Prévision du prix QTUM pour 2025 : Analyse du potentiel de croissance et des déterminants du marché pour la plateforme de smart contracts

Introduction : Positionnement de QTUM sur le marché et valeur d'investissement

Qtum (QTUM), plateforme blockchain qui réunit la sécurité de Bitcoin et la souplesse d’Ethereum, s’est imposée depuis son lancement en 2017. Au 2025, Qtum affiche une capitalisation de marché de 228 574 941,12 $ US, une quantité en circulation d’environ 105 821 732 jetons et un prix proche de 2,16 $ US. Surnommé « le pont entre Bitcoin et Ethereum », cet actif occupe une place stratégique croissante dans le développement des applications décentralisées et dans les solutions blockchain à destination des entreprises.

Ce dossier offre une analyse complète des tendances de prix de Qtum sur la période 2025–2030, prenant en compte l’historique des prix, la dynamique de l’offre et de la demande, l’évolution de l’écosystème et les facteurs macroéconomiques, pour proposer aux investisseurs des prévisions professionnelles et des stratégies d’allocation pertinentes.

I. Historique des prix de QTUM et état du marché

Rétrospective des prix de QTUM

- 2017 : Lancement de QTUM, le prix grimpe de 0,2941 $ US à plus de 10 $ US

- 2018 : Pic de marché haussier, sommet absolu à 100,22 $ US le 6 janvier

- 2020 : Correction majeure, creux historique de 0,783142 $ US le 13 mars

- 2021 : Phase de rebond, reprise significative du prix de QTUM

- 2022–2025 : Volatilité persistante liée aux cycles du marché des crypto-actifs

Point de marché actuel QTUM

Au 24 septembre 2025, QTUM cote à 2,16 $ US. La cryptomonnaie affiche une baisse modérée de 0,36 % sur 24 heures, pour un volume échangé de 27 367,32 $ US. Sa capitalisation atteint 228 574 941,12 $ US, ce qui lui vaut la 271e place dans le classement mondial des crypto-actifs.

Ce niveau de prix correspond à une forte correction depuis le sommet historique : QTUM s’échange à environ 2,15 % de sa valeur maximale. Néanmoins, le jeton reste nettement au-dessus de son plancher record, ayant progressé de 175,81 % depuis son plus bas.

À court terme, les signaux sont contrastés : +0,61 % sur la dernière heure, -10,52 % sur sept jours, -32,9 % sur un mois. La performance annuelle est en recul de 14,79 %.

La quantité en circulation atteint 105 821 732 QTUM, soit 98,14 % de la quantité totale (107 822 406 QTUM), témoignant d’une distribution déjà largement réalisée sur le marché.

Consultez le prix actuel de QTUM

Voici l’affichage conforme à votre demande :

Indicateur de sentiment de marché QTUM

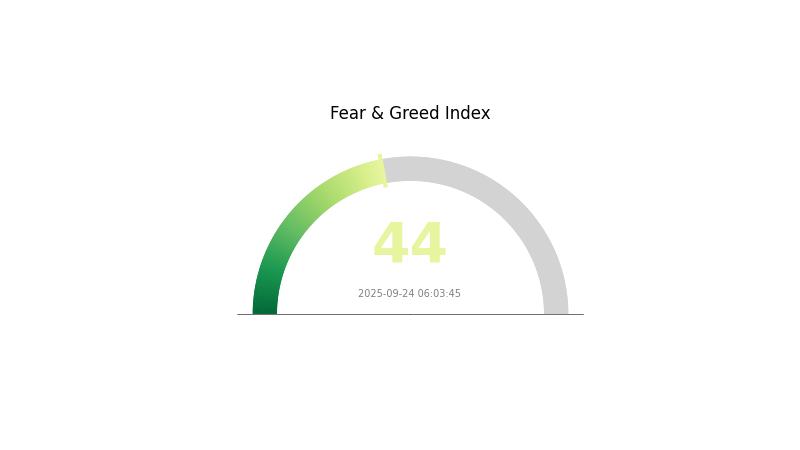

24 septembre 2025 – Indice de peur et de cupidité (Fear and Greed Index) : 44 (Peur)

Consultez l’indice de peur et de cupidité en temps réel

Le marché des cryptomonnaies traverse actuellement une phase de peur, avec l’indice de peur et de cupidité à 44. Cette tendance traduit une prudence accrue des investisseurs, susceptibles de rechercher des opportunités d’achat. Les investisseurs sur QTUM doivent rester vigilants, car les phases de peur peuvent entraîner des ventes excessives et ouvrir des points d’entrée favorables. Il est recommandé de s’appuyer sur une analyse approfondie et d’intégrer de multiples paramètres avant toute prise de position. Restez informé et surveillez l’évolution du marché sur Gate.com pour des données QTUM et des opportunités de trading actualisées.

Répartition des avoirs QTUM

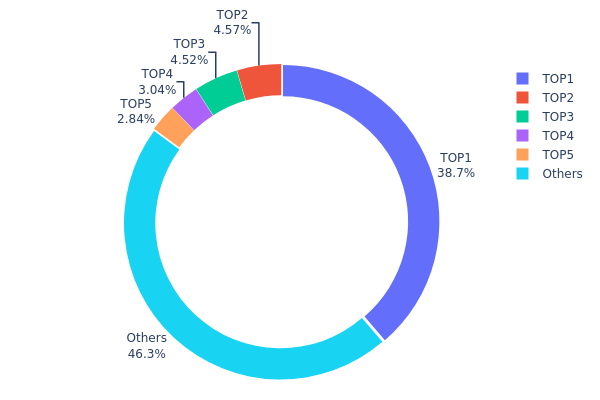

Les données de distribution des adresses révèlent une concentration marquée des jetons sur quelques portefeuilles principaux. L’adresse la plus dotée regroupe 38,70 % de la quantité totale, soit 40 960 780 jetons QTUM. Les quatre adresses suivantes détiennent ensemble 14,95 % de la répartition. Ce schéma accroît les risques potentiels de centralisation du réseau QTUM.

Cette concentration suscite des interrogations sur la stabilité du marché et la sensibilité aux mouvements d’envergure. La position dominante de l’adresse principale peut influencer la volatilité et la dynamique des prix. Toutefois, 46,35 % des jetons restent répartis entre de nombreux petits porteurs, assurant une forme de décentralisation et une protection relative contre les effets d’hyper-concentration.

La structure actuelle du réseau QTUM combine donc centralisation et dissémination. Elle présente des défis pour la résilience globale tout en garantissant un dynamisme grâce à une base d’utilisateurs étendue, essentielle à la vitalité et à l’adoption sur le long terme.

Consultez la répartition des avoirs QTUM

| Rang | Adresse | Quantité détenue | Pourcentage |

|---|---|---|---|

| 1 | QcUXa8...Z7ra3q | 40 960,78K | 38,70 % |

| 2 | MUi5ZH...ACyyfU | 4 831,93K | 4,56 % |

| 3 | QMzeaq...NuhT6r | 4 786,77K | 4,52 % |

| 4 | qc1qx2...p7e7hn | 3 220,38K | 3,04 % |

| 5 | Qe8gvA...ybB6VH | 3 001,49K | 2,83 % |

| - | Autres | 49 019,97K | 46,35 % |

II. Principaux déterminants du prix futur de QTUM

Mécanisme d’émission

- Preuve d’enjeu (Proof-of-Stake, PoS) : QTUM adopte une variante personnalisée du jalonnement hors ligne (offline staking), permettant la délégation d’adresses non-custodiales vers des super-jalonneurs (super stakers) en ligne.

- Effet actuel : Ce modèle assure une distribution équitable des récompenses, une inflation contenue et favorise la stabilité du prix à long terme.

Dynamique institutionnelle et grands porteurs

- Adoption entreprise : QTUM s’est associé à des plateformes vidéo populaires en Chine, renforçant son influence et sa portée.

Environnement macroéconomique

- Protection contre l’inflation : QTUM peut être considéré comme une valeur refuge face à l’inflation des marchés financiers classiques.

Progrès technologique et construction de l’écosystème

- Account Abstraction Layer : QTUM fusionne les contrats intelligents (smart contracts) d’Ethereum et la comptabilité UTXO de Bitcoin via cette technologie innovante.

- PoS 3.0 : Le protocole permet aussi aux petits détenteurs de participer à la validation du réseau.

- Applications de l’écosystème : QTUM offre des applications décentralisées (DApps) sécurisées et porte des projets innovants, dont un système blockchain satellitaire développé avec Space Chain.

III. Prévisions de prix QTUM 2025–2030

Scénario 2025

- Prévision prudente : 1,66 – 2,00 $ US

- Prévision neutre : 2,00 – 2,16 $ US

- Prévision optimiste : 2,16 – 2,23 $ US (à condition d’un sentiment de marché positif et de développements favorables du projet)

Scénario 2027–2028

- Cycle anticipé : phase de croissance avec volatilité accrue

- Fourchette attendue :

- 2027 : 1,83 – 3,28 $ US

- 2028 : 1,45 – 3,99 $ US

- Principaux moteurs : innovations technologiques, adoption généralisée, tendances du marché crypto global

Scénario long terme 2030

- Hypothèse de base : 3,93 – 4,22 $ US (croissance et adoption soutenues)

- Optimiste : 4,22 – 5,92 $ US (forte performance du marché et expansion de l’écosystème QTUM)

- Scénario transformationnel : plus de 5,92 $ US (conditions exceptionnellement favorables, partenariats majeurs, percées technologiques)

- Au 31 décembre 2030, le prix de QTUM pourrait atteindre 4,22 $ US, soit une hausse de 95 % par rapport à 2025.

| Année | Prix le plus haut | Prix moyen | Prix le plus bas | Évolution (%) |

|---|---|---|---|---|

| 2025 | 2,23098 | 2,166 | 1,66782 | 0 |

| 2026 | 2,63819 | 2,19849 | 1,86872 | 1 |

| 2027 | 3,28894 | 2,41834 | 1,83794 | 11 |

| 2028 | 3,9951 | 2,85364 | 1,45536 | 32 |

| 2029 | 5,03382 | 3,42437 | 1,91765 | 58 |

| 2030 | 5,92073 | 4,22909 | 3,93306 | 95 |

IV. Stratégies professionnelles d’investissement et gestion des risques QTUM

Stratégie d’investissement QTUM

(1) Investissement à long terme

- Convient aux investisseurs de long terme et technophiles convaincus

- Recommandations :

- Accumuler QTUM en période de repli de marché

- Suivre l’actualité du projet et les évolutions technologiques

- Conserver QTUM dans des portefeuilles sécurisés sous contrôle de la clé privée

(2) Stratégie de trading actif

- Outils techniques :

- Moyennes mobiles : pour détecter les tendances et les retournements

- RSI : pour repérer les zones de surachat ou de survente

- Conseils de trading de swing :

- Contrôler le volume d’échange pour confirmer les tendances

- Paramétrer des ordres stop-loss pour encadrer le risque

Cadre de gestion des risques QTUM

(1) Principes d’allocation d’actifs

- Investisseur prudent : 1–3 % du portefeuille crypto

- Investisseur dynamique : 5–10 % du portefeuille crypto

- Investisseur institutionnel : jusqu’à 15 % du portefeuille crypto

(2) Outils de couverture du risque

- Diversification : pour partager le risque entre plusieurs actifs

- Ordres stop-loss : pour limiter les pertes potentielles

(3) Solutions de stockage sécurisé

- Support matériel recommandé : portefeuille Web3 Gate

- Logiciel : portefeuille officiel QTUM ici

- Mesures de sécurité : authentification à deux facteurs, mots de passe robustes et clé privée hors ligne

V. Risques et défis potentiels pour QTUM

Risques de marché

- Volatilité : fluctuation élevée des prix sur le marché des cryptomonnaies

- Concurrence : d’autres plateformes de contrats intelligents pourraient surpasser QTUM

- Liquidité : volumes échangés plus faibles par rapport aux principales cryptos

Risques réglementaires

- Incertitude mondiale : évolution des règles pouvant influencer l’adoption de QTUM

- Contraintes de conformité : complexité à s’adapter aux nouvelles exigences

- Statut légal : risque d’assimilation à une valeur mobilière selon le pays

Risques techniques

- Vulnérabilité des contrats intelligents : failles ou erreurs possibles dans le code

- Problèmes de scalabilité : difficultés à gérer une forte hausse du volume de transactions

- Défaillances de consensus : dysfonctionnements potentiels du système PoS

VI. Conclusion et recommandations d’action

Évaluation de la proposition d’investissement QTUM

QTUM offre une approche hybride unique alliant le modèle UTXO de Bitcoin à l’intelligence des contrats intelligents Ethereum. Malgré ses atouts de long terme, il convient de prendre en considération la forte volatilité et la concurrence sectorielle dans le domaine des blockchains programmables.

Recommandations pour investir dans QTUM

✅ Débutant : privilégier des investissements modestes et réguliers pour appréhender le marché

✅ Investisseur confirmé : mixer investissement à long terme et trading stratégique

✅ Institutionnels : intégrer QTUM dans un portefeuille crypto diversifié, en axant l’analyse sur la dimension technologique

Modes de participation au trading de QTUM

- Spot : achat/vente sur Gate.com

- Jalonnement (staking) : générer des revenus passifs via le PoS de QTUM

- Applications décentralisées : explorer l’écosystème à travers les DApps QTUM

Les investissements en cryptomonnaies présentent un degré de risque très élevé : ce document ne constitue pas un conseil financier. Chaque investisseur doit agir conformément à sa propre tolérance au risque et consulter des professionnels avant toute décision. N’engagez jamais plus que ce que vous êtes prêt à perdre.

Foire aux questions (FAQ)

Quelle est l’évolution attendue du prix QTUM ?

QTUM pourrait s’apprécier jusqu’à 244,70 $ US à horizon 2045, soit une progression potentielle de 165,82 % selon les projections actuelles.

QTUM dispose-t-il d’un avenir ?

Oui, QTUM présente des perspectives solides. Les estimations anticipent une hausse de 4,6 % vers 2,28 $ US en septembre 2025, ce qui souligne son potentiel de croissance et sa pertinence sur le marché crypto.

L’ETF QTUM est-il un bon choix ?

L’ETF QTUM bénéficie de signaux favorables, tant à court qu’à long terme, ce qui suggère un potentiel positif. Coté 94,08 $ US en août 2025, il se révèle être une opportunité intéressante.

Quelle prévision pour le QuantumCoin en 2025 ?

Sur la base de l’analyse technique, le QuantumCoin pourrait atteindre un plancher de 0,0000012422656 $ US en 2025.

Partager

Contenu