2025 CRMC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of CRMC

Chrema Coin (CRMC) is a Web3-based ecosystem token built around a utility token and smart contract platform designed to digitize revenues from gold mining and distribution contracts. As of December 23, 2025, CRMC has established itself in the digital asset market with a market capitalization of approximately $29.79 million and a circulating supply of 10,992,356 tokens, trading at $0.5957 per token. This innovative asset is playing an increasingly important role in bridging traditional gold asset investment with decentralized finance (DeFi) infrastructure.

This article will provide a comprehensive analysis of CRMC's price trajectory and market dynamics, integrating historical price patterns, market supply-demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging Web3 gold-linked digital asset.

CHREMA Coin (CRMC) Market Analysis Report

I. CRMC Price History Review and Current Market Status

CRMC Historical Price Movement Trajectory

- November 29, 2025: CRMC reached its all-time high of $5.5247, marking a significant peak in the token's trading history

- November 21, 2025: CRMC hit its all-time low of $0.2241, representing a substantial correction from previous levels

- December 23, 2025: CRMC is currently trading at $0.5957, reflecting moderate recovery from the all-time low

CRMC Current Market Conditions

As of December 23, 2025, CRMC is trading at $0.5957, representing a 24-hour decline of 1% and a 1-hour decrease of 2.6%. Over the past seven days, the token has shown resilience with a 1.77% gain, though it remains down 3.23% over the last 30 days.

The token maintains a market capitalization of $6,548,146.47 with a fully diluted valuation of $29,785,000. With a circulating supply of 10,992,356 CRMC tokens out of a maximum supply of 50,000,000 tokens, the circulating supply represents 21.98% of total supply. The 24-hour trading volume stands at $14,103.70, with CRMC currently ranked at position 1382 by market capitalization. The token holds a market dominance of 0.00092%, indicating its modest share in the broader cryptocurrency market.

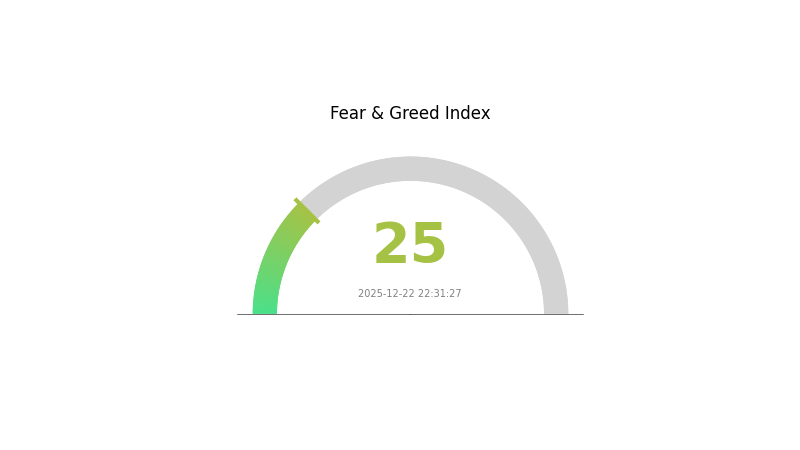

The market sentiment indicator shows extreme fear (VIX: 25), suggesting heightened market caution among investors.

Click to view current CRMC market price

CRMC 市场情绪指标

2025-12-22 恐惧与贪婪指数:25(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates significant market pessimism and risk aversion among investors. During such periods, assets are typically undervalued as panic selling dominates. Market participants should exercise caution and conduct thorough due diligence. While extreme fear can present buying opportunities for long-term investors with strong conviction, it also signals elevated volatility and potential further downside. Consider your risk tolerance carefully before making investment decisions during this highly volatile market phase.

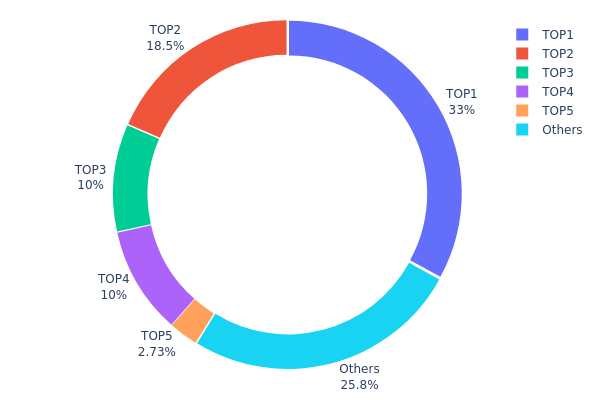

CRMC Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, revealing how CRMC tokens are allocated among individual addresses. This metric serves as a critical indicator of token decentralization, market structure health, and potential vulnerability to price manipulation or concentrated selling pressure.

The current holdings data for CRMC demonstrates a significant concentration risk, with the top four addresses collectively controlling 71.44% of the total token supply. The largest holder (0x07b6...cd9355) maintains a dominant position with 32.99% of all tokens, while the second-largest address (0xdcfa...e22783) controls an additional 18.45%. These two addresses alone account for over half of the circulating supply, indicating substantial centralization. The third and fourth addresses each hold precisely 10.00%, suggesting potential institutional or organized holdings, while the remaining dispersed addresses constitute only 25.84% of the total distribution.

This pronounced concentration presents notable implications for market dynamics. The heavy weight of the top holders creates asymmetrical liquidity conditions and elevates the potential for significant price volatility in response to large position adjustments. While the presence of substantial individual holders does not necessarily indicate malicious intent, such distribution patterns warrant careful monitoring, as coordinated or unilateral action by these major stakeholders could materially impact CRMC's price discovery mechanisms and market stability. The relatively low fragmentation among smaller retail holders further underscores the token's current centralized state, suggesting that genuine decentralization improvements would require broader token distribution initiatives.

Click to view the current CRMC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x07b6...cd9355 | 16499.97K | 32.99% |

| 2 | 0xdcfa...e22783 | 9229.64K | 18.45% |

| 3 | 0x16ca...65557e | 5000.00K | 10.00% |

| 4 | 0x21e6...6f4dfb | 5000.00K | 10.00% |

| 5 | 0xf707...22fdca | 1364.51K | 2.72% |

| - | Others | 12905.87K | 25.84% |

Analysis of Core Factors Affecting CRMC's Future Price

II. Core Factors Influencing CRMC's Future Price

Macroeconomic Environment

-

Policy Changes Impact: Policy shifts and regulatory developments play significant roles in shaping CRMC's price trajectory. Changes in government policies and industry-specific regulations can directly influence market sentiment and investment flows.

-

Market Demand and Competition: CRMC's future price is substantially affected by market demand dynamics and competitive landscape. Variations in market demand relative to supply, combined with competitive pressures from similar offerings, create essential price determinants.

-

Company Financial Health and Business Expansion: The company's financial stability and business development initiatives are key factors affecting price movements. Strong financial performance and successful business expansion typically support positive price momentum, while financial challenges may create downward pressure.

-

Industry Trends: Broader industry trends and sectoral developments significantly influence CRMC's price direction. Evolution of market conditions and shifting industry standards create the broader context within which CRMC's value is assessed.

Note: The provided source materials do not contain specific information regarding CRMC's supply mechanisms, institutional holdings, enterprise adoption, national policies, monetary policy impacts, inflation hedge characteristics, geopolitical factors, or technological developments. Therefore, these sections have been omitted from this analysis. Any investment decisions should be based on comprehensive research from authoritative sources and professional financial advice.

Three、2025-2030 CRMC Price Forecast

2025 Outlook

- Conservative Forecast: $0.40-$0.52

- Neutral Forecast: $0.58

- Optimistic Forecast: $0.68 (requires sustained market stability and positive sentiment)

2026-2027 Medium-term Outlook

- Market Stage Expectations: Consolidation and gradual recovery phase with increased institutional interest and ecosystem development

- Price Range Forecasts:

- 2026: $0.49-$0.66

- 2027: $0.36-$0.87

- Key Catalysts: Regulatory clarity, protocol upgrades, mainstream adoption milestones, and macroeconomic recovery

2028-2030 Long-term Outlook

- Base Case: $0.51-$1.07 (assumes steady adoption and favorable regulatory environment)

- Optimistic Case: $0.83-$1.41 (assumes significant ecosystem growth and widespread institutional participation)

- Transformation Case: $1.41+ (assumes breakthrough innovation, major partnership announcements, or significant market expansion)

Price Performance Summary:

- 2025: $0.40-$0.68 range with -2% annual adjustment

- 2026-2027: Gradual recovery trajectory with 5-8% gains

- 2028-2030: Accelerated growth phase with 27-60% cumulative gains, reaching $1.41 maximum by 2030

Monitor CRMC trading activity on Gate.com for real-time market insights and execution opportunities.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.68024 | 0.5814 | 0.40117 | -2 |

| 2026 | 0.66236 | 0.63082 | 0.48573 | 5 |

| 2027 | 0.8729 | 0.64659 | 0.36209 | 8 |

| 2028 | 1.07124 | 0.75974 | 0.50903 | 27 |

| 2029 | 0.99788 | 0.91549 | 0.52183 | 53 |

| 2030 | 1.40633 | 0.95669 | 0.82275 | 60 |

CHREMA Coin (CRMC) Professional Investment Strategy and Risk Management Report

IV. CRMC Professional Investment Strategy and Risk Management

CRMC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to DeFi-backed tangible assets and those believing in the gold digitalization narrative

- Operational recommendations:

- Accumulate CRMC during price dips below the 30-day moving average to build a core position

- Hold through market cycles, focusing on the project's revenue distribution mechanism from gold mining partnerships

- Maintain a 12-24 month investment horizon to allow the ecosystem to mature and demonstrate revenue generation capabilities

(2) Active Trading Strategy

- Technical analysis indicators:

- Moving averages (MA): Use 7-day and 30-day MAs to identify trend direction; trade above the 30-day MA suggests bullish momentum

- RSI (Relative Strength Index): Monitor overbought conditions above 70 and oversold conditions below 30 for potential entry/exit points

- Wave trading key points:

- Capitalize on the current price volatility (24-hour range: $0.531 - $0.7038) to execute short-term trades around support and resistance levels

- Document all trading activity to optimize entry and exit timing based on volume patterns

CRMC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of total portfolio allocation

- Active investors: 3-7% of total portfolio allocation

- Professional investors: Up to 10% of total portfolio allocation, contingent on thorough due diligence

(2) Risk Hedging Solutions

- Position sizing discipline: Limit individual trade size to no more than 2% of total capital to mitigate single-position risk

- Profit-taking strategy: Establish predetermined price targets at 50% gains to lock in profits and reduce exposure to volatility

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for frequent trading and active management

- Cold storage approach: Transfer majority holdings to self-custody solutions for long-term security

- Security considerations: Enable multi-signature authentication, use hardware verification for transaction approval, and never share private keys or recovery phrases

V. CRMC Potential Risks and Challenges

CRMC Market Risk

- Liquidity concentration: With only $14,103.70 in 24-hour trading volume and a market cap of approximately $29.79 million, CRMC faces significant liquidity constraints that could result in substantial slippage on large orders

- Price volatility exposure: The token has declined 1% in 24 hours and 3.23% over 30 days, indicating susceptibility to market downturns and sentiment shifts

- Market cap fluctuation: The fully diluted valuation at $29.79 million remains vulnerable to rapid devaluation if confidence in the project diminishes

CRMC Regulatory Risk

- Gold asset compliance uncertainty: Digitizing gold mining revenues may face regulatory scrutiny from financial authorities regarding commodity trading, securities classification, and jurisdictional licensing requirements

- Cross-border partnership complications: Collaboration with gold mining entities (AMC) may involve compliance challenges across multiple jurisdictions where mining operations occur

- DeFi regulatory exposure: Evolving global DeFi regulations could impact the platform's ability to distribute revenues and operate smart contracts

CRMC Technology Risk

- Smart contract vulnerability: The platform's revenue distribution mechanism relies on smart contract execution; potential bugs or exploits could compromise fund security

- Blockchain dependency: As an ERC-20 token on Ethereum, CRMC is subject to network congestion, transaction failures, and gas fee volatility

- Integration risk: Connectivity between the physical gold mining operations and blockchain-based revenue distribution requires reliable oracle systems and data verification mechanisms

VI. Conclusion and Action Recommendations

CRMC Investment Value Assessment

CHREMA Coin presents a novel intersection of traditional tangible assets (gold) and decentralized finance infrastructure. The project's core value proposition—automating and transparently distributing gold mining revenues to blockchain users—addresses legitimate inefficiencies in traditional gold investment. However, the token currently exhibits early-stage characteristics: modest trading volume ($14,103.70 daily), concentrated holder base (4,631 addresses), and recent price volatility ranging from a 30-day low of $0.2241 to a high of $5.5247. Success depends critically on the execution of partnership revenue flows with AMC and the platform's ability to attract sufficient liquidity and user adoption. Investors should view CRMC as a speculative, high-risk position rather than a stable value store.

CRMC Investment Recommendations

✅ Beginners: Start with minimal position sizing (0.5-1% of portfolio) after thorough research; use limit orders on Gate.com to accumulate at predetermined price levels; prioritize capital preservation over aggressive growth

✅ Experienced investors: Implement a disciplined trading strategy combining technical analysis with fundamental thesis validation; maintain stop-loss orders at 15-20% below entry points; actively monitor partnership announcements and revenue distribution metrics

✅ Institutional investors: Conduct comprehensive due diligence on AMC partnership terms, regulatory compliance frameworks, and smart contract security audits before significant allocation; establish direct communication channels with the CHREMA team for governance participation

CRMC Trading Participation Methods

- Direct spot trading: Purchase CRMC directly on Gate.com with fiat or stablecoin pairs for immediate exposure

- Dollar-cost averaging: Execute fixed weekly or monthly purchases to reduce timing risk and smooth entry prices across market cycles

- Limit order strategy: Set buy orders at technical support levels and sell orders at resistance zones to automate trading without constant market monitoring

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Always consult with qualified financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

What is CRMC and what is its current market cap?

CRMC is Chrema Coin, a cryptocurrency project in the web3 ecosystem. As of December 2025, its current market cap is $8.91 million, reflecting its valuation in the digital asset market.

What are the price prediction forecasts for CRMC in 2025 and 2030?

CRMC is predicted to reach $0.4880 by December 2025. Long-term forecasts suggest continued growth potential through 2030, though specific 2030 price targets remain subject to market dynamics and development progress.

What are the main factors that could influence CRMC's price movement?

CRMC's price is influenced by market sentiment, trading volume, technological developments, and user adoption trends. Broader crypto market conditions and investor confidence also significantly impact its price movement.

How does CRMC compare to other similar cryptocurrency projects in terms of fundamentals and potential?

CRMC stands out with strong community engagement and sustainability focus. Its innovative approach and robust fundamentals position it as a competitive choice among similar projects, offering significant growth potential in the crypto market.

Is Soil (SOIL) a good investment?: Analyzing the potential of this agricultural cryptocurrency in the evolving digital asset landscape

Is Avantis (AVNT) a good investment?: Analyzing the potential risks and rewards of this diversified ETF provider

Is Spark (SPK) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

2025 CFG Price Prediction: Analyzing Market Trends and Potential Growth Factors for Centrifuge Token

2025 HDRO Price Prediction: Analyzing Market Trends and Potential Growth Factors

CBL vs SNX: Comparing Two Approaches to Decentralized Synthetic Asset Trading

Guide to Using Phantom Wallet for Solana Transactions

Kodiak Project Explained: From Liquidity Protocol to a Core Component of the Berachain Ecosystem

2025 VXT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2026 NVDA Stock Price Forecast: Trend Insights and Investment Risk Management Strategies

Understanding Crypto Tax Regulations for Traders in India