2025 GEL Price Prediction: Expert Analysis and Market Forecast for the Georgian Lari

Introduction: GEL's Market Position and Investment Value

Gelato (GEL) is a decentralized automation protocol for Ethereum smart contracts, designed to execute user transactions automatically according to specified instructions and allowances through an open network of relayers. Since its launch in 2021, GEL has established itself as a key infrastructure solution in the Ethereum ecosystem. As of December 24, 2025, GEL's fully diluted valuation stands at approximately $5.29 million, with a circulating supply of around 268.5 million tokens trading at $0.01257. This protocol, which eliminates the need for developers to run underlying server infrastructure while maintaining censorship resistance, continues to play an increasingly vital role in enabling seamless asset flows across Ethereum smart contracts.

This article provides a comprehensive analysis of GEL's price trajectory and market dynamics, incorporating historical performance data, supply-demand fundamentals, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the 2025-2030 period.

Gelato (GEL) Market Analysis Report

I. GEL Price History Review and Current Market Status

GEL Historical Price Evolution Trajectory

- November 30, 2021: Project reached its all-time high (ATH) of $4.21, marking the peak valuation during the bull market cycle.

- December 19, 2025: Project touched its all-time low (ATL) of $0.01186543, representing a significant decline from historical peaks.

- Current Period (December 24, 2025): Token trading at $0.01257, showing marginal recovery from recent lows.

GEL Current Market Status

As of December 24, 2025, Gelato (GEL) displays the following market characteristics:

Price Performance:

- Current price: $0.01257

- 24-hour change: -2.25%

- 7-day change: -5.97%

- 30-day change: -42.80%

- Year-to-date change: -93.95%

Market Capitalization Metrics:

- Market capitalization: $3,375,062.71

- Fully diluted valuation: $5,288,073.30

- Market dominance: 0.00016%

- 24-hour trading volume: $12,282.21

Supply and Holder Information:

- Circulating supply: 268,501,408.54 GEL

- Total supply: 420,690,000 GEL

- Maximum supply: 420,690,000 GEL

- Circulating supply ratio: 63.82%

- Total holders: 3,713

Price Range (24-hour):

- High: $0.01332

- Low: $0.01191

Exchange Availability:

- Listed on 4 exchanges

- Actively traded on Gate.com

Click to view current GEL market price

GEL Market Sentiment Index

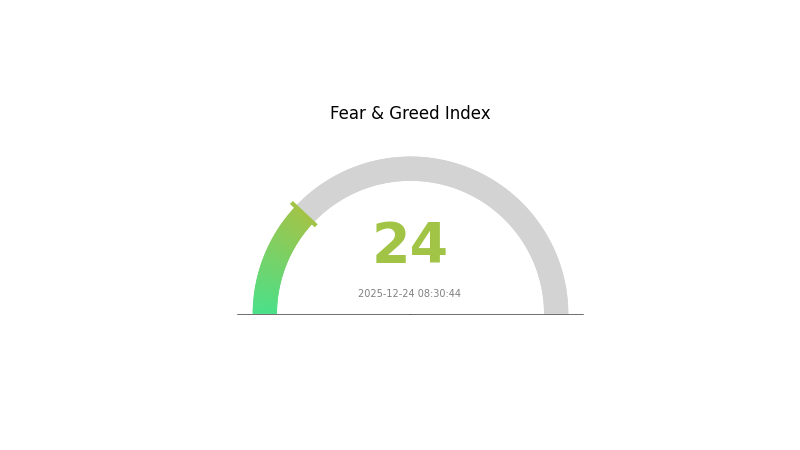

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This represents a significant shift in market sentiment, indicating heightened anxiety among investors. During periods of extreme fear, market volatility typically increases as traders reassess their positions. However, savvy investors often view such moments as potential opportunities, as extreme fear can signal oversold conditions. Monitor key support levels closely and consider dollar-cost averaging strategies. Stay informed through Gate.com's market data tools to navigate these turbulent conditions effectively.

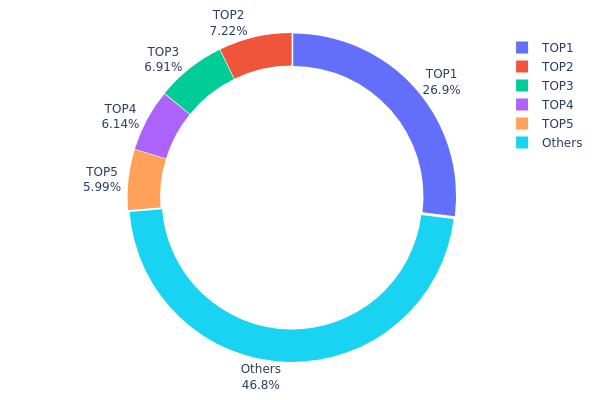

GEL Holdings Distribution

The address holdings distribution map illustrates the concentration of GEL tokens across on-chain wallets, revealing the degree of asset centralization within the ecosystem. This metric serves as a critical indicator for assessing decentralization levels, potential market manipulation risks, and the overall health of the token's network structure.

Current data demonstrates moderate concentration characteristics in GEL's holder landscape. The top five addresses collectively control approximately 53.16% of total token supply, with the largest holder commanding 26.94% of circulating tokens. This concentration level indicates a notable centralization tendency, though not extreme. The distribution pattern reveals a clear hierarchical structure, where the top address maintains substantially larger holdings than secondary wallets, suggesting potential influence over short-term price movements and governance decisions. However, the remaining 46.84% of tokens distributed among numerous other addresses provides a counterbalance, indicating that no single entity possesses overwhelming dominance.

The existing address distribution framework presents both structural considerations and market dynamics implications. While the top-five concentration exceeds typical decentralized token standards, the diversified holding base among remaining addresses offers some resilience against coordinated manipulation. The presence of substantial individual wallet positions in ranks two through five suggests multiple stakeholders with material economic interests, which could facilitate more distributed decision-making. Nevertheless, investors should monitor whether the leading address exhibits trading activity patterns, as concentrated holdings in few hands may amplify volatility during significant liquidation events or strategic repositioning by major holders.

Click to view current GEL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4c64...c69b7c | 113348.14K | 26.94% |

| 2 | 0x4a7c...a7ddd6 | 30353.37K | 7.21% |

| 3 | 0x55fa...fa4416 | 29057.86K | 6.90% |

| 4 | 0x0d07...b492fe | 25814.79K | 6.13% |

| 5 | 0x706c...d834c4 | 25197.64K | 5.98% |

| - | Others | 196918.21K | 46.84% |

II. Core Factors Impacting GEL's Future Price

Supply Mechanism

-

Halving Mechanism: GEL undergoes periodic halving events that reduce the rate of new coin issuance.

-

Historical Impact: Previous halving events have consistently enhanced scarcity and driven price appreciation.

-

Current Outlook: The next halving is expected to further increase scarcity and support upward price momentum.

-

Fixed Supply: GEL maintains a constant total supply, with scarcity positioned to support long-term price stability.

Three、2025-2030 GEL Price Prediction

2025 Outlook

- Conservative Forecast: $0.01191-$0.01254

- Neutral Forecast: $0.01254

- Optimistic Forecast: $0.01705 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectations: GEL is anticipated to enter a recovery and growth consolidation phase, with gradual appreciation driven by ecosystem maturation and increased adoption.

- Price Range Predictions:

- 2026: $0.00829-$0.02131 (17% upside potential)

- 2027: $0.01354-$0.02473 (43% cumulative upside)

- 2028: $0.01947-$0.02310 (70% cumulative upside)

- Key Catalysts: Protocol upgrades, strategic partnerships, increased institutional participation, and expansion of DeFi use cases within the GEL ecosystem.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01802-$0.03315 (76% cumulative upside by 2029; assumption: steady adoption and moderate market growth)

- Optimistic Scenario: $0.02521-$0.02991 (120% cumulative upside by 2030; assumption: mainstream adoption acceleration and positive macroeconomic conditions)

- Transformative Scenario: Price targets could exceed $0.03000+ (assumption: breakthrough in enterprise adoption, significant liquidity inflows on platforms like Gate.com, and broader crypto market bull run)

- 2025-12-24: GEL trades near $0.01254 (current consolidation phase with moderate volatility observed)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01705 | 0.01254 | 0.01191 | 0 |

| 2026 | 0.02131 | 0.0148 | 0.00829 | 17 |

| 2027 | 0.02473 | 0.01805 | 0.01354 | 43 |

| 2028 | 0.0231 | 0.02139 | 0.01947 | 70 |

| 2029 | 0.03315 | 0.02225 | 0.01802 | 76 |

| 2030 | 0.02991 | 0.0277 | 0.02521 | 120 |

Gelato (GEL) Professional Investment Strategy and Risk Management Report

IV. GEL Professional Investment Strategy and Risk Management

GEL Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: DeFi protocol developers, automation enthusiasts, and long-term believers in decentralized task execution infrastructure

- Operational Recommendations:

- Accumulate GEL during market downturns when the token trades significantly below historical highs, building a core position in the protocol

- Hold tokens through market cycles to participate in potential protocol adoption and value appreciation as the automation ecosystem matures

- Consider dollar-cost averaging (DCA) to reduce timing risk given the token's historical volatility

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Support and Resistance Levels: Monitor the 24-hour low of $0.01191 and high of $0.01332 as immediate trading bands; historical support at all-time low of $0.01186543

- Volume Analysis: Track the 24-hour trading volume of $12,282.21 to identify breakout opportunities and validate trend reversals

-

Range Trading Key Points:

- Capitalize on the negative price momentum across all timeframes (-0.24% in 1H, -2.25% in 24H, -5.97% in 7D) to identify oversold conditions

- Execute tactical entries near support levels and exits near resistance with stop-losses positioned below recent lows

- Be aware of the significant annual decline (-93.95% over 1Y) indicating strong downward pressure

GEL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio allocation

- Active Investors: 3-7% of total crypto portfolio allocation

- Professional Investors: 5-10% of specialized DeFi protocol allocations

(2) Risk Hedging Strategies

- Position Sizing with Stop-Losses: Implement strict 15-25% stop-loss orders below entry points to limit downside exposure given the token's high volatility and 93.95% annual decline

- Portfolio Diversification: Combine GEL holdings with other established DeFi infrastructure projects to reduce concentration risk and mitigate protocol-specific vulnerabilities

(3) Secure Storage Solutions

- Self-Custody Recommendation: For holdings exceeding $1,000 USD equivalent, consider moving GEL tokens to secure self-custody solutions for long-term storage

- Exchange Storage: For active traders, maintain positions on Gate.com for convenient execution and access to platform features

- Security Considerations: Ensure private keys are backed up in multiple secure locations, enable all available security features on exchange accounts, and never share recovery phrases or private keys with anyone

V. GEL Potential Risks and Challenges

GEL Market Risk

- Extreme Volatility and Price Depreciation: The token has experienced a catastrophic 93.95% decline over the past year, with recent historical lows set on December 19, 2025. This extreme downward trajectory indicates significant market pressure and reduced investor confidence

- Limited Trading Liquidity: With only $12,282.21 in 24-hour trading volume and a fully diluted market cap of just $5.29 million, GEL suffers from low liquidity which amplifies price swings and increases slippage during trades

- Market Cap Erosion: The circulating market cap of $3.38 million is extremely small, making GEL vulnerable to rapid devaluation from even modest sell pressure and limiting its ability to attract institutional capital

GEL Regulatory Risk

- Smart Contract Protocol Classification Uncertainty: Regulatory frameworks for autonomous execution protocols and decentralized relayer networks remain unclear across jurisdictions, creating potential compliance challenges if classified as unregistered securities or financial services

- Ethereum Ecosystem Regulatory Exposure: As an Ethereum-based protocol, GEL faces indirect regulatory risk from potential restrictions on smart contract automation, DeFi protocols, or decentralized services that could impact its operational viability

GEL Technology Risk

- Smart Contract Vulnerability Exposure: Any critical bugs or vulnerabilities discovered in Gelato's smart contract infrastructure could lead to funds at risk, protocol halts, or loss of user trust in the automation platform

- Relayer Network Centralization Challenges: The success of Gelato's decentralized relayer network depends on sufficient economic incentives to attract and maintain active participants; insufficient network participation could compromise the protocol's resilience and censorship resistance

VI. Conclusion and Action Recommendations

GEL Investment Value Assessment

Gelato (GEL) represents a niche infrastructure play in the Ethereum automation ecosystem with legitimate technical merit but significant market headwinds. The protocol addresses a real need for decentralized task execution without running centralized infrastructure. However, the token has experienced severe market depreciation (down 93.95% annually), trades on minimal liquidity, and maintains a small market cap of $5.29 million. The project shows limited exchange presence (listed on only 4 exchanges) and modest holder distribution (3,713 holders). While the core technology and use case remain relevant for DeFi developers, the investment carries substantial risk and remains highly speculative. The current market conditions suggest either significant undervaluation for long-term believers or continued depreciation risk.

GEL Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of crypto portfolio) only if you deeply understand smart contract automation protocols and can afford complete loss of capital. Consider this a high-risk experimental position rather than a core holding.

✅ Experienced Investors: Potentially add GEL as a small specialized allocation within a diversified DeFi infrastructure portfolio, focusing on long-term accumulation during extreme weakness if convinced of the protocol's eventual adoption trajectory.

✅ Institutional Investors: Conduct comprehensive due diligence on relayer network health, developer adoption metrics, and competitive positioning within automation protocols before considering any allocation given the extreme market cap and illiquidity constraints.

GEL Trading Participation Methods

- Spot Trading on Gate.com: Execute buy and sell orders directly on Gate.com's spot trading interface during market hours, benefiting from the exchange's liquidity pools and order matching

- Limit Orders: Set predetermined entry prices near support levels ($0.01190-$0.01200) and exit targets during rallies to establish positions without market impact

- Direct On-Chain Transactions: For large holders or developers, interact directly with the Gelato smart contracts via Ethereum mainnet at contract address 0x15b7c0c907e4c6b9adaaaabc300c08991d6cea05, enabling programmatic interactions with the protocol

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Consult professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Is gel stock a good buy?

Yes, GEL is considered a strong buy based on analyst ratings. With an average target price of $19.5 and positive market momentum, it presents good investment potential for long-term growth in the crypto ecosystem.

What is Gelato Network (GEL) and what does it do?

Gelato Network (GEL) is a decentralized protocol enabling automated smart contract executions across blockchains like Ethereum, Polygon, and Fantom. It provides reliable execution services for decentralized applications without requiring manual intervention.

What factors could affect GEL price in 2025?

GEL price in 2025 could be influenced by market sentiment, supply and demand dynamics, regulatory developments, and overall crypto market trends. Potential price range: $0.01962 to $0.8906.

How does GEL compare to other layer 2 solution tokens?

GEL differentiates through DeFi automation and developer partnerships. While facing technical resistance, it offers unique value in Layer 2 infrastructure with strong growth potential compared to competing solutions.

2025 UNI Price Prediction: Analyzing the Potential Growth and Challenges for Uniswap's Native Token

2025 PUFFER Price Prediction: Analyzing Future Growth Potential and Market Factors for This Emerging Cryptocurrency

Is Fluid (FLUID) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 FERC Price Prediction: Navigating Regulatory Changes and Market Dynamics in the Energy Sector

THE vs ETH: Comparing Two Giants in the Cryptocurrency Ecosystem

ETHS vs UNI: Comparing the Performance of Ethereum and Uniswap in the DeFi Ecosystem

TradFi Opens the Door to Cryptocurrencies: What It Means for Markets in 2026

TradFi Embraces Digital Assets as Japan Signals a New Era of Financial Integration

Is cryptocurrency mining legal in Germany?

Fear Market in Cryptocurrency: How to Navigate Extreme Sentiment and Find Opportunities

Coincheck: A Japan-Based Digital Currency Exchange