2025 GUSD Price Prediction: Analyzing the Future of Gemini's Stablecoin in a Changing Crypto Landscape

Introduction: GUSD's Market Position and Investment Value

GUSD (GUSD), as a flexible, principal-protected investment product, has achieved significant milestones since its inception. As of 2025, GUSD's market capitalization has reached $149,720,215, with a circulating supply of approximately 149,780,060 tokens, and a price hovering around $0.9996. This asset, often referred to as a "stable yield generator," is playing an increasingly crucial role in providing relatively stable returns in both bullish and bearish market conditions.

This article will comprehensively analyze GUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GUSD Price History Review and Current Market Status

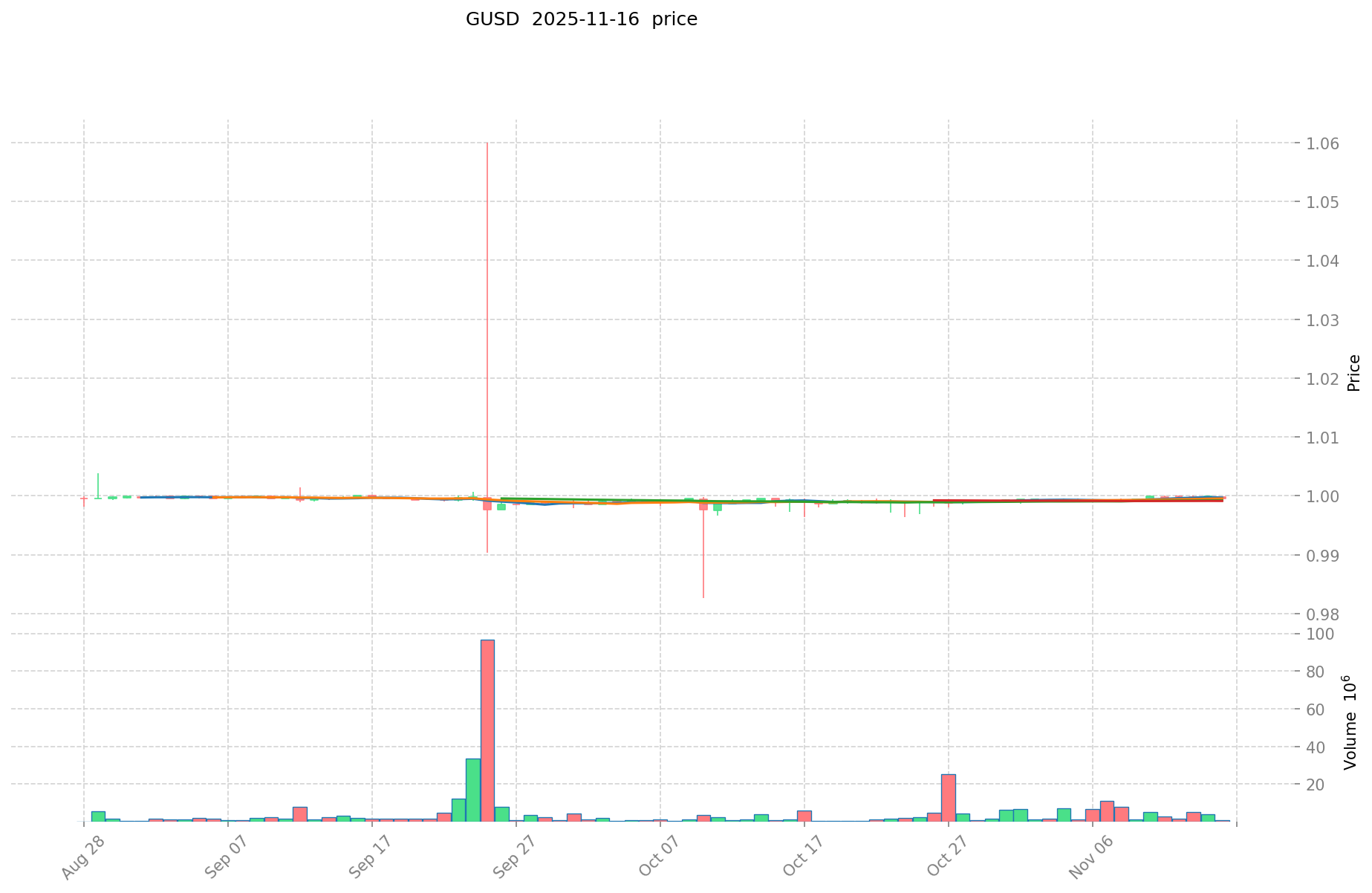

GUSD Historical Price Evolution Trajectory

- 2025: GUSD launched on September 25, reaching its all-time high of $1.06

- 2025: Market adjustment occurred, with price dropping to its all-time low of $0.9826 on October 10

- 2025: Price stabilized near $1, reflecting its design as a stablecoin

GUSD Current Market Situation

As of November 16, 2025, GUSD is trading at $0.9996, showing a slight decrease of 0.03% in the past 24 hours. The 24-hour trading volume stands at $836,212.01925, indicating moderate market activity. GUSD's market capitalization is currently $149,720,215.23, ranking it 301st in the overall cryptocurrency market.

The circulating supply of GUSD is 149,780,060.17, which represents 46.81% of its total supply of 320,000,000. This suggests a controlled release of tokens into the market. The fully diluted market cap is $319,872,000.00, reflecting the potential value if all tokens were in circulation.

GUSD has shown minimal price fluctuations in recent periods, with a 0.03% increase over the past 7 days and a 0.04% increase over the past 30 days. This stability aligns with its function as a stablecoin designed to maintain a value close to $1.

Click to view the current GUSD market price

GUSD Market Sentiment Indicator

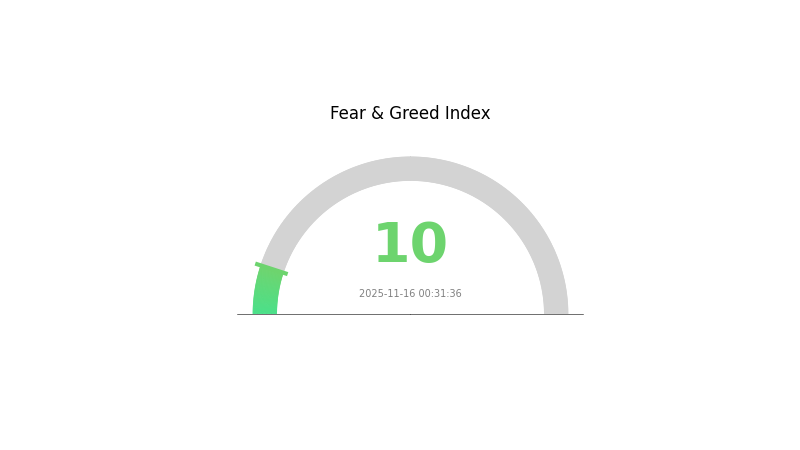

2025-11-16 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index plummeting to 10. This level of pessimism often indicates a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed, diversify your portfolio, and consider using Gate.com's advanced tools to navigate these uncertain times. As always, never invest more than you can afford to lose in the volatile crypto market.

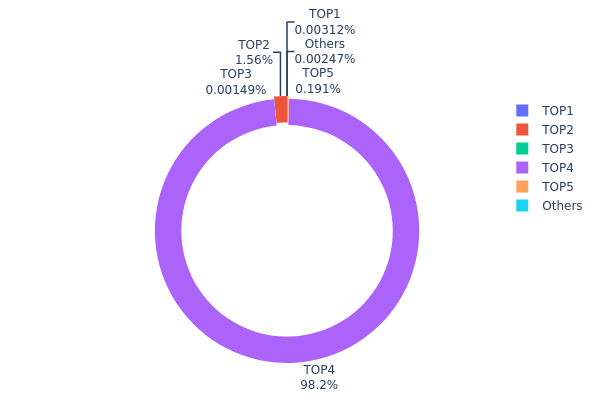

GUSD Holdings Distribution

The address holdings distribution data for GUSD reveals a highly concentrated ownership structure. The top address holds an overwhelming 98.23% of the total supply, equivalent to 314,367.72K GUSD. This extreme concentration raises significant concerns about the token's decentralization and market stability.

Such a concentrated distribution poses potential risks to the GUSD market. With a single address controlling nearly all tokens, there's an increased likelihood of market manipulation and price volatility. This centralization could lead to sudden large-scale movements in the market if the dominant holder decides to sell or transfer a substantial portion of their holdings.

From a broader perspective, this distribution pattern indicates a low level of decentralization for GUSD. The token's on-chain structure appears fragile, with most of the supply controlled by a single entity. This situation may deter potential investors and could impact the long-term viability and adoption of GUSD in the broader cryptocurrency ecosystem.

Click to view the current GUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x54bc...f3120f | 10.00K | 0.00% |

| 2 | 0x843a...e313e2 | 5000.00K | 1.56% |

| 3 | 0xd513...00caea | 4.78K | 0.00% |

| 4 | 0xc882...84f071 | 314367.72K | 98.23% |

| 5 | 0x0d07...b492fe | 609.60K | 0.19% |

| - | Others | 7.90K | 0.019999999999996% |

II. Core Factors Affecting GUSD's Future Price

Supply Mechanism

- Fixed Supply: GUSD is a stablecoin pegged to the US dollar, with its supply directly tied to the amount of USD held in reserve.

- Historical Pattern: As a stablecoin, GUSD's price is designed to remain stable at $1, regardless of supply changes.

- Current Impact: Supply changes are expected to have minimal impact on GUSD's price due to its stablecoin nature.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions may hold GUSD as part of their stablecoin reserves.

- Corporate Adoption: Some e-commerce platforms and cryptocurrency exchanges may use GUSD for transactions and as a trading pair.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve policies affecting the US dollar will indirectly impact GUSD's stability and adoption.

- Inflation Hedging Properties: As a USD-pegged stablecoin, GUSD does not serve as an inflation hedge but rather maintains dollar value stability.

- Geopolitical Factors: Global economic tensions or crises may increase demand for USD-pegged stablecoins like GUSD as a safe haven.

Technical Development and Ecosystem Building

- Regulatory Compliance: Ongoing efforts to maintain compliance with evolving stablecoin regulations may impact GUSD's adoption and usage.

- Ecosystem Applications: GUSD may be integrated into various DeFi protocols and platforms for lending, borrowing, and liquidity provision.

III. GUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.98 - $1.00

- Neutral prediction: $1.00

- Optimistic prediction: $1.00 - $1.02 (requires increased adoption of GUSD in DeFi platforms)

2027-2028 Outlook

- Market phase expectation: Stable growth with potential for minor fluctuations

- Price range forecast:

- 2027: $0.99 - $1.01

- 2028: $0.99 - $1.01

- Key catalysts: Regulatory clarity for stablecoins, integration with major payment systems

2029-2030 Long-term Outlook

- Base scenario: $0.99 - $1.01 (assuming continued peg maintenance)

- Optimistic scenario: $1.00 - $1.03 (assuming widespread adoption in cross-border transactions)

- Transformative scenario: $1.00 - $1.05 (assuming GUSD becomes a leading stablecoin in the crypto ecosystem)

- 2030-12-31: GUSD $1.00 (maintaining stability as a reliable stablecoin)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. GUSD Professional Investment Strategies and Risk Management

GUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Stake USDT/USDC to mint GUSD for daily yield

- Reinvest earned yields to compound returns

- Store GUSD in secure wallets or use as collateral

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price trends

- RSI: Identify overbought or oversold conditions

- Key points for swing trading:

- Track Gate ecosystem revenue and RWA yields

- Monitor redemption rates and liquidity levels

GUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across different yield-bearing assets

- Stop-loss orders: Set predetermined exit points

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable 2FA, use strong passwords, regular security audits

V. Potential Risks and Challenges for GUSD

GUSD Market Risks

- Yield fluctuations: Changes in Gate ecosystem revenue or RWA yields

- Liquidity risk: Potential imbalances in minting and redemption

- Correlation risk: GUSD performance tied to overall crypto market conditions

GUSD Regulatory Risks

- Stablecoin regulations: Potential new rules affecting GUSD operations

- Cross-border restrictions: Limitations on international use or transfers

- Taxation changes: Evolving tax treatment of yield-bearing tokens

GUSD Technical Risks

- Smart contract vulnerabilities: Potential exploits in the GUSD protocol

- Blockchain congestion: High gas fees or delayed transactions on Ethereum

- Oracle failures: Inaccurate price feeds affecting GUSD stability

VI. Conclusion and Action Recommendations

GUSD Investment Value Assessment

GUSD offers a unique value proposition as a yield-bearing stablecoin backed by Gate ecosystem revenue and real-world assets. It provides potential for stable returns with daily distributions, making it an attractive option for income-focused investors. However, investors should be aware of regulatory uncertainties and market risks associated with the broader crypto ecosystem.

GUSD Investment Recommendations

✅ Beginners: Start with a small allocation to understand the yield mechanics

✅ Experienced investors: Consider GUSD as part of a diversified crypto portfolio

✅ Institutional investors: Evaluate GUSD for treasury management or yield optimization

GUSD Participation Methods

- Direct minting: Stake USDT/USDC on Gate.com to mint GUSD

- Secondary market trading: Buy GUSD on Gate.com's spot market

- Yield farming: Explore GUSD liquidity pools or lending options if available

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GUSD a stable coin?

Yes, GUSD is a stablecoin. It's designed to maintain a 1:1 peg with the US dollar, offering stability in the volatile crypto market.

Is Gemini Dollar a good investment?

Yes, Gemini Dollar (GUSD) is a promising investment. As a stable coin, it offers low volatility and potential for steady returns, especially in DeFi applications.

What is the price prediction for Gemini IPO in 2030?

Based on market trends and industry growth, Gemini's IPO price could potentially reach $150-200 per share by 2030, reflecting the company's expansion and crypto market maturation.

Can grt coin reach $10?

While ambitious, GRT reaching $10 is possible in the long term with increased adoption and market growth. However, it would require significant ecosystem expansion and demand for The Graph's services.

Share

Content