2025年CRV価格予測:市場トレンド、導入の指標、Curve DAO Tokenの価値を決定する重要な要素の分析

Curve DAO Token(CRV)の将来展望を示す2025年価格予測記事をご紹介します。市場トレンドや普及状況、CRVに影響を与える重要要素を詳細に分析します。ダイナミックに変化する業界で、投資判断に役立つ専門的な視点と実践的な戦略を求める投資家に最適な内容です。はじめに:CRVの市場ポジションと投資価値

Curve(CRV)は、効率的なステーブルコイン取引を実現する分散型取引プロトコルとして、2020年のローンチ以降、重要な成果を挙げてきました。2025年現在、Curveの時価総額は10億3,000万ドル、流通供給量は約14億トークン、価格は0.7356ドル前後で推移しています。この資産は「ステーブルコイン取引の中核」と位置づけられ、分散型金融(DeFi)エコシステムで存在感を強めています。

本記事では、Curveの価格推移について2025年から2030年まで歴史的パターン、市場需給、エコシステムの成長、マクロ経済要因を総合的に分析し、投資家へ専門的な価格予測と実践的な投資戦略を提示します。

I. CRV価格の履歴と現状

CRV価格推移の概略

- 2020年:1月にCurveローンチ、8月14日には過去最高値(ATH)15.37ドルを記録

- 2021年:強気相場サイクルで大きな変動を経験

- 2022~2023年:暗号資産市場の冬期で高値から安値へ下落

- 2024年:8月5日に過去最安値(ATL)0.180354ドルを記録

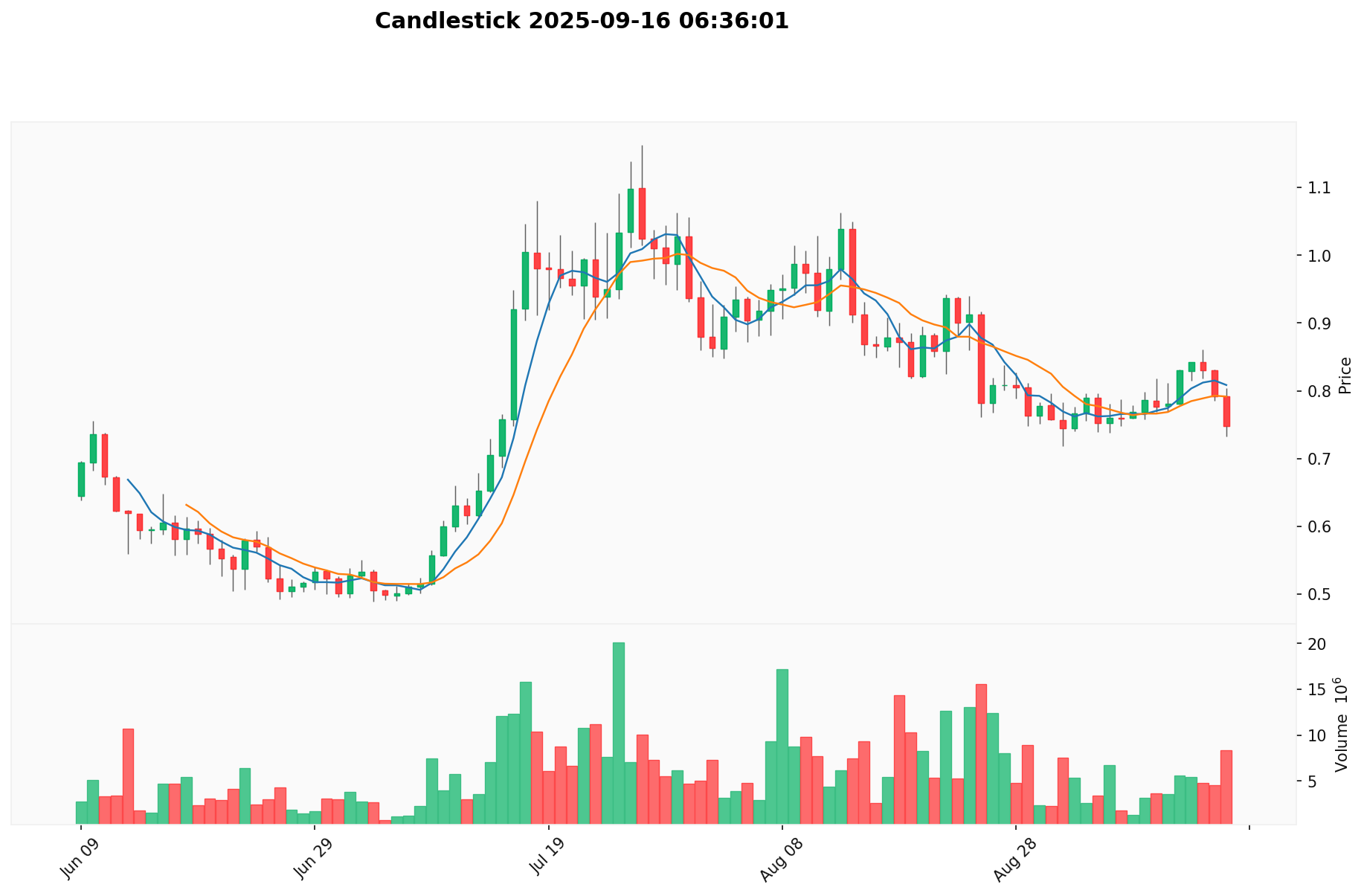

CRVの現状

2025年09月16日現在、CRVは0.7356ドルで取引され、24時間の取引量は5,877,317ドルです。直近24時間で7.82%の下落。時価総額は1,031,240,959ドルで全暗号資産中110位。流通供給量は1,401,904,512 CRV、総供給量2,304,788,327、最大供給量3,030,303,031トークンです。

CRVは過去最高値15.37ドルから95.21%下落していますが、過去最安値0.180354ドルからは307.87%上昇。過去1年では176.36%増加と健闘していますが、直近30日で−14.87%、過去1週間で−7.39%の短期下落も見受けられます。

CRVの最新市場価格はこちら

CRV市場センチメント

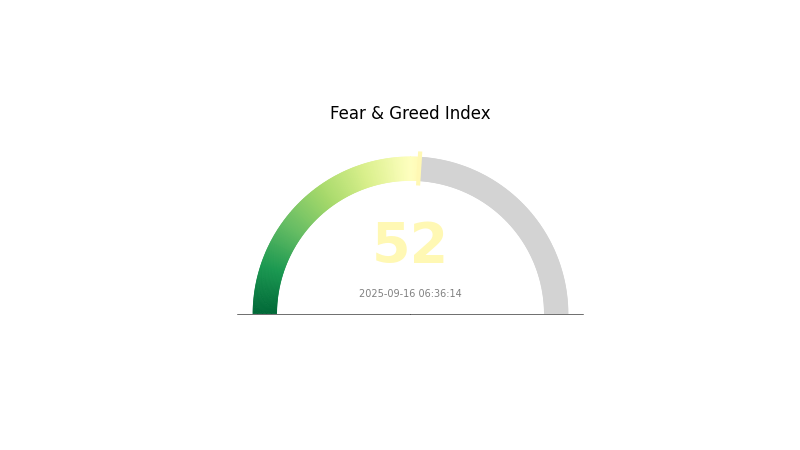

2025年09月16日 Fear and Greed Index:52(中立)

最新のFear & Greed Indexはこちら

暗号資産市場のセンチメントはFear and Greed Indexが52で均衡し、中立の状態にあります。投資家は過度な懸念も過度な期待もなく、慎重かつ楽観的な姿勢を保っています。市場参加者は冷静な判断を続けていますが、今後のセンチメント変化には注意が必要です。十分なリサーチとリスク管理の徹底が重要です。

CRV保有分布

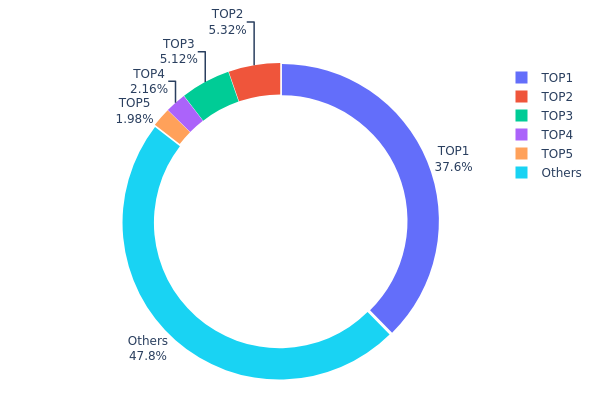

CRVの保有分布データを見ると、少数の上位アドレスへの集中が顕著です。最大保有者が全供給量の37.61%を保有し、上位5アドレスの合計で52.15%を支配しています。これは市場操作や中央集権化リスクに対する懸念材料です。

この集中構造により、大口保有者による大量売却が起きれば価格変動が激しくなり、Curveエコシステムのガバナンスにも偏りが生まれる可能性があります。

一方、CRVトークンの47.85%は上位5アドレス以外が保有しており、一定の分散も認められます。この分散が市場安定性や分散型特性の一助となっていますが、トップへの集中度は高いままです。

CRVの最新保有分布はこちら

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5f3b...94e2a2 | 866,979.80K | 37.61% |

| 2 | 0xf977...41acec | 122,609.42K | 5.31% |

| 3 | 0x5a52...70efcb | 118,000.00K | 5.11% |

| 4 | 0x8fa1...984d4a | 49,678.43K | 2.15% |

| 5 | 0xc06f...0b3370 | 45,626.78K | 1.97% |

| - | その他 | 1,101,858.07K | 47.85% |

II. CRVの将来価格に影響する主な要因

供給メカニズム

- 発行スケジュール: CRVの最大供給量は3,030,303,030.299トークン、流通供給量は現在1,389,745,746.69トークンです。

- 過去のパターン: 段階的なトークン解放は、供給増による価格への影響を持続的に及ぼしてきました。

- 現時点の影響: 最大供給量の約45.86%が流通しており、今後の追加発行による価格圧力も継続が予想されます。

機関・大型投資家の動向

- 機関保有: Framework VenturesやAlameda ResearchがCRVを保有しています。

- 企業利用: Curve FinanceプラットフォームはDeFiエコシステム全体で広く利用されています。

マクロ経済環境

- インフレヘッジ機能: CRVはDeFiトークンとしてインフレへの対抗手段とみなされる場合もあり、他の暗号資産同様に注目されています。

技術開発・エコシステム強化

- プラットフォームアップグレード: Curve Financeの継続的な技術改善は、CRVの価値に直接貢献します。

- エコシステム応用: Curve Financeは、ステーブルコイン取引や流動性供給においてDeFi分野の中核的役割を果たします。

III. 2025~2030年のCRV価格予測

2025年展望

- 保守的予想:0.57631~0.65ドル

- 中立予想:0.65~0.75ドル

- 楽観的予想:0.75~0.80975ドル(市場環境好転・DeFi採用拡大時)

2027~2028年展望

- 市場局面:成長期・変動性高まる可能性

- 価格予測レンジ:

- 2027年:0.73422~0.87291ドル

- 2028年:0.72614~1.19898ドル

- 主な成長要因:DeFiエコシステム拡大、スケーラビリティ向上、機関投資家の参入拡大

2030年長期予測

- 標準シナリオ:0.90~1.20ドル(DeFiと暗号資産市場の堅調な成長前提)

- 楽観シナリオ:1.20~1.50ドル(DeFi統合加速・規制環境改善時)

- 変革的シナリオ:1.50~1.68212ドル(DeFiの技術革新・普及時)

- 2030年12月31日:CRV 1.12894ドル(現時点予測平均値)

| 年 | 予測最高値 | 予測平均値 | 予測最安値 | 騰落率 |

|---|---|---|---|---|

| 2025 | 0.80975 | 0.7295 | 0.57631 | 0 |

| 2026 | 0.86198 | 0.76962 | 0.67727 | 4 |

| 2027 | 0.87291 | 0.8158 | 0.73422 | 10 |

| 2028 | 1.19898 | 0.84435 | 0.72614 | 14 |

| 2029 | 1.23622 | 1.02167 | 0.56192 | 38 |

| 2030 | 1.68212 | 1.12894 | 0.67737 | 53 |

IV. CRV投資戦略とリスク管理

CRV運用手法

(1) 長期保有戦略

- 対象:長期投資家・DeFi愛好者

- 運用提案:

- 下落局面でCRVを積立購入

- Curveガバナンス参加により報酬を獲得

- 安全な非カストディアルウォレットで管理

(2) アクティブトレード戦略

- テクニカル分析ツール:

- 移動平均線:トレンド・転換点の判別

- RSI:過熱・売られ過ぎ状況の判断

- スイングトレードのポイント:

- CurveのTVL(総預かり資産額)および取引量推移の監視

- プロトコルのアップグレード・提携情報をキャッチアップ

CRVリスク管理

(1) 資産配分指針

- 保守型:暗号資産ポートフォリオの1~3%

- 積極型:5~10%

- プロ:10~15%

(2) リスクヘッジ策

- 分散投資:複数DeFiプロトコルへの分散

- オプション戦略:CRVオプション取引を活用して下落リスクを軽減する

(3) 安全な保管策

- ホットウォレットを推奨:Gate Web3 ウォレット

- コールドストレージ:長期保管にはハードウェアウォレット

- セキュリティ対策:2FA設定・強固なパスワード・秘密鍵のバックアップ

V. CRVのリスクと課題

市場リスク

- 変動性:CRV価格の大幅な変動リスク

- 競合:新規DEXによるCurveのシェア低下可能性

- 流動性リスク:突発的な流動性流出時の価格影響

規制リスク

- 規制不透明:DeFiプロトコルへの監視強化

- コンプライアンス:KYC/AML対応の必要性

- 税務問題:DeFi参加に関する税法の変化

技術リスク

- スマートコントラクト脆弱性:不正利用やハッキングのリスク

- スケーラビリティ課題:Ethereumネットワーク混雑時の影響

- オラクル障害:価格フィードの不正確さが運用に与える影響

VI. まとめ・アクション推奨

CRV投資価値評価

CRVはDeFiトッププロトコルとして長期的な価値が見込まれますが、短期的には市場変動や規制不透明性のリスクも存在します。

CRV投資推奨

✅ 初心者:少額で開始し、Curveの仕組みを学習

✅ 経験者:Curveガバナンスへの積極参加を検討

✅ 機関投資家:イールドファーミングや流動性供給を活用

CRV参加方法

- トークン保有:CRVを購入・保有し値上がり益を狙う

- 流動性供給:Curveプールに資産提供で手数料・報酬獲得

- ガバナンス参加:CRVステーキングによるプロトコル投票

暗号資産投資は非常に高リスクです。本記事は投資助言ではありません。ご自身のリスク許容度に応じて慎重な判断を行い、専門家への相談を推奨します。余剰資金以上の投資は絶対にお控えください。

FAQ

CRVは1ドルに到達しますか?

はい、CRVは2025年までに1ドルへ到達すると予測されています。ピーク1.20ドル超の可能性も指摘されています。

CRVは投資価値がありますか?

CRVの価値は市場動向次第です。現状では不透明ですが、技術指標が改善すれば有望性が高まります。最新情報を参考に慎重な判断を。

CRVは優良トークンですか?

CRVはDeFi分野で主要なトークンであり、流動性プール運用などで長期成長が期待できます。

CRVの価格は回復しますか?

CRVの回復可能性はありますが確定的ではありません。市場やオンチェーンデータに改善傾向が見られますが、タイミングは不透明です。

共有

内容