2025 BAS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: BAS Market Position and Investment Value

BNB Attestation Service (BAS) serves as the native verification and reputation layer on BNB Chain, enabling composable on-chain KYC, identity, and asset verification across multiple ecosystems. Since its launch in January 2025, BAS has established itself as a critical infrastructure component. As of December 2025, BAS has achieved a market capitalization of $14.27 million with a circulating supply of 2.5 billion tokens, currently trading at $0.005707. This innovative protocol, recognized as a "verifiable Human Reputation Profile builder," is playing an increasingly vital role in real-world assets (RWA), decentralized finance (DeFi), AI agents, and emerging Web3 applications.

This article provides a comprehensive analysis of BAS price trends and market dynamics, integrating historical data, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for 2025-2030.

BNB Attestation Service (BAS) Market Analysis Report

I. BAS Price History Review and Current Market Status

BAS Historical Price Movement Trajectory

- 2025 (October): BAS reached its all-time high of $0.17051 on October 17, 2025, marking a significant peak in the token's trading history.

- 2025 (December): BAS hit its all-time low of $0.00385 on December 11, 2025, representing a substantial decline from its previous highs.

BAS Current Market Dynamics

As of December 21, 2025, BAS is trading at $0.005707 with a 24-hour trading volume of approximately $191,741. The token has experienced a 4.02% decline over the past 24 hours and a 1.72% decrease in the last hour. However, it has shown positive momentum on longer timeframes, with a 4.97% gain over the past 30 days and a notable 35.33% increase over the past year.

Market Capitalization and Supply Metrics:

- Current Market Cap: $14,267,500

- Fully Diluted Valuation (FDV): $57,070,000

- Circulating Supply: 2,500,000,000 BAS (25% of total supply)

- Total Supply: 10,000,000,000 BAS

- Maximum Supply: 10,000,000,000 BAS

- Token Holders: 198,860 addresses

24-Hour Price Range:

- High: $0.006367

- Low: $0.005365

The token is currently listed on 11 exchanges and operates on the BNB Smart Chain (BSC) as a BEP-20 token. With a market dominance of 0.0017%, BAS maintains a relatively modest position in the broader cryptocurrency market, though it serves a specialized niche within the BNB Chain ecosystem.

Click to view current BAS market price

BAS Market Sentiment Index

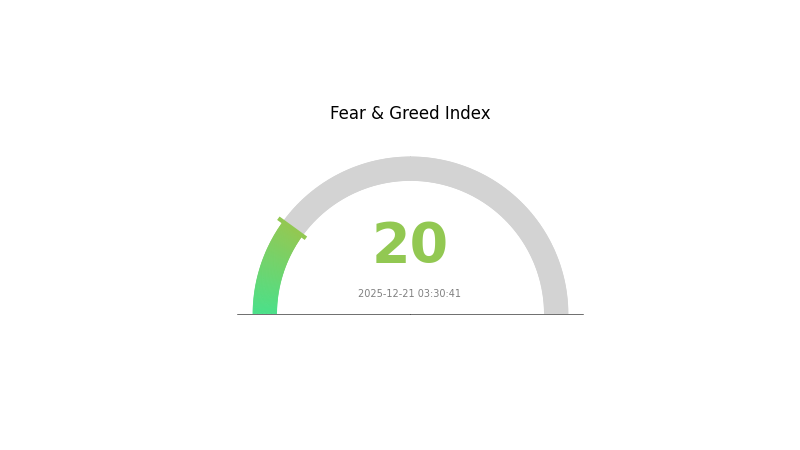

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 20. This indicates deep investor sentiment weakness, characterized by widespread uncertainty and risk aversion. When fear reaches such extreme levels, it often signals potential market bottoms, as excessive pessimism may be overdone. Investors should exercise caution and avoid panic selling. Consider dollar-cost averaging or accumulating quality assets during such periods. However, remain vigilant about fundamental developments and market trends. Monitor market indicators closely on Gate.com for trading opportunities while managing risk appropriately during this volatile period.

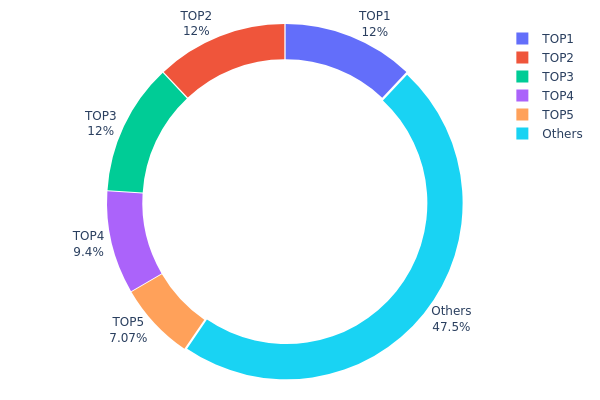

BAS Holdings Distribution

The address holdings distribution map illustrates the concentration of BAS tokens across the top wallet addresses, revealing the degree of decentralization and potential market concentration risks within the BAS ecosystem. By examining the proportion of tokens held by major addresses relative to the total supply, this metric provides critical insights into the distribution structure and potential vulnerabilities to market manipulation or large-scale sell-offs.

Current data demonstrates a moderately concentrated holding structure. The top five addresses collectively control approximately 52.48% of the circulating supply, with the leading address (0x1f91...e15ef2) commanding 12.01% and the second and third addresses each holding precisely 12.00%. While this concentration level warrants attention, it remains within acceptable parameters for established protocols. The remaining 47.52% of tokens distributed among other addresses suggests a reasonably diversified holder base, which mitigates extreme centralization risks. The relatively balanced distribution among the top three addresses, each holding approximately 12%, indicates no single dominant entity controlling an excessive majority.

The current distribution pattern suggests moderate stability with regard to price volatility and market manipulation potential. The fragmentation of majority holdings across multiple addresses reduces the likelihood of sudden coordinated liquidations or coordinated price suppression tactics. However, the substantial concentration in the top five addresses means that coordinated actions by these holders could still influence market dynamics. The relatively significant "Others" category at 47.52% demonstrates an emerging investor base, suggesting that BAS has achieved a degree of distribution maturity that supports long-term ecosystem stability and reduces vulnerability to institutional or whale-driven market distortions.

Click to view current BAS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1f91...e15ef2 | 300242.69K | 12.01% |

| 2 | 0xecd5...a5275f | 300000.04K | 12.00% |

| 3 | 0xf61b...f020ba | 300000.00K | 12.00% |

| 4 | 0x1536...e66c80 | 235000.00K | 9.40% |

| 5 | 0x73d8...4946db | 176795.47K | 7.07% |

| - | Others | 1187727.51K | 47.52% |

II. Core Factors Affecting BAS Future Price

Ecosystem Development and Market Liquidity

-

BNB Chain Ecosystem Growth: New application launches and increased user activity will drive demand for BAS tokens. As the BNB ecosystem expands with more DApps and services, the utility and value proposition of BAS strengthens accordingly.

-

Market Liquidity Impact: Trading depth and transaction volume on exchanges directly influence BAS price stability and movement. Higher liquidity reduces slippage and attracts more institutional participation, contributing to healthier price discovery mechanisms.

-

Trading Activity: The exchange trading ecosystem plays a crucial role in determining BAS price dynamics. Robust trading pairs and consistent volume on platforms like Gate.com support price stability and market accessibility for both retail and institutional investors.

Three、2025-2030 BAS Price Forecast

2025 Outlook

- Conservative Forecast: $0.0044 - $0.00572

- Neutral Forecast: $0.00572 (average expected level)

- Optimistic Forecast: $0.00629 (requires sustained market interest and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with increasing adoption momentum

- Price Range Forecast:

- 2026: $0.00348 - $0.00876

- 2027: $0.00406 - $0.01056

- 2028: $0.00583 - $0.0113

- Key Catalysts: Enhanced protocol functionality, expanded institutional participation, ecosystem partnerships, and improved market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.00618 - $0.01348 (assumes moderate adoption acceleration and stable market conditions)

- Optimistic Case: $0.00697 - $0.01523 (assumes significant ecosystem expansion and increased utility recognition)

- Transformative Case: $0.01523+ (extreme favorable conditions including mainstream adoption breakthrough and major strategic integrations)

- 2030-12-21: BAS at $0.01523 (representing 106% cumulative growth from current baseline, reflecting sustained long-term development trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00629 | 0.00572 | 0.0044 | 0 |

| 2026 | 0.00876 | 0.006 | 0.00348 | 5 |

| 2027 | 0.01056 | 0.00738 | 0.00406 | 29 |

| 2028 | 0.0113 | 0.00897 | 0.00583 | 57 |

| 2029 | 0.01348 | 0.01014 | 0.00618 | 77 |

| 2030 | 0.01523 | 0.01181 | 0.00697 | 106 |

BAS Investment Strategy and Risk Management Report

IV. BAS Professional Investment Strategy and Risk Management

BAS Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Risk-averse investors, institutional participants, and ecosystem believers seeking exposure to BNB Chain's verification infrastructure

- Operational Recommendations:

- Accumulate BAS during price dips below $0.006 to build a core position aligned with the project's development milestones

- Hold for a minimum of 12-24 months to capture potential value appreciation as adoption of on-chain identity verification increases across RWA, DeFi, and AI agent ecosystems

- Reinvest any rewards or gains into additional BAS positions during market volatility to average entry costs

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price floors at $0.005365 (recent 24h low) and resistance at $0.006367 (recent 24h high) for entry and exit signals

- Volume Analysis: Observe the 24-hour trading volume of $191,741 to identify breakout opportunities when volume spikes above average levels

- Wave Trading Key Points:

- Execute buy orders near support levels during market pullbacks, particularly when price approaches the all-time low of $0.00385

- Consider taking partial profits when BAS approaches resistance zones, such as the historic high of $0.17051

BAS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% portfolio allocation

- Active Investors: 5-8% portfolio allocation

- Professional Investors: 10-15% portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing Strategy: Limit individual trade sizes to no more than 2-3% of total portfolio value to mitigate impact from adverse price movements

- Dollar-Cost Averaging (DCA): Distribute capital inflows evenly across multiple purchase dates to reduce timing risk and volatility exposure

(3) Secure Storage Solutions

- Cold Storage Approach: Store the majority of BAS holdings offline using hardware solutions to eliminate hacking risks associated with exchange hot wallets

- Exchange Custody: Maintain only active trading amounts on Gate.com, utilizing the platform's insurance coverage for short-term liquidity management

- Security Considerations: Use strong authentication protocols including two-factor authentication (2FA) and IP whitelisting on all exchange accounts; regularly audit wallet balances; never share private keys or seed phrases with third parties

V. BAS Potential Risks and Challenges

BAS Market Risk

- Price Volatility: BAS exhibits significant price fluctuation with a 52-week performance ranging from $0.00385 (ATL on December 11, 2025) to $0.17051 (ATH on October 17, 2025), representing an 4,330% variance that can result in substantial losses for poorly timed entries

- Low 24-Hour Volume: Daily trading volume of approximately $191,741 indicates relatively thin liquidity, which may result in slippage during large orders and difficulty executing optimal exit strategies

- Market Cap Concentration: With a fully diluted valuation of only $57.07 million and market dominance of 0.0017%, BAS remains a micro-cap asset vulnerable to sudden capitalization shifts and whale manipulation

BAS Regulatory Risk

- Compliance Uncertainty: The intersection of on-chain KYC and identity verification with regulatory frameworks across multiple jurisdictions creates potential legal exposure if data handling practices fail to meet evolving privacy and compliance standards

- Jurisdiction-Specific Restrictions: Different countries may impose restrictions on projects facilitating identity verification or KYC functions, particularly in regions with strict data protection regulations like the European Union

BAS Technology Risk

- Smart Contract Vulnerability: As a blockchain-based protocol, BAS faces inherent risks from undiscovered bugs or security flaws in its smart contracts that could be exploited to compromise user data or drain protocol liquidity

- Adoption Dependency: The project's long-term viability depends on successful adoption by RWA platforms, DeFi applications, and AI agent systems; failure to achieve meaningful integration could render the verification layer economically obsolete

VI. Conclusion and Action Recommendations

BAS Investment Value Assessment

BAS represents an early-stage infrastructure play within the BNB Chain ecosystem, offering exposure to the growing demand for composable on-chain verification solutions across RWA, DeFi, and AI agent sectors. The project's positioning as a native verification and reputation layer provides genuine utility, though the token remains highly speculative with limited historical price stability. With a circulating supply of 2.5 billion tokens against a 10 billion maximum supply, significant dilution risk exists as more tokens enter circulation. Current valuation metrics suggest BAS is suitable only for investors with high risk tolerance and the ability to withstand potential 50-90% drawdowns.

BAS Investment Recommendations

✅ Beginners: Start with a minimal 1-2% portfolio allocation using dollar-cost averaging over 3-6 months; focus on understanding the project's use cases before scaling exposure; maintain holdings exclusively on secure storage with backup recovery procedures

✅ Experienced Investors: Implement a 5-8% core position combined with tactical trading around identified support and resistance levels; utilize technical analysis to optimize entry timing during 24-hour pullbacks; maintain strict stop-loss orders at 15-20% below purchase price

✅ Institutional Investors: Consider 10-15% allocations as part of emerging blockchain infrastructure portfolios; conduct comprehensive due diligence on the team's ability to deliver on stated milestones; negotiate direct investment terms to access preferential pricing and liquidity arrangements

BAS Trading Participation Methods

- Gate.com Spot Trading: Purchase BAS directly using BNB, USDT, or other supported pairs with full control over custody and transaction execution; ideal for investors seeking flexibility and lower fees on active trading strategies

- Dollar-Cost Averaging Programs: Schedule regular automated purchases through Gate.com's recurring buy features to eliminate emotional decision-making and systematically build positions during extended market downturns

- Liquidity Pools and Staking: Participate in BAS liquidity provision opportunities on BSC-based platforms to generate additional yield, though these strategies carry concentrated risk and impermanent loss exposure

Cryptocurrency investment carries extreme risk and this report does not constitute financial advice. Investors should make decisions based on their individual risk tolerance and financial situation. We strongly recommend consulting with a qualified financial advisor before allocating capital. Never invest more than you can afford to lose completely.

FAQ

Will the Bakery token rise again?

Yes, Bakery Token is expected to continue its upward trend, likely trading between $0.013 to $0.015 by December 2025. Market analysis suggests positive momentum ahead.

What factors influence BAS token price movements?

BAS token price is influenced by market sentiment, trading volume, technological developments, user adoption trends, and overall cryptocurrency market conditions.

What is Bakery Swap (BAS) and what is its use case?

Bakery Swap (BAS) is an automated market maker on Binance Smart Chain. It functions as a decentralized exchange enabling token and NFT trading, while BAS token holders participate in governance and earn rewards from platform transaction fees.

What is the current market cap and trading volume of BAS token?

BAS token currently has a market cap of approximately $17.89M with a 24-hour trading volume of $873.99K. The circulating supply stands at 2.50B tokens, reflecting moderate market activity and valuation in the current market cycle.

Is BAS a good investment for 2024-2025?

Yes, BAS presents strong investment potential for 2024-2025. With robust dividend history, diversified global portfolio, and expected growth in telecoms and real estate sectors as interest rates decline, BAS offers attractive opportunities for investors seeking stable returns and capital appreciation.

2025 LUMIA Price Prediction: Future Value Analysis and Market Trends for Investors

BNB Hits New High: What's Driving the Surge in Price

LYX vs BNB: Comparing Two Major Cryptocurrencies in the DeFi Ecosystem

BNB's Historic Rally: Reaching $1,375 and What Comes Next

How Does On-Chain Data Analysis Reveal BNB Chain's Growing Dominance in 2025?

Is Soil (SOIL) a good investment?: Analyzing the potential of this agricultural cryptocurrency in the evolving digital asset landscape

Bobo The Bear NFT Meme Token Achieves $150 Million Market Cap Milestone

Understanding the Simple Moving Average Formula

Ethereum Approaches $4000: Will It Surpass Resistance or Face Reversal?

The Ultimate Guide to Selecting a Top Crypto Wallet for Beginners in 2025

Effortless Ways to Earn Passive Income with Your BNB Holdings