2025 DMC Price Prediction: Market Trends, Key Factors and Investment Outlook for Digital Media Coin

Introduction: DMC's Market Position and Investment Value

Delorean (DMC), as the official Web3 platform of the DeLorean Motor Company, has been pioneering innovation in the automotive and blockchain sectors since its inception. As of 2025, DMC's market capitalization stands at $8,766,270, with a circulating supply of approximately 2,708,983,614 tokens, and a price hovering around $0.003236. This asset, hailed as the "tokenized electric vehicle pioneer," is playing an increasingly crucial role in revolutionizing the automotive industry through blockchain technology.

This article will provide a comprehensive analysis of DMC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. DMC Price History Review and Current Market Status

DMC Historical Price Evolution

- 2025: DMC launched, price peaked at $0.014002 on June 24

- 2025: Market correction, price dropped to $0.002891 on September 30

DMC Current Market Situation

As of October 9, 2025, DMC is trading at $0.003236. The token has experienced a 1.84% decrease in the last 24 hours, with a trading volume of $1,754,984. DMC's market cap stands at $8,766,270, ranking it 1484th in the cryptocurrency market. The token is currently trading 76.89% below its all-time high of $0.014002, reached on June 24, 2025. Despite the recent dip, DMC has shown some resilience with a 1.15% increase over the past week. However, it has faced a more significant decline of 10.83% over the last 30 days. The current market sentiment for DMC appears cautious, with short-term bearish trends but potential for recovery based on its weekly performance.

Click to view current DMC market price

DMC Market Sentiment Indicator

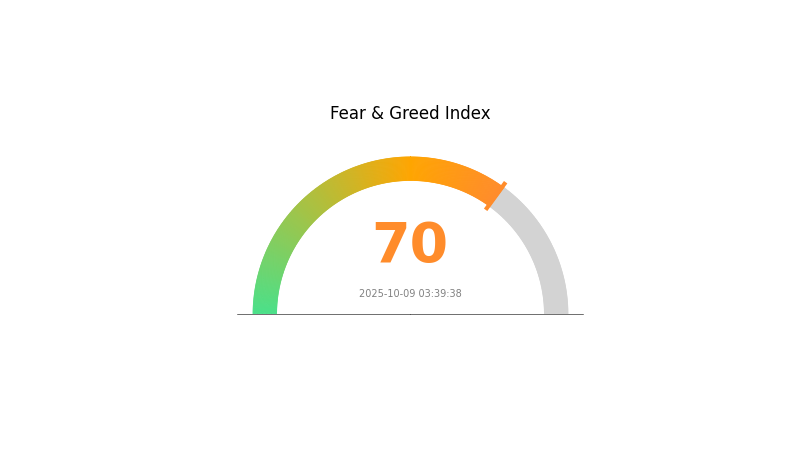

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance, with the Fear and Greed Index reaching 70, indicating "Greed". This suggests investors are becoming increasingly optimistic, potentially driving prices higher. However, caution is advised as extreme greed can lead to market corrections. Traders should consider taking profits or hedging positions. Remember, markets often reverse when sentiment reaches extremes. Stay informed and manage your risk wisely on Gate.com, where you can access a wide range of trading tools and market data.

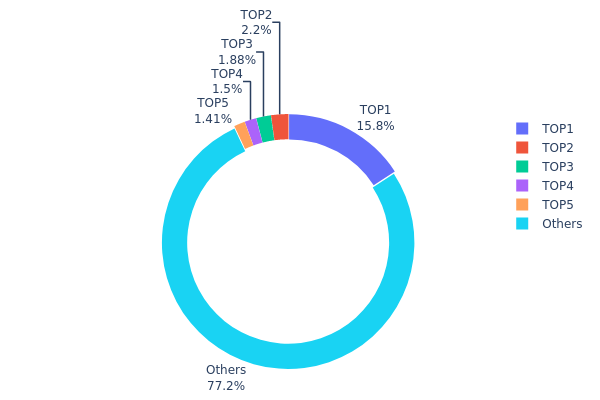

DMC Holdings Distribution

The address holdings distribution data for DMC reveals a moderately concentrated ownership structure. The top address holds a significant 15.79% of the total supply, equivalent to 2,021,977.98K DMC tokens. This concentration is notable but not extreme in the cryptocurrency landscape. The subsequent top four addresses hold considerably smaller portions, ranging from 2.20% to 1.40% of the total supply.

Collectively, the top five addresses control 22.76% of DMC tokens, while the remaining 77.24% is distributed among other addresses. This distribution suggests a relatively decentralized structure, as the majority of tokens are held by a broader base of addresses. However, the presence of a single address holding over 15% of the supply warrants attention, as it could potentially influence market dynamics or liquidity.

The current distribution pattern indicates a moderate level of decentralization for DMC. While the top address holds significant sway, the spread among other holders contributes to overall market stability. This structure may help mitigate extreme price volatility, but vigilance is necessary regarding potential market movements initiated by the largest holder.

Click to view the current DMC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8784...fcd2b1 | 2021977.98K | 15.79% |

| 2 | 0x35de...7bc835 | 282119.38K | 2.20% |

| 3 | 0x62f3...fa53ad | 240418.91K | 1.87% |

| 4 | 0x9cd9...326af9 | 192009.20K | 1.50% |

| 5 | 0x1e83...0118b3 | 180069.63K | 1.40% |

| - | Others | 9883404.90K | 77.24% |

II. Key Factors Affecting DMC's Future Price

Supply Mechanism

- Production Capacity Expansion: DMC production capacity and output have been rapidly increasing to meet growing downstream demand.

- Historical Patterns: Past supply increases have led to price fluctuations, with oversupply generally causing downward pressure on prices.

- Current Impact: Continued capacity expansion may lead to potential oversupply, putting pressure on DMC prices in the near term.

Institutional and Major Player Dynamics

- Enterprise Adoption: Major downstream industries like polycarbonate and lithium battery manufacturers are increasing their DMC consumption.

- National Policies: China's focus on "silicon energy" and clean energy development may provide policy support for the DMC industry.

Macroeconomic Environment

- Monetary Policy Impact: Global monetary tightening and high inflation may affect overall demand for DMC-related products.

- Geopolitical Factors: International trade tensions and supply chain disruptions could impact DMC exports and pricing.

Technological Development and Ecosystem Building

- Downstream Industry Growth: Rapid development in lithium batteries, new energy vehicles, and polycarbonate applications is driving DMC demand.

- Ecosystem Applications: DMC is a key component in the "silicon energy" ecosystem, supporting various clean energy and advanced materials applications.

III. DMC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00211 - $0.00325

- Neutral prediction: $0.00325 - $0.00364

- Optimistic prediction: $0.00364 - $0.00403 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00189 - $0.00462

- 2027: $0.00347 - $0.00550

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00436 - $0.00538 (assuming steady market growth)

- Optimistic scenario: $0.00538 - $0.00678 (assuming strong market performance)

- Transformative scenario: $0.00678+ (under extremely favorable conditions)

- 2030-12-31: DMC $0.00678 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00403 | 0.00325 | 0.00211 | 0 |

| 2026 | 0.00462 | 0.00364 | 0.00189 | 12 |

| 2027 | 0.0055 | 0.00413 | 0.00347 | 27 |

| 2028 | 0.00558 | 0.00481 | 0.00255 | 48 |

| 2029 | 0.00556 | 0.0052 | 0.00484 | 60 |

| 2030 | 0.00678 | 0.00538 | 0.00436 | 66 |

IV. DMC Professional Investment Strategies and Risk Management

DMC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in DeLorean's vision and the automotive industry's blockchain integration

- Operation suggestions:

- Accumulate DMC tokens during market dips

- Stay informed about DeLorean's project milestones and industry developments

- Consider storing tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor DeLorean's announcements and partnerships for potential price catalysts

DMC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects in the automotive sector

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and never share private keys

V. Potential Risks and Challenges for DMC

DMC Market Risks

- Volatility: Crypto market fluctuations can lead to significant price swings

- Competition: Other automotive companies may develop similar blockchain solutions

- Adoption: Slow uptake of tokenized vehicles could impact DMC's value

DMC Regulatory Risks

- Uncertain regulations: Changes in cryptocurrency or automotive industry regulations could affect DMC

- Cross-border compliance: Varying international laws may limit global expansion

- Token classification: Potential for DMC to be classified as a security in some jurisdictions

DMC Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits in the underlying code

- Blockchain scalability: SUI network congestion could affect transaction speeds

- Integration challenges: Difficulties in merging blockchain technology with traditional automotive systems

VI. Conclusion and Action Recommendations

DMC Investment Value Assessment

DMC presents a unique opportunity in the intersection of blockchain and automotive industries. Long-term potential lies in DeLorean's innovative approach to tokenized vehicles, while short-term risks include market volatility and adoption challenges.

DMC Investment Recommendations

✅ Newcomers: Start with small, exploratory investments to understand the project ✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider DMC as part of a diversified blockchain portfolio

DMC Participation Methods

- Exchange trading: Purchase DMC tokens on Gate.com

- DeLorean ecosystem participation: Engage with the platform's features as they become available

- Stay informed: Follow DeLorean Labs' official channels for updates and opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

As of 2025, Solana (SOL) is predicted to have the highest price. Institutional adoption and technological advancements drive its growth. Predictions are based on current trends and market analysis.

What is the price prediction for Mana 2025?

Based on forecasts, Mana's price in 2025 could reach a minimum of $0.33 and an average of $0.34. These predictions use machine gradient methods.

What is the price of major token in 2025?

Based on the latest data, the price of the major token on October 7, 2025, is $0.1256. This represents the most recent known value for the token in 2025.

What is the price prediction for ETH in 2025?

ETH is predicted to reach between $7,300 and $8,600 in 2025, driven by strong technical patterns and rising institutional demand.

Share

Content