2025 BELIEVE Price Prediction: Expert Analysis and Future Market Outlook for the BELIEVE Token

Introduction: BELIEVE's Market Position and Investment Value

BELIEVE (BELIEVE) serves as the native token of the Believe ecosystem—a token launchpad platform dedicated to bringing the highest quality creators on-chain. As of December 2025, BELIEVE has achieved significant traction within its ecosystem. Currently, the token boasts a market capitalization of approximately $15,014,666, with a circulating supply of around 1,333,333,284 tokens, trading at approximately $0.011261 per token. This ecosystem token is playing an increasingly pivotal role in bridging world-class creators to the blockchain space.

This article will provide a comprehensive analysis of BELIEVE's price trends through 2025-2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for investors.

BELIEVE Market Analysis Report

I. BELIEVE Price History Review and Market Status

BELIEVE Historical Price Evolution

Based on available data, BELIEVE has demonstrated notable price movements since its launch:

- October 30, 2025: All-time high (ATH) reached at $0.068, marking the peak valuation for the token during the tracked period.

- November 21, 2025: All-time low (ATL) recorded at $0.007719, representing a significant correction from the historical peak.

- Current Period (December 2025): Token trading in the $0.011261 range, showing recovery from the November lows with a current 24-hour price change of +2.67%.

BELIEVE Current Market Situation

As of December 21, 2025, BELIEVE is trading at $0.011261 with a 24-hour trading volume of $182,614.10. The token demonstrates the following market characteristics:

Price Performance Metrics:

- 1-Hour Change: +2.5% ($0.000275)

- 24-Hour Change: +2.67% ($0.000293)

- 7-Day Change: -10.63% ($-0.001339)

- 30-Day Change: +21.52% ($0.001994)

Market Capitalization and Supply:

- Total Market Cap: $15,014,666.11

- Circulating Supply: 1,333,333,284 BELIEVE (99.9999% of total supply)

- Maximum Supply: 1,333,333,333 BELIEVE

- Fully Diluted Valuation: $15,014,666.11

- Market Share: 0.00046%

Holder and Exchange Activity:

- Active Holders: 5,484

- Listed on: Gate.com

- Blockchain: Solana (SPL token standard)

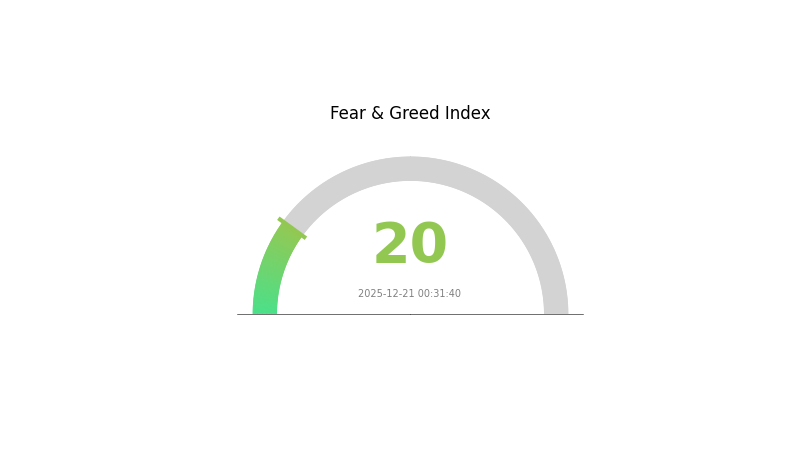

The token currently ranks #975 in the cryptocurrency market by capitalization. Market sentiment indicates extreme fear conditions (VIX: 20), reflecting broader market psychology on December 21, 2025.

Click to view current BELIEVE market price

BELIEVE Market Sentiment Index

2025-12-21 Fear & Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear & Greed Index standing at just 20 points. This indicator suggests significant market pessimism and investor anxiety. During such periods, panic selling often dominates, creating potential opportunities for contrarian investors who believe in long-term market recovery. However, extreme fear also signals heightened volatility and risk. Traders should exercise caution, maintain disciplined risk management, and avoid making emotional decisions. Consider using platforms like Gate.com to monitor market data and execute strategic trades during these critical market conditions.

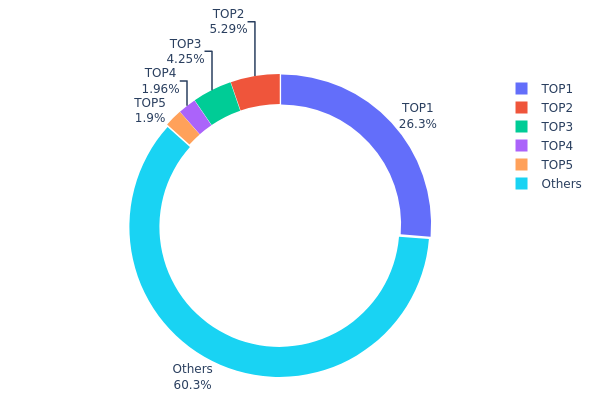

BELIEVE Holdings Distribution

Address holdings distribution refers to the concentration of token ownership across blockchain addresses, serving as a critical indicator of market structure decentralization. By analyzing the top wallet concentrations and their proportional share of total supply, this metric reveals potential risks associated with whale accumulation, market manipulation susceptibility, and overall token distribution health.

The current BELIEVE holdings distribution exhibits moderate concentration characteristics. The top address commands 26.29% of the total supply with 336.62 million tokens, while the top five addresses collectively control approximately 39.65% of all tokens in circulation. This concentration level warrants attention, as a single dominant holder represents a notable concentration risk. However, the remaining 60.35% distributed among other addresses provides a meaningful decentralization buffer. The secondary tier addresses (ranks 2-5) demonstrate relatively balanced holdings ranging from 1.89% to 5.28%, suggesting diversified mid-tier stakeholder participation rather than extreme wealth concentration.

The current distribution pattern reflects a market structure with manageable but notable centralization tendencies. While the top holder's 26.29% stake presents potential volatility risks through large sell-offs or strategic positioning, the substantial "Others" category indicates that majority token ownership remains fragmented across numerous addresses. This configuration suggests moderate resistance to coordinated price manipulation, though informed investors should monitor the largest address for significant movement. Overall, BELIEVE demonstrates neither excessive centralization comparable to newly launched tokens nor exceptional decentralization, positioning itself within typical mature altcoin distribution parameters.

Click to view current BELIEVE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8YWLTo...39kifC | 336617.95K | 26.29% |

| 2 | Fc4VR5...DoP56S | 67682.72K | 5.28% |

| 3 | u6PJ8D...ynXq2w | 54382.72K | 4.24% |

| 4 | 3g2TUk...y5GDpb | 25029.56K | 1.95% |

| 5 | GHXV4x...DETWKH | 24314.20K | 1.89% |

| - | Others | 771968.04K | 60.35% |

II. Core Factors Influencing BELIEVE's Future Price

Supply Mechanism

- Fixed Supply: BELIEVE has a capped total supply, which will demonstrate scarcity attributes as demand grows in the future.

- Historical Pattern: Cryptocurrencies with limited supply tend to exhibit increased value appreciation as adoption rates increase, given constrained token availability.

- Current Impact: The fixed supply mechanism is expected to support price appreciation as platform adoption and user growth accelerate.

Platform Adoption Rate

- User Growth: The expansion of the BELIEVE platform's user base and increased trading activity directly enhance the token's attractiveness and utility.

- Market Sentiment: Investor confidence and sentiment have a direct impact on BELIEVE price movements. Positive news regarding widespread platform adoption can drive significant price increases, while negative sentiment may suppress valuations.

Three、2025-2030 BELIEVE Price Forecast

2025 Outlook

- Conservative Forecast: $0.00877 - $0.01139

- Neutral Forecast: $0.01139 - $0.01373

- Optimistic Forecast: $0.01607 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with incremental growth trajectory, reflecting increasing market recognition and utility expansion

- Price Range Forecast:

- 2026: $0.00961 - $0.0195

- 2027: $0.01429 - $0.0191

- 2028: $0.01232 - $0.02465

- Key Catalysts: Protocol upgrades, ecosystem partnerships, institutional adoption acceleration, and improving market sentiment cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01594 - $0.02125 in 2029, extending to $0.01987 - $0.02614 in 2030 (assumes steady adoption and moderate market conditions)

- Optimistic Scenario: $0.03103 in 2029 reaching $0.0366 in 2030 (contingent on breakout adoption metrics and strong macroeconomic tailwinds)

- Transformative Scenario: $0.04+ range (requires revolutionary use-case breakthroughs, mainstream integration, and sustained positive regulatory environment)

Note: Price forecasts are based on historical data analysis and should be considered alongside fundamental research and risk assessment. Monitor developments on Gate.com and official project channels for real-time market updates.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01607 | 0.01139 | 0.00877 | 1 |

| 2026 | 0.0195 | 0.01373 | 0.00961 | 21 |

| 2027 | 0.0191 | 0.01661 | 0.01429 | 47 |

| 2028 | 0.02465 | 0.01786 | 0.01232 | 58 |

| 2029 | 0.03103 | 0.02125 | 0.01594 | 88 |

| 2030 | 0.0366 | 0.02614 | 0.01987 | 132 |

BELIEVE Investment Strategy and Risk Management Report

IV. BELIEVE Professional Investment Strategy and Risk Management

BELIEVE Investment Methodology

(1) Long-term Holding Strategy

- Suitable For: Investors seeking exposure to creator-focused blockchain ecosystems with medium to long-term conviction

- Operational Recommendations:

- Accumulate positions during market downturns when BELIEVE trades below $0.010, taking advantage of volatility

- Hold through market cycles, recognizing that creator economy tokens may experience extended consolidation periods

- Reinvest any gains or rewards back into the position to compound returns over 12+ month horizons

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price points at $0.010391 (24H low) and $0.011935 (24H high) to identify breakout opportunities

- Volume Analysis: Track the 24-hour volume of $182,614 to confirm price movements and identify potential reversals

- Swing Trading Considerations:

- Take advantage of the observed 24-hour volatility of 2.67%, entering positions near support and exiting near resistance

- Monitor the 7-day decline of -10.63% as a potential accumulation opportunity for contrarian traders

- Set strict stop-losses 5-10% below entry points to manage downside risk in this speculative token

BELIEVE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% portfolio allocation maximum

- Active Investors: 1-3% portfolio allocation maximum

- Experienced Traders: 3-5% portfolio allocation maximum

(2) Risk Hedging Approaches

- Position Sizing: Never allocate more than 2-3% of your total portfolio to BELIEVE due to its speculative nature and limited exchange coverage (currently trading on Gate.com only)

- Diversification: Balance BELIEVE holdings with established cryptocurrencies and other asset classes to reduce portfolio volatility

(3) Secure Storage Solutions

- Custody Option: Gate Web3 Wallet provides a user-friendly interface for securely storing BELIEVE tokens on the Solana blockchain

- Security Best Practices: Enable multi-factor authentication on your Gate.com account, use hardware-backed security where possible, and never share your private keys or seed phrases

- Risk Mitigation: For holdings below $1,000, web wallet solutions are acceptable; for larger positions, consider institutional-grade custody solutions

V. BELIEVE Potential Risks and Challenges

BELIEVE Market Risks

- Limited Exchange Availability: BELIEVE currently trades on only one exchange (Gate.com), creating significant liquidity constraints and potential exit challenges during market stress

- Market Capitalization Concentration: With a market cap of approximately $15 million and relatively small 24-hour volume, the token is highly susceptible to price manipulation and flash crashes

- Volatile Price Discovery: Historical price range from $0.007719 to $0.068 demonstrates extreme volatility, making valuation difficult and increasing liquidation risk for leveraged traders

BELIEVE Regulatory Risks

- Creator Economy Classification Uncertainty: Regulatory frameworks for creator-focused tokens remain undefined in most jurisdictions, exposing investors to potential reclassification as securities

- Compliance Evolution: As regulators worldwide establish clearer cryptocurrency guidelines, creator tokens like BELIEVE may face enhanced compliance requirements or operational restrictions

- Geographic Restrictions: Different jurisdictions may impose varying restrictions on BELIEVE trading or holding, affecting token liquidity and accessibility

BELIEVE Technology Risks

- Solana Network Dependency: As an SPL token on Solana, BELIEVE inherits all technical risks associated with the Solana blockchain, including network congestion and potential security vulnerabilities

- Smart Contract Risk: Limited information available regarding audits or security assessments of the BELIEVE smart contract increases the potential for undiscovered vulnerabilities

- Liquidity Pool Risk: With only 5,484 token holders and limited on-chain liquidity, large trades could experience severe slippage or price impact

VI. Conclusion and Action Recommendations

BELIEVE Investment Value Assessment

BELIEVE represents a speculative investment opportunity in the creator economy segment of blockchain technology. The token's small market cap and limited trading venues suggest it remains in early discovery phase, offering potential upside for early investors while carrying substantial downside risk. The 21.52% monthly gain demonstrates market interest, but the -10.63% weekly decline and extreme price volatility highlight the speculative nature of this asset. Investors should view BELIEVE as a high-risk, high-reward opportunity suitable only for experienced traders with risk capital.

BELIEVE Investment Recommendations

✅ Beginners: Start with minimal exposure (0.1-0.5% of portfolio) on Gate.com, use limit orders only, and focus on understanding the creator economy narrative before increasing positions

✅ Experienced Investors: Consider tactical 1-3% allocations during identified support levels, employ technical analysis for entry/exit timing, and maintain tight stop-losses around 5-10%

✅ Institutional Investors: Conduct thorough due diligence on the Believe ecosystem, evaluate team credentials and project roadmap, and consider larger positions only after comprehensive risk assessments

BELIEVE Trading Participation Methods

- Spot Trading on Gate.com: Purchase BELIEVE directly using fiat or other cryptocurrencies through Gate.com's spot trading interface

- Limit Order Strategy: Set buy orders at key support levels ($0.010391 or below) to accumulate positions at better prices

- DCA Approach: Dollar-cost average into positions over multiple weeks or months to reduce timing risk and emotional decision-making

Important Disclaimer: Cryptocurrency investment carries extreme risk, including potential total loss of capital. This report does not constitute investment advice. Investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely. BELIEVE is a highly speculative token with limited liquidity and exchange availability, making it suitable only for experienced traders with significant risk tolerance.

FAQ

What is BELIEVE token and what is its use case?

BELIEVE token enables staking for rewards, governance participation to influence project decisions, and trading within the ecosystem. It incentivizes community engagement and decision-making.

What is the price prediction for BELIEVE in 2025?

BELIEVE is expected to average $0.01113 in 2025, with a high of $0.01247 and a low of $0.007351, based on comprehensive market analysis.

What factors could affect BELIEVE's price movement?

BELIEVE's price is influenced by market trading volume, investor sentiment, overall crypto market trends, project developments, and adoption rates. Technical factors like support/resistance levels and fundamental aspects including tokenomics and ecosystem growth also play important roles in price fluctuations.

Where to Find Alpha in the 2025 Crypto Spot Market

Best Crypto To Buy: List 2025

why is crypto crashing and will it recover ?

How to convert SOL to USD: Real-time Solana price calculator

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

Explore the Future of Blockchain at the 2024 Tech Insights Conference

In-Depth Comparison of Leading Crypto Platforms for Traders

Exploring PayPal's PYUSD Stablecoin Integration with Solana

Exploring Blockchain Education Opportunities for Aspiring Developers

Exploring Solana's High Transaction Throughput and Scalability