2025 AVA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: AVA's Market Position and Investment Value

AVA (AVA) serves as the native token of Travala.com, a cryptocurrency-friendly travel booking platform that has established itself as a leader in enabling blockchain-based payments for travel services. Founded in 2017, Travala has grown from a small start-up to a globally recognized online travel agency trusted by thousands of customers worldwide. As of December 2025, AVA boasts a market capitalization of approximately $20,023,471, with a circulating supply of about 71,055,612 tokens, maintaining a price point around $0.2818. This utility-driven asset, recognized for its practical application in the travel and hospitality sector, continues to play an increasingly important role in facilitating cryptocurrency payments and loyalty rewards within the Travala ecosystem.

This article will provide a comprehensive analysis of AVA's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

AVA Token Market Analysis Report

I. AVA Price History Review and Current Market Status

AVA Historical Price Evolution

AVA token has experienced significant volatility since its launch in May 2019. The token reached its all-time high (ATH) of $6.45 on April 14, 2021, during the peak of the cryptocurrency market cycle. Since then, the token has experienced substantial depreciation, reaching lows of $0.01218947 on February 27, 2019 in its early stages. The dramatic price decline reflects broader market cycles affecting cryptocurrency assets and the travel sector's adoption of blockchain-based payment systems.

AVA Current Market Status

Price Data (As of December 20, 2025):

- Current Price: $0.2818

- 24-Hour High: $0.2846

- 24-Hour Low: $0.2736

- 24-Hour Change: +2.65%

Market Capitalization Metrics:

- Total Market Cap: $20,023,471.46

- Fully Diluted Valuation: $20,023,471.46

- Market Dominance: 0.00062%

- 24-Hour Trading Volume: $21,100.76

Supply Information:

- Circulating Supply: 71,055,612 AVA

- Maximum Supply: 100,000,000 AVA

- Circulation Ratio: 71.06%

Price Performance Analysis:

- 1-Hour Change: -0.18%

- 7-Day Change: -8.24%

- 30-Day Change: -12.02%

- 1-Year Change: -80.5%

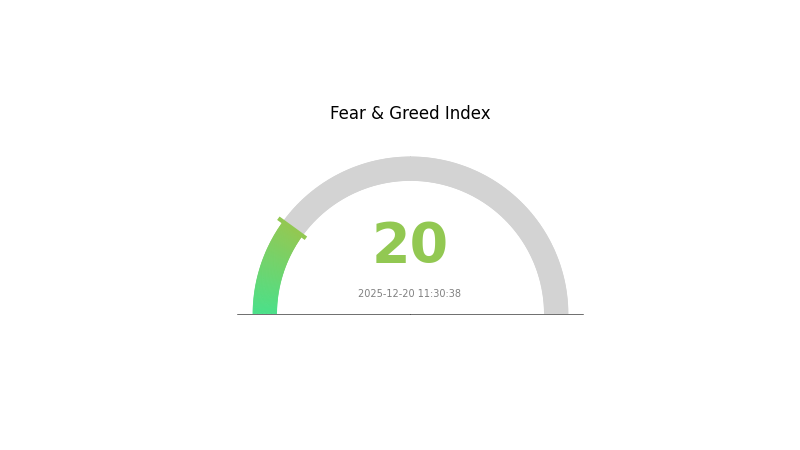

AVA is currently ranked 868th by market capitalization. The token shows modest positive momentum in the 24-hour timeframe (+2.65%), though it maintains negative performance across longer time periods. The token is listed on 18 exchanges and has 3,018 token holders. The current market sentiment indicates extreme fear (VIX: 20).

Check current AVA market price

AVA Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 20. This exceptionally low score reflects significant market pessimism and investor anxiety. During such periods, selling pressure typically intensifies as traders rush to exit positions. However, experienced investors often view extreme fear as a potential contrarian opportunity, as markets historically tend to reverse after reaching such lows. Investors should exercise caution, conduct thorough research, and consider their risk tolerance before making any trading decisions in this volatile environment.

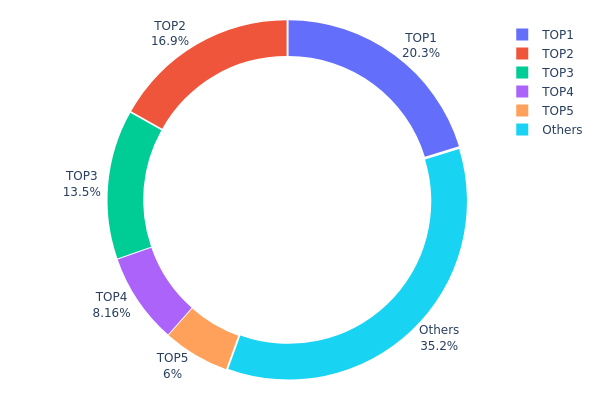

AVA Holding Distribution

The AVA token holding distribution map illustrates how the total circulating supply is distributed across different wallet addresses, serving as a critical indicator of token concentration and decentralization. This metric reveals the degree to which token ownership is dispersed throughout the network, directly impacting market dynamics, governance resilience, and vulnerability to coordinated price movements.

AVA currently exhibits moderate concentration characteristics. The top five addresses collectively control approximately 64.73% of the token supply, with the leading address alone accounting for 20.26%. The distribution shows a descending pattern typical of cryptocurrency assets, where early adopters and large stakeholders maintain substantial positions. However, the "Others" category representing 35.27% of holdings provides a meaningful counterbalance, suggesting a diversified base of smaller holders that prevents extreme centralization. The second and third largest holders maintain comparable positions at 16.87% and 13.45% respectively, indicating distributed control among major stakeholders rather than a single dominant entity.

This holding structure presents both stability and concentration risks. While the presence of multiple substantial stakeholders creates checks and balances against unilateral market manipulation, the 64.73% concentration among top five addresses remains elevated enough to warrant monitoring. Price volatility could be influenced by coordinated movements from these major holders, though the significant "Others" category suggests sufficient liquidity distribution to mitigate extreme scenarios. The current composition reflects a moderately decentralized network structure, characteristic of tokens that have progressed beyond pure concentration while maintaining institutional or founding team participation. This balance between whale concentration and retail distribution typically supports market maturity.

For current AVA holding distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5a52...70efcb | 14400.00K | 20.26% |

| 2 | 0xf977...41acec | 11987.84K | 16.87% |

| 3 | 0x259a...2de7d4 | 9563.97K | 13.45% |

| 4 | 0x20bc...d3da16 | 5796.13K | 8.15% |

| 5 | 0xd948...315a52 | 4264.09K | 6.00% |

| - | Others | 25043.59K | 35.27% |

II. Core Factors Affecting AVAX's Future Price

Supply Mechanism

- Fixed Token Supply Cap: AVAX has a maximum token supply of 720 million tokens, with 360 million tokens generated in the genesis block and the remaining 360 million tokens released according to a controlled emission formula similar to Bitcoin's early-stage release curve.

- Historical Pattern: The structured emission model provides predictable token circulation, supporting long-term price stability and preventing hyperinflation.

- Current Impact: The capped supply mechanism creates scarcity that can support upward price pressure as network adoption increases and demand for AVAX grows.

Macroeconomic Environment

- Monetary Policy Impact: As traditional financial institutions increasingly explore blockchain infrastructure, accommodative conditions in global markets may encourage institutional participation in Avalanche's ecosystem.

- Inflation Hedge Properties: As a decentralized platform token with fixed supply, AVAX may serve as a hedge against currency devaluation in inflationary environments.

Technology Development and Ecosystem Building

- High-Performance Consensus Mechanism: Avalanche's consensus engine achieves near-instant finality with the ability to process thousands of transactions per second (TPS) at significantly lower costs than legacy networks, making it attractive for DeFi and enterprise applications.

- Subnet Scalability and Interoperability: The network supports multiple subnets, where each subnet can run different blockchains, enabling developers to customize blockchain solutions for specific use cases and dramatically improving scalability.

- EVM Compatibility: Avalanche supports the Ethereum Virtual Machine (EVM), allowing developers to seamlessly migrate smart contracts and dApps from Ethereum to Avalanche, lowering development barriers and attracting developer migration.

- Ecosystem Applications: Key ecosystem developments include the Avalanche Rush program, which provides incentives to attract DeFi projects and users; partnerships with institutions like Circle enabling USDC issuance on Avalanche; growing DeFi protocols, NFT platforms, and enterprise applications; and recent institutional focus on Real-World Asset (RWA) tokenization through platforms like Securitize, which selected AVAX for RWA deployment under the EU's MiCA framework.

- staking and Yield Products: Institutional investors increasingly pursue AVAX staking opportunities, with proposals featuring annual yields of 4%-6%, establishing AVAX as an institutional-grade asset with income generation potential.

III. 2025-2030 AVA Price Forecast

2025 Outlook

- Conservative Forecast: $0.2034 - $0.2825

- Base Case Forecast: $0.2825

- Optimistic Forecast: $0.35313 (requiring sustained market recovery and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth momentum

- Price Range Forecast:

- 2026: $0.232 - $0.44176

- 2027: $0.28864 - $0.48992

- 2028: $0.30875 - $0.49139

- Key Catalysts: Ecosystem development progress, institutional adoption expansion, and market sentiment improvement driving cumulative 12-54% appreciation through 2028

2029-2030 Long-term Outlook

- Base Case: $0.42952 - $0.74238 (assuming continued regulatory clarity and mainstream adoption trends)

- Optimistic Case: $0.59743 - $0.74238 (contingent on accelerated ecosystem integration and increased institutional inflows)

- Transformative Case: $0.74238+ (predicated on breakthrough technological advancements and widespread DeFi integration)

- 2025-12-20: AVA trading at foundational levels with 88% projected appreciation potential through 2030

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.35313 | 0.2825 | 0.2034 | 0 |

| 2026 | 0.44176 | 0.31781 | 0.232 | 12 |

| 2027 | 0.48992 | 0.37979 | 0.28864 | 34 |

| 2028 | 0.49139 | 0.43485 | 0.30875 | 54 |

| 2029 | 0.59743 | 0.46312 | 0.28713 | 64 |

| 2030 | 0.74238 | 0.53027 | 0.42952 | 88 |

AVA Professional Investment Strategy and Risk Management Report

IV. AVA Professional Investment Strategy and Risk Management

AVA Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Cryptocurrency enthusiasts seeking exposure to travel technology ecosystem, long-term believers in crypto adoption for travel bookings

- Operation Recommendations:

- Accumulate AVA during market downturns, particularly given the 80.5% year-over-year decline suggesting potential oversold conditions

- Hold through platform adoption cycles and travel industry recovery periods

- Reinvest any rewards or discounts earned through Travala.com usage back into AVA holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.2736-$0.2846) as immediate technical barriers

- Volume Analysis: Track the $21,100.76 daily volume to identify breakout opportunities and trend confirmation

- Wave Operation Key Points:

- Capitalize on the recurring -8.24% 7-day and -12.02% 30-day downtrends for short-term trading opportunities

- Watch for reversal signals near the all-time low of $0.01218947 (set in February 2019) for contrarian positions

AVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation with hedging instruments

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Implement systematic purchases over time to mitigate entry price risk, particularly given recent price volatility

- Portfolio Diversification: Balance AVA holdings with stablecoins and other established cryptocurrencies to reduce concentration risk

(3) Secure Storage Solutions

- Hardware wallet Option: Maintain custody of AVA tokens through self-hosted solutions with proper backup and recovery procedures

- Exchange Custody: Use Gate.com's secure wallet services for frequent trading and immediate liquidity needs

- Security Precautions: Enable multi-signature authorization, utilize hardware wallet backup phrases stored in secure locations, never share private keys, and verify contract addresses (ETH: 0xa6c0c097741d55ecd9a3a7def3a8253fd022ceb9, BSC: 0xd9483EA7214FCfd89B4Fb8f513B544920E315A52) before transactions

V. AVA Potential Risks and Challenges

AVA Market Risk

- Historical Price Volatility: AVA has experienced an 80.5% decline over one year, indicating significant price volatility and potential for continued downside pressure

- Liquidity Risk: With $21,100.76 in 24-hour volume and only 3,018 token holders, liquidity may be insufficient for large position exits without significant slippage

- Market Concentration: Limited exchange availability (only 18 exchanges) restricts trading accessibility and price discovery mechanisms

AVA Regulatory Risk

- Crypto Regulatory Uncertainty: Increasing global regulatory scrutiny on cryptocurrency projects may impact AVA's utility and adoption

- Travel Industry Compliance: The integration of crypto payments with traditional travel booking requires compliance across multiple jurisdictions and regulatory frameworks

- Securities Classification: Potential reclassification of AVA token as a security in certain jurisdictions could limit trading and custody options

AVA Technical Risk

- Smart Contract Vulnerability: Multi-chain deployment (Ethereum and Binance Smart Chain) increases surface area for potential security exploits

- Network Dependency: Token functionality depends on the stability and security of underlying blockchain networks

- Protocol Updates: Future changes to Ethereum or BSC protocols could impact AVA token functionality and accessibility

VI. Conclusion and Action Recommendations

AVA Investment Value Assessment

Travala.com's AVA token represents exposure to the cryptocurrency-enabled travel economy, a niche but meaningful segment of the broader travel industry. The project has maintained operational presence since 2017 and achieved significant market recognition at its $6.45 all-time high in April 2021. However, the current market conditions reveal substantial challenges: an 80.5% year-over-year price decline, minimal trading volume, and a concentrated holder base suggest limited mainstream adoption and market enthusiasm. The token's utility remains primarily confined to the Travala.com ecosystem, limiting organic demand drivers. Potential upside scenarios include increased crypto adoption in travel bookings and platform expansion, while downside risks include continued market disinterest and regulatory headwinds.

AVA Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% portfolio allocation) after thorough platform research; use Gate.com for secure trading and custody; focus on understanding Travala.com's competitive advantages before investing

✅ Experienced Investors: Consider opportunistic accumulation during significant drawdowns using DCA strategies; implement technical analysis-based entry/exit points; maintain strict position sizing given volatility and liquidity constraints

✅ Institutional Investors: Conduct comprehensive due diligence on regulatory positioning and travel industry partnerships; evaluate potential for platform revenue growth; consider hedging strategies appropriate for volatile alternative asset exposure

AVA Trading Participation Methods

- Gate.com Direct Trading: Execute spot trades on Gate.com with AVA/USDT and AVA/BTC pairs, leveraging the exchange's security infrastructure and trading tools

- Ecosystem Participation: Accumulate AVA through Travala.com platform usage, booking transactions, and member rewards programs to reduce entry cost basis

- Portfolio Rebalancing: Use AVA as tactical allocation to cryptocurrency-enabled travel platforms within broader diversified crypto portfolios

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose.

FAQ

Is Ava worth investing in?

Ava demonstrates strong investment potential with experts predicting 10-20x returns. Strong community support and market position suggest promising growth opportunities ahead.

What will Aave be worth in 2025?

Based on current market analysis, Aave is projected to reach approximately $195.88 by end of 2025, driven by continued DeFi adoption and platform expansion.

What is the price prediction for Ava in 2040?

By 2040, Ava is expected to trade between $22.48 and $60.60 based on current market trends and expert analysis.

How high could Aave go?

Aave could potentially reach $594.49 by 2026 at peak predictions, representing significant upside from current levels. Long-term growth depends on protocol adoption, market conditions, and ecosystem development.

What factors influence AVA/Aave price movements?

AAVE price movements are driven by market demand and supply dynamics, broader cryptocurrency market trends, regulatory developments, and technological innovations within the Aave protocol ecosystem.

What are the risks of investing in AVA/Aave based on price predictions?

Key risks include smart contract vulnerabilities, market volatility, regulatory uncertainties, and liquidity constraints. Price predictions rely on historical data that may not guarantee future performance. Always conduct thorough research before investing.

2025 ACH Price Prediction: Bullish Outlook for Alchemy Pay Amid Growing Crypto Adoption

2025 SVL Price Prediction: Expert Analysis and Market Forecast for Savage Coin's Future Value

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

TRX to BDT Conversion: Live Rates and Best Platforms in 2025

Exploring Licensed Event Prediction Platforms: Bridging Real-World Events with Blockchain

What is SWEAT: A Comprehensive Guide to the Acronym and Its Applications in Modern Business and Personal Development

What is BLUE: A Comprehensive Guide to Understanding the Color, Science, and Cultural Significance of Blue in Our World

What is VIC: A Comprehensive Guide to Vehicle Identification Code and Its Importance in Automotive Management

What is OAS: A Comprehensive Guide to Understanding Open API Specifications