2025 AITECH Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: AITECH's Market Position and Investment Value

Solidus AI Tech (AITECH) stands as the world's first deflationary AI infrastructure utility token, designed to power an ecosystem featuring GPU rental markets, AI tool discovery platforms, and early-stage project launchpads. Since its launch in 2023, AITECH has established itself within the emerging AI infrastructure sector. As of December 2025, AITECH maintains a market capitalization of approximately $20.9 million, with a circulating supply of roughly 1.75 billion tokens, currently trading around $0.01052 per token. This innovative utility token is revolutionizing how users access high-performance computing resources and AI services through blockchain-based infrastructure.

This article will provide a comprehensive analysis of AITECH's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply dynamics, ecosystem development initiatives, and macroeconomic factors to deliver professional price forecasts and actionable investment guidance for participants in the AI infrastructure space.

I. AITECH Price History Review and Current Market Status

AITECH Historical Price Movement Trajectory

- 2023: Launch period, with the all-time low (ATL) recorded at $0.006 on August 28, 2023

- 2024: Growth phase, reaching the all-time high (ATH) of $0.5 on March 13, 2024, representing an approximately 8,233% increase from the ATL

- 2025: Correction period, price declined significantly from the peak, currently trading at $0.01052 as of December 20, 2025

AITECH Current Market Status

As of December 20, 2025, AITECH is trading at $0.01052, reflecting a substantial 79.04% decline from its all-time high of $0.5. The token has experienced notable weakness across multiple timeframes: down 0.76% in the past hour, down 1.15% in the past 24 hours, down 16.66% over the past week, down 33.62% over the past month, and down 88.039% over the past year.

The token maintains a market capitalization of approximately $18.44 million with a fully diluted valuation of $20.90 million, indicating an 87.66% circulation ratio. The 24-hour trading volume stands at $189,573.95, with the token currently ranked 900th by market capitalization. The ecosystem boasts 58,063 token holders and maintains listings on 15 cryptocurrency exchanges.

Price volatility remains elevated, with the 24-hour range spanning from $0.01023 to $0.01087. Market sentiment indicates extreme fear conditions (VIX score: 20), reflecting broader market apprehension.

Click to view current AITECH market price

AITECH Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The AITECH market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This reading indicates significant market pessimism and heightened risk aversion among investors. During such periods, market participants typically exhibit cautious behavior, with increased selling pressure and reduced trading activity. However, extreme fear can also present contrarian opportunities for long-term investors who believe in the market's fundamental value. It is advisable to conduct thorough research before making investment decisions and consider your risk tolerance carefully during this volatile period.

AITECH Holdings Distribution

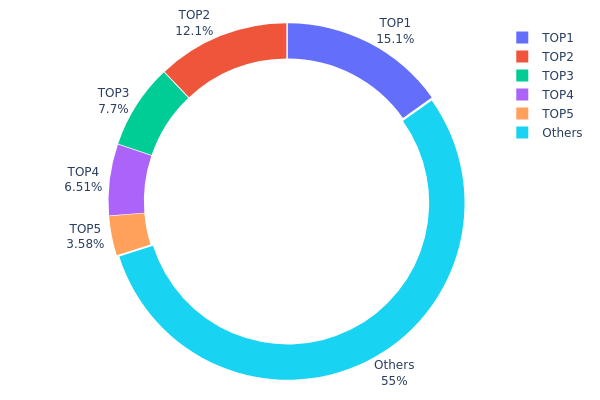

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, serving as a critical indicator of market decentralization and potential concentration risks. By analyzing the top holders and their respective percentages of total supply, this metric reveals the distribution pattern of assets and helps assess the vulnerability of a project to potential price manipulation or sudden liquidity shifts.

The current AITECH holdings distribution exhibits a moderate concentration pattern, with the top five addresses collectively controlling approximately 45% of the circulating supply. The largest holder (0x0529...c553b7) accounts for 15.14% of total holdings, followed by the second-largest holder (0xbb6d...22f720) with 12.08%. While these individual positions are substantial, the distribution does not present extreme concentration characteristics. Notably, the remaining 55% of tokens are distributed among "Others," indicating that the majority of AITECH's supply remains dispersed across numerous addresses, which suggests a relatively healthy decentralization structure at the grassroots level.

From a market structure perspective, this distribution pattern presents moderate stability. The top five holders, though influential, do not constitute an overwhelming majority that would enable coordinated price manipulation or catastrophic liquidity withdrawal scenarios. The significant "Others" category (55%) serves as a stabilizing factor, distributing voting power and liquidity across a broader stakeholder base. However, the cumulative 45% concentration among the top five addresses warrants monitoring, particularly regarding potential coordinated actions or large-scale liquidations that could trigger substantial price volatility.

Click to view current AITECH Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 300949.73K | 15.14% |

| 2 | 0xbb6d...22f720 | 240000.00K | 12.08% |

| 3 | 0x2c4d...c31184 | 153066.39K | 7.70% |

| 4 | 0x2e8f...725e64 | 129254.09K | 6.50% |

| 5 | 0xffa8...44cd54 | 71180.92K | 3.58% |

| - | Others | 1092152.95K | 55% |

II. Core Factors Influencing AITECH's Future Price

Supply Mechanism

- Token Burn Mechanism: A certain percentage of tokens used on the Solidus AI Tech platform are systematically destroyed by the system, which affects token scarcity and subsequently influences price movements.

- Current Impact: The deflationary nature of the token plays a key role in price determination. As tokens are continuously burned through platform usage, the circulating supply decreases, potentially creating upward pressure on token value.

Ecosystem Adoption and Utility

- Platform Utility: AITECH token enables users to access the AI Tech ecosystem's functions and benefits, including authorized AIaaS (Artificial Intelligence as a Service), BaaS (Backend as a Service), and HPC (High Performance Computing) rental services.

- User Benefits: Token holders can trade AITECH on multiple exchanges, participate in staking and mining activities, and enjoy voting rights on the DAO governance platform.

- Infrastructure Development: Solidus AI Tech is building ecosystem-friendly high-performance computing (HPC) data centers and Infrastructure as a Service (IaaS) platforms, enabling governments, enterprises, SMEs, and professionals to purchase AI services using AITECH tokens seamlessly.

Market Sentiment and Broader Cryptocurrency Conditions

- Market Sentiment Impact: Market sentiment, cryptocurrency analysis, and price predictions play crucial roles in determining AITECH token prices.

- Industry Trends: Viewpoints from cryptocurrency experts and influencers, cryptocurrency event announcements, and the overall cryptocurrency market conditions significantly influence token price movements.

- Adoption Trends: Broader cryptocurrency market adoption trends and the expansion of the Solidus AI Tech platform in AI and blockchain technology development are important determinants of future price trajectories.

III. AITECH Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00798 - $0.01052

- Neutral Forecast: $0.01050 - $0.01276

- Bullish Forecast: $0.01276 - $0.01502 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with emerging bullish signals as project maturity increases and adoption strengthens.

- Price Range Predictions:

- 2026: $0.00753 - $0.01556 (21% potential upside)

- 2027: $0.00977 - $0.01968 (34% potential upside)

- Key Catalysts: Ecosystem expansion, technological upgrades, increased institutional interest, and growing DeFi integration opportunities.

2028-2030 Long-term Outlook

- Base Case: $0.0088 - $0.02166 (60% growth projection by 2028), advancing to $0.01119 - $0.02681 (83% growth by 2029)

- Optimistic Case: $0.02167 - $0.0332 (119% potential upside by 2030), contingent on successful mainstream adoption and network effect acceleration

- Transformational Case: Further upside potential beyond base projections, dependent on breakthrough partnerships, regulatory clarity, and market-wide bull cycle conditions

- 2025-12-20: AITECH trading at foundational levels, positioned for medium to long-term accumulation opportunities on Gate.com and major trading venues

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01502 | 0.0105 | 0.00798 | 0 |

| 2026 | 0.01556 | 0.01276 | 0.00753 | 21 |

| 2027 | 0.01968 | 0.01416 | 0.00977 | 34 |

| 2028 | 0.02166 | 0.01692 | 0.0088 | 60 |

| 2029 | 0.02681 | 0.01929 | 0.01119 | 83 |

| 2030 | 0.0332 | 0.02305 | 0.02167 | 119 |

Solidus AI Tech (AITECH) Professional Investment Analysis Report

IV. AITECH Professional Investment Strategy and Risk Management

AITECH Investment Methodology

(1) Long-Term Hold Strategy

- Suitable for: Investors with strong conviction in AI infrastructure and willing to hold through market volatility

- Operational recommendations:

- Accumulate gradually during periods of high negative price pressure, considering the -88.039% year-over-year decline may present entry opportunities for long-term believers

- Monitor ecosystem development including GPU Marketplace utilization, AI Marketplace adoption, and AITECH Pad Launchpad project quality

- Hold positions for minimum 2-3 years to allow deflationary tokenomics and ecosystem expansion to materialize

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Utilize AITECH's all-time high of $0.50 (March 13, 2024) and recent low of $0.006 (August 28, 2023) as reference points; current price of $0.01052 remains in recovery phase

- Volume analysis: Current 24-hour volume of approximately $189,573.95 indicates moderate liquidity; track volume spikes during ecosystem announcements

- Range trading considerations:

- Execute buy positions during pullbacks below $0.009 support level

- Take profits on rallies toward $0.012-$0.015 resistance zone

AITECH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of total portfolio allocation

- Aggressive investors: 3-5% of total portfolio allocation

- Professional investors: 5-8% of total portfolio allocation with active rebalancing

(2) Risk Hedging Solutions

- Position sizing control: Never allocate funds exceeding personal loss tolerance; maintain strict position limits given high volatility

- Dollar-cost averaging: Implement systematic purchases over extended periods to reduce timing risk and smooth entry prices

(3) Secure Storage Solutions

- Hardware wallet option: Recommended storage on verified Binance Smart Chain-compatible wallets with hardware security support

- Security considerations: AITECH token operates on BSC (Binance Smart Chain) at contract address 0x2D060Ef4d6BF7f9e5edDe373Ab735513c0e4F944; ensure private key protection and enable transaction verification before executing transfers

- Safe custody practices: Never share private keys or recovery phrases; verify contract addresses on official channels before token transfers

V. AITECH Potential Risks and Challenges

AITECH Market Risks

- Severe price depreciation: Token has declined 88.039% year-over-year and 33.62% over the past 30 days, indicating significant market skepticism or reduced investor confidence

- Liquidity constraints: With 15 trading pairs across exchanges and 24-hour volume of approximately $189,573.95, liquidity may prove insufficient for large position exits

- Market capitalization volatility: Current market cap of $18.4 million against fully diluted valuation of $20.9 million suggests limited room for capitalization growth relative to downside risks

AITECH Regulatory Risks

- Evolving AI infrastructure classification: Regulatory frameworks for AI infrastructure tokens remain unclear across jurisdictions, potentially creating compliance uncertainties

- Data center operational oversight: European HPC data center operations may face changing environmental or operational regulations affecting profitability

- Cross-border compliance: International fiat-to-token conversion mechanisms may encounter regulatory obstacles as governments scrutinize token-based payment systems

AITECH Technology Risks

- Ecosystem adoption uncertainty: GPU Marketplace, AI Marketplace, and AITECH Pad Launchpad adoption rates remain unproven in competitive landscape

- Smart contract security: BSC-based contract requires continuous security auditing; any vulnerabilities could result in token loss or system compromise

- Scalability requirements: Supporting large-scale AI infrastructure demands may encounter technical limitations or performance degradation

VI. Conclusion and Action Recommendations

AITECH Investment Value Assessment

Solidus AI Tech presents a speculative opportunity positioned at the intersection of AI infrastructure and tokenized computing resources. The project's deflationary tokenomics mechanism—where a percentage of tokens used are systematically burned—theoretically creates supply pressure supporting long-term value. However, the 88% year-over-year decline reflects substantial headwinds including potential ecosystem adoption challenges, market sentiment deterioration, and broader cryptocurrency market pressures. Investors should recognize this as a high-risk, speculative position rather than a stable infrastructure play.

AITECH Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) using dollar-cost averaging strategy; prioritize understanding the ecosystem's GPU Marketplace and AI Marketplace functionality before increasing exposure

✅ Experienced traders: Implement range-bound trading strategies between $0.009 and $0.015 support-resistance levels; monitor ecosystem announcements and development milestones for trend confirmation signals

✅ Institutional investors: Conduct thorough due diligence on Solidus' European HPC data center operations, GPU utilization rates, and customer acquisition metrics before position establishment; consider strategic allocation only after validating measurable revenue generation

AITECH Trading Participation Methods

- Gate.com spot trading: Access AITECH/USDT and AITECH/BTC trading pairs directly through Gate.com's spot market with transparent order books and competitive fees

- Gate.com margin trading: Qualified users may execute leveraged positions, though extreme caution recommended given the token's high volatility profile

- Staking and yield programs: Monitor Gate.com for any AITECH-based staking or liquidity incentive programs that may provide additional returns beyond price appreciation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consult qualified financial advisors before making significant investment decisions. Never invest funds you cannot afford to lose entirely.

FAQ

What is AITECH coin?

AITECH is a cryptocurrency built on the Solana blockchain, part of the Solidus Ai Tech project. It leverages Solana's fast and low-cost transaction capabilities, enabling efficient Web3 applications and decentralized services in the crypto ecosystem.

What is the future of Solidus Ai Tech?

Solidus Ai Tech shows promising long-term potential with expert predictions indicating significant growth by 2030. The project's positive trajectory and market outlook suggest strong future prospects for AITECH.

Will AITECH be listed on Binance?

Yes, AITECH is already listed and trading is available. The listing has been confirmed, providing increased visibility and accessibility for users to trade AITECH.

why is crypto crashing and will it recover ?

2025 SAHARA Price Prediction: Expert Analysis and Market Outlook for the Coming Year

2025 US Price Prediction: Expert Analysis of Market Trends and Economic Forecasts for the Coming Year

Where to Find Alpha in the 2025 Crypto Spot Market

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Unlocking Innovation: Exploring AI Governance Tokens in DAOs

Exploring the Future of LGNS Token in the DeFi Landscape

AI Gaming Platform: Earn Rewards by Playing on Cutting-Edge Blockchains

Understanding Hive Blockchain: A Guide to Technology and Acquisition

Understanding AI Meme Coins: Functionality and Purchase Guide