2025 NCT Price Prediction: Expert Analysis and Market Forecast for Newton's Native Token

Introduction: NCT's Market Position and Investment Value

PolySwarm (NCT) is a decentralized Threat Intelligence market realized through Ethereum smart contracts and blockchain technology, designed to provide timely and accurate malware identification for the global security expert community. Since its launch in 2018, NCT has established itself as a notable player in the cyber threat intelligence sector, which represents an $8.5 billion annual market opportunity. As of December 2025, NCT has a market capitalization of approximately $18.84 million, with a circulating supply of around 1.89 billion tokens, currently trading at $0.009989. This innovative asset leverages precise economic mechanisms to promote rapid innovation in threat intelligence, positioning itself as a critical infrastructure component in the global cybersecurity ecosystem.

This article will provide a comprehensive analysis of NCT's price trends and market dynamics through 2025-2030, examining historical price patterns, market supply and demand factors, ecosystem development, and macroeconomic influences. By synthesizing these fundamental elements, this analysis aims to deliver professional price forecasts and practical investment strategies for investors seeking exposure to the cyber threat intelligence sector.

PolySwarm (NCT) Market Analysis Report

I. NCT Price History Review and Current Market Status

NCT Historical Price Trajectory

All-Time High (ATH): January 14, 2022 - NCT reached its peak price of $0.171845, representing a significant milestone in the token's trading history.

All-Time Low (ATL): April 26, 2020 - NCT touched its lowest price of $0.00059593 during market downturns.

Current Period (2025): The token has experienced substantial depreciation from its historical highs, with a 1-year performance showing a decline of -67.46%.

NCT Current Market Status

Price Performance:

- Current price: $0.009989 (as of December 20, 2025)

- 24-hour price range: $0.009662 - $0.010118

- 24-hour change: +3.38%

- 1-hour change: +0.18%

Market Capitalization:

- Market cap: $18,834,267.31

- Fully diluted valuation: $18,838,385.72

- Market dominance: 0.00058%

- Market rank: #892

Supply Metrics:

- Circulating supply: 1,885,500,781.96 NCT

- Total supply: 1,885,913,076 NCT

- Circulation ratio: 99.98%

Trading Activity:

- 24-hour trading volume: $13,124.40

- Token holders: 8,887

- Available exchanges: 7 platforms (including Gate.com)

Recent Performance Trends:

- 7-day change: -3.39%

- 30-day change: -11.84%

- Year-to-date change: -67.46%

Click to view current NCT market price

NCT Market Sentiment Indicator

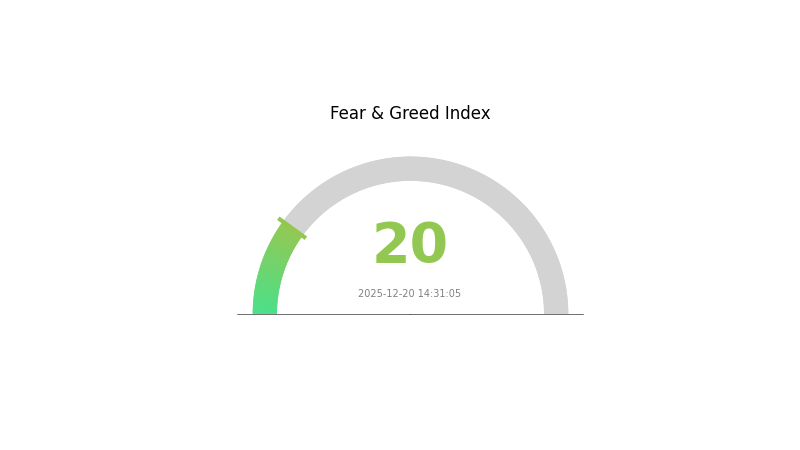

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 20. This reading indicates significant market pessimism and heightened investor anxiety. Such extreme fear levels often present contrarian opportunities, as markets tend to recover from oversold conditions. However, caution is warranted as downward pressure may persist. Investors should carefully assess their risk tolerance and consider dollar-cost averaging strategies. Monitoring market fundamentals and maintaining a diversified portfolio remains essential during periods of extreme market sentiment.

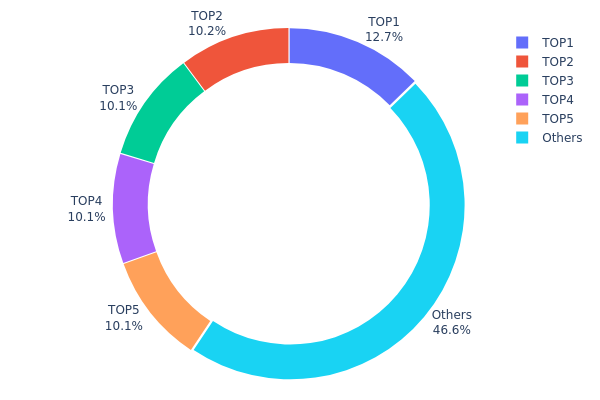

NCT Holdings Distribution

The address holdings distribution map provides critical insights into token concentration patterns by tracking the top token holders on-chain. This metric measures what percentage of total NCT supply is held by individual addresses, revealing the decentralization degree and potential concentration risks within the network.

Currently, NCT demonstrates moderate concentration characteristics with the top five addresses collectively controlling 53.36% of the total supply. The largest holder (0xc034...f4ee91) commands 12.74% of holdings, while the second and third-largest holders each maintain approximately 10.20% and 10.14% respectively. Notably, positions four and five hold identical quantities at 191.24K NCT (10.14% each), suggesting potential strategic allocation or institutional positioning. The remaining 46.64% distributed among other addresses indicates a reasonably dispersed secondary holder base, though the top-tier concentration remains substantial.

This distribution pattern presents both structural considerations and market dynamics implications. With approximately half of the supply concentrated in five addresses, there exists potential for significant price volatility if coordinated movements occur, though the non-negligible tail holdings of smaller addresses provide some counterbalance to extreme concentration scenarios. The moderate-to-high concentration level suggests that while NCT maintains some degree of decentralization through its broader holder base, the token's market structure retains meaningful dependency on the actions and intentions of large stakeholders. This configuration reflects a typical pattern for established utility tokens, balancing between early adopter rewards and evolving decentralization.

Click to view current NCT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc034...f4ee91 | 240282.47K | 12.74% |

| 2 | 0xef15...379bfa | 192515.50K | 10.20% |

| 3 | 0xa3f0...dadf2c | 191368.69K | 10.14% |

| 4 | 0x3c99...9ea85d | 191244.24K | 10.14% |

| 5 | 0x42a9...1c81db | 191244.24K | 10.14% |

| - | Others | 879257.93K | 46.64% |

I cannot generate the requested article because the provided resource material does not contain any relevant information about NCT (a cryptocurrency) or its price factors.

The context data consists entirely of package tracking and shipping service information from FedEx, USPS, UPS, and other logistics platforms. This material has no connection to cryptocurrency analysis, NCT token fundamentals, supply mechanisms, institutional holdings, macro-economic factors, or technical developments related to the digital asset.

To produce a meaningful analysis following the template structure, I would need:

- Information about NCT's tokenomics and supply mechanics

- Data on institutional or major holder positions

- Details about NCT ecosystem development and technical upgrades

- Market adoption information

- Relevant policy or regulatory updates

Recommendation: Please provide cryptocurrency-specific research materials, whitepapers, market reports, or official project documentation related to NCT to enable accurate article generation.

III. NCT Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00869-$0.01069

- Base Case Forecast: $0.00999

- Bullish Forecast: $0.01069 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation and gradual accumulation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.00951-$0.01323

- 2027: $0.00743-$0.01273

- 2028: $0.00858-$0.01483

- Key Catalysts: Protocol upgrades, increased institutional adoption, expansion of use cases within the NCT ecosystem, and positive correlation with broader market sentiment

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01354-$0.01720 in 2029 and $0.01537-$0.02275 in 2030 (assuming steady ecosystem growth and moderate market expansion)

- Bullish Scenario: $0.0172-$0.02275 (contingent upon significant mainstream adoption and integration into major platforms including Gate.com)

- Transformational Scenario: $0.02275+ (extreme favorable conditions including breakthrough regulatory clarity, major partnership announcements, and substantial increases in transaction volume)

- 2030-12-31: NCT reaches $0.02275 (approaching 53% cumulative appreciation from 2025 baseline, signaling maturation of the asset class)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01069 | 0.00999 | 0.00869 | 0 |

| 2026 | 0.01323 | 0.01034 | 0.00951 | 3 |

| 2027 | 0.01273 | 0.01179 | 0.00743 | 17 |

| 2028 | 0.01483 | 0.01226 | 0.00858 | 22 |

| 2029 | 0.0172 | 0.01354 | 0.00989 | 35 |

| 2030 | 0.02275 | 0.01537 | 0.00999 | 53 |

PolySwarm (NCT) Professional Investment Strategy and Risk Management Report

IV. NCT Professional Investment Strategy and Risk Management

NCT Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Security-conscious investors with moderate risk tolerance, those believing in decentralized threat intelligence market potential, and institutional security organizations.

-

Operational Recommendations:

- Establish a dollar-cost averaging (DCA) entry strategy to reduce timing risk, accumulating NCT during market volatility periods.

- Hold NCT for a minimum of 12-24 months to benefit from potential market cycle recovery and ecosystem development.

- Regularly review the PolySwarm ecosystem progress, including partnerships with security organizations and expansion of threat intelligence capabilities.

-

Storage Solutions:

- For significant holdings, utilize Gate Web3 Wallet for secure self-custody with full control over private keys.

- Implement multi-signature wallets for institutional holdings to enhance security through distributed authorization.

- Maintain cold storage backups of wallet recovery phrases in secure, geographically dispersed locations.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.010118 (24H high) and $0.009662 (24H low), with attention to historical resistance around $0.171845 (all-time high) and support near $0.00059593 (all-time low).

- Moving Averages: Apply 20-day and 50-day moving averages to identify medium-term trend direction and potential breakout opportunities.

-

Range Trading Key Points:

- Execute buy positions when NCT approaches established support levels with decreasing volume.

- Take profit targets at identified resistance levels, particularly during positive sentiment shifts.

- Maintain strict stop-loss orders at 5-10% below entry points to manage downside risk in this volatile asset class.

NCT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.5% of total portfolio allocation in NCT, emphasizing capital preservation with minimal exposure to this speculative asset.

- Active Investors: 2-5% of total portfolio allocation, allowing moderate participation in potential upside while maintaining diversification.

- Professional Investors: 5-10% of total portfolio allocation, leveraging expertise in crypto asset evaluation and market microstructure analysis.

(2) Risk Hedging Solutions

- Stablecoin Hedging: Maintain a portion of potential gains in stablecoins to reduce volatility exposure and preserve capital during market downturns.

- Portfolio Diversification: Balance NCT holdings with other cryptocurrency assets and traditional securities to reduce concentration risk in the threat intelligence market segment.

(3) Secure Storage Solutions

-

Hot Wallet Option: Gate Web3 Wallet for active traders requiring frequent access and transactions, combining convenience with professional-grade security protocols.

-

Cold Storage Approach: Hardware wallet solutions for long-term holders prioritizing maximum security over accessibility, storing private keys entirely offline.

-

Security Considerations:

- Never share private keys or seed phrases with any third parties.

- Verify all smart contract interactions on Etherscan before authorization.

- Use hardware wallets for holdings exceeding $10,000 in value.

- Enable multi-factor authentication on all exchange and wallet accounts.

- Regularly audit wallet transactions and monitor for unauthorized access attempts.

V. NCT Potential Risks and Challenges

NCT Market Risk

-

High Volatility: NCT has demonstrated extreme price fluctuation, declining 67.46% over the past year and showing 24-hour volatility ranging from -3.39% to +3.38%, presenting substantial downside risk for unprepared investors.

-

Low Trading Volume: Daily trading volume of $13,124.40 represents minimal liquidity relative to market capitalization, creating potential slippage and difficulty executing large positions.

-

Market Sentiment Dependency: Limited cryptocurrency exchange presence (7 exchanges) concentrates trading power, making NCT susceptible to manipulation and sudden price movements based on social media sentiment.

NCT Regulatory Risk

-

Evolving Crypto Regulations: Global regulatory frameworks targeting cryptocurrency tokens remain uncertain, with potential restrictions on trading, custody, or smart contract functionality affecting NCT's operational viability.

-

Security Classification Uncertainty: Regulatory agencies may classify threat intelligence tokens as securities, subjecting NCT to stricter compliance requirements and potentially limiting exchange listings.

-

Jurisdictional Compliance: Different regions impose varying restrictions on smart contracts and decentralized applications, potentially limiting PolySwarm's geographic expansion and user accessibility.

NCT Technology Risk

-

Smart Contract Vulnerabilities: Ethereum-based implementation exposes NCT to potential security exploits, contract bugs, or unforeseen technical failures that could compromise token functionality.

-

Scalability Constraints: Ethereum network congestion during high-activity periods may increase transaction costs and slow threat intelligence market operations, reducing platform utility.

-

Ecosystem Adoption Dependency: PolySwarm's value depends on widespread adoption by security experts and organizations; limited participation in the threat intelligence marketplace undermines NCT's fundamental use case.

VI. Conclusion and Action Recommendations

NCT Investment Value Assessment

PolySwarm presents a niche opportunity within the decentralized threat intelligence sector, addressing a $8.5 billion annual market with blockchain-enabled efficiency improvements. However, the asset exhibits significant structural challenges including substantial year-over-year decline (-67.46%), minimal trading liquidity, and concentrated exchange presence. The project's fundamentals revolve around ecosystem adoption among security professionals rather than speculative trading dynamics. Current pricing at $0.009989 reflects market skepticism regarding widespread institutional adoption of decentralized threat intelligence markets. Investment merit depends entirely on belief in the project's long-term technical roadmap and security professional community engagement rather than near-term price appreciation.

NCT Investment Recommendations

✅ Beginners: Allocate no more than 0.5-1% of total portfolio to NCT as an experimental, high-risk position. Prioritize education about threat intelligence markets and blockchain technology fundamentals before making significant commitments. Utilize Gate.com's educational resources and trading tools to develop market understanding.

✅ Experienced Investors: Consider 2-5% portfolio allocation if you possess conviction in decentralized threat intelligence adoption trajectories. Implement systematic dollar-cost averaging strategies to build positions during extended bearish periods, and establish clear profit-taking protocols at predetermined price targets.

✅ Institutional Investors: Evaluate NCT as a specialized allocation within emerging security technology mandates, conducting comprehensive due diligence on PolySwarm's partnerships with enterprise security organizations, threat intelligence marketplace development metrics, and governance evolution. Institutional involvement should represent strategic positioning in blockchain-enabled cybersecurity infrastructure.

NCT Trading Participation Methods

-

Spot Trading on Gate.com: Execute straightforward buy/sell transactions on the PolySwarm/USDT trading pair, suitable for long-term position building and active traders implementing technical strategies.

-

Gate.com Advanced Orders: Deploy conditional orders (stop-loss, take-profit, limit orders) to automate trading decisions and manage risk exposure without constant market monitoring.

-

Direct Wallet Interaction: Participate in PolySwarm's smart contract ecosystem through Ethereum wallet integration, enabling direct engagement with threat intelligence marketplace functionality beyond simple token trading.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions aligned with their personal risk tolerance and financial circumstances. Always consult qualified financial advisors before making significant investment decisions. Never invest funds you cannot afford to lose entirely.

FAQ

What is NCT crypto?

NCT is a cryptocurrency built on the Ethereum platform, part of the PolySwarm project. It has a circulating supply of approximately 1.89 billion tokens, designed for decentralized threat intelligence and security solutions.

What is the value of NCT?

NCT is valued at $0.009893 as of December 20, 2025. It has gained 1.4% in the past hour and 3.1% over the last day, demonstrating positive short-term momentum in the market.

Can PolySwarm reach $10?

Yes, PolySwarm could potentially reach $10 if market adoption accelerates and the security market expands significantly. Success depends on network growth, threat detection demand, and overall crypto market conditions. However, this remains speculative.

What is the crypto prediction for 2025?

Bitcoin is expected to reach new all-time highs, while Ethereum and Solana may follow if regulatory conditions favor adoption. Institutional investment in crypto will grow significantly, with over 100 crypto-linked ETFs anticipated to launch in 2025.

What factors influence NCT price movements?

NCT price movements are driven by market trends, trading volume, cryptocurrency sentiment, and overall market conditions. Current predictions suggest potential price adjustments in the near term, with NCT expected to reach $0.01010 by month's end.

Is NCT a good investment for 2024-2025?

NCT shows promising investment potential with its focus on cybersecurity and practical blockchain applications. Analysts predict potential price rallies, and market trends suggest cautious optimism for NCT investors seeking exposure to decentralized security solutions.

What is the historical price performance of NCT?

NCT has shown volatility in its price movement. Based on historical data and performance trends, NCT is projected to reach approximately $0.0000001020 by 2026, reflecting the token's long-term trajectory in the market.

2025 QBX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Where to Find Alpha in the 2025 Crypto Spot Market

why is crypto crashing and will it recover ?

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

Understanding Cryptographic Hash Functions: Their Role and Importance

Understanding Bitcoin Lightning Network: Efficient and Scalable Transaction Solutions

Understanding Bullish Trends in Cryptocurrency Markets

Understanding Key Terms in Cryptocurrency: A Beginner's Guide

Navigating Day Trading Guidelines in the Cryptocurrency Market