Previsão de preço da AWE para 2025: análise detalhada das tendências do mercado e do potencial de crescimento futuro

Introdução: Posição de Mercado e Valor de Investimento da AWE

A AWE Network (AWE) consolidou-se como protagonista no setor de mundos autônomos via inteligência artificial, apresentando grandes avanços desde sua origem. Em 2025, seu valor de mercado atingiu US$174.429.251, com oferta circulante aproximada de 1.942.419.283 tokens e cotação próxima de US$0,0898. Comumente denominada “Portal para Mundos Autônomos,” esse ativo assume papel estratégico ao impulsionar colaboração e evolução de agentes de IA.

Este artigo realiza uma análise profissional das tendências de preço da AWE entre 2025 e 2030, considerando históricos, dinâmica de oferta e demanda, evolução do ecossistema e cenários macroeconômicos para entregar previsões técnicas e estratégias de investimento ao investidor qualificado.

I. Histórico de Preço da AWE e Panorama Atual do Mercado

Evolução Histórica do Preço AWE

- 2025: Lançamento e início das negociações, com preço entre US$0,04677 e US$0,09197

Situação Atual do Mercado de AWE

Em 24 de setembro de 2025, AWE está cotada em US$0,0898, com volume negociado de US$435.663,98 nas últimas 24 horas. O token apresentou valorização de 12,43% neste período. Hoje, AWE atingiu seu máximo histórico de US$0,09197, e o mínimo, US$0,04677, foi registrado em 1 de setembro de 2025.

O valor de mercado da AWE representa US$174.429.251,61, posicionando o ativo na 323ª colocação entre criptomoedas. Com 1.942.419.283 tokens circulando, de um suprimento total de 2.000.000.000, seu índice de circulação é de 97,12%.

A performance da AWE é consistente: crescimento de 29,58% na semana, alta de 75,7% nos últimos 30 dias e valorização acumulada de 88,94% no ano.

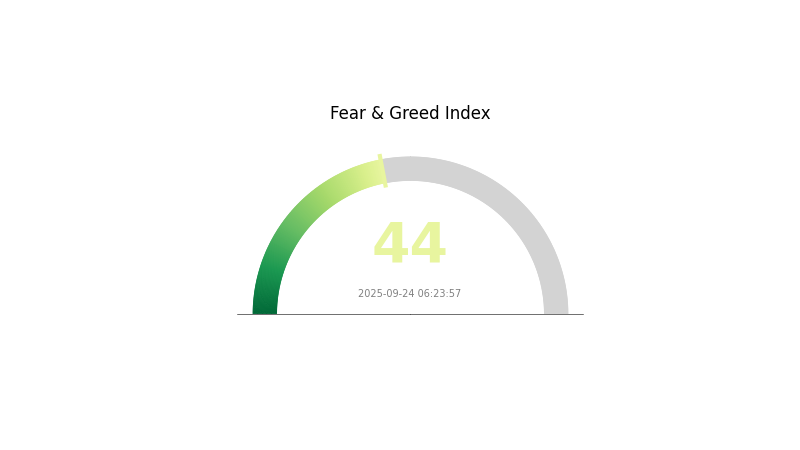

O cenário atual indica otimismo para AWE, negociando próxima ao recorde histórico. Entretanto, o índice de medo e ganância do setor aponta 44, sinalizando “Medo” predominante no mercado cripto.

Clique para consultar o preço atual da AWE

Indicador de Sentimento de Mercado da AWE

24/09/2025, Índice de Medo e Ganância: 44 (Medo)

Clique para acompanhar o Índice de Medo & Ganância

O sentimento do mercado permanece em área de “Medo”, com índice de 44. Esse ambiente sugere cautela dos investidores, podendo indicar condições de mercado subvalorizadas. Historicamente, momentos de medo extremo abrem oportunidades para posições de longo prazo. Realize análise detalhada e avalie seu perfil de risco antes de investir. Monitoramento contínuo de tendências e fundamentos é essencial para antecipar mudanças futuras de sentimento.

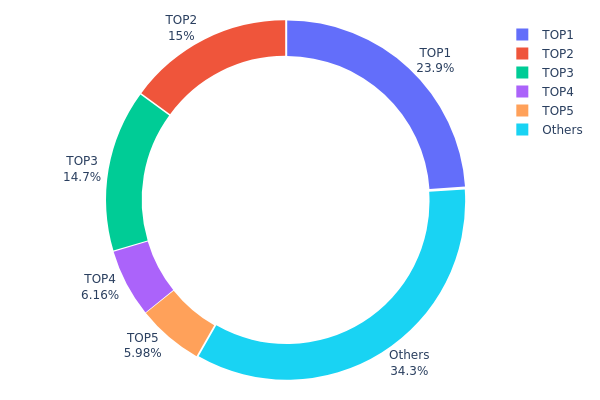

Distribuição de Posses de AWE

O levantamento dos endereços revela forte concentração de tokens: os 5 principais wallets detêm 65,65% da oferta total, sendo o maior responsável por 23,91%. Essa configuração gera preocupações sobre riscos de manipulação de mercado e centralização.

O segundo e terceiro maiores detentores concentram em torno de 15% cada, intensificando a assimetria. Estruturas concentradas elevam a volatilidade caso grandes holders vendam ou movimentem suas posições, impactando a estabilidade e os princípios de descentralização da AWE.

Com 34,35% dos tokens distribuídos entre demais endereços, o padrão reforça a necessidade de dispersão maior para fortalecer a resiliência do mercado e limitar o poder de grandes players sobre o ecossistema e governança.

Clique para acessar a Distribuição Atual de Posses de AWE

| Top | Endereço | Qtd. em Posse | Posse (%) |

|---|---|---|---|

| 1 | 0xb93e...c32efa | 478.365,18K | 23,91% |

| 2 | 0xf977...41acec | 299.001,38K | 14,95% |

| 3 | 0xa2b7...45d022 | 293.116,66K | 14,65% |

| 4 | 0x9554...adf161 | 123.243,93K | 6,16% |

| 5 | 0x1805...750287 | 119.638,02K | 5,98% |

| - | Outros | 686.634,83K | 34,35% |

II. Principais Fatores que Influenciam o Preço Futuro da AWE

Mecanismo de Oferta

- Custo de Matéria-Prima: O preço de insumos afeta diretamente os custos de produção da AWE e, consequentemente, sua cotação.

- Histórico: Elevação de custos costuma refletir em aumento do preço da AWE.

- Impacto Atual: Tendência de alta nos preços de matéria-prima pressiona AWE para cima.

Dinâmica Institucional e dos Grandes Detentores

- Adoção Corporativa: Empresas que adotam tecnologia AWE tendem a ampliar a demanda e influenciar os preços.

Ambiente Macroeconômico

- Proteção Inflacionária: Desempenho da AWE em contextos de inflação pode alterar sua trajetória de preço.

- Fatores Geopolíticos: Conflitos internacionais influenciam cadeias globais de suprimentos e a cotação da AWE.

Desenvolvimento Tecnológico e Ecossistema

- Integração de IA: Implementação de IA em chips AWE representa avanço estratégico.

- Aplicações de Ecossistema: Expansão de aplicações em inferência de IA, edge computing e robótica pode impulsionar demanda e valor da AWE.

III. Projeção de Preço AWE para 2025-2030

2025

- Projeção conservadora: US$0,06542 – US$0,08

- Projeção neutra: US$0,08 – US$0,09

- Projeção otimista: US$0,09 – US$0,09947 (requer ambiente positivo)

2027-2028

- Ciclo de mercado: Fase de crescimento provável

- Faixa estimada:

- 2027: US$0,06936 – US$0,12733

- 2028: US$0,08657 – US$0,16737

- Catalisadores: Adoção acelerada e avanços tecnológicos

2029-2030

- Cenário base: US$0,14139 – US$0,15907 (crescimento estável)

- Cenário otimista: US$0,17674 – US$0,19406 (forte desempenho de mercado)

- Cenário transformador: Acima de US$0,20 (em condições excepcionais e adoção massiva)

- 31 de dezembro de 2030: AWE US$0,19406 (potencial de novo máximo histórico)

| Ano | Máxima Projeta | Média Prevista | Mínima | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,09947 | 0,08961 | 0,06542 | 0 |

| 2026 | 0,1125 | 0,09454 | 0,08225 | 5 |

| 2027 | 0,12733 | 0,10352 | 0,06936 | 15 |

| 2028 | 0,16737 | 0,11542 | 0,08657 | 28 |

| 2029 | 0,17674 | 0,14139 | 0,07635 | 57 |

| 2030 | 0,19406 | 0,15907 | 0,08113 | 77 |

IV. Estratégias Profissionais de Investimento e Gestão de Riscos para AWE

Metodologia de Investimento em AWE

(1) Estratégia de manutenção de longo prazo

- Perfil: Investidores com visão de longo prazo e interesse em IA

- Recomendações:

- Acumule tokens nas correções de mercado

- Adote aporte periódico para suavizar preço de entrada

- Armazene tokens com segurança em wallets não-custodiais

(2) Estratégia de Trading Ativo

- Ferramentas Técnicas:

- Médias Móveis: Acompanhamento de tendências de curto e longo prazo

- RSI: Indicação de sobrecompra/sobrevenda

- Pontos para swing trade:

- Defina entradas e saídas baseadas em sinais técnicos

- Use stop-loss para limitar riscos de perda

Estrutura de Gestão de Riscos AWE

(1) Princípios de Alocação de Ativos

- Perfil conservador: 1–3% do portfólio em cripto

- Moderado: 3–5% em criptomoedas

- Agressivo: 5–10% em ativos digitais

(2) Soluções para Proteção de Risco

- Diversificação: Distribua investimentos entre diferentes criptoativos

- Stop-loss: Ordens automáticas para limitar perdas

(3) Soluções para Armazenamento Seguro

- Carteira quente recomendada: Gate web3 wallet

- Cold storage: hardware wallets para hold prolongado

- Boas práticas: Ative a autenticação em dois fatores (2FA), utilize senhas fortes e mantenha suas chaves privadas offline

V. Riscos e Desafios para AWE

Riscos de Mercado

- Alta volatilidade característica do segmento

- Concorrência crescente entre projetos de IA e blockchain

- Baixa liquidez pode gerar slippage em grandes operações

Riscos Regulatórios

- Legislação incerta pode prejudicar operações futuras

- Divergências regulatórias internacionais dificultam adoção global

- Mudanças fiscais podem impactar holders de tokens AWE

Riscos Técnicos

- Vulnerabilidades em smart contracts e possíveis bugs

- Desafios de escalabilidade frente à demanda crescente

- Dificuldades de integração tecnológica em sistemas legados

VI. Conclusão e Recomendações

Avaliação de Valor da AWE

AWE Network oferece perspectiva sólida de valorização a longo prazo no ecossistema de IA e blockchain, porém volatilidade e questões regulatórias impõem desafios consideráveis.

Recomendações de Investimento em AWE

✅ Novatos: Invista pequenos valores e recorrentemente para aprendizado

✅ Investidores experientes: Combine estratégia de hold com trading ativo

✅ Institucionais: Avalie detalhadamente e insira AWE em portfólios diversificados

Formas de Participação nas Negociações AWE

- Spot trading: Negociar tokens AWE na Gate.com

- Staking: Caso disponível, obtenha renda passiva em programas de staking

- DeFi: Explore alternativas de finanças descentralizadas com AWE

Investimento em criptomoedas envolve riscos elevados e este artigo não constitui consultoria financeira. Decida com responsabilidade conforme seu perfil e busque orientação profissional. Jamais invista valores superiores à sua tolerância ao risco.

FAQ

Qual a previsão de preço para Cardano em 2025?

A Cardano pode atingir pico de US$3,33 em 2025, com cenário provável em US$3, indicando forte potencial de valorização para ADA.

O que é AWE crypto?

AWE é um criptoativo construído na Solana, destacando-se por transações rápidas e baixas taxas, sendo parte fundamental do ecossistema Web3 com ampla negociação.

Qual a previsão de preço do XRP em 2030?

Projeções de analistas preveem faixa entre US$4,67 e US$26,97 para XRP em 2030, dependendo da adoção e regulação. US$10 é viável sob condições favoráveis de mercado.

Qual a principal previsão para criptomoedas em 2025?

Bitcoin (BTC) é estimado em US$200.000 até 2025, enquanto o Ethereum (ETH) deve alcançar US$10.000, representando as maiores projeções do mercado cripto para o período.

Compartilhar

Conteúdo