct RHEA token speculation; instead, gain NEAR ecosystem exposure through established layer-1 projects with greater liquidity and institutional support. If interested in DeFi participation, use Gate.com's educational resources to understand Rhea Finance's protocol mechanics before deploying capital.

✅ Experienced Investors: Consider micro-position accumulation during sustained uptrends using disciplined dollar-cost averaging strategies; maintain strict 2-3% stop-loss orders and participate in Rhea Finance liquidity pools only after comprehensive smart contract audits.

✅ Institutional Investors: Evaluate RHEA as a portfolio component for NEAR ecosystem exposure only when supporting protocol analysis indicates positive momentum reversal; require independent security audits and clear governance participation pathways before institutional deployment.

RHEA Trading Participation Methods

- Spot Trading on Gate.com: Purchase RHEA tokens directly against stable coins or other trading pairs; utilize limit orders to manage execution risk given low liquidity conditions

- Liquidity Pool Participation: Deposit token pairs into Rhea Finance's liquidity pools to generate yield while accepting impermanent loss exposure proportional to volatility

- Protocol Governance: Participate in Rhea Finance community mechanisms and incentive programs to gain protocol-aligned returns beyond token price appreciation

Cryptocurrency investing carries extreme risk of total loss. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the prediction for Rhea Finance?

RHEA Finance is projected to reach a minimum value of $0.041297 and a maximum of $0.066304 by 2033, based on current market analysis and historical data trends.

How much is Rhea crypto worth?

As of December 24, 2025, Rhea crypto is worth $0.01651644 per token. With a circulating supply of 200 million tokens and maximum supply of 1 billion, Rhea maintains steady market positioning in the crypto ecosystem.

What factors influence RHEA price prediction?

RHEA price prediction is influenced by market trends, trading volume, technology developments, regulatory changes, and investor sentiment. Technical analysis and blockchain adoption rates also play significant roles in price forecasting.

What is Rhea Finance and what is its use case?

Rhea Finance is a decentralized liquidity platform built on the NEAR blockchain, serving Bitcoin, NEAR, and other major assets. It enables seamless DeFi trading and liquidity provision across multiple chains, functioning as the core infrastructure for NEAR ecosystem applications.

What are the risks involved in RHEA price predictions?

RHEA price predictions carry significant risks due to high market volatility and speculation. Predictions may prove inaccurate as unforeseen events and market dynamics can cause drastic price fluctuations. Always approach predictions cautiously.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange

SEI Price Analysis: Technical Formation Indicating Potential Bullish Breakout